Hyundai has planned an investment of ₹32,000 crore in India over the next 10 years

Hyundai has planned an investment of ₹32,000 crore in India over the next 10 years

It’s a baffling tale in India’s automotive industry. On the one hand, two European automotive giants, the world’s second-largest and fourth-largest carmakers, just can’t seem to find their footing in the country. One wants to sell its stake, while the other is yet to crack into the top ten despite pouring billions. Both Volkswagen Group and Stellantis have been operational in India for more than 20 years.

Then there is Hyundai, the Korean automobile giant, which is set to reap over $3 billion from the country by selling 17 percent in the Indian subsidiary. The initial public offering (IPO), touted as the largest in the country, hit the bourses on October 15, when Hyundai put on offer for sale 142 million shares. Hyundai has fixed a price band of between ₹1,865 and ₹1,960 per share for the ₹27,870-crore IPO.

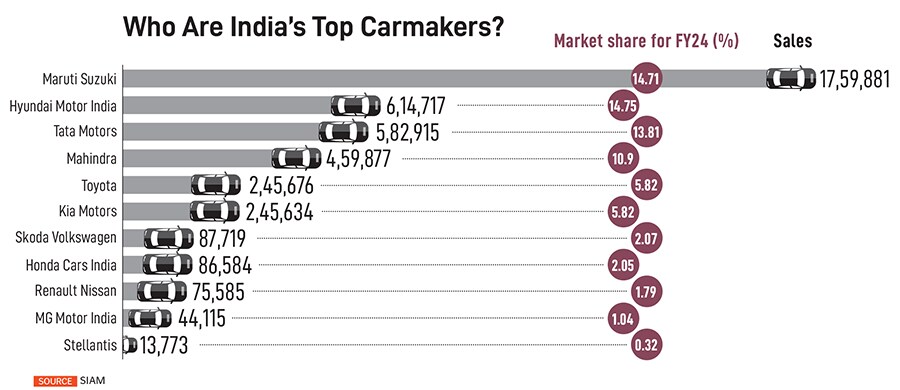

The listing also means it joins homegrown automakers such as Maruti Suzuki, Tata Motors and Mahindra as publicly-traded entities. Among them, the four publicly-listed companies control a little over 80 percent of the domestic market. Hyundai Motors India will be valued at some ₹1.6 lakh crore after the IPO, and a public listing is expected a week before Diwali. Hyundai is be the first carmaker to list after Maruti Suzuki went public in 2003.

Hyundai will use the proceeds to invest in new products, future technology and research and development capabilities of the India unit. In all, the Korean carmaker has planned an investment of ₹32,000 crore in the country over the next 10 years.

“India is among the fastest-growing economies globally, and, as this growth continues, the strategic importance of Hyundai Motor India will only increase,” Euisun Chung, the executive chair of Hyundai Motor Group, said during his visit to India in April. “By leveraging our strong reputation and competitive quality in India, we aim to expand exports to neighbouring countries, making India the global export hub to boost our regional market competitiveness.”

Hyundai has, for long, remained India’s second-largest carmaker since it set shop in the country nearly three decades ago. Its models such as Creta, Venue, and Exter have emerged top sellers in their segments. It’s only in recent times that homegrown automakers like Tata Motors and Mahindra have begun challenging the automaker for the coveted second position. Even then, Hyundai has firmly protected its turf.

That’s precisely why its success is certain to make global automakers such as Volkswagen, General Motors, Stellantis, and Ford envious, and a case study in cracking one of the most complex yet rewarding automobile markets in the world. India is currently the world’s fourth-largest automobile market, with sales of 3.8 million cars.

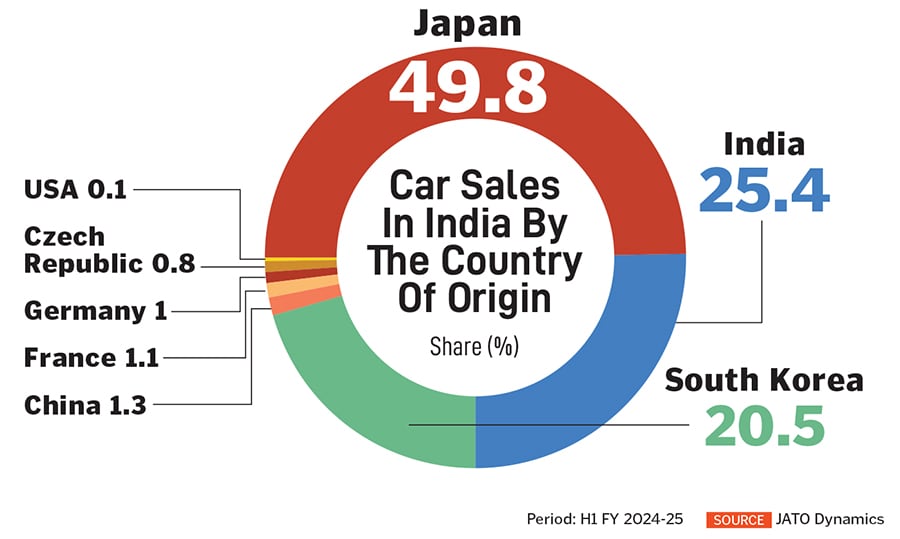

“Japanese and Korean companies have their key decision-makers operating from India helping in faster and better decision-making,” says Arun Malhotra, the former managing director of Nissan India, “Also, they come with a clear short-term and a long-term plan which does not change every two three years.”

“Hyundai has invested heavily in its R&D and manufacturing hubs, turning India into one of its largest global production bases with its Chennai plant powering both domestic sales and exports, allowing Hyundai to maintain competitive pricing while introducing advanced technologies,” says Bakar Agwan, senior research analyst, at S&P Global Mobility. “Its journey in India has been a masterclass in understanding local nuances and delivering excellence across the board.”

Also read: Made in India, sold worldwide: How India is becoming an export hub for passenger vehicles

Getting it right

For Hyundai, a little-known player when it came to India, much of its success story was scripted by its first car, the Santro. “They had a clear, robust product plan, which was evident right at the time of launch,” adds Malhotra. “European and US companies do not have specific products in their portfolio which can relate to the Indian market.”

When the Seoul-headquartered Hyundai, then a 29-year-old company, began operations in India in 1996, a slew of foreign automakers, from Ford to Mercedes Benz and General Motors, had also set up operations here. At that time, Indians were only beginning to get acquainted with Korean brands, such as Samsung, LG, or even Hyundai, which didn’t boast the legacy that some of its Western counterparts had.

But, the Santro, an Indianised version of Hyundai’s popular Atos in South Korea, would go on to change that perception. The Atos was a runaway success in South Korea after its launch in 1997, taking on the likes of the Daewoo Matiz and the Tico, the Korean version of the Maruti Suzuki 800.

For India, Hyundai tweaked the model, most notably the rear end, and provided better ground clearance along with a 1-litre engine churning out 55 bhp. The vehicle also offered a multi-port fuel injection engine with three valves in the entry-level segment instead of carburetors, along with power steering and rear seat belts. To keep costs low, Hyundai also ensured that its supplier base moved to Chennai. The factory that Hyundai set up in 1996 in Chennai continued to be its only plant in India until it acquired the General Motors Talegaon plant in 2024.

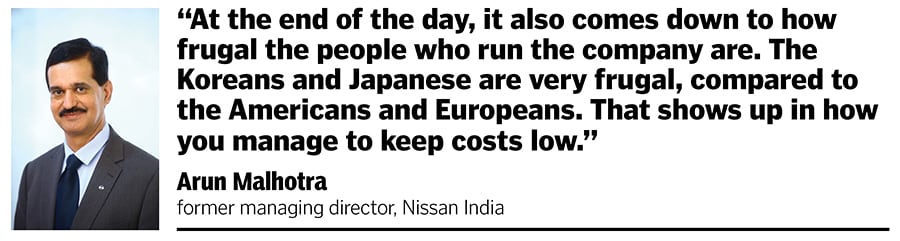

“At the end of the day, it also comes down to how frugal the people who run the company are,” says Malhotra. “The Koreans and Japanese are very frugal, compared to the Americans and Europeans. That shows up in how you operate and manage to keep your costs low.”

Hyundai also significantly benefitted from Bollywood superstar Shah Rukh Khan becoming its brand ambassador, a partnership that continues to this day. Since the launch of the Santro, the company has unleashed models such as the Accent, Verna, i10, Sonata, and Creta, solidifying its presence in the Indian market, one of the world’s fastest-growing that boasts millions of first-time buyers.

Runaway success

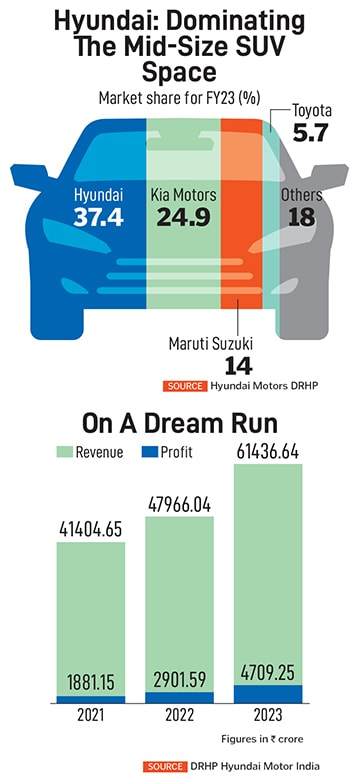

But a gamechanger of sorts came in 2015, when the company launched its wildly popular mid-size SUV, the Creta, which has since been the category leader and instrumental in driving India’s huge SUV shift in the past decade. In 2024, sales of the Creta crossed a million units, and the company has since launched a facelifted version of its second-generation variant.

“Introduction of Hyundai Creta in Fiscal 2016 has propelled the mid-size SUVs (length 4 -4.4 m) segment,” the company says in its Draft Red Herring Prospectus (DRHP). “The mid-size SUV segment outpaced the entire SUV segment and has grown its share within the mid-size SUV segment in the last 5 years.”

Also Read: Top 10 best selling cars in India

“In the India market, there is a clear number one, which is Maruti Suzuki,” says Ravi Bhatia, the president and director at market research firm Jato Dynamics. “But the market is a pyramid with the weighted average per unit at ₹8.5 lakh. Maruti Suzuki’s weighted average per unit is at ₹8.27 lakh while Hyundai is second in the pyramid at ₹11.55 lakh after Mahindra at ₹15.42 lakh. That means they make more per car compared to Maruti Suzuki.”

Today, Hyundai dominates the mid-size SUV sub-segment in the country, cornering some 30 percent of the market, from about 68 percent in 2019.

But, with the mid-size SUV market growing to 402,000 units from a little over 183,000 units in 2019, led by the foray of numerous models including Toyota’s Urban Cruiser Hyryder, Maruti Suzuki Grand Vitara, Honda Elevate, Skoda Kushaq, Volkswagen Taigun, Mahindra XUV400 and Citroen C3 Aircross, Hyundai has begun to feel the heat from domestic and global automakers.

But, with the mid-size SUV market growing to 402,000 units from a little over 183,000 units in 2019, led by the foray of numerous models including Toyota’s Urban Cruiser Hyryder, Maruti Suzuki Grand Vitara, Honda Elevate, Skoda Kushaq, Volkswagen Taigun, Mahindra XUV400 and Citroen C3 Aircross, Hyundai has begun to feel the heat from domestic and global automakers.

“Hyundai has always had a good pulse on buyers who have an affinity for better-featured cars, which has propelled it to the number two position,” says Bhatia. “But that spot is currently under intense competition with the likes of Tata and Mahindra offering more features and upping their game.”

Last year, Hyundai posted net profits of ₹4,709.25 crore for the year ended March 2024, while revenues stood at ₹61,436 crore.

That’s also why India has begun playing a more serious role in its global plans, with the country becoming one of its regional headquarters, alongside Hyundai Motor North America and Hyundai Motor Europe.

“Hyundai’s ability to constantly evolve—whether it’s launching feature-loaded cars at affordable prices or spearheading the transition to EVs—makes it a standout not just among foreign players, but in the Indian automotive landscape overall,” adds Agwan. “They didn’t just survive in India—they thrived by making India a core part of their global strategy.

The Skoda Kushaq on the production line at their plant in Pune

The Skoda Kushaq on the production line at their plant in Pune

Europe’s struggle

It’s against this phenomenal run by the Korean automaker in the Indian market that the abysmal performance of some of its Western rivals looks startling.

In July, Klaus Zellmer, the CEO of Skoda Auto, the lead brand for the Volkswagen Group in India, said the group hasn’t proven to be on the right track in the highly cost-sensitive Indian market, forcing the company to scout for a partner in the domestic market. Rumour mills suggested that Mahindra is in the running to acquire a 50 percent stake in the Indian entity.

The Volkswagen Group already has a relationship with Mahindra to supply electric vehicle (EV) components for the Indian carmaker’s upcoming INGLO-based EVs. According to the agreement, Volkswagen will supply components over several years, totalling volumes of over 50 GWh. The VW Group is currently building three giga factories in Germany, China, and Spain, and has invested over $2 billion in India.

That raises the question of why Volkswagen just can’t seem to catch a break in India despite starting in 2001 with the launch of Skoda. Skoda came to the Indian shores with the popular Skoda Octavia before the group decided to bring Audi and Volkswagen in 2007. Lamborghini and Porsche followed suit in 2012. Volkswagen’s popular models in India include the Polo, Vento, Virtus, Jetta, and the Tiguan while Skoda’s portfolio includes the Octavia, Superb, Kushaq, Kodiaq, and Slavia.

By 2018, despite being operational for two decades, the company turned to a new strategy, named India 2.0, where it merged different units to create an umbrella organisation and increase dealer networks. The group also developed a new platform, MQB A0-IN, on which it launched new products with higher localisation. The Volkswagen Group’s Czech subsidiary had been handed the mandate to lead India operations, in line with a global strategy where one subsidiary drives strategy and sales in a specific region.

But, five years later, in 2023, the group only managed to sell less than 90,000 units in the country when it sold a little less than 10 million vehicles globally. These include the sales of around 44,500 units for Skoda and 43,000 units for Volkswagen.

Volkswagen is not the only European carmaker to struggle in India. Stellantis, the Netherlands-headquartered automaker also has faced a similar fate, with its two subsidiaries, Jeep and Citroen, struggling to find takers.

Stellantis, which owns Fiat, traces its links to India as early as 1964, when the Mumbai-based Premier Automobiles Limited (owned by Walchand Group), joined hands with Fiat Automobiles and obtained a licence to manufacture the Premier Padmini, known globally as Fiat 1100.

By the late 1990s, Fiat came directly to Indian shores and joined hands with Tata Motors to set up Fiat Group Automobiles India Private Limited in Pune. By 2012, the Fiat Chrysler group decided to go all alone in India, before deciding to shut the Fiat brand altogether in the country in 2019.

In the meantime, the Fiat Chrysler group, through its arm, FCA India Automobiles Private Limited (FCAIPL), turned its attention to the Jeep brand and brought products such as the Jeep Compass to the Indian shores. By 2021, Fiat Chrysler Automobiles (FCA) and the French PSA Group joined hands to form Stellantis, which now operates in India with the Jeep and Citroen brands. In all, the group has spent more than €1 billion on its Indian operations since 2015.

Global focus, India neglect

“What happens with a lot of automakers, is that they need to get their investments, budgets, and products planning approved by their international headquarters,” says Vinay Piparsania, the former executive director at Ford Motors. “That takes its own time and procedures, needing to be aligned and in sync with their global priorities. At the same time, as global automakers, there are the distractions and urgencies from other more profitable and higher volume markets, taking away from the India focus. This has collateral effects on allocation of resources and capital, and thereby the product pipeline and operations.”

Stellantis, which manufactures over six million vehicles a year through its 14 brands, including the likes of Alfa Romeo, Citroen, Peugeot, Fiat, Jeep, and Chrysler, has revenues of more than £180 billion and is also the fourth-largest carmaker in the world by volumes. By 2030, the company wants to double its revenue, while also maintaining double-digit profit margins.

“When you are selling 10,000 vehicles a month, you are losing money,” says an industry insider who didn’t want to be quoted. “With Stellantis, they have emerged as a brand that keeps coming and going. You had Fiat, then Jeep, followed by Citroen. Over time, the trust in the brand has slowly disappeared. The export base has also not been the biggest in India.”

It’s into this mix that the Indian automakers led by Tata, Mahindra, and Maruti Suzuki have upped their game, offering feature-packed vehicles. Over the past five years, both Mahindra and Tata have grown their market share by more than 8 percent each.

“With the European carmakers, they did not make sufficient investments in India,” adds Bhatia of Jato. “They kept a lot of their focus on China, which was their cash cow. They never built sufficient capacity or took on the losses associated with market entry. Now that the well (China) has dried, they are trying to focus on India. But it’s perhaps too late.”

It also hasn’t helped that some of the foreign automakers are also struggling with domestic headwinds as Chinese automakers make a beeline in Europe with their cheaper offerings. Volkswagen is currently considering closing factories in Germany for the first time, as pressure increases to bring down costs. The company is looking at savings of €10 billion by 2026.

Can they find a way out?

With four automakers now controlling as much as 80 percent of the market, it is increasingly becoming difficult for the likes of European and American automakers to continue their presence in India.

In 2021, Ford Motors quit its India operations after piling up a debt of over $2 billion. Before that in 2017, General Motors had exited India leaving the Stellantis-owned Fiat Chrysler Automobiles (FCA), makers of the Jeep brand as the only American brand in the country. European brands in India currently comprise Volkswagen, Skoda, Citroen, and Renault apart from the luxury carmakers including Mercedes, BMW, and Audi.

In 2021, Ford Motors quit its India operations after piling up a debt of over $2 billion. Before that in 2017, General Motors had exited India leaving the Stellantis-owned Fiat Chrysler Automobiles (FCA), makers of the Jeep brand as the only American brand in the country. European brands in India currently comprise Volkswagen, Skoda, Citroen, and Renault apart from the luxury carmakers including Mercedes, BMW, and Audi.

“Market success is not easy to change currently,” says Bhatia of Jato. “India’s automakers have also improved their products and are well aligned with the Indian consumer. Unless you can aim for the belly of the pyramid, and offer great value with good service, success is very difficult to come.”

Even then, with India’s changing powertrain preferences, homegrown automakers have had a headstart with offerings such CNG and hybrid powertrains in addition to electric. Tata Motors, for instance, corners 65 percent of the domestic electric vehicle market, which makes it particularly difficult for global automakers, who have struggled in the past, to make fresh inroads when the electric vehicle boom takes place.

Despite that, Skoda Auto Volkswagen India has committed investments of ₹15,000 crore in establishing an electric vehicle (EV) manufacturing plant in Chakan, Maharashtra, while Stellantis will invest an additional investment of ₹2,000 crore into the Citroen.

“Today, the Indian automobile industry has matured and follows global trends” adds Piparsania. “We should give due credit to the fact that most of the best practices now being standard operating procedure in the auto industry, like dealer development, feature upgrades, improved engine performance, appealing designs, enhanced interiors and improving safety standards. This progressive evolution of Indian auto industry will remain as their lasting impact, and legacy, for the Indian Industry.”

Can they try and chart a new path for success? There just might be some hope on the horizon. “Foreign automakers can tap into growing consumer demand for advanced technology, safety features, and sustainability initiatives, especially as the market shifts towards electrification and shared mobility,” says Harshvardhan Sharma, the head of auto retail practice at Nomura research Institute.

One thing, though, is certain. India is something of a predicament. You can’t ignore it nor can you find a way around it. It’s all a wait-and-watch game.

(This story appears in the 01 November, 2024 issue

of Forbes India. To visit our Archives, click here.)