Raamdeo Agrawal, Chairman and co-founder, Motilal Oswal Financial Services

Raamdeo Agrawal, Chairman and co-founder, Motilal Oswal Financial Services

Image: Bajirao Pawar for Forbes India

India’s Nifty 50 Index, which comprises most of what are loosely called “blue chips” in stock market parlance, has delivered a 13 percent return year-to-date and more than doubled in a five-year period. The track record of these listed companies, in terms of earnings data, market capitalisation and profitability, makes them among the most sought-after stocks, particularly if falling prices make them more attractive, valuation-wise. The Nifty 50 index is down 6 percent off its recent September peak of 26,216 levels.

Raamdeo Agrawal, chairman and co-founder, Motilal Oswal Financial Services, who has just completed his 29th Annual Wealth Creation Study, has now defined the framework of how investors need to study and invest in blue-chip stocks. This is the theme of the current report titled Creating wealth through investing in bruised blue-chip stocks.

For the purpose of this study, a blue-chip is defined as one that has a track record of listing for 10 years, profitability and size, and one with a 10-year average return on equity (RoE) of at least 20 percent.

Re-look bruised blue chips

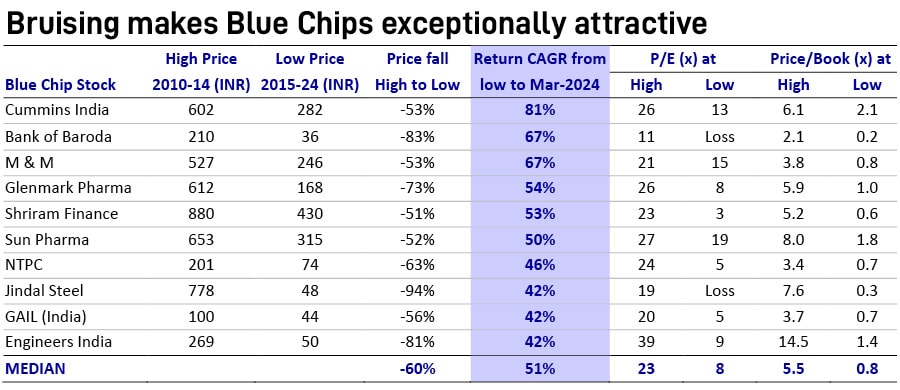

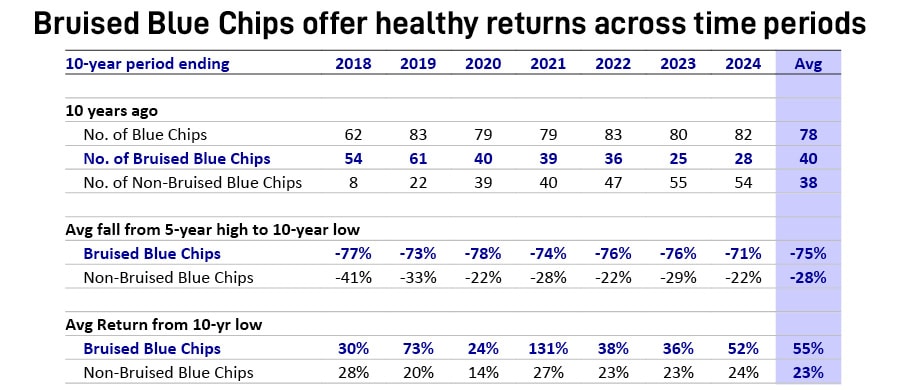

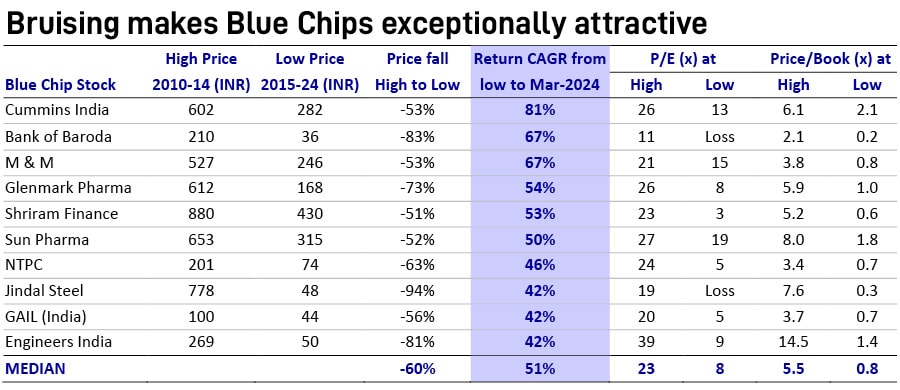

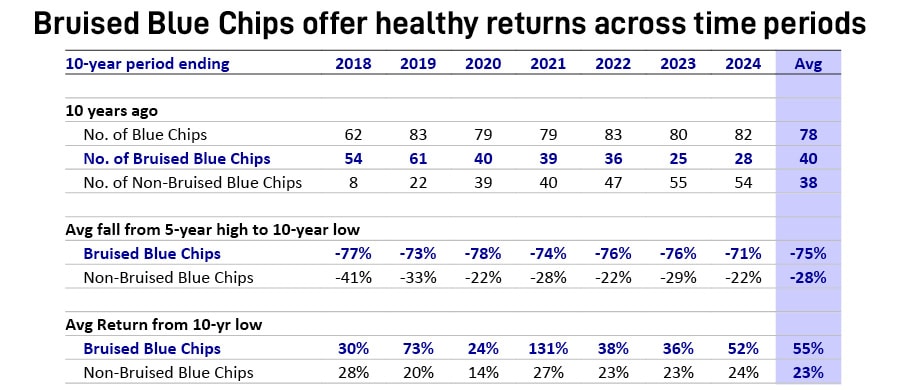

A bruised blue-chip stock is not just one that might have corrected price-wise. Agrawal defines a bruised blue-chip stock as one that has, at any time over the next 10 years, fallen by 50 percent or more from its 5-year high.

“I have seen that on every rise in the stock markets, investors are keen to buy into blue chips but when they are falling, everybody is deserting them. But this study shows [see table], that the easiest way of making money is by following the bruised blue chips,” Agrawal told Forbes India, in his office, while explaining the nuances of the report. As he gets into the conversation, he compares bruised blue chips to the Indian cricketer Rishabh Pant, who appears to be emerging from a career- and life-threatening accident in late December 2022.

“Pant came back as captain of Delhi Capital [in IPL 2024],” Agrawal says. “He had the drive and the performance behind him.” Agrawal’s analogy indicates there is always opportunities to re-look and re-invest in bruised blue chips.

In one of the detailed case studies of bruised blue chips, the Oswal wealth creation report puts the spotlight on Mahindra & Mahindra. In the five years to FY20, there were several external factors that put pressure on the company’s earnings and stock performance. This included transition to BS6 emission norms, a slowdown in its core utility vehicles and tractor businesses, a weak portfolio and a slow push towards electric vehicle expansion. The financial burden of loss-making SsangYong, high operating costs, expansion into aerospace and two-wheelers all impacted returns and RoE levels for the company.

In FY21, the leadership reins were handed over to Dr Anish Shah as the new managing director and CEO. These changes brought a renewed emphasis on profitability, capital efficiency, and strategic clarity, Agrawal says. It resulted in better capital allocation, consolidation and evaluation of loss-making subsidiaries and businesses, improving market share through a revitalised SUV portfolio and acceleration of innovation.

This has all boosted earnings and investor confidence, with revenue over FY20-24 growing 22 percent CAGR. This was led by a volume growth in tractors and automotive segments. The M&M stock price has gained over 80 percent in the past year and over 480 percent in the past five years.

Also read: The banking sector is one of the few spaces with some upside for market investors: Prashant Jain

Reliance trumps in wealth creation

For the sixth time in succession, the study shows that Reliance Industries emerged the biggest wealth creator over 2019-24. This takes Reliance’s overall No 1 tally to 11 in the last 17 five-year study periods.

The 29th Wealth Creation study for the period 2019 to 2024, shows that the top 100 wealth creators in India created record wealth of Rs 138 lakh crore. The pace of wealth creation was the second sharpest, at 26 percent CAGR in the last 10 study periods, also significantly higher than the BSE Sensex return of 14 percent.

Adani Green emerged as the Fastest Wealth Creator with 2019-24 Price CAGR of 118 percent. Despite volatile trends and negative news in recent years, two more Adani group companies, Adani Enterprises and Adani Power, have made it to the list of top 10 fastest wealth creators.

Besides the comeback of PSU stocks, one of the key highlights was that finance companies were the top wealth destroyers despite being the third largest wealth creator. Banks and NBFCs have been facing rough times in 2024, where regulatory concerns, a tempering of unsecured lending, pressures of bad loans growing in the micro-finance sector and growing competition in the digital lending space, have all hurt growth and business for lenders. Six of the top 10 wealth destroying companies are from the finance sector. Agrawal argues that once the interest rate cuts start to take place, banks and NBFCs could start to see improved lending opportunities.

Time to re-balance portfolios

Agrawal continues to express concerns over corporate earnings growth, adding that “four quarters are going to be bad”. But he sees huge opportunities in the new-age, consumer facing brands.

India saw its GDP growth slowing to 5.4 percent for the September-ended quarter, its slowest pace of growth in the past seven quarters. State Bank of India has now pegged FY25 growth at a lower 6.3 percent. This is lower than the RBI forecast of 6.6 percent for the same period.

But Agrawal is confident that domestic consumption demand will start to pick up, but did not offer a timeline. “It is a cycle and will pick up,” he adds.

On individuals planning investments in the stock markets, Agrawal says there is no need to alter the equities strategy, but there might be a need to re-balance the portfolio, if one is completely equity focussed. “One can consider booking some profit and get into high-yield debt products like REITs. If your need is to diversify into other asset classes, diversify on fixed income to buy REITs,” he says.

Raamdeo Agrawal, Chairman and co-founder, Motilal Oswal Financial Services

Raamdeo Agrawal, Chairman and co-founder, Motilal Oswal Financial Services