There is a growing adoption of digital verification methods and addresses emerging challenges like moonlighting and AI-powered checks while recruiting. Image: Shutterstock

There is a growing adoption of digital verification methods and addresses emerging challenges like moonlighting and AI-powered checks while recruiting. Image: Shutterstock

‘Fake it till you make it’ might work in some walks of life and is still widely practised on resumes across India and the world, but there’s a high probability that sooner or later the fake ones get caught. As per HRO Today, an American magazine for leaders in HR, which conducted research on over 2000 American citizens and released its findings early this year 64.2 percent of employees have lied about skills, experience, or references at least once, up from 55 percent in 2022. Over half (56 percent) of the respondents said that the rising cost of living will make them more likely to lie on a resume in 2024 to try and secure a job. While that’s about the US, what’s the scene in India?

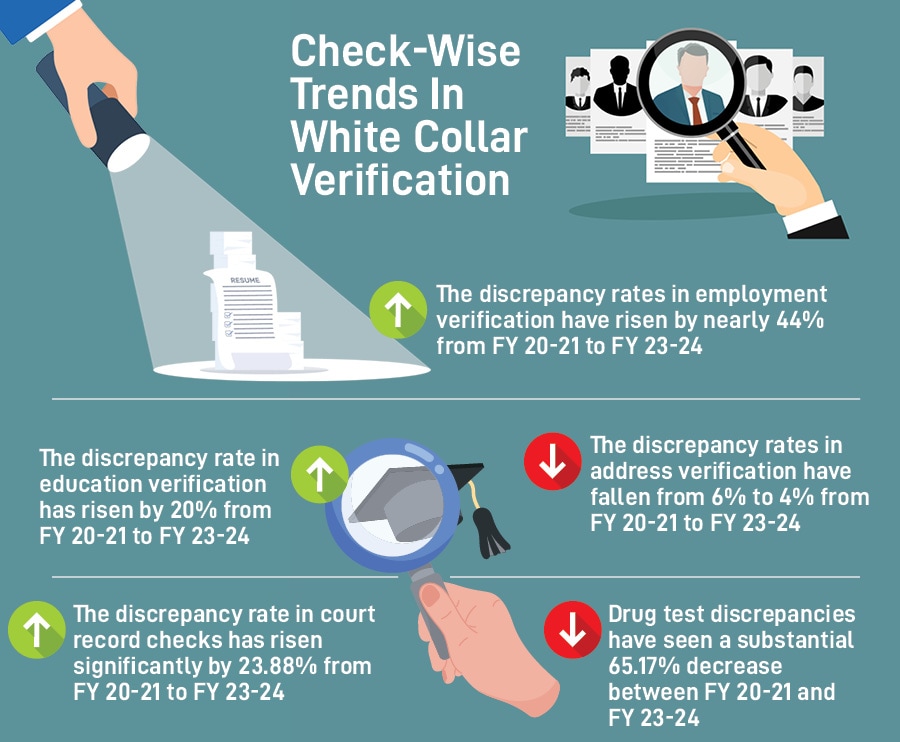

AuthBridge’s Annual Trends Report 2024, which was released in the second week of October, found that there is a 44 percent spike in employment verification discrepancies across six major sectors in India, which include telecom, BFSI (banking, financial services, and insurance), pharmaceuticals, FMCG (fast-moving consumer goods), e-commerce, IT, and the gig economy. The report, which draws from millions of background checks conducted between FY2021 and FY2024, explores the growing adoption of digital verification methods and addresses emerging challenges like moonlighting and AI-powered checks, offering actionable intelligence for businesses looking to navigate today’s complex verification landscape.

As per the report, the telecom sector experienced a sharp increase in discrepancy rates, reaching 18.2 percent, which underscores its heightened vulnerability to identity fraud. In the BFSI sector, discrepancy rates rose to 10.4 percent, pointing to growing difficulties in employment verification as financial institutions encounter risks from falsified credentials. The pharma sector also saw a substantial 50 percent increase in discrepancy rates since FY2021, reaching 17.1 percent, indicating a rise in fraudulent qualifications.

While the FMCG industry reported an overall decline in discrepancies, e-commerce—accounting for 17 percent of FMCG consumption—faced mounting verification challenges, particularly due to the rise of gig workers. The IT and ITES (Information Technology Enabled Services) sectors, despite a 9.8 percent decrease in discrepancy rates compared to FY2021, still contend with issues of falsified credentials, with employment and education discrepancies at 10.2 percent. The gig economy, which is projected to reach 25 million workers in India by 2030, showed a 12.5 percent discrepancy rate in verifications, highlighting the urgent need for thorough screening in high-demand areas such as logistics, e-commerce, and last-mile delivery.

The report also highlights technological advancements, particularly the use of AI and machine learning algorithms, which have significantly enhanced the speed and accuracy of background verification processes. Furthermore, after performing over 1,50,000 moonlighting checks in FY 2023-24, the report revealed a 12 percent discrepancy rate, emphasising the increasing concern regarding dual employment risks.

According to Ajay Trehan, CEO of AuthBridge, a company that provides digital-first background verification and authentication solutions across workforce management, customer onboarding, and third-party business verifications, the report has helped a lot of its customers in improving their hiring processes. Trehan highlights that the hiring patterns and discrepancy rates are directly proportional. Sectors that are hiring in large numbers today have increased discrepancy rates vs. those low on hiring.

Why else do discrepancies exist?

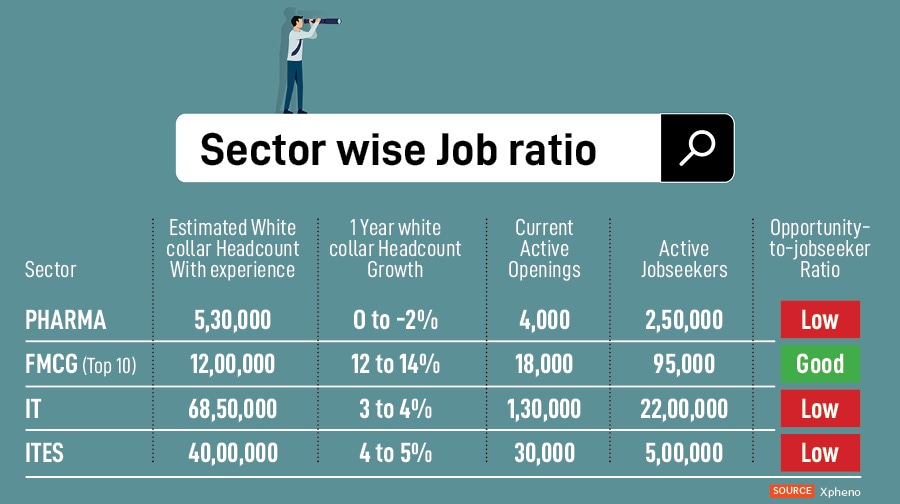

As per Kamal Karanth, co-founder, Xpheno, it is a play of supply and demand. In India currently, there are a number of sectors in which there are more active job seekers as compared to available jobs. “Let’s say the supply is high and demand is low. But obviously, there is friction to get into that space. That is when people try to match things that they don’t have because they want the job.” But, as Karanth points out, the opposite can also be true. “When there is too much demand, it comes with perks of great salaries, great brands, everything aspirational, and you want to be there because you think big bucks are coming.”

Do verification discrepancies affect hiring?

As per Karanth, discrepancies per se do not really impact the hiring process. The fact is that no matter the discrepancies, companies need to recruit. The problem arises when companies sometimes do mass onboarding and already offer positions to candidates before conducting a background check because they are in a hurry to hire. Later, when something comes out in the check, the candidate has to be asked to leave. “The way around is, if companies experienced too many fraud cases in the past, this term they might decide to make the offer only after the background check comes,” says Karanath. The only caveat there, as Karanth explains, is that sometimes the check process takes too long, and in some of the hot sectors, like tech, it’s risky to do that because you might lose out on a lot of good candidates who would’ve moved on by then. Karanth is of the view that while large companies are more cautious with more stringent background checks when it comes to hiring, the risk appetite for startups is high, so they would still go ahead and hire the person.

The way out

If we were to look at the various models in which companies hire, it is either through their websites or from platforms like LinkedIn, social media, or staffing agencies like Xpheno. Companies also have internal reference programmes. As per Karanth, using staffing agencies or internal referencing is a way to avoid hiring fraud candidates. “Agencies have far more filtration, because for them, their reputation is at stake. And there is a commercial fee involved. And, internal referral can be the best thing, because they have somebody from the company based on whose trust they can take a call with a sense of accountability.”

According to Trehan, there has been an evolution in the hiring and verification process in the last few years on two fronts. The first is the extensive use of artificial intelligence (AI), and the second is a thorough social media check of the applicant. “We’ve been using AI for reading and interpreting court orders and criminal and civil litigation, which are bulky, ongoing, and difficult to comprehend. Now, for us to read that data within a few seconds, using AI, and being able to say that a candidate is good or bad, is where the science comes in,” says Trehan. This has resulted in a lot of companies who were earlier not looking at criminal and civil litigation, adopting it as a standard check at the time of the initial pre-offer stage.

Also read: Coursera has nearly 2 crore registered learners in India. Can it help them find jobs?

Up until a few years ago, a big issue that most companies faced was that they would trigger background checks after the offer had been released, between the period of offer and joining, and most background check companies would take about 15 days to respond. “When we started going out saying that we can conduct identity and criminal record checks within a few seconds or minutes, our customers started waiting for our checks to be done before sending out offer letters. Now, more and more employers are coming to us asking to pre-verify, to save them a lot of time and trouble,” says Trehan.

The second step towards the evolution of the hiring and verification process is an increasing trend to know more about the social media footprint of the candidate. Today, with AI engines being available, companies can read through multiple social media posts of an applicant within a few seconds and decide if any of their posts can hamper the organisation’s reputation.

Are employment verification discrepancies giving rise to unemployment?

The general consensus is that employment verification discrepancies do not affect unemployment. According to Rosa Abraham, assistant professor at Azim Premji University with a PhD focused in Economics from the Institute for Social and Economic Change, there exists a verification problem, especially when jobs are scarce and workers are plentiful. She believes that employers need to use some kind of signal to measure quality. “There are ways in which the signal can be corrupted—when education is no longer a measure of quality because educational attainment does not come with an improvement in skills/learnings, or when workers ‘fraud’ the system by advertising/signalling qualifications that they do not have—so the high discrepancy is not a surprise. To the extent that discrepancies are to the extent of 12-20 percent, that still suggests that there are about 80 percent of applications that are ‘credible’ and match up. I wouldn’t be certain that the unemployment outcomes we see are a result of high discrepancies,” says Abraham.

Also read: Hey, employers: Job hunters really want to see your diversity data

Trehan is of the same view. “Organisations will still hire. They may take a little longer, so that’s unlikely to impact an unemployment rate in any significant manner; maybe not impact at all.” He thinks, on the contrary, they may actually end up being on the cautious side and might end up hiring a little bit more than what they may need, just in case there are certain aspects of a candidate’s background that they can’t verify and have to let him/her go later.

Change in landscape in the coming years

According to Trehan, in the coming years, the whole HR process is going to get disrupted totally through AI. Creating job descriptions, going through CVs, sorting them, doing background checks, social media checks—all could be done by an algorithm. “AI is going to completely change the way we’ve been looking at resumes because AI engines can’t be fooled. AI’s ability to filter a resume is going to be very different from how humans have done it in the past. There are certain jobs that are very, very likely to get impacted,” says Trehan. He believes that the HR industry will have to really upskill itself to be able to leverage AI and adopt it. Otherwise, they’re going to be very severely impacted.