It’s among the most unexpected of comebacks. But, as with much of his life, Grandhi Mallikarjuna (GM) Rao, chairman of the eponymous GMR Group, with interests in airports, highways and the country’s power sector, has managed to turn the tide for him and his group. The 74-year-old has made a stunning return to the Forbes India Rich List, with his wealth swelling to $3.99 billion in 2024, making him the 78th richest person in the country.

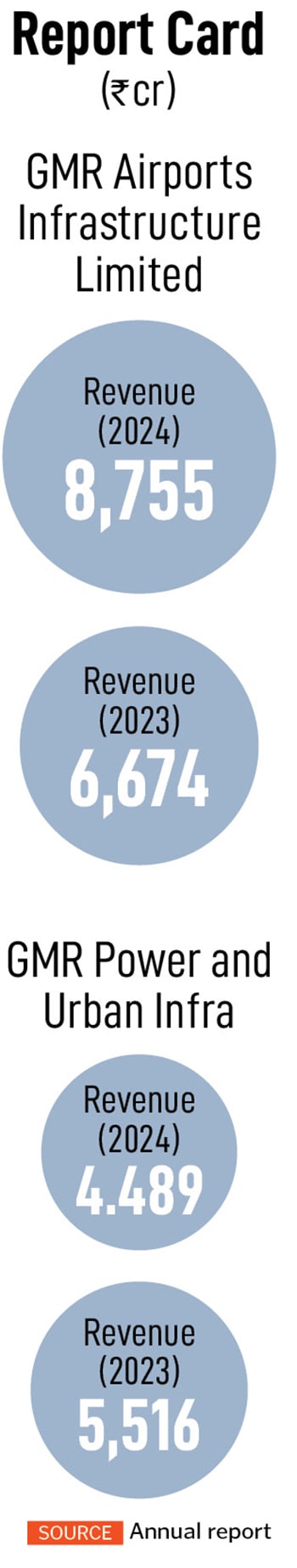

For many years, Rao, whose flagship companies include GMR Airports and GMR Power, was a regular on the list before dropping out as his business, which operates in the core infrastructure sector, had seen tailwinds. This year, much of the rise in wealth is on the back of a phenomenal rally on the bourses for Rao’s two listed entities—GMR Airports Infrastructure Limited and GMR Power and Urban Infra.

Between April 2023 and November 2024, GMR Power and Urban Infra saw a 517 percent rally on the bourses, while GMR Airport saw a 77 percent surge in its market capitalisation.

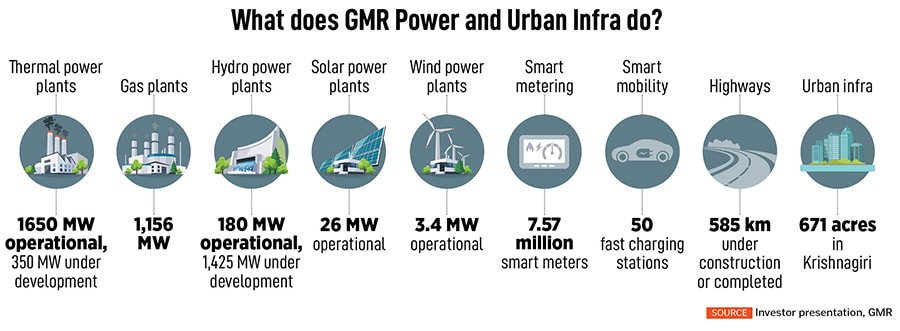

GMR Power and Infra, the arm that looks after energy, urban infrastructure and transportation, currently has two thermal plants, a 1,650 MW operational plant and a 350 MW under-construction plant. There are also gas plants, hydropower plants, solar power plants and wind plants that the company is currently operating or developing alongside road infrastructure projects. GMR is also setting up 50 EV (electric vehicles) charging facilities in addition to a 2,101-acre multi-product Special Investment Region (SIR) at the industrial hub of Krishnagiri in Tamil Nadu.

GMR Power and Infra, the arm that looks after energy, urban infrastructure and transportation, currently has two thermal plants, a 1,650 MW operational plant and a 350 MW under-construction plant. There are also gas plants, hydropower plants, solar power plants and wind plants that the company is currently operating or developing alongside road infrastructure projects. GMR is also setting up 50 EV (electric vehicles) charging facilities in addition to a 2,101-acre multi-product Special Investment Region (SIR) at the industrial hub of Krishnagiri in Tamil Nadu.

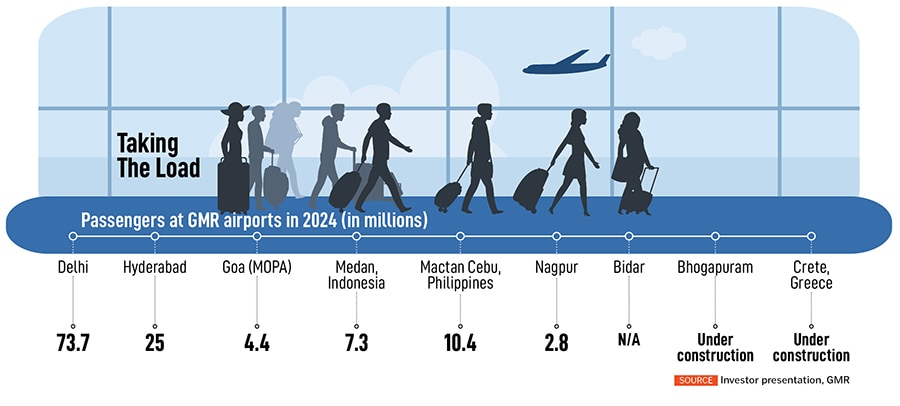

GMR’s airport business operates the country’s best-known Indira Gandhi International Airport in New Delhi and the Rajiv Gandhi International Airport in Hyderabad. Last year, GMR completed work on the MOPA airport in Goa, in addition to operating two international airports in Indonesia and the Philippines. In the process, it is among the two biggest private airport operators in the country alongside the Adani Group which forayed into the sector in 2021. The only other big player is the government-controlled Airport Authority of India (AAI).

“GMR Aero has grown to become the second-largest private airport operator in India. With Delhi, Hyderabad and the new Goa Mopa airport, they are setting benchmarks in airport quality and management,” says Alok Anand, chairman and CEO of Bengaluru-based Acumen Aviation, an aircraft asset management and leasing company. “I’ve seen firsthand how Delhi airport, one of the busiest in India, has transformed under GMR’s stewardship. The improved passenger and cargo handling, and modern operational practices are light years ahead of what we used to experience in AAI-managed airports.”

Today, the GMR Group, with its listed entities, has combined annual revenues in excess of ₹13,000 crore, a significant portion of which comes from the airport operations arm. The urban infra and power arm had annual revenues of ₹4,489 crore in 2024.

From Andhra to the World

GM Rao grew up in a small town of Rajam in Andhra Pradesh. A mechanical engineer, he worked with the government as a junior engineer before he forayed into the world of business, with a jute mill in 1978. Over the next few years, even as he scaled up that business, Rao began buying a stake in Vysya Bank, then a small bank in Andhra Pradesh, finally holding between 18 percent and 20 percent stake in the bank by the early 1990s.

As the country’s economy opened up as part of the neo-economic policies of 1991, Rao decided to move away from jute into the lucrative power segment and set up Tamil Nadu’s first private power plant, the GMR Vasavi Diesel Power Plant. Before that, he had set up a 388 MW gas-based Vemagiri Power Plant in Rajahmundry, Andhra Pradesh. The Chennai plant was followed by the group’s foray into building highways, which started by building three highway projects as the National Highways Authority allowed road projects under a build, operate, transfer (BOT) annuity model.

In all, Rao has dabbled in 28 businesses which include a brewery that he later sold to liquor baron Vijay Mallya, operating a ferroalloys production unit, sugar mills and a cotton bud manufacturing company. He had also started an IT company, Quintant, in 2003 before exiting a year later. That year, he also sold his nearly-40 percent stake in Vysya Bank to ING for ₹560 crore. Renamed ING Vysya, the bank was acquired by Kotak Mahindra Bank in 2014.

In all, Rao has dabbled in 28 businesses which include a brewery that he later sold to liquor baron Vijay Mallya, operating a ferroalloys production unit, sugar mills and a cotton bud manufacturing company. He had also started an IT company, Quintant, in 2003 before exiting a year later. That year, he also sold his nearly-40 percent stake in Vysya Bank to ING for ₹560 crore. Renamed ING Vysya, the bank was acquired by Kotak Mahindra Bank in 2014.

By the early part of the millennium, though, GM Rao also stepped up the game in the infrastructure sector, bidding for a new greenfield airport in Hyderabad in partnership with Malaysia Airport Holdings Berhad. While the project took almost eight years to fructify, the Hyderabad airport, later named Rajiv Gandhi International Airport, became a hallmark of sorts in airport operations with a world-class terminal that boasted numerous check-in and immigration counters, and boasted Asia’s longest runway at 4.26 km, while the air traffic control (ATC) tower stood at 75 metres. Until then, India’s airports were mostly run by the AAI.

By 2006, the company also won the right to develop the Indira Gandhi International Airport in New Delhi, and in order to avoid a monopoly in the sector, the government awarded the Mumbai airport redevelopment to Hyderabad-based GVK Group. The GMR Group had agreed to share 45.99 percent of revenue with AAI for developing the Delhi airport, while the GVK group offered 38.7 percent for the Mumbai airport.

The airport has since been counted among the best globally and has repeatedly been rated the best in the Asia-Pacific in the over-40 million passengers per annum (MPPA) category by the Airports Council International, a Canada-based organisation with members that operate over 2,000 airports.

India’s aviation industry has seen tremendous growth in the past decade, with the number of operational airports in the country doubling from 74 in 2014 to 157 in 2024. The government is looking to raise that number to 400 by 2047 as air travel in the country is expected to grow significantly over the next decade. India’s domestic passenger traffic is expected to reach 170 million in FY25, growing to 300 million by 2030.

In the process, with the GVK group having sold its Mumbai airport business to the Adani Group, and the Ahmedabad group’s aggressive step-up in aviation in recent years, the sector is effectively moving into a duopoly as the government looks at greater private participation to run airport infrastructure in the country.

“We’re likely moving toward a GMR-Adani duopoly, with AAI still holding some Tier 2 and III airports,” adds Anand. “However, this is not necessarily negative. Indian private airports, particularly those run by GMR, are world class. India is closing the gap with global leaders in airport infrastructure, especially compared to the Middle East and Asia, but has already surpassed the airports in the US and Europe. More AAI airports may be privatised, MRO (maintenance, repair and overhaul) services will expand, and there may even be consolidation in service divisions. Ultimately, passengers will benefit the most from better infrastructure and lower operational costs for airlines.”

That’s also why in their attempt to streamline the airport infrastructure business, the GMR Group had, in 2024, through a complex merger-demerger scheme, created GMR Airport Infrastructure Limited, which will have GMR Group holding 33.7 percent stake and France-based Groupe ADP holding 32.3 percent. Groupe ADP operates 26 airports, including the Charles De Gaulle airport in Paris, and had first invested in GMR in 2020. Today, GMR has eight airport subsidiaries, including the Delhi, Hyderabad, Nagpur and Goa airport, among others.

Also read: Parle Products has been popular for nearly 100 years. Can the 3rd gen continue its bull run?

In 2006, GMR won the rights to develop Delhi’s IGI airport

In 2006, GMR won the rights to develop Delhi’s IGI airport

Image: Anintido Mukherjee / Bloomberg via Getty Images

Power Play

With the airport business firmly under control, especially with a global partner, GMR has also been significantly growing its power and infrastructure sector, gradually bringing down debt that had been plaguing the group for long.

Over the past 15 years, the group’s aggressive expansion strategy, coupled with capital-intensive projects with long gestation periods, led to mounting debt levels at the group. From FY11 to FY15, GMR’s consolidated debt surged from ₹21,200 crore to ₹46,000 crore, while its debt-to-equity ratio increased from 1.9x to 5.5x.

“The group undertook significant restructuring aimed at reducing debt through various strategies, including fund raise, induction of partners, asset sales and monetisation, while disinvesting non-core assets, thereby enabling the group to allocate resources more effectively and focus on core businesses such as airports and energy,” brokerage firm Emkay Global said in a recent report.

In 2021, the group initiated a demerger for its then-sole listed unit, GMR Infrastructure, into two listed entities—GMR Airports Infrastructure (GIL) and GMR Power and Urban Infra (GPUIL). Today, that arm has a market capitalisation of ₹7,341 crore.

Apart from operating three highway projects totalling approximately 730 km in Andhra Pradesh, Haryana-Punjab and Tamil Nadu, the company is also in the midst of installing and maintaining over 7.57 million smart meters in Uttar Pradesh. The smart meter project is valued at ₹7,593 crore and with various state governments looking at transforming their electricity meters into smart ones, an estimated 250 million meters are expected to come up in the next few years.

“The consolidated gross debt of GPUIL has declined by around ₹4,500 crore over the last two years to ₹10,800 crore as on June-end, supported by healthy operating cash flows and monetisation of 30 percent stake in PT GEMS, thereby resulting in a sizeable reduction in net debt of the energy business to ₹5,800 crore as on June-end, from around ₹9,000 crore as of March 22,” the Emkay report adds.

In 2022, GMR Coal Resources Pte Ltd (GCRPL), a subsidiary of GMR Power and Urban Infra Limited, entered into definitive agreements to divest the 30 percent equity stake it holds in PT Golden Energy Mines Tbk (PT GEMS) to PT Radhika Jananta Raya for $420 million.

Today, the company’s core thermal assets (1,650 MW capacity) are operating at a strong plant load factor (PLF) of more than 80 percent and are backed by 100 percent coal linkages and power purchase agreements for as much as 90 percent of the capacity. PLF measures how much a power plant is being used compared to its maximum potential. “This robust financial performance is expected to continue in the medium term given the healthy power demand in India and would support annual debt repayments of ₹500 crore per annum to steadily trim its related debt burden of ₹5,000 crore,” the Emkay report says.

India operates around 243 GW of thermal power capacity, contributing to some 55 percent of total power plant capacity in India. However, thermal power generation forms 75 percent of the total generation mix, led by higher PLFs for thermal power as compared to renewable energy.

All that means, GMR’s strategy now to focus on an asset-light model, alongside its debt reduction, has meant that the power and urban infra arms are looking at significant growth in the coming years. “GMR has significant opportunities ahead, but the primary challenges will come from competition and regulatory hurdles,” says Anand. “However, given their extensive experience, I believe they’re well-positioned to navigate these challenges successfully.”