Surging demand for electric vehicles, leading to a significant accumulation of end-of-life batteries in the coming decade.

Surging demand for electric vehicles, leading to a significant accumulation of end-of-life batteries in the coming decade.

Image: Shutterstock

The EV battery industry is poised for explosive growth, with the entire lithium-ion battery value chain expected to grow by more than 30 percent annually till 2030, which will amount to a staggering $400 billion and over 4.7 Terawatt-hour (TWh) of the market size (Jackob, et al. 2023) This rapid expansion is driven primarily by the surging demand for electric vehicles, leading to a significant accumulation of end-of-life batteries in the coming decade.

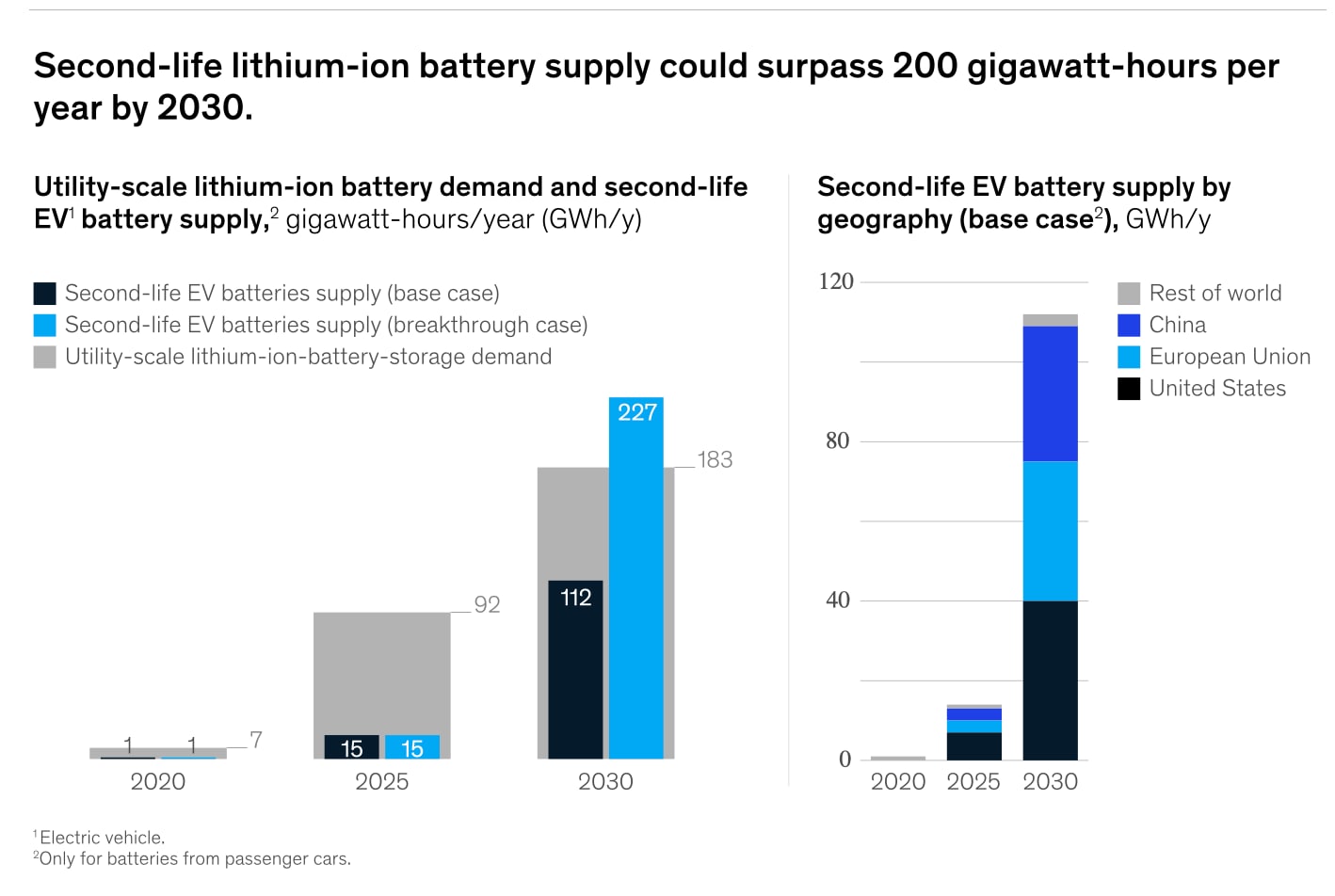

Mckinsey estimates that the supply of the second-life lithium-ion battery could surpass 200 GWh per year by 2030 (refer to Figure 1). Experts estimate that the raw materials contained within batteries produced in the last five years alone are valued at €20 billion, a figure projected to skyrocket to €600 billion by 2030 (Lopez, J., 2024). These figures underscore the immense economic potential that can be unlocked by the repurposing and recycling industry.

Figure 1: Supply of lithium-ion battery after first-life application

Figure 1: Supply of lithium-ion battery after first-life application

The second-life battery market faces several major challenges. First, retired EVBs have a wide range of chemical and electrical properties and states of health. There is a lack of comprehensive standards to test the performances of different cell chemistries, cell formats, and battery pack designs. Additionally, battery usage data from the first-life application is often not tracked or made available.

Furthermore, safety concerns are heightened during post-EV applications. This is because, when the battery is considered for secondary applications, it has undergone significant changes in internal and external characteristics after numerous cycles in demanding conditions, leading to diminished primary safety features. As a result, the inspection process is crucial for ensuring the viability and safety of repurposing and recycling efforts.

Also read: Lohum Cleantech: Recycling EV batteries

Inspection is essential before repurposing batteries for second-life applications for three key reasons:

- To assess residual value (RV) for economic viability.

- To evaluate degradation and estimate remaining useful life (RUL).

- To identify potential risks and hazards for safe operation.

What do inspections consist of?

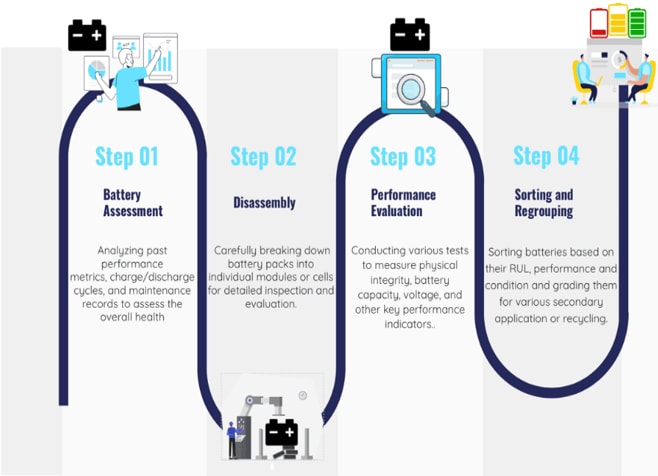

The inspection mainly consists of four steps, which are described as follows (refer to Figure 2):

1. Battery Assessment: In the battery assessment process, historical data analysis is performed to evaluate past performance metrics, charge/discharge cycles, and maintenance records to gauge the battery’s overall health and remaining lifespan. This helps determine its suitability for reuse or repurposing in secondary applications.

2. Disassembly: Following battery assessment, the battery is disassembled, and the components are separated, which involves disassembling the battery pack into individual modules or cells for thorough inspection and evaluation.

3. Performance Evaluation: This phase involves conducting a series of mechanical and electrochemical tests to assess the battery’s chemical and electrical properties

4. Sorting and Regrouping: In this final stage, batteries are sorted based on their performance and condition, categorizing them for reuse, repurposing, or recycling.

Figure 2: Battery Inspection Process.

Figure 2: Battery Inspection Process.

Battery inspection depends on various non-destructive testing (NDT) technologies (Lehman, 2024). There are different modalities for testing the health of the batteries:

- Electrical/Electrochemical: The most common and cost-effective method, typically taking up to 5 hours, is often enhanced by thermal measurements and impulse response analysis.

- Imaging and Acoustic: X-ray techniques reveal degradation modes but are costly and equipment-limited, whereas acoustic methods are emerging and require high precision to analyse lithium-ion cell structures effectively.

Across all these modalities and often in a multi-modal manner, a layer of Machine Learning (ML) can speed up diagnostics significantly while improving accuracy. For example, at Lohum, the firm has developed algorithms that can run on commodity battery testing hardware and reduce the electrical testing time for batteries from over 5 hours to less than 15 minutes. Further, it leverages slightly more advanced hardware to bring this down to 2 minutes. All this without significant loss in accuracy.

As battery inspection requires a long time, high capital expenditure, and extensive infrastructure, startups and companies are adopting a scan-as-a-service business model, allowing OEMs to avoid the cost of establishing their own inspection units. Another way to cut down on testing times is to collect more data during the first life of the battery. This data, if made available ahead of time to refurbishers, can cut down inspection times significantly.

Indian automakers have been a bit slow in adopting best data practices. There’s a lack of investment in the tech infra and caginess in sharing data. Some of this reluctance will need to be addressed from a regulatory angle, and OEMs have yet to recognise the business case for better data practices. Based on Lohum’s estimates, the availability of battery lifetime usage data can cut inspection times by 80 percent while enhancing Residual Values by up to 30 percent.

Road Ahead for India

According to NITI Aayog (2022), the growth of the Indian EV battery reuse market will increase from 2 GWh in 2023 to 128 GWh by 2030. To enhance this pace of growth, emphasis should be on improving the current inspection technologies and policies to ensure the safe and sustainable reusability and recyclability of batteries. Regulations regarding the testing and certification of retired EV batteries should be central. Additionally, advancements in testing technology will be key to making these processes more efficient. Startups should also seize opportunities in this emerging space, leveraging cutting-edge inspection technology to drive innovation and growth in the battery reuse and recycling market.

1. Rajat Verma, Founder and CEO, LOHUM Cleantech (https://lohum.com/about-us/).

2. Nandan Kumar Singh, Postdoc Fellow, Production and Operations Management, Indian Institute of Management Bangalore.

3. Nishant K Verma, Faculty of Production and Operations Management, Indian Institute of Management Bangalore.

4. Milan Kumar, Faculty of Production and Operations Management, Indian Institute of Management Vishakhapatnam.

References:

Jakob, F., Mikael, H., Evan, H., Dina, I., S¨oren, J., Martin, L., Patrick, S., Lukas, T., and Alexandre, R. (2023). Battery 2030: Resilient, sustainable, and circular. McKinsey Insights.

Lopez, J. (2024). Unlocking C600 billion worth of battery materials: the end-of-life battery puzzle. Medium. https://medium.com/@joellopezs/a-prize-worth-600bn-the-prize-hidden-on-dead-batteries-264623557044

Josh Lehman, (2024), Opportunities and Challenges of Second-Life Batteries, Relyion Energy, Medium. https://medium.com/batterybits/opportunities-and-challenges-of-second-life-batteries-f1f62fa846a5

NITI Aayog (2022), Advanced Chemistry Cell Battery Reuse and Recycling Market in India https://www.niti.gov.in/sites/default/files/2022-07/ACC-battery-reuse-and-recycling-market-in-India_Niti-Aayog_UK.pdf

Flavia Calvar (2022), Titan Advanced Energy Solutions https://www.titanaes.com/post/titan-wins-doe-battery-recycling-prize

[This article has been published with permission from IIM Bangalore. www.iimb.ac.in Views expressed are personal.]