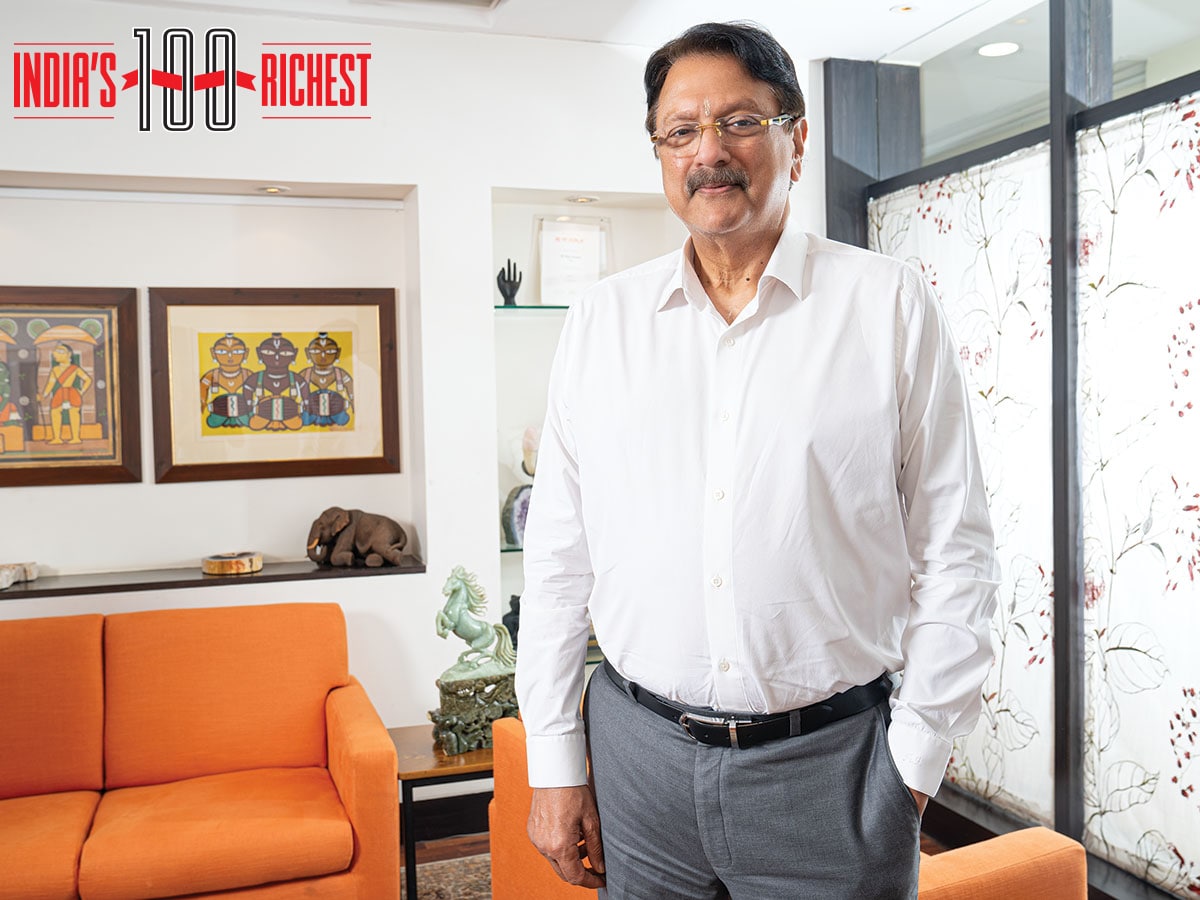

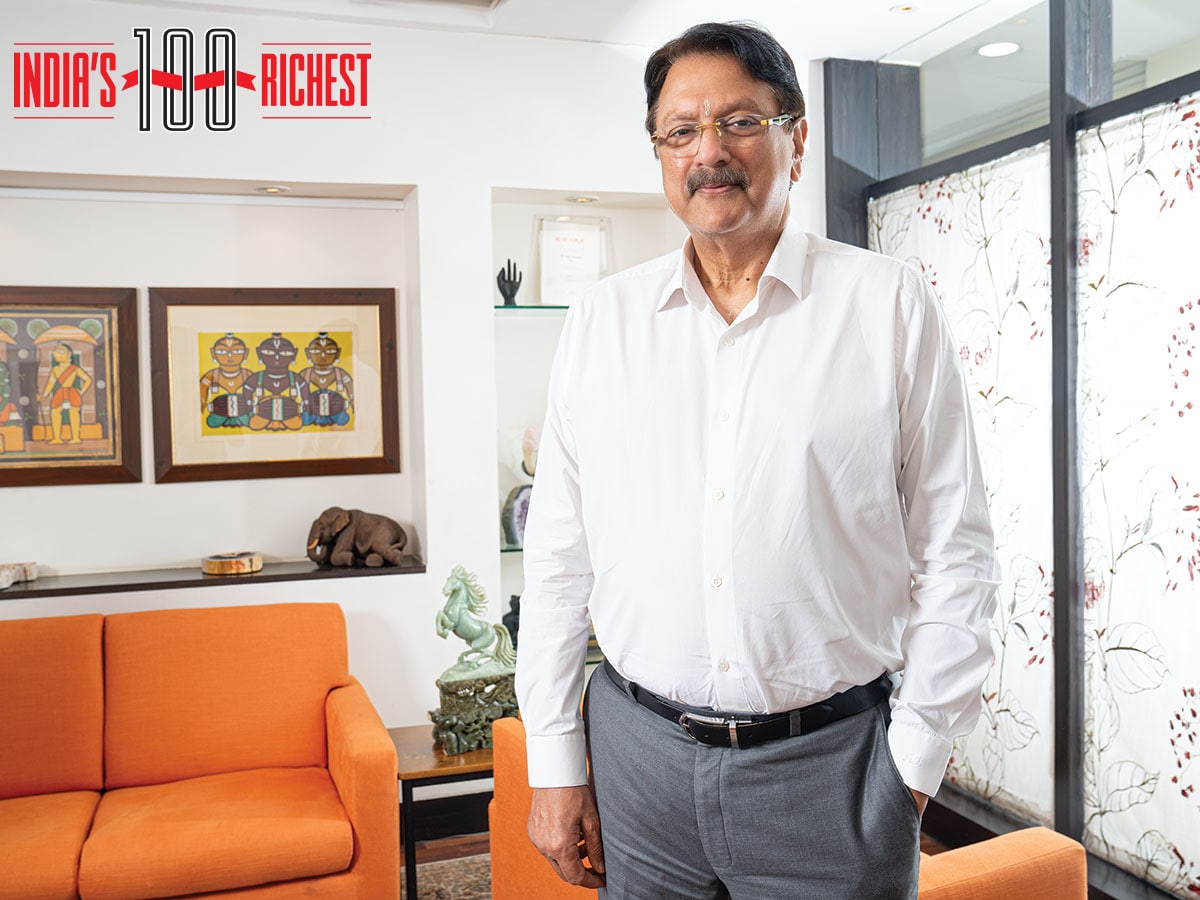

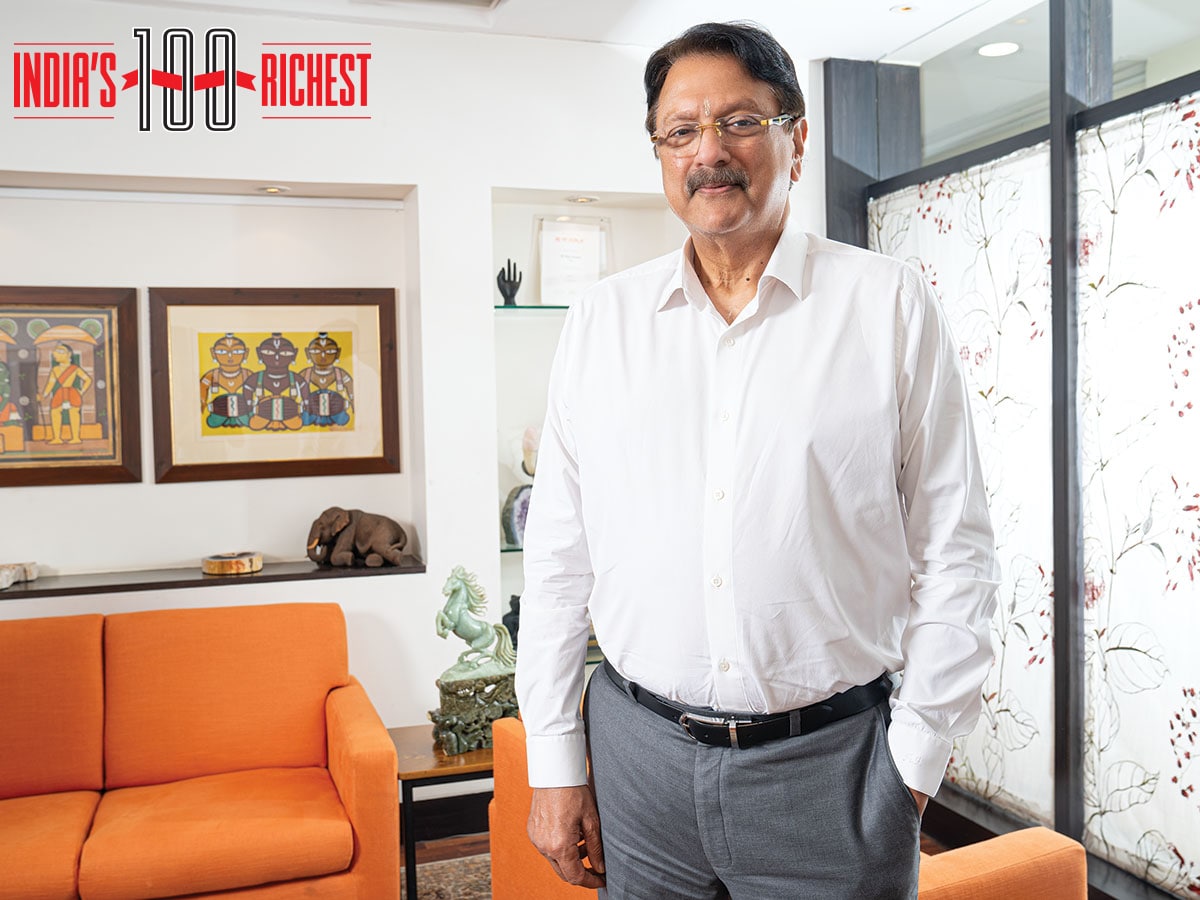

Ajay Piramal, chairman of PEL

Image: Mexy Xavier

A roller-coaster ride in business cycles and risks has impacted the fortunes of India’s richest. Banks and non-banking financial companies (NBFC) have been particularly at risk, where underwriting risks and credit costs have been rising as have bad loans in both retail and wholesale lending. This has meant weakening earnings growth for diversified NBFC Piramal Enterprises (PEL) in recent quarters, with the stock gaining just 7.76 percent in a year, underperforming the sectoral Nifty Midcap 100 (up 31 percent) in the past year.

The financial services arm of PEL includes Piramal Capital and Housing Finance Ltd (PCHFL). It is now a pure-play financial company, after the demerger of the pharma business in 2022. A year earlier, it had sold the Piramal Glass business to US private equity firm Blackstone for $1 billion. PEL’s growth engine comprises retail lending (72 percent), which was boosted by the acquisition of the DHFL book in 2021—housing loans, LAP, used car loans, business loans, unsecured personal loans and digital loans. The wholesale lending book (28 percent) comprises real estate and corporate loans. Other assets include a 10 percent stake in Shriram Capital, the holding company of Shriram Finance.

The fortunes of Indian billionaire Ajay Piramal, chairman of PEL, have been on the slide. His net worth has been fluctuating in recent years and he is now India’s 93rd richest with a net worth of $2.8 billion as of 2024. Piramal was ranked 24th in 2018, but his rank fell to 45 in 2019, as banks faced a credit crunch after the collapse of the Infrastructure Leasing & Financial Services (IL&FS) and curtailed lending towards housing finance companies and property projects.

Click here for full list here

Stress to Retail Lending

So how will the current business cycle for this NBFC pan out in the coming quarters? In the September-ended quarter of FY25, PEL’s retail AUM (assets under managem ent) grew by 42 percent year-on-year and are now at an AUM of ₹54,737 crore. But disbursements to the digital loan business are slowing, at ₹562 crore of disbursements in Q2FY25 against ₹836 crore in the previous sequential June-ended quarter. “From peak, this business has reduced by more than two-thirds on a quarterly disbursement run rate basis,” Jairam Sridharan, CEO (retail lending) and MD of PCHFL, told analysts at an earnings call meet on October 23.

The company’s top management has also said that within all the unsecured areas, the area where you see the most steady increase in risk is business loans and digital loans, which includes the microfinance basket. The 90-day delinquency trends have moved up (seen at 0.7 percent in Q2FY25). The company data also shows that estimated gross credit cost (ex-recoveries) was up 90 basis points quarter-on-quarter at 2 percent. Forbes India reached out to PEL for a comment, but they did not want to participate in the story. Jefferies analysts Bhaskar Basu, Kaushik Agarwal and Prakhar Sharma, in a note to clients, have kept an ‘underperform’ rating for PEL with a target price of ₹820, based on 0.6x December 2026 BV (0.6x September 26E). The analysts still see some downside risks for the company and their rationale is near-term provision could “stay elevated” as PEL unwinds [its] residual wholesale 1.0 [book] and as broader stress in retail is still elevated.

Also read: Kalyan Jewellers: How a regional, family business became India’s No. 2 jewellery player

The PEL stock had risen about 25 percent in the past six months, but the Jefferies analysts say risk/reward has turned negative after the recent rally.

Abhijit Tibrewal, a research analyst at Motilal Oswal Financial Services, has reiterated a ‘neutral’ rating with a revised target price of ₹1,015 for PEL. His assessment is that in the near term, he “does not see catalysts for any meaningful improvement in the core earnings trajectory of the company”.

Tibrewal estimates total AUM CAGR of around 21 percent and an around 29 percent CAGR in retail AUM between FY24 and FY27. “While its growth business (excluding one-off gains and exceptional items) is showing signs of improvement, it will still take at least nine to 12 months for it to mitigate the earnings and credit costs impact of an accelerated decline in the legacy AUM,” Tibrewal says in his note to clients.

But, to be fair to the Piramal top management, they had reiterated on challenges relating to credit costs.

In the earnings call, Sridharan outlined the current scenario which the company is facing. “We are a multi-product business. At every point in time, we expect some portfolio or the other, some business or the other to be going through some challenges either on the risk front or on the growth front etc.”

“But that’s the benefit of having a multi-product platform. As you’ve seen in these last two quarters, while we have slowed down, let us say, digital lending growth, our overall growth has not come down because we have been able to accelerate on affordable housing this quarter, LAP in the previous quarter,” he added.

On-the-ground lending activity has slowed down and analysts say it is quite likely that stress in retail lending could continue for some more quarters and there is a possibility of credit costs also rising, which will impact the retail growth book in the near term. But PCHFL has the advantage of strong leadership and an experienced management, which will help the company ride through this tough face and build a strong franchise.

(This story appears in the 12 December, 2024 issue

of Forbes India. To visit our Archives, click here.)