Pre-demonetisation, Indian citizens were deploying their black money in a number of activities, of which investing money in ‘benami’ properties was a big contender.

Pre-demonetisation, Indian citizens were deploying their black money in a number of activities, of which investing money in ‘benami’ properties was a big contender.

On November 8, 2016, India’s Prime Minister Narendra Modi announced demonetisation in India which invalidated certain currency notes in circulation as a measure to combat black money, counterfeit currency, and corruption. He announced the sudden withdrawal of ₹500 and ₹1,000 banknotes, which were the highest denominations in circulation at the time. This move was framed as a step towards a cleaner and more transparent economy. While it did result in increased digitisation and a temporary formalisation of some parts of the economy, the overall success of the policy remains a subject of debate. Its immediate effects were disruptive, and its long-term benefits, particularly in terms of curbing black money, were less clear than initially hoped.

Pre-demonetisation, Indian citizens were deploying their black money in a number of activities, of which investing money in ‘benami’ properties was a big contender. According to a report released by research platform LocalCircles today, real estate continues to be the top sector where black money continues to find favour, with many properties still falling under the benami (no name) category.

In order to reduce the problem of benami properties, the Department of Land Resources (DoLR) has implemented various initiatives to maintain land and property ownership records like digitisation of property records, and linking Aadhaar with property registration. The LocalCircles report, which surveyed over 45,000 citizens from 371 districts in India, aimed to understand how effective the government move has been till date and whether usage of black money is still common in property buying/selling.

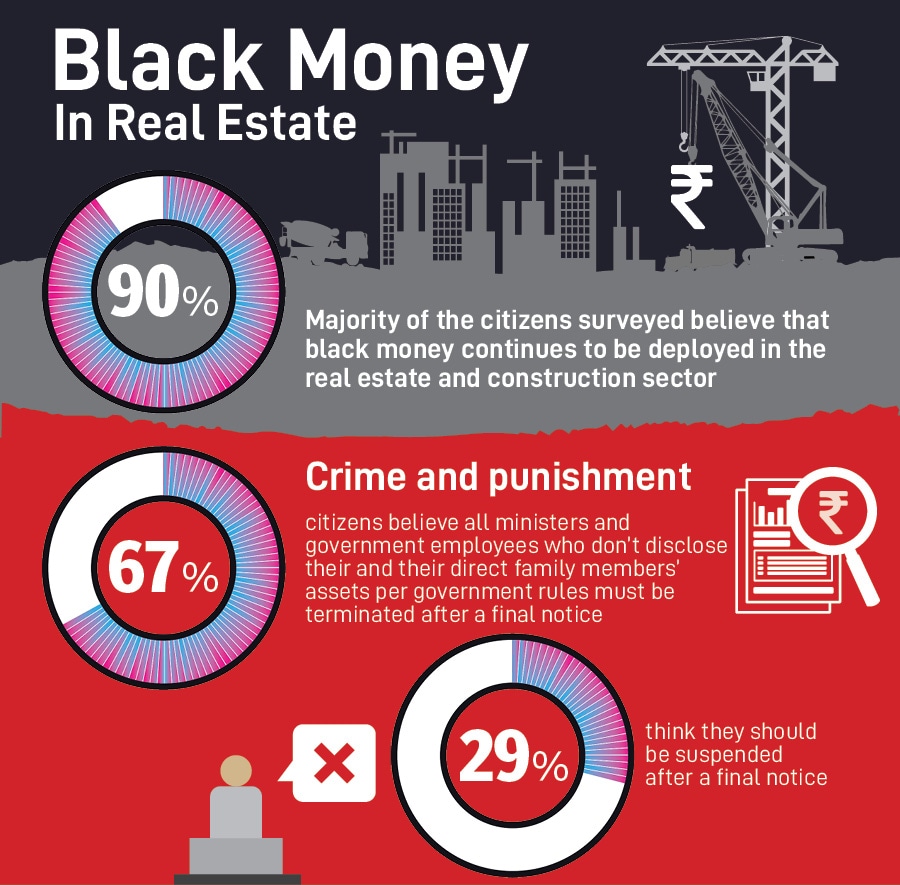

As per the report data, 62 percent property owners surveyed have not linked their Aadhaar to their property. The report further highlights that reports of benami properties often crop up in relation to probes against government employees and political leaders alleged to be involved in various scams. As a reflection of citizens’ view on these government officials, the report highlights that 67 percent citizens believe that all ministers and government employees who do not disclose their and their direct family members’ assets as per government rules must be terminated from service, while 29 percent are in favour of their suspension from service instead of termination.

Further, 9 in 10 citizens surveyed believe that black money is deployed in the real estate and construction sector and additional audits and checks are needed to ensure all products and services in the sector by builders and their subcontractors are being purchased with GST receipts.

What is being done?

As of December 31, 2023, 95.09 percent of the total 6,57,397 villages in India (6,25,137 villages) have completed the computerisation of Record of Rights (RoRs), according to the Management Information System (MIS) of the Digital India Land Records Modernization Programme (DILRMP). The DILRMP, as stated by the government, aims to establish a modern, transparent land records system through an integrated land information management system. Additionally, by August of the previous year, 76 percent of the digitisation of maps across the country had been completed, as per official data. The DoLR is also assigning a unique Bhu Aadhar or Land Parcel Identification Number to every land parcel, with nearly 9 crore parcels already assigned this identification within a year. Furthermore, while document registration used to be a manual process, e-Registration is now being implemented.

Also read: Cash is still king five years after demonetisation

Linking Aadhaar with property registration is another initiative by the government which aims to ensure the authenticity of property ownership, helping to prevent benami transactions (where the true owner is concealed) and reducing the use of fraudulent documents in property transactions. This initiative is also seen as a step toward digitising property records, simplifying the process of tracking and verifying ownership. Although not mandatory in all states, linking Aadhaar with property registration is expected to foster a more transparent and efficient real estate sector while curbing black money. In the Union Budget for 2024-25, the government has proposed the introduction of a unique identification number for land, or ‘Bhu-Aadhaar,’ in rural areas, along with the digitisation of all urban land records as part of broader land reforms.