With the new guidelines, the market watchdog wants to bring transparency in all stock market recommendations by non-mainstream financial analysts and trading strategies as they often seem to be manipulating prices and indulging in speculative trading.

With the new guidelines, the market watchdog wants to bring transparency in all stock market recommendations by non-mainstream financial analysts and trading strategies as they often seem to be manipulating prices and indulging in speculative trading.

Illustration: Chaitanya Dinesh Surpur

Imagine a world where your money doubles, triples and quadruples every day; you get to own luxurious cars, take exotic holidays, and perhaps even travel to the outer space. You get rich and richer, just sitting at home. Financial influencers or finfluencers peddling such cotton candy-like world is not new in the Indian capital markets anymore.

Market regulator Securities and Exchange Board of India’s (Sebi) recent interventions to clamp down on such menacing influence on stock markets and misleading naive investors are steps in the right direction, even if perhaps a little late.

Finfluencers were largely unregulated before such norms were introduced by Sebi. With the new guidelines, the market watchdog wants to bring transparency in all stock market recommendations by non-mainstream financial analysts and trading strategies as they often seem to be manipulating prices and indulging in speculative trading. As concerns of frauds and scams led by finfluencers increase, the Sebi regulations will protect investors from misinformation related to capital markets.

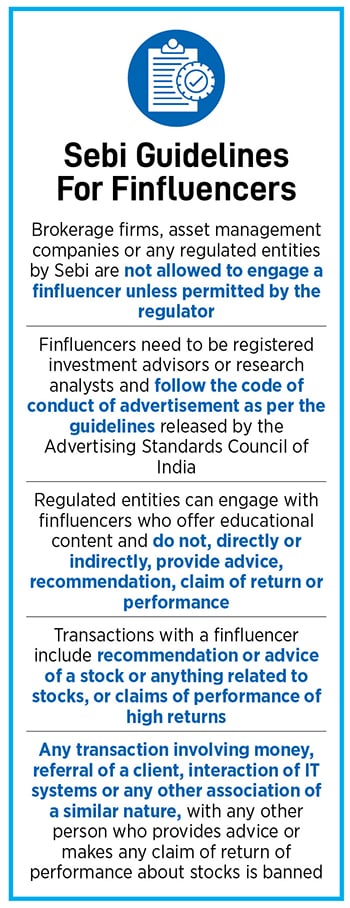

Sebi has banned brokerage firms and fund houses from engaging finfluencers for promotion or marketing campaigns. It explicitly states that no regulated entity can deal with any finfluencer who offers financial advice or makes performance claims without the market regulator’s permission. Transaction with a finfluencer includes any monetary deals, referral of a client or interaction of IT systems or any other association of similar nature. Referral fee for usage, non-cash benefits, direct compensation from social media or other platform, income from a profit-sharing model with the product, channel, platform or services are income sources identified by Sebi that finfluencers are not allowed to avail to promote content.

Simply put, a regulated entity can associate with a finfluencer only if the person is a registered investment advisor or research analyst. Second, the person—even if they are a Sebi-registered investment advisor or research analyst—can’t make performance claims.

However, this regulation comes with an exemption. Sebi says a regulated entity can engage with finfluencers or persons who are promoting investor education but should strictly not provide advice, recommendation, claim of return or performance. The market regulator has also prescribed certain eligibility criteria for those who can be classified as finfluencers—with strict instructions to follow the code of conduct of advertisement as per the ‘guidelines for influencer advertising in digital media’ released by the Advertising Standards Council of India.

Cycle of Greed

Finfluencers are one of the many reasons for the tearing rise of retail investors in Indian stock markets, especially during the Covid-induced lockdown. Currently, the total number of demat accounts in India is 17.11 crore, more than double the population of the UK and four times that of Canada. A total of 42.3 lakh new demat accounts were opened in August. A demat account is opened by an investor with a depository participant to invest in securities such as stocks and bonds. The securities are held in digital format.

However, the phenomenal rise in retail investors has led to greed with investors, who are often misled by finfluencers for their vested interests—expecting dramatically high returns in stock markets.

“Unfortunately, finfluencers have contributed to a rapid increase in retail participation in speculative and high-risk products rather than long-term wealth-creating investing,” says Mayank Joshipura, vice dean, research and professor (finance), School of Business Management, NMIMS. He adds that most influencers give hope on how quickly money can be made without informing about the associated risks.

“Unfortunately, finfluencers have contributed to a rapid increase in retail participation in speculative and high-risk products rather than long-term wealth-creating investing,” says Mayank Joshipura, vice dean, research and professor (finance), School of Business Management, NMIMS. He adds that most influencers give hope on how quickly money can be made without informing about the associated risks.

Case in point is the fact that 93 percent of over a crore individual F&O (Futures and Options) traders incurred average losses of around ₹2 lakh per trader (inclusive of transaction costs) in three years from FY22 to FY24. According to a Sebi study released in September, in contrast, only 1 percent of individual traders managed to earn profits exceeding ₹1 lakh, after adjusting for transaction costs.

On an average, individual traders spent ₹26,000 per person on F&O transaction costs in FY24. Over the three-year period to FY24, individuals collectively spent about ₹50,000 crore on transaction costs, with 51 percent of these costs being brokerage fees and 20 percent exchange fees, says the Sebi study.

A further look at the demographic slice shows that the proportion of young traders [aged below 30] in the F&O segment rose to 43 percent in FY24 from 31 percent in FY23. Individuals from beyond the top 30 (B30) cities made up over 72 percent of the total F&O trader base, a higher proportion compared to mutual fund investors, 62 percent of whom are from B30 cities. “Younger traders below 30 are the most vulnerable,” claims Joshipura.

Stressing the lack of accountability, he says brokerage firms, fund houses and companies taking help of influencers to promote products and services is a direct conflict of interest. “Human greed helps to add followers to any influencer talking about making quick money from the stock market, and that, in turn, provides an opportunity for financial product providers to push their high-risk products through these influencers without any accountability. There is no clarity whether and how many finfluencers are qualified to understand the underlying risk-return trade-offs of complex financial products to make them eligible to give objective financial advice to the followers,” Joshipura elaborates.

A recent research study conducted by Navi Mutual Fund shows that, in mutual funds, 80 percent of investors (millennial and Gen-Z) rely on their social networks and finfluencers for investment information, which is risky.

Click here for India’s Top 100 Digital Stars

Frauds and Scams

“I listened to a finfluencer on YouTube and trusted him because he recommended the app and said good things about it with confidence. I downloaded it and started investing. The company has gone bankrupt and lost my money. I feel helpless at times. Who should I blame?” says a Reddit user referring to Singapore-based crypto firm Vauld’s sudden suspension of withdrawal and deposit services in July 2022.

In India, many popular YouTubers had endorsed Vauld, advising people to invest with the platform. Few popular finfluencers like PR Sundar, Ankur Warikoo, Akshat Srivastav and Booming Bulls had promoted it as an investment option to earn high returns. In 2023, Sebi penalised and barred Sundar from trading as he was providing investment advisory services without the requisite registration mandated by the regulator. That was the market watchdog’s first action against any finfluencer for not adhering to regulatory norms.

However, the cycle continues. In August, Kamlesh Varshney, a wholetime member of Sebi, said that in the last three months, the regulator had removed more than 15,000 content sites by unregulated financial influencers. In another instance, Sebi banned Mohammad Nasiruddin Ansari, owner of ‘Baap of Chart’ on social media platforms, and six others. Sebi also directed to refund ₹17.21 crore which they earned by ‘carrying out unregistered and fraudulent illegal advisory service’. Ansari misguided investors on various social media platforms by projecting himself as a stock market expert providing various educational courses. He offered stock recommendations to those who paid for live market transactions. The YouTube channel of Nasir (@Baapofchart) has more than 4.43 lakh subscribers with more than 7 crore views. Contrary to Nasir’s claims that he had been making a profit of 20 to 30 percent, he incurred a net trading loss of about ₹2.9 crore.

Also read: Sharan Hegde: Finfluencer turned entrepreneur shows how it’s done

Pump and Dump

Pump and dump is a classic old scheme of duping investors with fake assurances of high returns. Typically, scamsters spread false or misleading information about a stock, which in most cases is a thinly traded or illiquid stock. First, scamsters buy in large volume shares of the illiquid stock, then create a buzz around it by promoting it on various platforms which increases its price in the stock market. Once its price goes up significantly, the scamsters dump or sell shares of that stock, leaving gullible investors with hefty losses.

In a recent pump and dump cases of stock rigging, Sebi has discovered extensive use of social media and finfluencers to manipulate prices. On June 1, the Sebi slapped a fine of ₹7.75 crore on 11 individuals for allegedly operating a ‘pump and dump’ scheme in the scrip of Svarnim Trade Udyog.

In a similar case of pump and dump in 2023, Sebi had banned actor Arshad Warsi, his wife Maria Goretti and 29 other entities from the securities markets for manipulating stock prices of Sadhna Broadcast and Sharpline Broadcast through misleading videos on YouTube.

Nuts and Bolts

According to Sebi, finfluencers should be registered investment advisers (IAs) or research analysts (RAs). It is mandatory for finfluencers registered with Sebi or the stock exchanges or the Association of Mutual Funds in India in any capacity to display their registration number, contact details, investor grievance redressal helpline, and make appropriate disclosures and disclaimers on all posts.

They are required to comply with the advertisement guidelines issued by Sebi, stock exchanges as well as any Sebi-recognised supervisory body. Also, Sebi-registered intermediaries/regulated entities are not allowed to pay any trailing commission based on the number of referrals as referral fee.

They are required to comply with the advertisement guidelines issued by Sebi, stock exchanges as well as any Sebi-recognised supervisory body. Also, Sebi-registered intermediaries/regulated entities are not allowed to pay any trailing commission based on the number of referrals as referral fee.

In its last board meeting in September, Sebi approved the proposal of review of the regulatory framework for IAs and RAs to attract more people in the profession. Currently, the numbers of IAs and RAs are disproportionately low to the high domestic investor base in India.

The market regulator has relaxed the existing qualification requirements for registration as IAs or RAs from postgraduation to graduation, and no previous work experience is required. Among other new norms, it has replaced the minimum net worth required to be IAs or RAs with a reduced requirement of deposits. It has also granted permission to register as a part-time IA or RA but it is mandatory to disclose the nature of other activities to eliminate conflict of interest.

Sebi’s mandate to regulate the finfluencer community is a long shot and will be a test of time as influencers are part and parcel of the new marketing paradigm. “Proper disclosures on conflict of interest, required qualification for offering specific financial advice and provisions to ensure accountability will help financial influencers favourably… they can contribute to retail participation and spread financial literacy rather than [become] a primary channel of mis-selling financial products,” says Joshipura.

Agrees Pranav Haldea, MD of Prime Database, saying that taking financial decisions based on the recommendations of friends and family has been prevalent in India even before social media. “Taking tips to buy/sell a stock or a service from someone just because s/he has many followers is dangerous. Strict regulations will make the finfluencer community better prepared to protect investor interest. It is hard for the regulator to stay ahead of the market. However, the regulator has and can continue to tighten regulations as newer issues come to light. But one has to also stay vigilant and not be gullible to fall for unsolicited advice and greed.”

Haldea feels once Sebi starts processing the data benchmarking for investors, it will reduce a lot of misinformation and misguidance. The regulator is actively exploring the need of setting up two new institutions, aimed at improving the quality of information provided to investors in the securities market.

The first is a Performance Validation Agency to validate the claims of performance related to services offered by investment advisors, research analysts and algo providers. The second is a Data Benchmarking Institution to provide a central repository of standardised and comparable data related to various asset classes, which will be useful for investors and analysts, says Sebi in its FY24 annual report.

(This story appears in the 18 October, 2024 issue

of Forbes India. To visit our Archives, click here.)