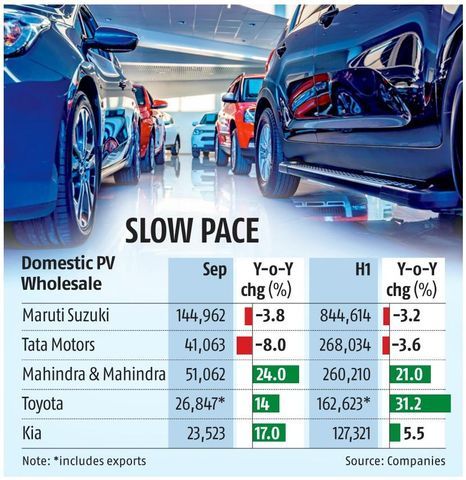

Wholesale dispatches of passenger vehicles (PVs) in September marginally dipped to 355,000-360,000 as against 364,198 units last year.

Though the festival season, which pushes up sales, began in September with Ganesh Chaturthi and Onam, since September 17 the Shraddh (inauspicious period) also started, which affected retail demand.

Click here to connect with us on WhatsApp

Companies said they were recalibrating their dispatches (wholesales) keeping in mind retail demand.

Barring Maruti Suzuki, Tata Motors, and Hyundai Motor India, most original equipment manufacturers posted growth in wholesales.

Maruti Suzuki’s domestic wholesales of PVs dropped 3.8 per cent to 144,962 units in September. In the first half of 2024-25 (H1FY25), domestic PV sales dropped 3.2 per cent to 844,614 units.

Partho Bannerjee, senior executive officer, marketing and sales, said the company was recalibrating its wholesales and aligning them with retail demand. In the first 14 days of the Shraddh period (which started on September 17 and will end on October 3), enquiries have grown 6 per cent and bookings 5 per cent or so, Bannerjee said.

He added rural demand was positive after a good monsoon.

In H1FY25, rural sales grew 8.4 per cent. Maruti sold 53,431 units of CNG (compressed natural gas) vehicles in September, taking the penetration in this segment to 34 per cent in its portfolio.

Maruti Suzuki has one month’s inventory in the market.

)

The company’s sales were affected due to a drop in electric-vehicle (EV) sales. Sales in the first half of the financial year dipped 3.6 per cent to 268,034 units.

Shailesh Chandra, managing director, Tata Motors Passenger Vehicles Ltd. and Tata Passenger Electric Mobility, said EV sales in the personal segment were affected by the lapse of registration and road tax waivers for hybrids in key states.

On top of this, fleet EV sales also continued to remain impacted due to lapse of Faster Adoption and Manufacturing of Electric (and Hybrid) Vehicles scheme II and not including the fleet segment in the PM eDrive scheme.

After the Uttar Pradesh (UP) government removed registration tax on strong hybrid cars on July 5, their monthly sales have more than doubled. In stark contrast, electric car sales in UP have remained relatively unchanged.

Chandra said: “The PV industry in Q2FY25 saw more than a 5 per cent decline in retail (Vahan registrations) compared to Q2FY24, driven by slow consumer demand and seasonal factors. In contrast, industry offtake was significantly higher than registrations in anticipation of a strong start to the festive season, resulting in a continued buildup of channel stocks.”

The company has readjusted wholesales to lower than expected retails to keep channel inventories in control.

It launched the Curvv, a sport utility vehicle, during July-September, and Tata Motors said it would continue to ramp up production in Q3FY25.

Mahindra and Mahindra (M&M) posted a 24 per cent rise in wholesale dispatches of PVs in September to 51,062 units.

Veejay Nakra, president, automotive division, said with Navratri festivities, booking for the Thar RoXX would start from October 3. As for H1FY25, M&M has posted 21 per cent growth to 260,210 units.

Kia India sold 23,523 units in September, growing 17 per cent. It racked up 5.5 per cent sales growth in H1FY25 to 127,321 units.

Hardeep Singh Brar, senior vice-president and head of sales and marketing, said: “Our performance is driven by the response from customers during the festival season of Ganesh Chaturthi and Onam. We have prioritised expanding our touchpoints, ensuring that our best-in-class mobility solutions are accessible to all our customers across the country.”

Hyundai Motor India sold 64,201 units. Tarun Garg, whole-time director and chief operating officer, said: “We witnessed increased consumer demand for CNG-powered vehicles.”

Bajaj Auto announced a 20 per cent increase in vehicle sales in September 2024, reaching 469,531 units compared to 392,558 units in the same month last year. Domestic sales rose 23 per cent to 311,887 vehicles, while exports grew 13 per cent to 157,644 units. 2W sales climbed 22 per cent to 400,489 units, with domestic sales up 28 per cent to 259,333 units.

Commercial vehicle sales increased 6 per cent to 69,042 units from 64,846 units in September 2023.

First Published: Oct 01 2024 | 11:42 PM IST