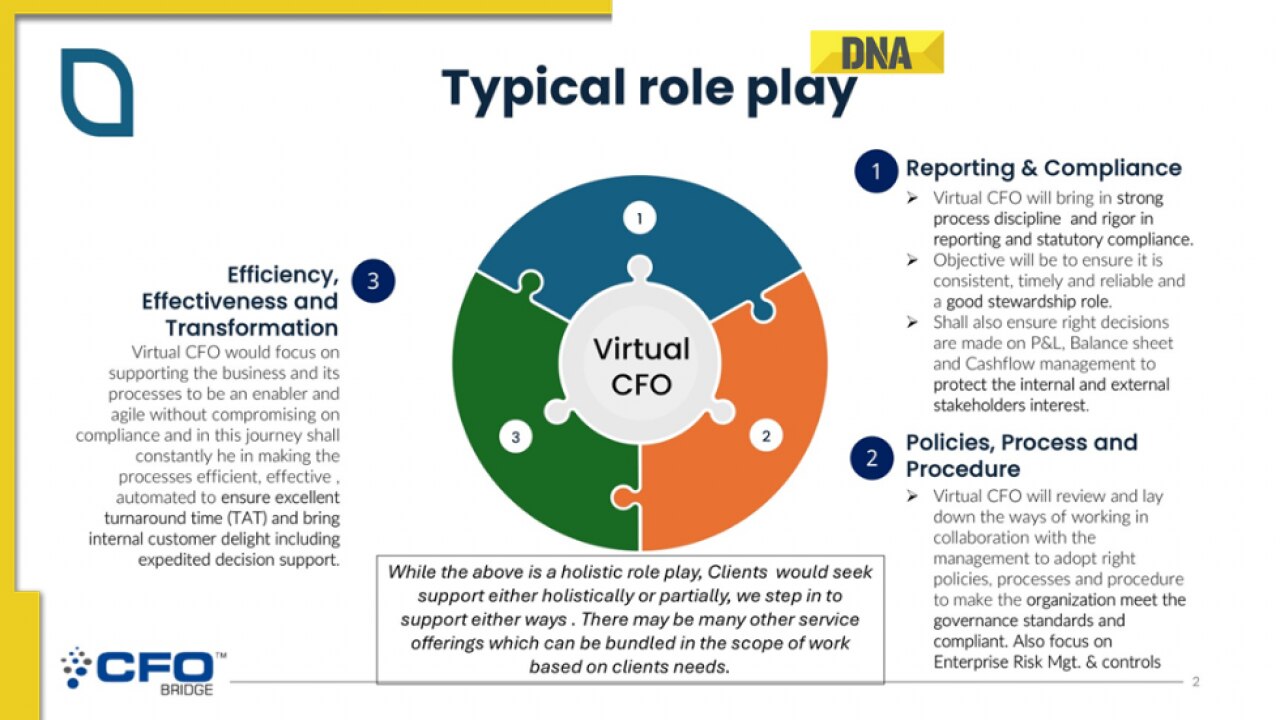

Alt text – key responsibilities of a virtual CFO

Running a small or mid-sized business is harder than one might think. From managing cash flow to meeting tax deadlines, financial risks often overshadow growth opportunities. Imagine Mr. Srivastava, a mid-sized manufacturing company owner in Pune, grappling with these very issues. Hiring a full-time CFO was beyond his budget, leaving him with incomplete financial guidance. This is where Virtual CFO services step in, offering cost-effective, expert-level financial leadership without the overhead of a full-time hire.

Why SMEs Need Virtual CFOs?

Indian SMEs often lack the resources to hire full-time CFOs, yet they face the same financial complexities as large firms. Studies reveal that over 60% of SMEs struggle with cash flow management and financial planning in India. At this juncture, Virtual CFOs provide a strategic and scalable solution to fast-track growth while building resilient, goal-aligned business processes.

10 compelling reasons why Virtual CFOs are indispensable for SMEs in India:

1. Strategy, Growth, and Profitability

Virtual CFOs provide actionable financial strategies and insights that align with your business goals. Using data-driven analysis, they focus on improving profitability and driving sustainable business growth for SMEs.

2. Driving Efficiency Through Technology

With tools like AI, RPA, and ERP systems, they drive process automation, reduce manual inefficiencies, and enhance productivity. For SMEs, leveraging these technologies translates into significant cost savings and operational efficiency.

3. Revenue Maximisation and Cost Optimisation

By analysing revenue drivers and cost structures, Virtual CFOs deliver actionable plans to maximise earnings and minimise expenses. Their expertise in cost optimisation and revenue enhancement ensures every financial decision boosts ROI.

4. Strategic Financial Co-Pilot

Whether it’s fundraising, mergers, or IPO readiness, Virtual CFOs act as calculated advisors. They provide expertise in financial structuring and valuation, ensuring such initiatives align with your overall business strategy.

5. Strengthening Core Systems

SMEs looking to raise funds, merge, or prepare for an IPO benefit from expert financial guidance. Virtual CFOs bring valuation expertise and advanced financial structuring to ensure smooth execution and successful outcomes.

6. Building a Profitable Customer Portfolio

By analysing customer and product/project performance, Virtual CFOs guide businesses in creating sustainable growth frameworks. Tools like BCG 2×2 matrices help identify and focus on high-performing areas, improve on moderate-performing areas, and weed out low or non-performing areas to enable maximum returns.

7. Comprehensive Risk Management

Enterprise Risk Management (ERM) is often ignored or avoided by SMEs. Virtual CFOs establish risk management frameworks, ensuring businesses are equipped to identify and mitigate potential threats effectively.

8. Cash Flow Optimisation

Effective cash flow management is critical for any business. Virtual CFOs identify bottlenecks, improve forecasting, and ensure liquidity to avoid operational disruptions and enable reinvestment. They can leverage their relationship or their ecosystem to find financiers for short-term, medium-term, and long-term financial needs by building a financial model to assess the requirements.

9. Supporting Domestic and Global Expansion

Planning to enter new markets? Virtual CFOs manage complexities like tax compliance, Forex management, and process setup. They also guide mergers and acquisitions, ensuring seamless integration and sustainable growth.

10. ESG Reporting Expertise

With the growing importance of environmental, social, and governance (ESG) metrics, Virtual CFOs help businesses prepare robust ESG frameworks. They bridge the gap for companies aiming to meet stakeholder expectations on sustainability.

Future-Proof Your Business

Virtual CFOs can support a comprehensive suite of services from cash flow management and cost optimisation to ESG reporting, risk management, and global expansion, empowering SMEs to address financial complexities as specialists and achieve substantial progress. By integrating digital solutions and financial strategies, they invigorate SMEs to thrive in competitive markets and become resilient.

Subramanian Gopalakrishnan, CFO Partner at CFO Bridge, emphasised the growing role of Virtual CFOs in India : “SMEs strive for rapid growth but often face challenges due to the lack of a full-time CFO to provide expert financial guidance as a strategic co-pilot. Hiring and retaining a CFO, while aligning with their career aspirations adds further complexity. Virtual CFOs bridge this gap seamlessly, offering the strategic expertise of a seasoned CFO at an optimal cost with continuity. By combining methodical vision and operational excellence, they drive transformation, build robust processes, and accelerate business growth as a trusted business partner”

For businesses seeking higher profitability and enduring success, a Virtual CFO is more than a service—it’s a partner that drives tangible outcomes and aligns your vision with lasting growth. Consider it the catalyst that turns goals into reality.

(This article is part of DMCL Consumer Connect Initiative, a paid publication programme. DMCL claims no editorial involvement and assumes no responsibility, liability or claims for any errors or omissions in the content of the article. The DMCL Editorial team is not responsible for this content.)