A young bride-to-be samples a makeup look under the watchful eyes of her mother at Moiza Studios, a multibrand beauty and skincare outlet in Aminabad, Lucknow. Image: Madhu Kapparath

A young bride-to-be samples a makeup look under the watchful eyes of her mother at Moiza Studios, a multibrand beauty and skincare outlet in Aminabad, Lucknow. Image: Madhu Kapparath

In the sleepy town of Kolhapur in Maharashtra, inside an otherwise quiet shopping mall, a salesperson artistically sweeps a brush on the cheekbones of a volunteer, as a group of women watch the makeup demonstration with rapt attention. The crowd swells as women, across age-groups, gather to buy and learn more about the different steps of using an assortment of beauty products.

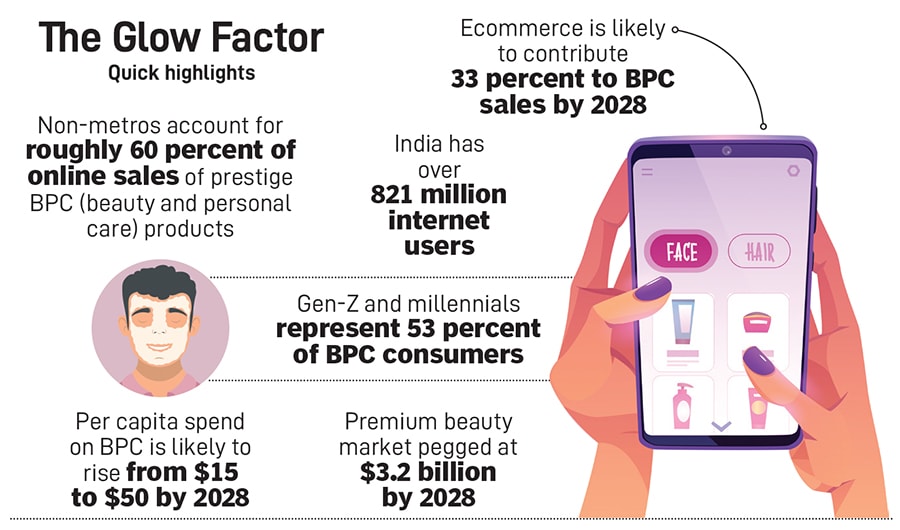

In fact, from Mumbai to Barabanki, Uttar Pradesh, in a frugal and price-conscious market like India, where less is more, this is symbolic of a massive transformation underway. Men and women, young and old, are spending on cosmetics and personal care products like never before.

Just as diamonds became synonymous with love, buying good-quality skin and hair care products is now seen as an extension of ‘self-care’, as people want to live better and experience joy and pleasure in the small moments of life. Or at least that’s what clever marketers will tell you. But one thing is clear. The element of guilt, associated with the purchase of lipsticks and serums, has been stripped off. Using cremes and scrubs is no longer seen as an indulgence of the well-heeled because high-end and mas-market products coexist in the world’s fastest growing beauty industry.

“In metro cities such as Mumbai and Delhi, premium products with advanced formulations are highly favoured, driven by higher disposable incomes and global beauty trends,” notes a Deloitte-Ficci report published in October. “Meanwhile, affordability remains key in rural areas and tier 2 cities, with traditional products still dominating, though modern branded goods are gradually gaining ground.”

The rise of social media, ecommerce and quick commerce has majorly contributed towards this tectonic shift. Luxe to affordable, companies are targeting consumers with a vast catalogue of offerings, across different hues, textures, price-bands and formulations. So much so, that an average consumer is spoilt for choice with unending access to the latest global trends along with reviews of hot-selling beauty and personal care products, and most importantly the convenience of buying these at the click of a tab on a mobile phone app. And what’s more? The order can even be delivered in 10 minutes.

Also read: From Barabanki to Kalimondir to Raigarh, small towns are new playing ground for beauty brands

Look around, and you are sure to notice how consumers—from different regions and income groups—are increasingly using more beauty products where multi-step routines are a norm as they influence makeup, skin care and hair care. It is not far-fetched to say that beauty has evolved into a fast-fashion category where brands have to constantly innovate and renovate products to cater to their largest target group, Gen-Z and millennials, which is extremely discerning and experimentative.

“They are tech-savvy, value authenticity and are quick to adopt new trends,” the Deloitte-Ficci report notes. “Understanding their preferences is crucial for businesses looking to connect with and cater to this important demographic.”

But it’s not just Gen-Z. The other end of the spectrum is turning out to be a lucrative market too as life expectancy has increased. “The older generation, known as the silvers, is emerging as a large opportunity to build brands,” Kanwaljit Singh, co-founder, Fireside Ventures, says. “The silver economy is a big deal,” Priyanka Gill, co-founder, MyGlamm, agrees.

But it’s not just Gen-Z. The other end of the spectrum is turning out to be a lucrative market too as life expectancy has increased. “The older generation, known as the silvers, is emerging as a large opportunity to build brands,” Kanwaljit Singh, co-founder, Fireside Ventures, says. “The silver economy is a big deal,” Priyanka Gill, co-founder, MyGlamm, agrees.

Actor-entrepreneur Masaba Gupta, who launched her beauty brand, Lovechild, in 2022, is amazed to see the big change in consumer awareness and the rise in demand for eco-friendly and ethical products. “Consumers have become sharper, smarter and I would say that you can’t fool anyone today,” the House of Masaba founder elaborates. “Suddenly the consumer knows everything that’s going on the back of the pack. They know ingredients. They know the chemical names for ingredients. They know everything.”

Also read: Shriti Malhotra: On top of the beauty industry game

Domestic and global beauty and personal brands are on steroids as they race to capture a lion’s share in a market projected to grow at a CAGR of 10 percent to $34 billion by 2028. “It’s gloves off,” a contract manufacturer tells Forbes India to explain how companies are regrouping to roll out new strategies in a cluttered-but-high-growth market. This has, interestingly, accelerated the growth of the third-party manufacturing ecosystem in more ways than one.

Consider the rise and rise of beauty direct-to-consumer (D2C) brands. Investments in this segment rose from $0.41 million to $85.2 billion over the last decade, according to Tracxn. Singh, called the kingmaker in the D2C space, was among the first investors to bet on the potential of this market.

“Amazon, Flipkart, and of course, Google, Meta and Instagram were the building blocks which enabled entrepreneurs in those early days to even think about building brands using the digital-first playbook,” he recalls.

New-age startups have been challenging incumbents with their agility and quick-turnaround cycles. Behemoths have learnt a hard lesson and have responded with new urgency. Singh asserts that it’s difficult for a large organisation to adopt a startup’s ‘launch fast, fail fast’ model due to the size and scale of its operations.

“We thought there will be a pipeline of a good product running for seven to eight years, but I think that frame is going to come down to three to four years,” Manish Chowdhary, co-CEO, Body Cupid, which owns brands like WOW Skin Science, says in a Gokwick panel discussion moderated by Forbes India, to emphasise why large and small brands alike need to launch new brands faster to keep pace with the evolving market dynamics.

As a result, most large consumer multinationals, Singh explains, are becoming more acquisitive once a startup reaches a certain size. “For them taking a Rs100 crore brand to Rs200 crore, and building that to Rs1,000 crore is a far more manageable process than building a brand from 0 to 100.” Marico, for example, fully acquired Just Herbs, a D2C ayurvedic skin and hair care company, in October. Similarly, FMCG behemoth HUL is targeting the ‘masstige’ beauty segment and is reportedly scouting for inorganic growth opportunities.

Also read: ‘Sabyasachi was clear he wanted to play in beauty and wanted to start with 10 lipstick shades’

A big definitive trend in the journey of legacy and new-age brands has been artificial intelligence (AI)-driven personalisation. Since last year, most beauty and personal care companies have been using generative AI to offer personalised recommendations to consumers. The Deloitte-Ficci report finds that several leading brands have used data analytics and AI algorithms to gain a competitive edge and enhance their ecommerce platform by integrating AI-powered tools to provide tailored solutions. “Virtual skin care advisors analyse consumer skin types and suggest personalised skin care regimens,” it notes. “This has been particularly popular in urban markets.”

A perplexing trend has been the rise in demand for premium beauty products even as the domestic economy grows at a slower clip. There was a sharp decline in the Q2 GDP numbers to 5.4 percent from 6.7 percent in the previous quarter and 8.1 percent in the corresponding period in FY24.

“When consumers face financial constraints, they often prioritise spending on smaller, affordable luxuries that offer a sense of indulgence without a significant cost. In the beauty and personal care industry, this trend is seen as premium products consistently outpace mass-market options,” the report mentioned earlier states. “Driven by a desire for high-quality, innovative formulations and self care, consumers continue to invest in premium segments, highlighting their preference for accessible luxuries that provide comfort and satisfaction, even in tight economic conditions.”

The economic blip notwithstanding, India is the fastest growing global economy with a vibrant domestic market given its population of 1.4 billion people and rising income levels. An increasing number of global luxury beauty players are betting big to benefit from the size and scale of the opportunity.

Also read: How Gen-Z women are redefining Indian beauty

NARS Cosmetics—bought by Shiseido in 2000—is a 30-year-old global beauty brand, with a large presence in countries such as US, China, UK, Australia and Japan. It entered India one year ago.

“We acknowledge that we’re getting into the India market after 29 years of existence. I think it’s better late than never,” Sanjay Sharma, country head, Shiseido India, tells Forbes India. “Now, India has become important, not only from a business point of view but also strategically as we look towards the future,” he adds. “In the next decade, or even the decade after that, a lot of growth, not only for NARS, but for many beauty brands, will come from India,” he predicts. “On our global social media page, Indians are the second largest followers after America. This gave us total confidence that now is the time to enter. We can’t be any later than this.”

Sharma believes India is at a tipping point.

“Once India’s GDP per capita crosses $4,000 from its current level of $2,500, we can expect rapid growth, similar to what happened in China,” Sharma says. “In the next 10 years, India will likely follow a similar growth trajectory to China’s. This is why many companies are excited about India’s potential. The beauty sector, in particular, has immense room for growth, with opportunities to increase value spent on beauty products per consumer and expand the number of products used by consumers.”

Even as global companies are eyeing India to accelerate growth, many homebred companies are looking to expand into international markets with native offerings, such as, ayurvedic products. “Companies can look at developing products based on Indian recipes and native ingredients and could use India’s association with health and wellness as a country,” the Deloitte-Ficci report highlights. “Indian companies can look to derive learnings from Korean brand success and look at international markers as new avenues for growth.