(L to R) Akshit Bansal and Raghav Arora, Co-Founders at Statiq. Photographed at one of Statiq’s EV charging stations in Cyber Cuty, Gurugram.

(L to R) Akshit Bansal and Raghav Arora, Co-Founders at Statiq. Photographed at one of Statiq’s EV charging stations in Cyber Cuty, Gurugram.

Image: Amit Verma

Founded in 2019, Statiq has emerged as the second biggest company in India’s electric vehicle (EV) charging market. With over 8000 electric chargers’ network on its App, it has 22 percent of the market share in the EV charging space.

India has over four million electric vehicles on its roads. Annual EV sales in FY24 crossed 1.7 million units, with a 40.31 percent year-on-year (y-o-y) growth. India’s annual EV sales are expected to reach 10 million by 2030. Statiq is preparing to lead the charging industry as India’s EV market expands.

The Gurugram-based startup was co-founded by two friends, Akshit Bansal (who is also the CEO), and Raghav Arora (who is also the CTO). Before Statiq, the duo had co-founded another startup called Sharify, which worked as a vehicle-renting platform for individual owners. From 2018 to 2019, they worked on scaling Sharify without raising capital. However, the biggest challenge in scaling it up was not money, but regulations. In India, you cannot rent personal vehicles. They need to be registered as commercial vehicles for leasing purposes.

Before starting their entrepreneurial journey, Bansal was in a risk advisory role in Deloitte, while Arora was a data scientist at Wipro. Bansal says that the two of them had no experience in running a business, building a team and product. “When we left our jobs and started working, the expectation we had was not to succeed at one time. We thought that it might happen, it might not happen, and maybe it will take a very long time. That’s why it didn’t feel or hurt a lot, and we continued,” he says.

By the time Sharify shut down, the co-founders were prepared for their next venture. Arora mentions how small things like setting up their first Amazon Web Services (AWS) account, building a website and user interface, and search engine optimisation (SEO) skills came in handy while building Statiq. “We did not have to re-engineer the process of making something. Of course, we had to make something from scratch, but we knew how to set this up and choose the right programming languages because we were already using niche programming languages. That helped, in addition to all the scaling, growth, and customer acquisition that we learned,” he says.

In 2019, EVs were the talk of the town. That year, 1,66,822 EVs were sold in India, as per the Ministry of Road Transport and Highways . While automobile companies were planning their EV transition and EV sale reached new heights, a charging infrastructure was needed to support this growth. Bansal and Arora saw an opportunity and started Statiq in October 2019 to build their own EV charging infrastructure as well as an aggregator platform for other Charging Point Operators (CPOs). They designed their EV charger in-house, and their manufacturing responsibilities were given to their Manesar-based Original Equipment manufacturers (OEMs). Further, they partnered up with existing CPOs, such as Bharat Petroleum and ChargeMod, to onboard their charging stations on Statiq’s network.

“Given his (Raghav’s) expertise was software and my expertise was hardware, we divided our work. I started working on the hardware, and he started working on the software part.” Bansal recalls the early days of product development at Statiq. Bansal, having a bachelor’s degree in electrical engineering, headed the team responsible for designing the chargers, while Raghav, a software engineer, supervised the design and development of the Statiq App.

Also read: A better business model for electric vehicle charging stations

Funding and Early Days

In the first quarter of 2020, Statiq released its first app, which worked as a CPO aggregator. The hardware, EV chargers, came out in the next quarter. While both the co-founders were developing the products, they also reached out to many VCs to raise funds. In the early first quarter of 2020, they got a few soft commitments from several VCs, and then Covid happened.

“As soon as Covid happened, everyone took a small pause. It was the time of uncertainty because that was the time we were also looking for funds, and nobody was looking to grant them,” Bansal says.

As the first few months of Covid passed, things started returning to normal, and Statiq began hearing back from VCs. It got $1.8 million in seed funding in August 2020 from Y-Combinator. At this point, Statiq’s total revenue was $60,000. The seed funding gave it enough strength to scale its software and hardware development operations.

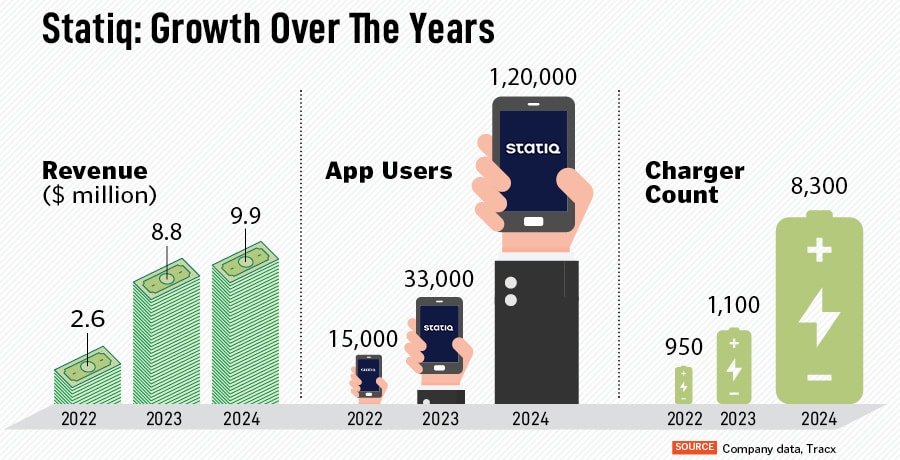

By the time Statiq raised its Series A in June 2022, its yearly revenue had reached $2.6 million. At this point, the chargers counted on the app was 950, and the number of app users reached 15000. The company raised $25.7 million in its Series A. Shell Ventures led the funding round, and VCs such as Astir Ventures, VentureSouq, and Oyster Ventures participated.

Network Expansion

Today, Statiq has over 8,000 charging stations in 63 cities on its network, about 1,000 designed by the company, while the rest are aggregated from other CPO companies. Over the years, Statiq has partnered with many leading CPO companies, such as Bharat Petroleum, Gentari, ChargeMod, Fortum, and ElectreeFi, who have onboarded Staiq’s network.

“Many oil companies and bigger CPUs in India have made the charging infra, but it is not easily accessible to the public. Accessibility is a very important aspect of charging infra, and we have a customer-facing app that is extremely accessible with top-notch features.” Bansal adds on the adoption of Statiq’s network by other CPOs.

Further, Statiq has partnered with several mobility and logistics companies such as Hyundai, Tata, BMW, Kia, Bluewheelz, and Noida International Airport to provide charging infrastructure. It offers 3.3 KW, 22KW, and 60KW DC chargers in hardware. The company designs the chargers in-house with a team of 45 research and design engineers.

With the increased sales of hardware products and network expansion, Statiq’s revenue jumped to $8.8 million in FY 2023 and $9.9 million in FY 2024. The number of app users has reached 1.9 lakh. Besides the small commission from CPOs on the network, the company generates the bulk of its revenue through hardware sales.

Bansal says the company’s revenue will gradually shift from hardware to software sales as charging infrastructure further develops in the country. “So first, people will buy and set up charging stations, and then there will be recurring revenue from charging sessions. So today, 70 percent of our revenue is generated from hardware sales, and 30 percent is from software and energy sales. But we imagine this will shift as more and more infra builds up.” he adds.