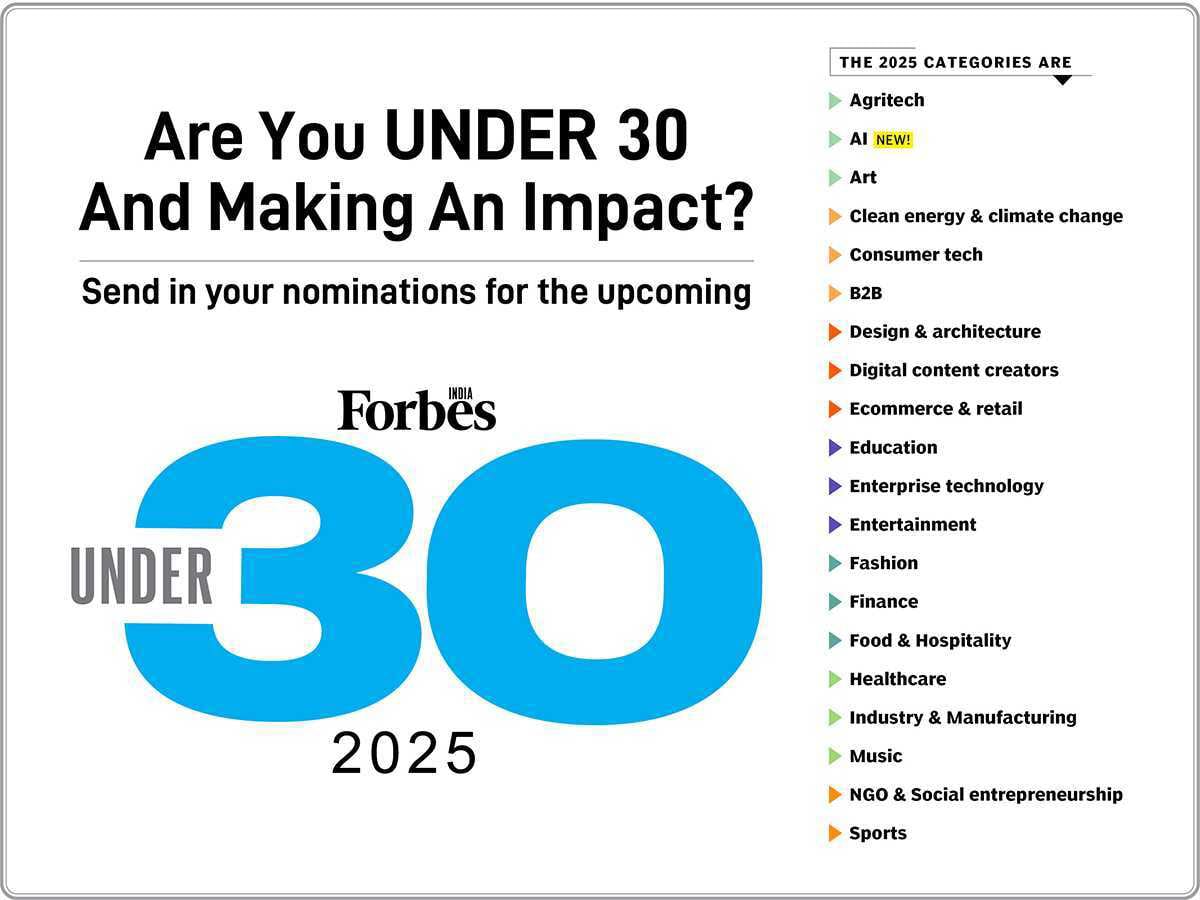

1) Forbes India Under 30 Class of 2025

In the middle of the festive season every year, Forbes India adds more excitement by opening the nomination forms for the coveted Forbes India Under 30 list. We pride ourselves on evolving with time and updating the categories as the tide changes. Artificial Intelligence (AI) has found its place among 20 categories this year. This prestigious list has given winners such as Ritesh Agarwal of Oyo, Aadit Palicha and Kaivalya Vohra of Zepto, Sahil Barua of Delhivery, Nikhil Kamath of Zerodha, designer Masaba Gupta, Indian women’s team skipper Harmanpreet Kaur, Olympian Neeraj Chopra, actors Rajkummar Rao and Triptii Dimri among more than 330 winners in the last decade. Now, it is your chance, or of someone you know who deserves this recognition, to nominate yourself and come a step closer to being part of this illustrious club of winners.

2) Organic solutions to the rescue

Puran Singh Rajput (left), co-founder and COO, with Ankit Jain, co-founder of EF Polymer Private Limited Image: Mexy xavier

Puran Singh Rajput (left), co-founder and COO, with Ankit Jain, co-founder of EF Polymer Private Limited Image: Mexy xavier

Forbes India’s latest issue puts focus on Indian companies on Forbes Asia’s prestigious 100 to watch list. These companies have figured out innovative ways to disrupt their industries and put them on a greater path. Founded by Narayan Lal Gurjar, Puran Singh Rajput, and Ankit Jain, EF Polymer is one such company that is revolutionising the agriculture sector in India. Extreme weather events such as droughts and floods are a significant risk to food security and have led to governments and farmers trying resilient cropping methods to protect yields and farm incomes. Here’s how EF Polymer’s organic solutions are helping solve these problems for farmers.

3) Gold loans home-delivered

Nitin Misra (right) and Deepak Abbot of Indiagold describe their company as a “Zepto meets Muthoot Finance”. Image: Madhu Kapparath

Nitin Misra (right) and Deepak Abbot of Indiagold describe their company as a “Zepto meets Muthoot Finance”. Image: Madhu Kapparath

Quick commerce is slowly revolutionising how consumers interact with products and influencing their behaviour towards access. What if this service was extended to provide gold loans at your doorstep, just like your groceries, food or clothes? One of the 20 Indian companies on Forbes Asia’s 100 to Watch list, Indiagold, offers that financing option. It was started by Deepak Abbot and Nitin Misra, two former Paytm executives, in 2020. The founders explain the concept as Zepto meets Muthoot Finance. Since the market for gold loans is pegged at around ₹7.1 lakh crore, the service has tremendous potential. But how will the founders deal with the challenges of a highly regulated sector and concerns about bad loans? Here are some answers.

Discover

1) Swiggy IPO: Worth it?

A Swiggy food delivery boy is delivering food on a bicycle in Kolkata, India. Image: Debarchan Chatterjee/NurPhoto via Getty Images

A Swiggy food delivery boy is delivering food on a bicycle in Kolkata, India. Image: Debarchan Chatterjee/NurPhoto via Getty Images

The three-day sale for Swiggy IPO closed yesterday. At the time of preparing this newsletter, it had already been subscribed 2.72 times, and the retail portion was completely booked. The IPO of Bengaluru-based online food and groceries delivery company received bids for 43.50 crore equity shares against 16.02 crore shares on offer, according to NSE data till 2:30 PM. It looked like the retail investors were putting faith in the future of the food delivery giant as they chose to ignore the conventional wisdom of not betting on a loss-making business. Are they headed in the right direction? Here are some analytical points to understand the nuances of this IPO.

2) IBM India and growth plans

Sandip Patel, managing director, IBM India & South Asia region; Photo by: Neha Mithbawkar for Forbes India

Sandip Patel, managing director, IBM India & South Asia region; Photo by: Neha Mithbawkar for Forbes India

When Arvind Krishna took charge of IBM as its CEO in April 2020, the tech services giant saw a massive strategy shift. It was now focusing more on hybrid cloud computing and AI. IBM India plays a crucial role in this change in direction. If you ask Sandip Patel, managing director of IBM India and South Asia region, about this contribution, he reveals, “IBM India operates almost like a microcosm of the IBM Corporation.” In a detailed conversation with Forbes India, Patel gives a review of the three years of consecutive growth for IBM in India, working with various governments, MSMEs in emerging markets, and the new avenues of growth–AI, Semiconductors, and Quantum computing.

3) The dealmaker’s advice

Softbank, founded by maverick investor Masayoshi Son, has backed some of the most disruptive companies in the world, like Nvidia, Uber, TikTok and Alibaba. So, when you are the former CFO of such an essential cog in the world economy, you have quite a lot of insight to share from the world of dealmaking. Alok Sama was that chief dealmaker at what was possibly the most influential technology investor in the world. In the latest episode of From the Bookshelves of Forbes India podcast, Sama discusses his book The Money Trap, in which he gives an insider’s account of the people, deals and businesses that have steered and shaped the course of the world.

4) To changing the course

Hockey India has kicked off celebrations for 100 years of the organised presentation of the national sport. It comes at the heels of the revival of the Hockey India League. The men’s tournament will begin on December 28, 2024, and the inaugural Women’s Hockey India League will start on January 12, 2025. While many factors, factions, and people contribute daily for the betterment of the sport, one particular individual stands out. Ravneet Gill, founder of New Horizons Alliance, a startup that focuses on esports, sports education, and sports leagues, has played a special part. On the latest episode of the Sports UnLtd podcast, Gill explains why, despite being a lifelong banker, he moved to sports management, becoming a commercial partner for HIL, and the rise of esports in India.