Mohammad Imran at his Taaj Palace cosmetic and beauty store at the Rahmani market in Rae Bareli, Uttar Pradesh

Image: Madhu Kapparath

Rae Bareli, December 2024. It’s a crisp winter morning. Mohammad Imran’s attire—a mustard full-sleeve shirt carelessly tucked out of a sloppy indigo denim—livens up the dull ambience of the groggy Rahmani market, which is leisurely waking up on a Sunday. Jam, brownie, cookie, cupcake, toffee, coffee, sauce…the 43-year-old cross-checks his to-do-list, takes a swig of freshly brewed ginger tea served in an earthen cup, and starts his day by haggling with a vegetable vendor. “Ek kilo ₹90 ka kaun bechta hai? Tamatar hai ya khajur? (Who sells tomatoes for ₹90 per kilo? Are these tomatoes or dates?),” he says, trying to make sense of the skyrocketing prices of vegetables.

The shopper-buyer drama unfolds over the next few minutes. “Miyan, aap sauce kyon nahin khareed lete? Sasta padega (Why don’t you buy sauce? It won’t pinch you),” the seller retorts. Imran looks unflustered and navigates the cluttered market street, which is bifurcated by a long row of motionless two-wheelers. “It’s the official parking space for bikes. It’s in the middle of the road but that’s how they do it here,” he smiles, and enters one of the constricted bylanes to complete his to-do list. “The Taaj Palace shop is just a few meters away,” says Imran, a school dropout, with a warm smile.

“Muskuraiye, aap Lucknow main hain (Smile, you are in Lucknow)” is how a giant billboard in Hindi and English greets the flyers at the city’s glitzy airport. The infectious smile, it seems, is all-pervasive across the biggest state in India.

“Muskuraiye, aap Lucknow main hain (Smile, you are in Lucknow)” is how a giant billboard in Hindi and English greets the flyers at the city’s glitzy airport. The infectious smile, it seems, is all-pervasive across the biggest state in India.

Meanwhile, at the Rahmani market—some 85 km from Lucknow—Imran seamlessly morphs into a seller. “We have seven versatile shades for every skin tone,” he says to two young buyers who are hunting for “right kind of lipstick” at the Taaj Palace, a cosmetic and beauty accessories store that is a one-stop destination for all feminine needs: Bangles, handbags, sanitary napkins, hair clips, perfumes, and moisturising cream. The persuasive shopkeeper gets back to his selling act and lists out the seven shades of Renne Everyday Matte lipstick: Jam, brownie, cookie, cupcake, toffee, coffee, and sauce. The brand rolled out an affordable range of products under the ‘Everyday’ range this August, and the matte lipstick happens to be one of them.

A signboard at Lucknow airport reads ‘Muskuraiye, aap Lucknow mein hain’ (Smile, you are in Lucknow)

A signboard at Lucknow airport reads ‘Muskuraiye, aap Lucknow mein hain’ (Smile, you are in Lucknow)

Image: Shutterstock

The lipstick, Imran underlined, has a creamy matte finish, and is enriched with Vitamin C, hyaluronic acid, and SPF 30. He talks about the benefits in a desperate attempt to get the buyer to close the transaction. Hyaluronic acid keeps the lips hydrated and plump, SPF 30 protects lips from harmful sun rays, and Vitamin C acts as a rich antioxidant. “I learned all these on Google,” grins Imran, whose father started the shop in 1991, and seven years later, the sons—Imran and Gulfam—joined the family business of retailing cosmetics. “There is an extra ‘a’ in the name of our shop,” says Imran, alluding to the spelling of Taaj.

The lipstick, Imran underlined, has a creamy matte finish, and is enriched with Vitamin C, hyaluronic acid, and SPF 30. He talks about the benefits in a desperate attempt to get the buyer to close the transaction. Hyaluronic acid keeps the lips hydrated and plump, SPF 30 protects lips from harmful sun rays, and Vitamin C acts as a rich antioxidant. “I learned all these on Google,” grins Imran, whose father started the shop in 1991, and seven years later, the sons—Imran and Gulfam—joined the family business of retailing cosmetics. “There is an extra ‘a’ in the name of our shop,” says Imran, alluding to the spelling of Taaj.

The demand for extra is not confined to consumers in Tier III cities like Rae Bareli. “Dilli waaley bhi extra dhaniya aur paani puri maangte hain (People from Delhi also ask for extra coriander and water balls),” he says, alluding to the consumer behaviour of eking out extra from the amount paid. “But you can’t charge a bomb,” reckons Imran, underlining that a battery of new-age brands—Renee, Swiss Beauty, Sugar Cosmetics, Recode, and Juice—has caught the imagination of users with affordable premium and luxury products. “This is the best time to be in the business of beauty,” reckons Imran, who has an Instagram account, shares the latest products and offers to his long list of loyal customers on WhatsApp, and credits the social media revolution for fanning fashion trends and beauty boom across the country.

Some five kilometres away from the hustle and bustle of the Rahmani market is a beauty parlour that thrives on Instagram trends. “We have parlours in Rae Bareli. Mumbai and Delhi call them salons,” says Rekha Yadav, owner of Beauty Blush by Rekha.

Born and brought up in Mirzapur, Yadav moved to Rae Bareli after her marriage in 2000. Seven years later, the mother of two decided to do something of her own and set up a small beauty parlour. For a decade, till 2017, the business was modest and the consumers were content with basic makeup needs. Things changed dramatically over the next seven years. “Women became bold and they wanted to look and feel beautiful,” she says. “Instagram empowered women. It made them confident.” The wave of social media influencers stoked the beauty aspirations of women across economic and social strata. Growing internet penetration, falling prices of smartphones, and rising income levels have added fuel to the fire.

From Maybelline and Bobby Brown to L’Oréal and Mac, Beauty Blush by Rekha has stocked the store with top international labels.

Salman Khan, owner of Parlour House, has been running his cosmetic store in Rae Bareli since 2021

Salman Khan, owner of Parlour House, has been running his cosmetic store in Rae Bareli since 2021

Image: Madhu Kapparath

Yadav also offers price ranges to suit all pockets—from a modest ₹500 to a steep ₹25,000. The ask of all, though, is just one: Make me look good. “We give what they want and what they aspire for,” says the 44-year-old owner of the parlour.

Some 105 km from Rae Bareli is Barabanki, another Tier III region that defies the stereotypical description of such places. As one enters the small town, one spots a huge Spencer’s Retail. Next to it is a dine-in restaurant by Pizza Hut, which has dangled a billboard of ‘Momo Mia’ range of pizzas to attract foodies. There are no empty seats at the spacious restaurant. A few metres down the road, there is the big daddy of pizza: Domino’s, and a challenger brand La Pino’z Pizza. There are other ‘aspirational’ brands as well: The American Pizza Co, Belgian Waffle Co, and Giani’s ice-cream. And if you think that only food and grocery brands have queued up for a portion of the consumer’s bulging wallet, you are wrong. There is an expansive Lenskart store just a few blocks away from Belgian Waffle.

Some 105 km from Rae Bareli is Barabanki, another Tier III region that defies the stereotypical description of such places. As one enters the small town, one spots a huge Spencer’s Retail. Next to it is a dine-in restaurant by Pizza Hut, which has dangled a billboard of ‘Momo Mia’ range of pizzas to attract foodies. There are no empty seats at the spacious restaurant. A few metres down the road, there is the big daddy of pizza: Domino’s, and a challenger brand La Pino’z Pizza. There are other ‘aspirational’ brands as well: The American Pizza Co, Belgian Waffle Co, and Giani’s ice-cream. And if you think that only food and grocery brands have queued up for a portion of the consumer’s bulging wallet, you are wrong. There is an expansive Lenskart store just a few blocks away from Belgian Waffle.

Rekha Yadav at her eponymous salon, Beauty Blush by Rekha, in Rae Bareli, Uttar Pradesh

Rekha Yadav at her eponymous salon, Beauty Blush by Rekha, in Rae Bareli, Uttar Pradesh

Image: Madhu Kapparath

And if what Barabanki has visually offered so far is not startling to a resident of Delhi or Mumbai, there is more to gape at in awe. Laiyya Mandi, one of the buzzing marketing complexes, is dotted with cosmetic stores that have stocked a wide range of brands. Look at the assortment at the Sardarji Cosmetic Shop. The owner tells us a list of blockbuster products: Naked and rich choco body butter by mCaffeine, Olay whip moisturiser loaded with regenerist whip UV, Ubtan face and body pack by Wow, rosemary hair-growth oil by Mamaearth, L’Oréal total repair serum, and Bollywood Filter, a face primer, by Renee. “Muskuraiye, aap Uttar Pradesh main hain (Please smile, you are in Uttar Pradesh),” says Parevsh Walia, regional sales manager (North and East India) at Renee, a new-age beauty makeup brand that rolled out its first television commercial in August 2024.

Walia explains why India and Bharat are similar in taste. “Bharat is aspirational, brand-hungry, and is in the midst of a beauty boom,” says Walia, who has over two decades of experience in FMCG and has had stints with Dabur, ITC, Nivea, and Biotique. He joined Renee in March 2023. The legacy brands, he reckons, have been too exclusionist in their approach, language, and prices. The consumers in smaller towns, he explains, want glitz, gloss, and effective products at an affordable price. “The new generation needs new brands who speak their language, and understand their needs,” he contends. “Small towns are big opportunities,” he adds.

Walia explains why India and Bharat are similar in taste. “Bharat is aspirational, brand-hungry, and is in the midst of a beauty boom,” says Walia, who has over two decades of experience in FMCG and has had stints with Dabur, ITC, Nivea, and Biotique. He joined Renee in March 2023. The legacy brands, he reckons, have been too exclusionist in their approach, language, and prices. The consumers in smaller towns, he explains, want glitz, gloss, and effective products at an affordable price. “The new generation needs new brands who speak their language, and understand their needs,” he contends. “Small towns are big opportunities,” he adds.

Indeed, small towns are fuelling the beauty boom in India. The beauty wave is driven by an insatiable need to look good and a surging aspiration to add gloss, glitter, and matte to their lives. No wonder, most of the new-age brands get 40-60 percent of their sales from Tier II, III, and beyond.

Aditya Srivastava, an IT undergrad student, prefers to stick with ‘tried and tested’ legacy cosmetic brands

Aditya Srivastava, an IT undergrad student, prefers to stick with ‘tried and tested’ legacy cosmetic brands

Image: Madhu Kapparath

Take, for instance, Plum. Founded by Shankar Prasad in 2014, Plum gets 60 percent of its sales from outside of the top eight cities. Some of the emerging smaller towns that have been clocking brisk numbers include Kalimondir in West Tripura, Nabarangpur in Odisha, Dima Hasao in Assam, Raigarh in Maharashtra, Khargone in Madhya Pradesh, and Chandauli in Uttar Pradesh. Prasad credits three factors for the brisk pace of growth of the new-age brands across smaller towns and cities: Social media, influencers, and ecommerce channels. “The spread of digital has democratised access to information and commerce across the country,” reckons the founder, adding that, today, it’s redundant to look at a consumer geographically.

Take, for instance, Plum. Founded by Shankar Prasad in 2014, Plum gets 60 percent of its sales from outside of the top eight cities. Some of the emerging smaller towns that have been clocking brisk numbers include Kalimondir in West Tripura, Nabarangpur in Odisha, Dima Hasao in Assam, Raigarh in Maharashtra, Khargone in Madhya Pradesh, and Chandauli in Uttar Pradesh. Prasad credits three factors for the brisk pace of growth of the new-age brands across smaller towns and cities: Social media, influencers, and ecommerce channels. “The spread of digital has democratised access to information and commerce across the country,” reckons the founder, adding that, today, it’s redundant to look at a consumer geographically.

Affordability stopped being a concern in non-metros many years ago. “Thanks to lower rents and living expenses, they have more to spare on discretionary purchases,” says Prasad, adding that the brands don’t need to be price warriors to win in such places. “It’s a myth that price is a deal breaker,” he says, adding that the consumers mirror the behaviour of their urban counterparts. “They too want to look good, feel good, and be socially ahead,” he says. Plum’s revenue numbers corroborate the boom story: From ₹52.31 crore in FY20 to ₹341.7 crore in FY24.

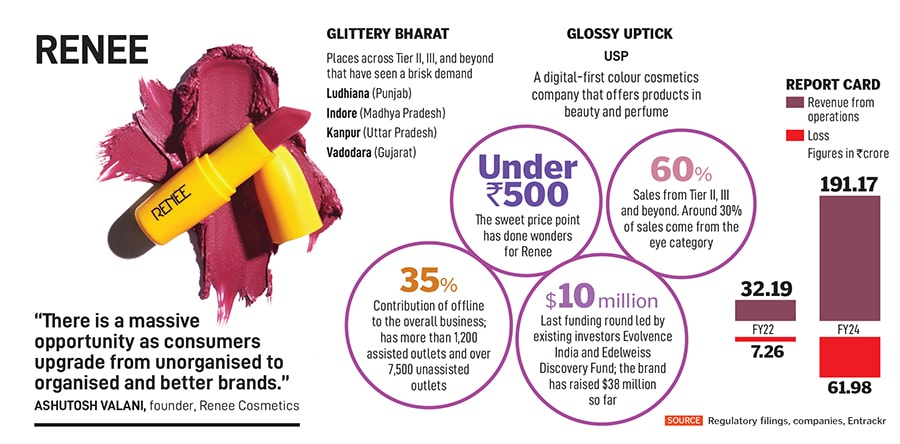

Another brand that gets a plum share from smaller towns is Renee. Around 60 percent of sales come from the hinterland, and places like Ludhiana in Punjab, Indore in Madhya Pradesh, Kanpur in Uttar Pradesh, and Vadodara in Gujarat have emerged as the new hubs. The revenue numbers speak for the sales boost: From ₹32.19 crore in FY22 to ₹191.17 crore in FY24, almost a six-times jump in two years. Ashutosh Valani, founder of Renee Cosmetics, explains what works in small towns. Conceding that price is a barrier, Valani contends that if one has managed to create a pull rather than a push, one can demand a bit of a premium. “It shouldn’t be too high but something which one can justify to the consumers,” he says, adding that the buyers in smaller towns have become aware, which means they are more conscious of quality and product. “There is a massive opportunity as consumers in India and Bharat upgrade themselves,” he says.

Also read: India is scripting a personal care story for millennials: Varun and Ghazal Alagh

Parvesh Walia, regional sales manager (North and East India), at Renee. Walia has had stints with Dabur, ITC, Nivea, Biotique, and joined Renee in March 2023

Parvesh Walia, regional sales manager (North and East India), at Renee. Walia has had stints with Dabur, ITC, Nivea, Biotique, and joined Renee in March 2023

Image: Madhu Kapparath

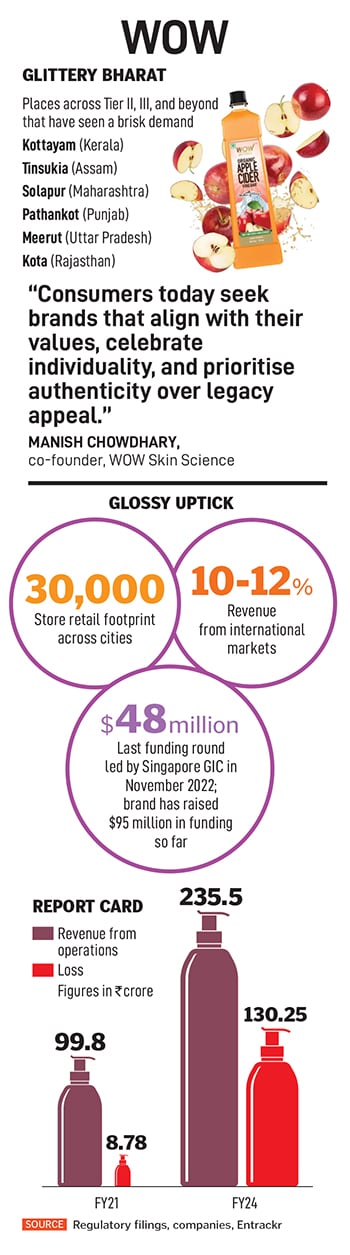

One more brand making the most of the upgrade is Wow. “The consumers are more informed, discerning, and value-driven,” reckons Manish Chowdhary, co-founder of WOW Skin Science. The users have a strong preference for brands that align with their values. As a result, beauty brands are shifting their focus to these untapped markets, recognising their potential and the evolving needs of a new generation of beauty enthusiasts. What goes inside the brand is also something that such users are aware of. “They prioritise ingredient transparency and value toxin-free, plant-based formulations, making these attributes key drivers in their purchasing decisions,” he underlines.

Meanwhile, back at Rae Bareli, the “ethical behaviour” of a consumer gets exhibited in full strength. Meet Aditya Srivastava, an IT undergrad student. “I go for brands that are vegan and cruelty-free,” says the 23-year-old who likes nude colours when it comes to cosmetics. Though she is impressed with the explosion of choice offered by new-age brands, Srivastava prefers to stick with the ‘tried and tested’ and legacy brands like Maybelline. But are MNC brands not prohibitively priced? The young beauty connoisseur reckons the brands are listening to the consumers and rejigging their pricing strategy. Take, for instance, Super Stay Teddy Tint by Maybelline. Launched recently, the tint reportedly carries a tag of ₹749. “It’s transfer-proof, smudge-proof, and waterproof. And it comes in 10 shades,” she says. “New and legacy brands will co-exist in India and Bharat. It’s not that one will replace the other.”

As one crisscrossed the hinterlands of Uttar Pradesh, the theme of co-existence gets pronounced. Bharat has become the melting pot of new, old, and not-so-old. It’s a place that can be humbling for marquee brands but, at the same time, fascinating for a challenger brand. If one finds new-age beauty brands such as Renee, Sugar, Wow, Plum, Mamaearth, Swiss Beauty, Recode, and Glam21 scrambling for a space on the cluttered offline shelf, one can also generously spot Maybelline, Lakme, and L’Oréal sitting pretty inside the store.

Bharat, indeed, is a land of contrasts. There is no one way, one brand, or one size. “Social media is not the only way to advertise and reach out to the masses,” reckons Ashita Aggarwal, professor of marketing at SP Jain Institute of Management and Research. “The old ways still work and are effective.”

Bharat, indeed, is a land of contrasts. There is no one way, one brand, or one size. “Social media is not the only way to advertise and reach out to the masses,” reckons Ashita Aggarwal, professor of marketing at SP Jain Institute of Management and Research. “The old ways still work and are effective.”

In Barabanki, one can witness the old way of advertising. Two loudspeakers are strapped on a rickety cycle rickshaw, which is advertising men’s and women’s wear from Bum Bum Beauty Collections. Salman Khan, who has been running a cosmetic store since 2021, tells us why affordability is a gamechanger in the hinterlands. He starts with the economics of the offline business. If new-age brands like Mamaearth are struggling to crack the offline market, it is due to a slew of reasons. First, dumping or stocking of brands has been counter-productive.

Retailers, explains Khan, play a huge role in influencing the decision of a buyer. “And the loyalty of the retailers lies with the hefty margin,” he says, adding that the shopkeepers are mercenaries. “Whoever offers the highest gets the loyalty,” he says. The brands doing well in the offline space usually offer a retail margin of 30-60 percent. Look at Half N Half, Hilary Rhoda, Blue Heaven, Mattlook, and Twacha. Consumers in top cities might be unaware of these names, but they rule the roost in the hinterland. Most of these brands import from China, have owners in Gurugram and Delhi, and they ship it across tier II, III, and IV. “You can’t match them in margins,” he says.

Another challenge for beauty and cosmetic brands is the growing clout of the ‘D Company’—‘duplicates’ have made life tough for genuine brands. “You can only tackle duplicates if you are serious about your brands in Bharat,” says one of the top cosmetic retailers in Barabanki. “Most of the brands dump their stuff and vanish,” he says, requesting anonymity. Their heart, he adds, still lies in the buyers in top cities. “If you fake it, you don’t make it in Bharat,” he says. Brands, he underlines, need long-term commitment in time and resources to scale operations and footprint in the hinterland.

Another challenge for beauty and cosmetic brands is the growing clout of the ‘D Company’—‘duplicates’ have made life tough for genuine brands. “You can only tackle duplicates if you are serious about your brands in Bharat,” says one of the top cosmetic retailers in Barabanki. “Most of the brands dump their stuff and vanish,” he says, requesting anonymity. Their heart, he adds, still lies in the buyers in top cities. “If you fake it, you don’t make it in Bharat,” he says. Brands, he underlines, need long-term commitment in time and resources to scale operations and footprint in the hinterland.

There is one more thing that these regions need: A drastic change in outlook. “The approach of Bharat and India is condescending in nature,” reckons Ankur Bisen, senior partner and head (retail, consumer products, and food) at Technopak. Most of the beauty and personal care companies in India have not been honest with their customer segments. “They have overestimated the size of premiumisation and they want to skim the market,” he says, adding that the prohibitive pricing of the products takes them beyond the reach of the people. “How will you get scale if you don’t crack such markets,” he says, dishing out the example of Zudio. Four to five years ago, the share of the value-retail format of Tatas to Trent’s overall revenue was under 5 percent. “Now it’s over 55 percent. This is the magic of catering to value-sensitive users across small towns,” says Bisen.

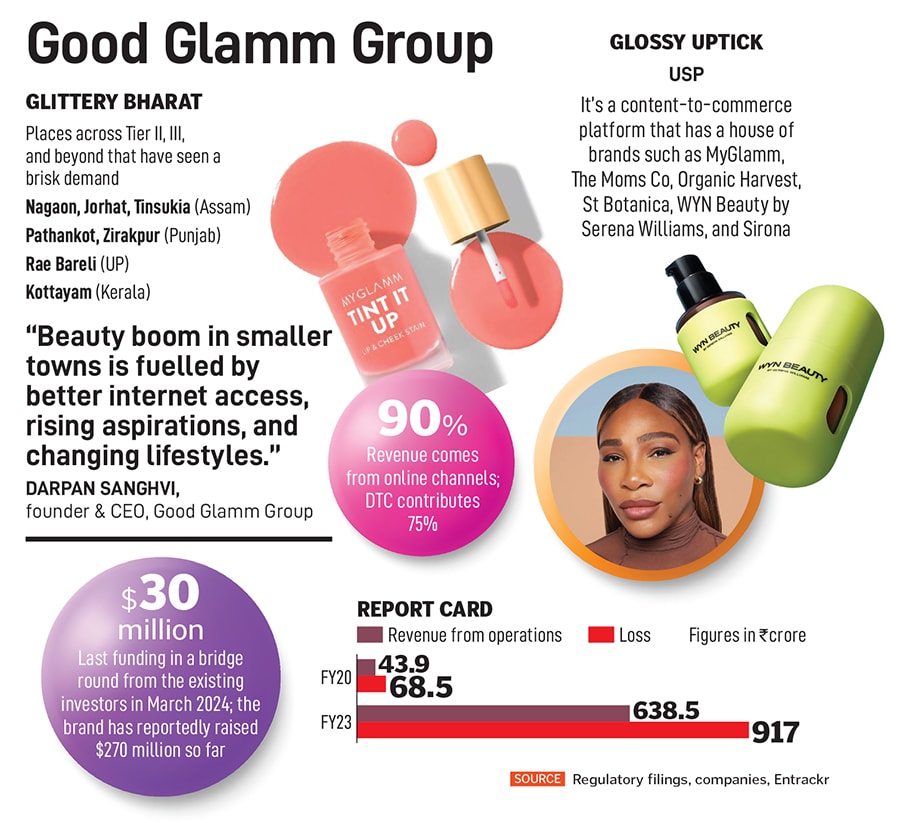

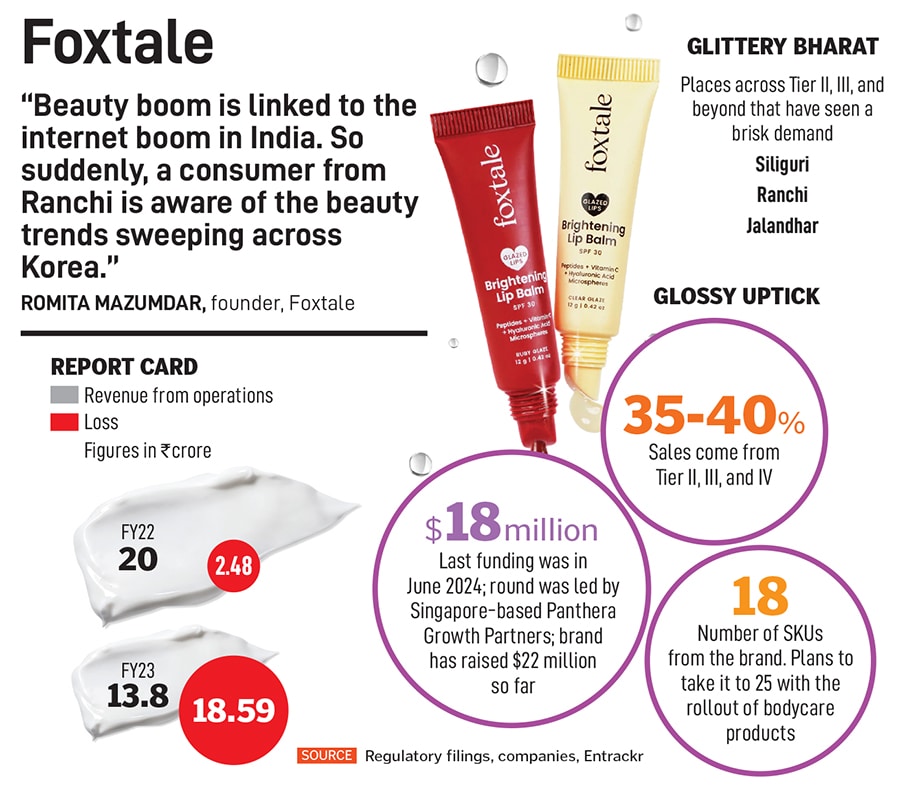

A formidable challenge is also taking care of bloated bottom lines. In their quest to reach masses in the hinterland, most companies have posted heavy losses due to aggressive advertising, marketing, and expanding offline footprint. (see box ‘The Big Bharat Challenge’). Using direct-to-consumer (D2C) channels and ecommerce platforms have ensured that the new-age beauty companies didn’t bleed on establishing and pushing their retail footprint. However, the necessity of an offline presence has brought in its wake the tough task of keeping expenses under check. As these companies go deeper into the hinterland, they would need to ensure that their stores become profitable or don’t bleed excessively.

“There is no Bharat. There is only India,” he says, adding that the consumers across the hinterland are aspirational. They wear jeans, they watch K-Pop, they consume social media, and they are exposed to global trends. “Embrace them and you will see how the magic works,” he adds.

As one headed back to the Lucknow airport, the duality of Bharat and India indeed gets submerged. Small towns are lip-smacking opportunities.

But are big and new-age brands humble and nimble enough to make the most of the gusty beauty wave sweeping across the country? Well, for that, the blind spots must morph into beauty spots.