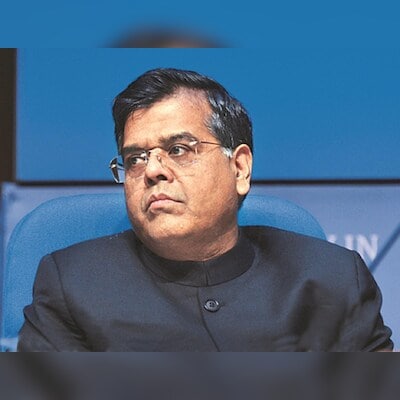

Finance Secretary T V SOMANATHAN in conversation with Ruchika Chitravanshi, Shrimi Choudhary, and Asit Ranjan Mishra discusses the Union Budget’s emphasis on employment, skills, and state-level reforms. Edited excerpts:

The Economic Survey has stated that around 8 million jobs in the non-farm sector need to be created each year until 2036. How many jobs could be generated this year and in subsequent years with the Budget schemes?

Job creation in the economy will occur through various inherent economic processes, not solely because of government schemes. However, will government incentives act as a catalyst for faster and greater employment? I believe so.

Industry always claims that it will spend more if given fiscal incentives. By the same logic, if you provide industry and employers with incentives to hire, they will employ more. At the margin, incentives make a difference.

We know that many companies say they struggle to find qualified people. Skilling is an area where we have found that the

How will you ensure that?

The internship programme is voluntary; it is only for companies required to do corporate social responsibility (CSR). We do not expect companies to spend any of their bottom-line money on the scheme. The government will cover the lion’s share of the internship cost, which is 90 per cent of the stipend.

Total CSR expenditure in India was Rs 26,000 crores in 2022, with under half coming from the top 100 companies. More than two-thirds come from the top 500 companies. We are focusing on companies that are mandated to do CSR under the Companies Act.

Regarding the employment incentive schemes you mentioned, what have you learned from them? Did they work?

There were some complaints about the short-term recruitment.

Who will be eligible for the internship programme?

For the reform-linked interest-free loans, can you share any conditions that states would have to satisfy?

One condition is related to tourism, and another involves better use of industrial land.

The survey suggests linking monetary policy with non-food inflation. Are you considering this?

It is an interesting suggestion. We haven’t taken any action on it yet. The question that repeatedly arises is how effective monetary policy is in controlling food inflation, as it operates through aggregate demand.

Food consumption is relatively inelastic, and in a poor country, one does not want to restrict food consumption, particularly at lower levels.

It’s a theoretical question, but it raises an interesting point: if monetary policy is unable to control food price inflation, perhaps food prices should not be included in the index used to determine monetary policy.

Have you changed your stance on disinvestment?

I would say that we are not focusing on disinvestment; rather, we are more for value creation.

First Published: Jul 24 2024 | 11:13 PM IST