As you step into Parle’s Mumbai office, nestled in Vile Parle, a wave of nostalgia hits. Memories of childhood come flooding back—Mango Bite, Kismi, Poppins, and the toffee with its catchy slogan, ‘Melody itni chocolaty kyun hai?’ One can’t help but remember how Parle has been an integral part of growing up, with Parle-G biscuit being a constant companion.

The company’s name is borrowed from the western suburb of Mumbai (Parle) it operates out of. Inside the Mango Bite meeting room—each room is named after a Parle product—Vijay Chauhan, chairman and managing director, enters with a warm smile. Dressed in a formal attire, the 88-year-old exudes energy.

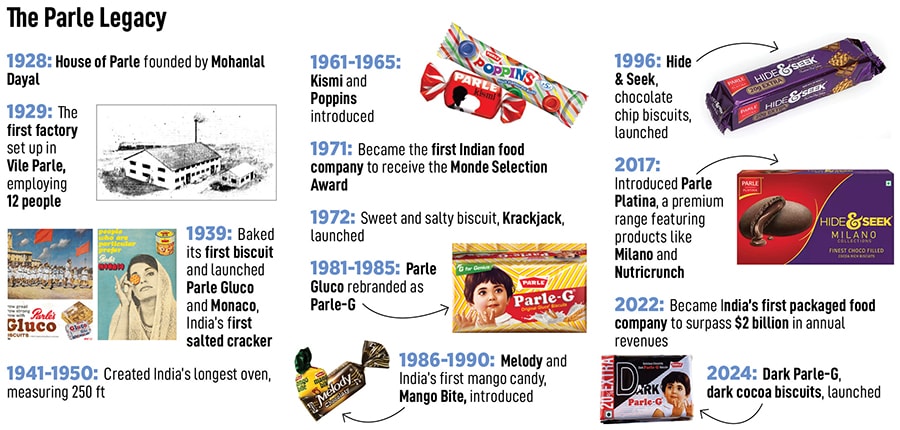

A mechanical engineer from the Massachusetts Institute of Technology, Chauhan joined the family business at 22 as a second-generation entrepreneur. His leadership has enabled Parle Products, established in 1929, to maintain its market prominence and the lasting appeal of Parle-G, introduced in 1939. Chauhan made his debut on the Forbes India Rich List in 2015 with a net worth of $2.7 billion, which has since surged to $8.3 billion in 2024, securing him the 34th spot.

“I’m passionate about golf,” Chauhan shares in an exclusive interaction. “I play three times a week. I’ve even had the pleasure of playing with the legendary JRD Tata.” While Chauhan regularly visits the office to provide strategic oversight, he has reserved select days for tee-offs at the Willingdon Sports Club. “I’m not directly involved in daily operations,” he explains. “Succession planning is in place, and my son, two nephews, and niece are currently at the helm.”

The third generation managing the daily operations has worked extensively on expanding the contract manufacturing network, increasing the marketing footprint, and improving logistics. Additionally, they established new plants and drove growth in international markets, building upon the foundations laid by the previous generations. Chauhan’s son, Ajay, manages manufacturing facilities, product development, and human resources. Arup, his nephew, oversees sales, contract manufacturing, exports, and international business. Another nephew, Samar, handles finance, procurement, and logistics. Chauhan’s niece, Ambika, takes care of marketing and cost-cutting.

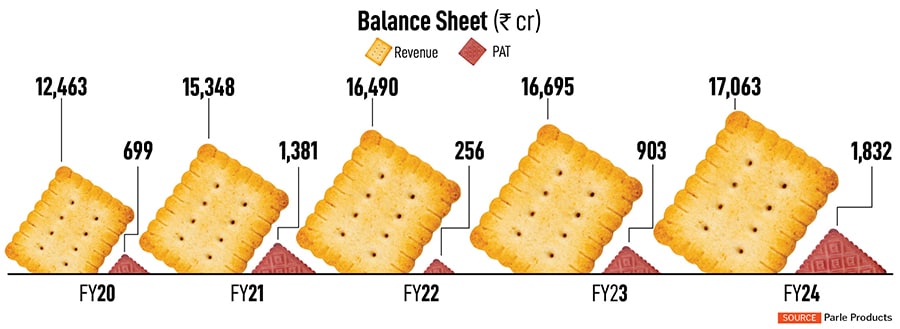

The unlisted company derives ₹1,500 crore of its total ₹17,000 crore revenue from international markets with eight manufacturing units in Cameroon, Nigeria, Ghana, Ethiopia, Kenya, Ivory Coast, Nepal and Mexico. “We’re witnessing a surge in demand from the Middle East and, surprisingly, Mongolia,” says Chauhan. “Participating in key exhibitions like Cologne’s International Confectionery Fair and Dubai’s Gulfood enables us to build relationships with global buyers, driving sales and fostering loyalty.”

The unlisted company derives ₹1,500 crore of its total ₹17,000 crore revenue from international markets with eight manufacturing units in Cameroon, Nigeria, Ghana, Ethiopia, Kenya, Ivory Coast, Nepal and Mexico. “We’re witnessing a surge in demand from the Middle East and, surprisingly, Mongolia,” says Chauhan. “Participating in key exhibitions like Cologne’s International Confectionery Fair and Dubai’s Gulfood enables us to build relationships with global buyers, driving sales and fostering loyalty.”

Until recently, biscuits accounted for over 90 percent of Parle’s revenue, which has come down to 75 percent, with snacks, confectionery, atta, rusks and bakery items contributing the remaining. Despite retailing over 50 brands across categories, Parle-G’s iconic glucose biscuits dominate consumer perception—which the company is trying to change with various ad campaigns. Parle Products has increased its digital ad spend nearly threefold in five years. The company allocates 35 percent of its ad budget to digital, 50 percent to TV, and 8 to 9 percent to print.

With a strong distribution network, ensuring availability even in remote regions, Parle’s retail network has grown from four distributors since inception to over 7,000 distributors and 7.5 million outlets across India. Their general trade contributes about 87 percent to the total sales, modern trade 10 percent, and quick-and ecommerce contribute about 3 percent.

“The biggest factors to have made Chauhan and Parle successful are consistency of quality and innovation,” says Harsh Mariwala, chairman of Marico Limited. “To maintain the quality of a brand like Parle-G—which is popular even in New York—is noteworthy. They have also been able to innovate with newer biscuit brands in recent years.”

Nearly four years ago, the FMCG giant had outpaced rivals, including Britannia and Nestlé, to become the country’s biggest food company by revenue. Britannia is the market leader by value in biscuits and has been gaining market share consecutively over the past few years. Parle leads in volume and sells about 1.2 million metric tonnes of biscuits annually. Parle-G is the world’s best-selling single biscuit brand, surpassing Oreo, claims Chauhan. While Oreo boasts of being consumed every three minutes, Parle-G’s sales far exceed theirs. “As a low-cost, low-margin item, Parle-G’s success lies in its massive volumes,” he adds.

Nearly four years ago, the FMCG giant had outpaced rivals, including Britannia and Nestlé, to become the country’s biggest food company by revenue. Britannia is the market leader by value in biscuits and has been gaining market share consecutively over the past few years. Parle leads in volume and sells about 1.2 million metric tonnes of biscuits annually. Parle-G is the world’s best-selling single biscuit brand, surpassing Oreo, claims Chauhan. While Oreo boasts of being consumed every three minutes, Parle-G’s sales far exceed theirs. “As a low-cost, low-margin item, Parle-G’s success lies in its massive volumes,” he adds.

The Goods & Services Tax (GST) implementation in 2017 revolutionised the biscuit industry’s tax landscape. Previously, Parle-G benefited from lower excise duty due to its mass market classification. However, the GST introduced a uniform 18 percent rate, significantly increasing the tax burden. To mitigate this, Parle reduced biscuit quantities in ₹5 packs. “We had to reduce it to offset losses,” says Chauhan. “Unfortunately, this affected destitute consumers who relied on our affordable biscuits. Despite meetings with former Finance Minister Arun Jaitley, we couldn’t secure exemptions. The challenge persists: Balancing profitability with consumer affordability.”

The Parle legacy began before Independence, influenced by the Swadeshi movement. In 1928, Narottam Chauhan founded Parle along with his brothers Maneklal, Pitambar, Kantilal and Jayantilal, purchasing an old factory in Vile Parle for ₹75,000. After learning confectionery-making in Germany, Narottam launched Parle’s first product, the orange candy, in 1929. Defying European dominance in the confectionery industry, Parle produced 40 tonnes of candies annually, achieving a turnover of ₹50,000 in 1936. Despite challenges, it also broke even and profited ₹3,000 in the same year.

The Parle Group’s family split happened in the 1970s, resulting in the division of the company into three entities. Family disagreements, diverging interests and strategies, as well as the company’s expansion and diversification, led to the splitting of the business. The business was subsequently divided among the siblings. Kantilal and his sons—Vijay, Sharad and Raj—took the reins of Parle Products. Jayantilal and his sons Prakash and Ramesh took over Parle Agro and Parle Bisleri, respectively.

Earlier this year, Parle-G sparked a social media frenzy when a user shared images of its new flavour, ‘Dark Parle-G’, on X. The post went viral, with many doubting its authenticity, suspecting artificial intelligence generation or digital manipulation. Later, Parle’s X account confirmed the launch of dark cocoa biscuits, which are currently growing slowly for the brand.

Also watch: Nadia Chauhan of Parle Agro on the balancing act of gen-next entrepreneurs

In 2017 too, Parle responded to changing tastes with the launch of its premium Platina range, introducing flavours from dark cocoa to mixed berries, all presented in sleek, modern packaging that distinctly appeals to Gen-Z, explains Abhik Choudhury, founder, Salt & Paper Consulting. Despite inflation fluctuations across decades, they never diluted their mothership brand of being the most value-for-money biscuits in the country. And they achieved that level of affordability at a scale no other brand, big or small, could compete with.

When asked why the company still hadn’t gone public, Chauhan replies, “Probably nobody felt the need. All family members are satisfied with our current trajectory, and we don’t require additional funding at this point.”

The Chauhans (from left): Executive directors Samar, Arup, Vijay (who is MD and chairman), Ambika and Ajay

The Chauhans (from left): Executive directors Samar, Arup, Vijay (who is MD and chairman), Ambika and Ajay

India’s biscuit and confectionery market is experiencing limited growth due to decreased spending propensity, inflation and unemployment. Premiumisation-driven growth has plateaued, resulting in muted growth and negligible volume expansion. While niche segments like healthy options and new flavours show rapid growth, this doesn’t significantly impact large companies’ top-line performance.

Post Covid, large players like Parle, Britannia, ITC and the likes consolidated market share as smaller competitors struggled with working capital requirements. Regional players have since rebounded vigorously. During quarterly results, many companies acknowledged the surge in local competition. Due to the price-point sensitivity in the market, local players can maintain profitability with leaner cost structures. This trend is evident in confectionery, chips and biscuits, where local players are proliferating, explains Nikhil Sethi, partner and national head, consumer goods, KPMG India.

Urban consumption faces pressure due to high income stress, prioritising essentials over discretionary spends like biscuits. However, affordable biscuit categories remain in demand. Rural consumption grows relatively faster from a lower base.

“To drive growth, companies are adopting three strategies: Enhancing operational efficiency, developing micro products for specific regions, and M&A activity. Consumer companies trade at high multiples, emphasising profitability and revenue growth. The key challenge remains balancing growth with valuation,” adds Sethi. Growth now comes from market share gains rather than market expansion. Data analytics plays a crucial role in targeting retail outlets, utilising decades of transaction data to craft localised strategies. This approach is inspired by consumer-level personalisation, as seen in companies like Zomato and Amazon.

Chauhan concedes, “Establishing relationships with buyers is crucial. Once trust is built, they become loyal customers.” Parle faced a challenge due to the low-cost nature of its products, which made transportation costs a significant expense. To mitigate this, “we partnered with over 125 contract manufacturers across India. Our model involves supplying raw materials while they invest in machinery and labour. Our quality control team monitors production, and contract manufacturers are paid per kilogram produced. This approach enables us to maintain quality while avoiding operational liabilities”.

As Choudhury describes, with Parle-G for grandfathers, Monaco for grandmothers, Marie for moms, Rusk for dads, Hide & Seek for teens, and Kaccha Mango Bite for kids, Parle became one of the few brands in the world to establish a seamless, individual connection across three generations. If that’s not the formula for billion-dollar dreams, then what is?

“That the success of the Chauhans sustained for over almost a century isn’t a fluke; if anything, the G of Parle-G might actually stand for genius when it comes to them,” adds Choudhury.