Last-minute shopping for makeup on quick commerce has quickly evolved into a matter of choice, driven by convenience.

Last-minute shopping for makeup on quick commerce has quickly evolved into a matter of choice, driven by convenience.

Illustration: Shutterstock

You’ve placed the order and—ding dong!—in less than 30 minutes, it’s at your doorstep. But before you bring out the chilli flakes, this isn’t pizza we’re talking about.

Instead, you’re probably mid blow-dry, waiting for that Mac Ruby Woo lipstick for a finishing touch. In a sea of groceries, cleaning supplies and stationery, delivery platforms are seeing a surge in last-minute or quick delivery of beauty and personal care products.

Quick commerce refers to the next phase in ecommerce, where items that are ordered get delivered in less than an hour. India has seen a massive proliferation of quick commerce apps such as Zepto, Zomato’s Blinkit and Swiggy’s Instamart, which originally started with stocking groceries and other emergency items, and have now evolved into full-fledged stores that offer everything from Christmas tree ornaments to the latest iPhone.

“As consumers started turning to Zepto for their every day essentials, the basket naturally expanded to include personal care, skin care and then beauty products, including kajal, lipstick, foundation and beauty accessories,” says Divya Sreenivas, VP, category—beauty at Zepto. “Our beauty business has grown more than 5x since last year, and is growing at a rate that is significantly higher than that of our personal care categories.”

What started out as need-based last-minute shopping for makeup on quick commerce has quickly evolved into a matter of choice, driven by convenience.

“Customers initially turn to us for emergency or last-minute needs—whether it’s a kajal pencil for a quick touch-up, a matching nail enamel for an outfit, or fake nails when there’s no time for a manicure,” says Dipak Krishnamani, vice president, business (new commerce), Swiggy Instamart. “But soon, they start using our platform for their regular shopping as well, once they see the width of the selection and the competitive prices on offer.”

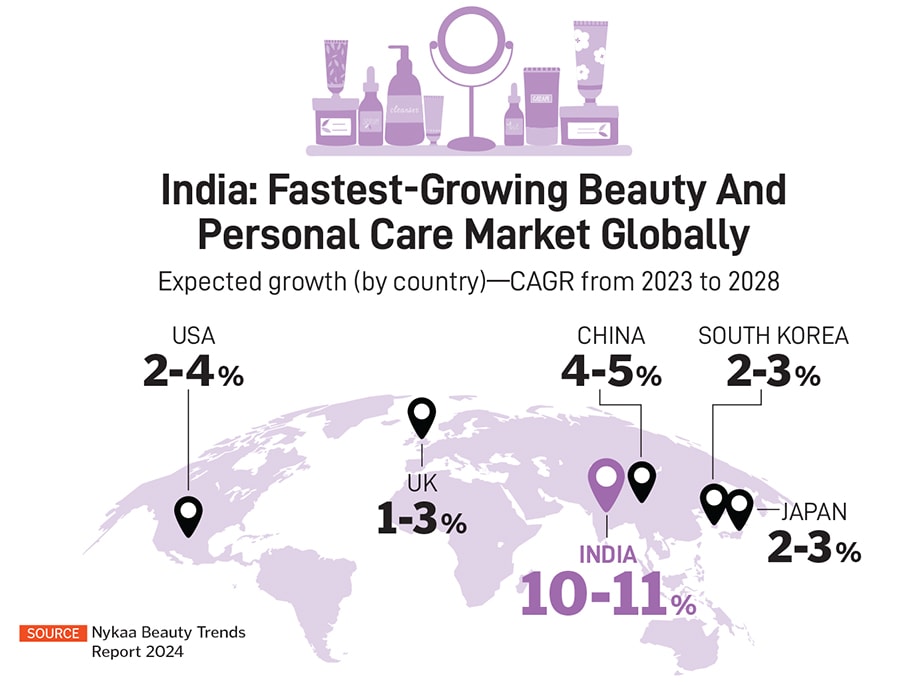

India’s beauty and personal care (BPC) market will reach $34 billion by 2028, driven by the online penetration of core beauty categories. According to the Nykaa Beauty Trends Report 2024, India is the fastest growing BPC market globally—expected to grow at a 10 percent to 11 percent compound annual growth rate (CAGR) between 2023 and 2028. Next in line is China, with an expected CAGR of 4 percent to 5 percent, followed by the US, Japan and South Korea, all with a CAGR expected to fall between 2 percent and 4 percent.

India’s beauty and personal care (BPC) market will reach $34 billion by 2028, driven by the online penetration of core beauty categories. According to the Nykaa Beauty Trends Report 2024, India is the fastest growing BPC market globally—expected to grow at a 10 percent to 11 percent compound annual growth rate (CAGR) between 2023 and 2028. Next in line is China, with an expected CAGR of 4 percent to 5 percent, followed by the US, Japan and South Korea, all with a CAGR expected to fall between 2 percent and 4 percent.

According to Zepto’s Sreenivas, the average order value for beauty products on the quick commerce platform is currently ₹550.

In total, the per capita annual spend on beauty in India will grow to $15 (~₹1,250) by 2027, up from about $10 (~₹850) in 2023, according to a report by The Business of Fashion and McKinsey & Company, titled ‘The State of Fashion’.

The size of the quick commerce market in India is pegged at $3.34 billion in 2024 and strategy consulting firm Redseer sees it nearly tripling to $9.95 billion by 2029, at a CAGR of over 4.5 percent.

The Business of Fashion says quick commerce in the fashion and beauty space is likely to grow 40 to 45 percent in three years, and the beauty segment is experiencing 1.5 times high annual growth than personal care.

Homegrown skin care and hair care brand Minimalist says Q-comm is now among its top retail channels. “The rise of quick commerce platforms has played a pivotal role in enhancing our sales and customer acquisition strategies,” Mohit Yadav, co-founder, Miniamlist, says. “The rapid growth in topline revenue and the shift in sales contribution within just a year indicate that customers increasingly prefer faster delivery options.”

In fact, one of India’s original fashion e-tailers, Myntra, announced their foray into quick commerce for fashion and beauty orders on December 5, starting with Bengaluru.

In 2022, Myntra first launched an express delivery feature called M-Express for deliveries within 24 to 48 hours. ‘M-Now’, its quick commerce play, will deliver within 30 minutes.

“Within fashion as a category, there are many trade-offs that a customer has to make—be it the convenience with which they can shop or the width of selection available. Our job has always been to try and reduce the trade-offs that the customer has to make. That’s how we started M-Express,” Myntra CEO Nandita Sinha tells Forbes India.

Myntra is looking to replicate its success with M-Express, extending it further with M-Now, she adds.

Unlike most quick commerce players, Myntra will continue to work with third-party delivery partners for its deliveries, for now. “We are ramping up and working with our logistics partners to deal with the challenges that come with 30-minute deliveries. We will continue to be agile, learn and expand as we see demand coming in, because that’s always a good problem to have,” Sinha says.

Beauty products being processed and dispatched at a Myntra warehouse in Bengaluru Image: Selvaprakash Lakshmanan for Forbes India

Beauty products being processed and dispatched at a Myntra warehouse in Bengaluru Image: Selvaprakash Lakshmanan for Forbes India

Myntra is hoping to leverage its tech prowess for real-time order management and capacity enhancement to ensure consistent order fulfilment. Currently, Myntra services over 19,000 pin codes across the country.

Aside from fashion, Myntra will give customers access to instant delivery of premium beauty brands. This includes collections from Huda Beauty, MAC, Bobbi Brown, Forest Essentials, Carolina Herrera, Armani, Paco Rabanne, Olaplex, Dyson, Bath & Body works and Estée Lauder.

“Customers have become impatient… they want deliveries in 10 minutes. The beauty and personal care space is one that has seen a huge uptick in terms of quick commerce, and this is why players like Myntra need to invest heavily in supply chain and logistics for quick commerce,” says Karan Taurani, senior vice president, Elara Capital.

Also read: India’s beauty boom and contract manufacturers: A love-hate story?

India’s largest beauty ecommerce retailer, Nykaa, is also experimenting with its own 10-minute deliveries, piloting in small parts of big cities, such as Borivali in Mumbai. Called Nykaa Now, the initiative comes even as the company says that nearly 70 percent of orders on its regular ecommerce store, from 110 cities, deliver the next day.

“Nykaa caters to many different consumer journeys. A lot of them are not a good fit for quick commerce. There is a lot of discovery involved when making a purchase in certain categories within beauty,” Anchit Nayar, CEO, beauty ecommerce, Nykaa, said during the company’s analyst call. “If you are trying to buy a foundation, there are 30 different shades that suit the Indian skin tone and colour, for example. So I think beauty is a long tail category.”

However, he adds, there are products that consumers buy every day, which they consider essentials. “This category is more relevant to the quick commerce business,” he added. “And for us to continue to dominate market share in those SKUs (stock keeping units), we think it is important to be competitive in certain metros from a quick delivery perspective, meaning 30-minute to three-hour deliveries.”

The investment of setting up rapid stores or warehouses isn’t going to be large. “Our average order values tend to be quite high, so we feel that this business can actually be profitable—at this point, it is not going to be a margin dilutive nor is it a large capital investment,” Nayar said.

Cosm(et)ic Change

Fuelled by social media, which is rife with both influencers and certified dermatologists dispensing information about skin care and the ingredients used, laypeople today have a lot more knowledge about what goes into the products they use. This means that they are pickier about what they buy, and are likely to make repeat purchases of products that they trust.

“The lines between traditional personal care are blurring rapidly,” says Vinay Singh, co-founder and partner, Fireside Ventures, a venture capital firm that has various consumer brands in its portfolio. “On the one hand, regular moisturisers are giving way to tinted moisturisers, and on the other hand, traditional makeup or cosmetic categories like foundations and lipsticks have skin care-infused formulations.”

One of its portfolio companies, Pilgrim, for instance, has a matte foundation infused with Vitamin C and Australian Kakadu plum.

“This category behaviour is led by consumers increasingly viewing makeup and cosmetics as essentials. In addition, makeup and perfumes form an essential part of gifting culture in India, some of which are last-minute requirements,” says Singh. “Given this context, we believe beauty brands will prioritise Q-comm as an essential channel to help their consumers access their products in their time of need.”

“We’ve noticed that suddenly, the consumer knows everything that’s going on—they know ingredients, they know the chemical names for ingredients… the consumer has become sharper and smarter,” Masaba Gupta, founder of lifestyle brand House of Masaba, told Forbes India in a recent interview. The brand includes a makeup line called LoveChild by Masaba. “They’re much more aware of what they’re putting on their bodies and faces. Today, you can’t fool anyone.”

LoveChild now lists its lipsticks and other makeup products on Zepto and Blinkit, retailing at the same price (sometimes even discounted) as on traditional ecommerce portals. “If we have to win in this category, we have to have the ability to make sure that this product, the lipstick, can reach you. Suddenly, you may decide, ‘I don’t have this purple lipstick that I want today, and I only want to wear purple lipstick’. It should be with you in 11 minutes,” Gupta says. “All these things matter, and we have to keep up, be agile and fluid on the service end of things.”

Beauty brands are seeing an uptick in sales via Q-comm, currently led mostly by urban population in cities such as Mumbai, Delhi, Bengaluru and Hyderabad.

“At the moment, quick commerce is primarily focussed on metropolitan areas and Tier 1 cities. However, we anticipate that demand will expand to Tier II and III towns within 12 months,” says Anurag Kedia, co-founder, Pilgrim. “As infrastructure and digital adoption improve in these regions, we expect to see a significant contribution from these markets.”

Pilgrim began its quick commerce journey about 18 months ago, and says that now, 10 percent of its online sales come from this channel, anticipated to grow to 25 to 30 percent in the next year. Another homegrown clean beauty brand, Plum, which began listing on quick commerce in early 2023, says that depending on the month, it clocks 10 to 20 percent of its overall sales via this route. O3+ Professional, an Indian skin care brand, says 11 percent of its monthly digital business comes from quick commerce, a number that is growing quickly.

“While beauty products might not traditionally be seen as ‘emergency’ items, customer behaviour is evolving rapidly,” says Shankar Prasad, founder and CEO, Plum. “Many of our customers look for last-minute skin care replenishments before events or while planning their routines, and Q-comm perfectly fulfils that need. It’s about being responsive to changing lifestyles and offering accessibility to customers at every touchpoint.”

Swiggy Instamart’s data shows a growing demand for products like lipsticks, eyeliners and a wider variety of nail paints. Zepto says eye makeup, lipsticks and face make-up cement its beauty business, including foundations and concealers.

“Buying patterns in terms of sub-categories closely mirror those of lifestyle e-tailers rather than grocery platforms,” Zepto’s Sreenivas says. “We are seeing users search for a variety of brands as well as specific shades and ranges across categories, including complex and premium products. Gifting is also a key category, and we have worked closely with brands to build a strong assortment ahead of the festive season.”

During special events and holidays, platforms say they see a 60 to 70 percent increase in sales compared to normal days. “Events like the Glam Up Sale, for instance, drive an even bigger spike, with sales numbers jumping as much as 80 percent higher than usual,” Sreenivas says.

“Festivals have become a major occasion for us,” Krishnamani of Swiggy adds. “From Raksha Bandhan to Diwali, Dussehra to New Year, people no longer want to plan ahead but still expect convenience. With a wide range of lipsticks, eyeshadows, tints, contours, highlighters and more available in just 10 minutes, we’ve become the go-to for festive beauty needs.” “We have also seen parties and weddings as key occasions when customers look to Instamart for getting ready with makeup. It’s not just the standard black eyeliner, but we have seen demand for holographic eyeliners and edgy shades bright green and blue too,” he adds.

As opposed to perishable items like fruit and vegetables, which retail for a few rupees and expire or rot quickly, it is also in the interest of quick commerce players to focus on categories such as beauty, which makes warehousing easier.

“Cosmetics typically have a shelf life of two to three years,” says Krishamani. “However, it’s the small size of the products, combined with their higher ticket price that makes them financially optimal for us from a supply chain perspective. Additionally, the frequent replenishment and repeat purchase nature of cosmetics contribute to long-term viability and growth.”

Room to Grow

Vidur Kapur, director of O3+ Professional, says while quick commerce is growing, a large part of its ‘serious’ audience still prefers specialised ecommerce platforms for their comprehensive shopping experience. “In fact, we’re seeing more growth in quick commerce among men, who show a stronger inclination towards the convenience and speed,” Kapur says. “We’re seeing a shift for the ‘convenience’ items, but not for those products that need detailed information and customer reviews, along with a good amount of education.”

As Nykaa’s Nayar said, a certain amount of discoverability is key to shopping for cosmetics or skin care online, and quick commerce is tailored to offer just that—a quick look at a quick selection of products.

“We believe the shopping mission where the consumer is sure about what she wants to purchase or in the case of repeat purchases will have a higher incidence with Q-comm,” says Singh of Fireside Ventures. “Regular one-to-three-day delivery beauty e-tailers will still have salience as a destination to browse and discover. For a smaller section of their merchandise, traditional beauty e-tailers will probably also eventually offer the 10-to-15-minute option.”

“One of the challenges is to reduce dependence on search and to build a more immersive makeup shopping experience on-app, and an engaging community that educates and inspires consumers,” Swiggy’s Krishnamani says. “Given the high replication nature of quick commerce business, another challenge is to maintain healthy inventory levels while still offering customers sufficient selection, factoring in regional nuances and preferences.”

Inventory management is crucial to quick commerce—products must be consistently available in real time, and those that are no longer in stock need to be updated on the platform. “The correct balance of offering enough variety in terms of brands, shades and variants for the customer while keeping in mind inventory health is important for this category. Regional variations in preference also needs to be kept in mind while planning inventory for different dark stores,” says Zepto’s Sreenivas.

Moreover, established beauty e-tailers have cemented a strong foothold, and offer significant competition to the nascent Q-comm players. “Zepto is focusing on differentiating itself through speed, personalised service, user shopping experience and convenience. We’re also bringing in exclusive product launches and collaborations, offering a curated selection of both legacy and new-age brands,” Sreenivas says. “With a focus on customer satisfaction, our goal is to offer competitive pricing, fast delivery, and a seamless shopping experience that keeps users coming back.”