Nitin Misra (right) and Deepak Abbot of Indiagold describe their company as a “Zepto meets Muthoot Finance”

Nitin Misra (right) and Deepak Abbot of Indiagold describe their company as a “Zepto meets Muthoot Finance”

Image: Madhu Kapparath

What would you expect when a curious data enthusiast and a creative sales specialist get together to build a company? A gold fintech startup wouldn’t be a tough choice, especially when the two founders are former Paytm senior executives. However, for Deepak Abbot and Nitin Misra, the conviction of creating a business built around home-delivered gold loan services came after several ideas were dismissed, junked and reshaped.

“We ourselves didn’t know what we wanted to do after leaving Paytm,” says Abbot. “Initially, we wanted to create a startup related to grocery and kirana stores,” chimes in Misra, 48, a musician during his student days in Delhi University, and who had previous experience of handling a digital gold product during his stint at Paytm.

Abbot, 47, who traces his roots [parents] to Pakistan, is a data and fitness geek. He left his chartered accountancy course midway to pursue computers and web development in 1997. He persuaded his banker parents to buy him a computer on a bank loan so that he could self-learn web designing and web development, which landed him his first job. His enthusiasm for data and web products got him to work closely in the founding team of Paytm where he met Misra. Their friendship later blossomed in the fintech startup.

Looking for gold dust themselves, Abbot and Misra took the plunge and launched Flat White Capital in 2020. The brand Indiagold, owned by Flat White Capital, offers gold loans at customers’ doorsteps as opposed to the traditional gold loan services offered at branches by banks and non-banking financial companies (NBFCs).

“Think of it like Zepto meets Muthoot Finance. This offering not only improves the catchment area of partner bank branches, but also enables them to offer differentiated services to their customers,” Abbot explains.

The potential of offering gold loan just like delivering groceries, clothes or food looked promising, especially when the market is pegged at around ₹7.1 lakh crore. However, the business came with its challenges as the sector is highly regulated and laden with concerns of bad loans.

“The doorstep model is not easy to deliver. A branch DNA is different from a field operations-led one. Combining trust, transparency, security of a branch with speed and convenience of doorstep needs the entire business—that is product, technology, processes, people —to be purpose-built from scratch; doorstep can’t be retro-fit into a branch model,” Misra says.

“Therein, lies our differentiator,” he adds.

Striking gold, yet?

The company is at a nascent stage of growth and has completed two fund raising rounds so far. It has cumulatively raised $23.8 million from the time of its launch. Out of the total, $1.8 million was in a seed round in August 2020, while the remaining was pumped in a Series-A round in September 2021. The company is not planning to raise any more funds.

Its clutch of investors include AWI (Alpha Wave Incubation), PayU Fintech, Titan Capital, Leo Capital, Rainmatter Capital, 3one4 Capital, Better Tomorrow Ventures, Kunal Shah (Cred), Amrish Rau (Pine Labs), Ramakant Sharma (Livspace) and Sameer Mehta (boAt).

Its clutch of investors include AWI (Alpha Wave Incubation), PayU Fintech, Titan Capital, Leo Capital, Rainmatter Capital, 3one4 Capital, Better Tomorrow Ventures, Kunal Shah (Cred), Amrish Rau (Pine Labs), Ramakant Sharma (Livspace) and Sameer Mehta (boAt).

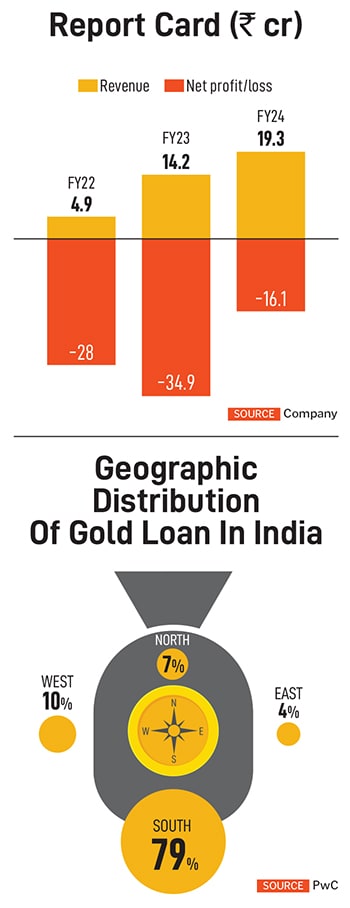

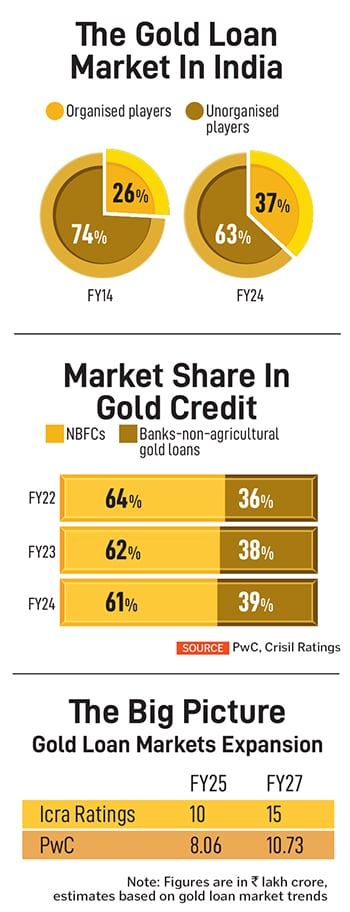

Currently operational in 12 cities, Indiagold aims to expand it to 15 by end of this year. Tamil Nadu, Telangana and Andhra Pradesh are on the radar along with plans to add new cities in the North and expand its footprint in East India by next year. South India is a dominant market for gold loans in India, with 79.1 percent share of the total outstanding loans in the industry.

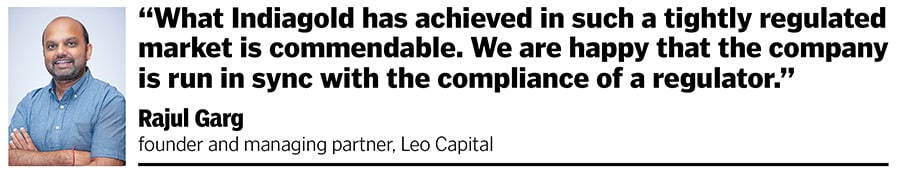

Since 2021, the company has disbursed over ₹2,500 crore loans. Its revenue grew to ₹19.3 crore in FY24 from ₹4.9 crore in FY22. Its losses have declined steadily to ₹16.1 crore in FY24 from ₹34.9 crore in the previous year and ₹28 crore in FY22.

Abbot explains that the company has been able to cut costs due its non-branch model. “Our current opex (operating expenses)-to-AUM (assets under management) is around five to seven percent while large players (branch model) in the industry are at five to eight percent. As our loan book grows, we will get to opex-to-AUM at two percent in the coming fiscals, which will be a considerable saving on our expenses,” Abbott says. Opex to AUM signifies how well-managed and efficient an NBFC’s operations are.

Typical customers of Indiagold are self-employed/MSMEs, looking for low-cost, short-term working capital without paying EMIs. Without loan against gold, these MSMEs would either have to pay high interest rates or not be eligible for loans at all due to their sporadic and unstable income.

“We were the first investors in Indiagold at a pre-revenue stage. What attracted us as an investor was its business model and the founders who have a rich experience in the fintech industry. The sector is growing and will expand further wherein lies our growth opportunities. In the last three years what Indiagold has achieved in such a tightly regulated market is commendable. We are happy at the way the company is run in sync with the compliance of a regulator,” says Rajul Garg, founder and managing partner, Leo Capital.

Also read: Jar: How to build your own pot of gold

The horizon?

The company has set its eyes on becoming profitable by March 2026. “Our margins grew 110 percent in the last 12 months and burn reduced by 55 percent in the same period so we’re getting there hopefully,” claims Abbot. He is optimistic about sustaining profitability by maintaining a continued focus on margins, keeping a tight leash on costs, strengthening customer retention and acutely following compliance.

With an ambition of taking the company public via an initial public offering (IPO) in a few years, it also plans to apply for an NBFC licence. The company’s ultimate vision is to build a GOCEN (gold-enabled credit-enablement network) platform that will enable Indian households to responsibly financialise their household assets.

With an ambition of taking the company public via an initial public offering (IPO) in a few years, it also plans to apply for an NBFC licence. The company’s ultimate vision is to build a GOCEN (gold-enabled credit-enablement network) platform that will enable Indian households to responsibly financialise their household assets.

In the organised gold loan sector, banks and NBFCs have made a significant transformation in the traditional channel by partnering with financial technologies or fintechs. This comes with mutual benefits as fintechs get to leverage and capitalise on the network and capabilities of lenders. “Lenders have been leveraging fintechs’ extensive customer networks and digital channels to expand their market reach and capture new customer segments,” says PwC.

RBI clampdown & regulations

Even as the sector is growing, recent regulatory interventions by the Reserve Bank of India are expected to hinder business growth. The central bank has highlighted a few areas related to deficiencies in monitoring of the loan-to-value (LTV) ratio, asset classification norms for overdue loan accounts, and inadequate due diligence in monitoring the end-use of gold loans, among others.

“Potentially, this could impact gold loan disbursements during the transition phase and curb growth in the business,” says Crisil. The circular comes in the backdrop of high growth in the gold loan portfolio of both banks and NBFCs over the past few quarters.

Rating agency ICRA forecasts the organised gold loans by banks and NBFCs to exceed ₹10 lakh crore in FY25; it is estimated to reach ₹15 lakh crore by March 2027.

As for Abbot and Misra, their company will continue to explore the untapped potential of the gold loan market in Tier 1 and II cities. “I am the impulsive but emotional one, while Deepak is data-driven in all decisions. As long as we both maintain this balance and harmony, we will take the company to uncharted territories with our innovative tech-led products,” Misra says.

(This story appears in the 15 November, 2024 issue

of Forbes India. To visit our Archives, click here.)