As India journeys on its ambitious path towards becoming a $5 trillion economy, the nation’s Small and Medium Enterprises (SMEs) and startups are a beacon of hope and a powerful engine of growth. The Forbes India Small Business Summit, presented by PhonePe Payment Gateway (PhonePe PG), aims to explore how small businesses across India can scale. It brings together entrepreneurs, business leaders, policymakers, and enablers to create an environment where aspiring entrepreneurs have the tools, resources, and support to succeed. The summit also focuses on fostering a culture of innovation at the core of society. After kicking off its pre-event series in Chennai, the platform for entrepreneurial stalwarts will move to Pune, Lucknow and Indore before concluding with a grand finale in Delhi.

Setting the Stage for Growth

The Chennai Huddle, aptly themed “From Traditional to Tech-Enabled”, highlighted the significant transition many SMEs in Tamil Nadu are making from conventional operational frameworks to modern, technology-driven approaches. Known as the gateway to South India, Chennai has a dynamic ecosystem of start-ups and tech companies, making it an ideal starting point for this series.

Ankit Gaur, Head of Payment Gateway and Online Merchants at PhonePe, delivered the opening address. “In a world where the spotlight is often on the grand, it’s easy to overlook some of the transformative ideas and businesses that start small. But these small beginnings often lead to the most profound changes,” he said, stressing the importance of digital tools in empowering SMEs to transcend traditional barriers.

Challenges and Opportunities

The Summit was about celebrating success and addressing the challenges SMEs face in their growth journey. Ankit Gaur highlighted three critical areas where SMEs need support: access to resources, forums for networking and learning, and finance. He pointed out the significant credit gap that hampers SME growth and the need for innovative financing models that leverage proxies, like digital transaction histories or GST returns, to assess creditworthiness.

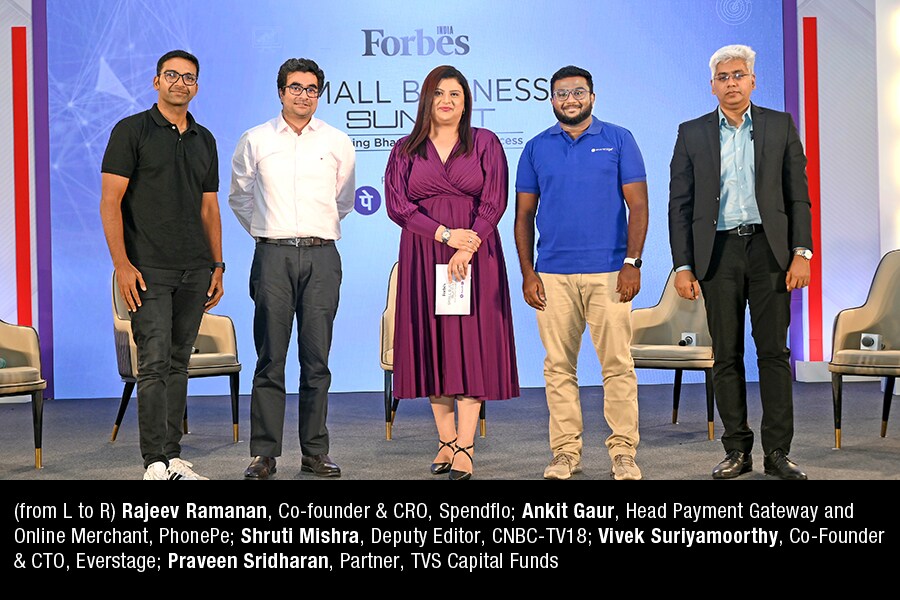

The first-panel discussion of the evening, titled ‘Charting the Digital Evolution of India’s Small Businesses,’ featured Vivek Suriyamoorthy, Co-Founder and CTO of Everstage; Rajiv Ramanan, Co-Founder and CRO of Spendflo; Ankit Gaur, Head of Payment Gateway and Online Merchant at PhonePe; and Praveen Sridharan, Partner at TVS Capital Funds. Shruti Mishra, Deputy Editor of CNBC-TV18, was the Moderator.

The discussion focused on how digital transformation has reshaped the SME/MSME landscape. Adopting SaaS and cloud computing has enabled MSMEs to optimise operations and expand their market reach. Digital tools have significantly reduced the cost of launching businesses and onboarding clients, allowing MSMEs to operate more efficiently and access global markets with minimal upfront investments.

The deliberations also highlighted how e-commerce platforms and fintech innovations have enhanced market access for businesses in remote areas, promoting financial inclusion and providing easier access to credit. Digital payments were identified as a game-changer, streamlining transactions and boosting credibility. The panel acknowledged several challenges: user adoption, return on investment (ROI), and the digital skills gap. These obstacles must be addressed so that MSMEs can fully leverage digital technologies. Despite these challenges, the discussion emphasised the vast potential for digital tools like cloud technology, CRM systems, and payment solutions to transform MSMEs, helping them scale, innovate, and compete globally.

The discussion concluded on an optimistic note, agreeing on the crucial role digital transformation will continue to play in driving the future growth of MSMEs.Thinking Big to Grow BiggerThe subsequent panel discussion was titled “Creating Opportunity, Shaping Outcomes, Helping Small Companies Think Big”. It explored how stakeholders, from government bodies, financial institutions, and industry partners, can work together to create opportunities that empower MSMEs to think big and achieve substantial growth. The panel featured luminaries KE Raghunathan, National Chairman, Association of Indian Entrepreneurs; Sivakumar Palanisamy, Vice President, StartupTN; TT Keshav, Co-Convenor, CII TN, CEO Forum and Director, Taylor Rubber; Divya Abhishek, Chairperson, FICCI, FLO Chennai and Daniel Prabhakaran, AVP, Partnership, iTamil Nadu Technology Hub.

The panelists discussed the importance of shifting SMEs from a survival mindset to a growth-oriented one. They emphasized that smaller businesses must think big as economies evolve to remain competitive. On the one hand, digital transformation has played a pivotal role in enabling SMEs to scale, improve efficiencies, and expand market reach without heavy investments. On the other hand, financial inclusion through fintech solutions and access to capital have empowered SMEs to grow.

However, challenges remain, including better technology adoption, training, and overcoming resistance to change. Additionally, participants noted the importance of innovation, whether through product development, business models, or leveraging government schemes designed to support MSMEs. Another key focus was aligning digital tools with long-term business goals. MSMEs were encouraged to adopt affordable technologies and utilize shared resources, like innovation hubs and government-supported centers to drive growth.

The panelists agreed that for MSMEs, ‘thinking big’ is not just about profit but about sustainability, scalability, and innovation. They concluded that while barriers exist, with the right mindset, tools, and support, MSMEs can compete and succeed on both national and global stages.Collaboration for a Future-Ready EcosystemThe final session of the summit was an engaging conversation with Siva Soundaravalli, Additional Commissioner for Industries and Commerce and Executive Director of FaME TN. She discussed the evolving landscape of MSMEs in Tamil Nadu, focusing on making them future-ready. She recounted how SMEs are the backbone of the economy, contributing significantly to employment and innovation.

According to her, the key characteristics of future-ready SMEs include adaptability, innovation, compliance with global standards, and the adoption of technologies like AI and green practices. “Digital transformation is vital, enabling cost-effective solutions, better decision-making, and improved safety,” she said. “MSMEs should start by automating tasks, digitizing records, and leveraging partnerships with institutions like IIT Madras and CII for advanced technology access.”The Commissioner also highlighted the importance of green skilling, technical capabilities, and cultivating a smart, innovation-driven workforce. Collaboration and partnerships, such as vendor development programs and decarbonization initiatives with organizations, like WRI and JICA, are crucial in helping MSMEs meet global standards and embrace sustainable practices.

Setting Benchmarks

The highlight of the evening was the felicitation ceremony, which commended 10 outstanding SMEs from various sectors. These companies not only excelled in their fields but have also embraced Innovation and digital transformation, becoming key drivers of growth in the MSME sector in India.. The companies that were honoured were Nuts ‘n’ Spices, Specsmakers, Sweet Karam Coffee, Suxus, TeraLumen Solutions Pvt Ltd, Wasted Solution, Amma Samyal Foods and Goodness Farm, Chai Kings and EarthFokus..

A Vision for the Future

As Ankit Gaur aptly stated, “The future of SMEs in India is not just about survival; it is about thriving, setting the stage for the next wave of economic growth, and redefining what it means to be a business in the 21st century.” The Forbes India Small Business Summit is a step towards realizing this vision, and as it continues its journey across India, it will undoubtedly leave a lasting impact on the country’s entrepreneurial landscape.

The pages slugged ‘Brand Connect’ are equivalent to advertisements and are not written and produced by Forbes India journalists.