IT services companies have seen no change in hiring, and software product companies are mostly consolidating their existing workforce.

IT services companies have seen no change in hiring, and software product companies are mostly consolidating their existing workforce.

Image: Shutterstock

Kamal Karanth, co-founder and CEO at Xpheno, a Bengaluru-based staffing specialist, explains what’s unfolding. Here are five takeaways:

1. There’s been a modest uptick in the last two months

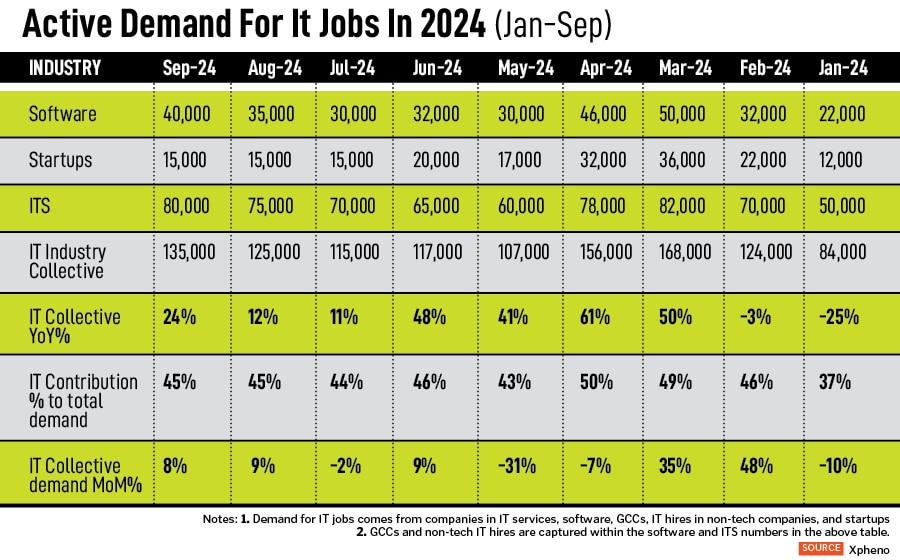

IT job openings today still constitute nearly half of the total white-collar positions in corporate India (See table: 45 percent in September). However, that’s a climb down from accounting for more than two-thirds of vacancies in India’s corporate sector during the peak of the IT surge in the immediate post-Covid period.

IT industry lobby Nasscom’s data shows the sector hired 2,30,000 people net in FY22 and only 60,000 in FY23, as the surge reversed into a global tech cut back due to macroeconomic uncertainties. Nasscom estimated that FY24 also saw about 60,000 net hires for the IT sector, with the total workforce at about 5.34 million.

This fiscal year, in August and September, there have been some green shoots, but this increase is still modest, in the range of about 10 percent. The number of active IT job openings in May was 107,000, Xpheno estimated. This rose to 125,000 in August and 1,35,000 in September.

These are still low, compared to March and April figures this year. And the current quarter, because of the larger number of holidays, will likely continue to see lower numbers.

2. Demand is being driven by non-tech recruiters and GCCs

Demand for IT recruits comes from five or six different segments, including the IT services companies, non-IT companies hiring tech talent, global capability centres (GCCs), which are the India-based development centres of foreign multinational companies, product companies and startups.

Startups are definitely still not hiring as they continue to face a funding crunch. IT services companies have seen no change in hiring, and software product companies are mostly consolidating their existing workforce. Demand is picking up because there is a new wave of GCCs in India, and domestic large businesses such as banks, pharmaceuticals and health care companies are hiring more IT recruits.

The fortunes of the non-tech companies are more closely associated with the Indian economy. So, for example, if banks and NBFCs are seeing more lending on the back of an improving rural economy, or the country’s biggest conglomerates that are deeply rooted in the domestic market. Growth in their operations is translating to an uptake of tech talent.

As to the GCCs, they have continued to incrementally hire more recruits. While established GCCs have not made a big splash, there have been nearly 45 new ones that have come to India in the last 12 months. A single new GCC can account for as many as 500 new tech hires. Some of the larger multinationals may even hire as many as 1,000 to 1,500 people in the first 12 months after setting up an India centre.

Also read: 5 Questions to Anant Adya at Infosys on how AI is influencing the shift to the cloud

3. There’s demand for experienced people, freshers not so much

Demand from non-tech recruiters and the GCCs is also typically characterised by their need for experienced people, not fresh college graduates. Therefore, there’s more demand for people with four to 12 years of experience. That is where the core demand is today.

Data science and cybersecurity are two evergreen areas in terms of demand for experienced talent. There is also growing demand for the so-called “full stack” developers and, in fact, full-stack software engineers are in the top three, when it comes to demand for skillsets. Artificial intelligence (AI) talent pool is more work-in-progress because it’s such a nascent field.

Freshers will have to wait for demand from IT services companies. Based on the existing commitments these companies have made, they are likely to hire 60,000 to 70,000 fresh graduates, which is about the same as last year. And last year’s figure was the lowest in two decades, at about 70,000.

Overall, Xpheno estimates fresher hiring could be, at best, between 100,000 and 120,000 this fiscal year.

4. IT industry fresh hires unlikely to go back to the highs

Multiple factors will ensure that the IT industry will probably never go back to such highs as FY22, when it comes to hiring freshers. AI-led automation is on the rise. There will be increased adoption of low-code and no-code software development, and some functions, such as testing, will get increasingly automated. And there are already close to 700,000 people in just that space alone.

Productivity increases from AI are yet to kick in at scale, and the existing IT and IT-enabled workforce in India offers sufficient capacity at a time of global macroeconomic uncertainty and lack of any spending on discretionary projects. Hiring increases in the foreseeable future will be incremental.

5. Entry-level IT services salaries won’t change any time soon

This is for the logical reason of there being more supply than demand. India sees some 800,000 engineering graduates, a fair number of them from premium institutes, and about 200,000 of them with computer science degrees. Therefore, with excess supply, in the near future, barring some premium colleges and specific skillsets, there is no incentive for IT companies to raise entry level salaries and earn shareholder ire.