As we share the last newsletter of 2024 with the readers, it is time to take stock of the year that was for the economy. First is an overview of the bourses that were on a roller coaster ride through the year. Investors braced for the outcomes of Lok Sabha elections, a few key state elections, and the US Presidential elections. The strong dollar, high interest rates, and geopolitical crises unfolding around the globe didn’t help either. Here’s a rundown of how investors dealt with the shocks and what they can expect from the coming year.

Two things have shone prominently in 2024 in the tech sector–Artificial Intelligence and semiconductors. AI chip giant Nvidia’s growth nearly doubled this year and experts predict that the company will soon hit $5 trillion in market cap. But behind this glittering success in the semiconductors sector is an intense race brewing where the US and China are competing to produce the world’s most advanced chips. In 2024, India also made a promising start to enter this race. Here’s a recap of the sector this year and what to expect from 2025.

A recent study by Meta shows that 91 percent of Indian online consumers are aware of quick commerce and more than half of them have used it for convenience and efficiency, primarily for food, grocery, and personal care items. Market research firm NIQ claims that quick commerce is the primary shopping platform for 31 percent of urban Indians. Besides, quick commerce is gradually finding acceptance in Tier 2 and Tier 3 markets. This is a summary of the explosive growth of quick commerce platforms in India this year. Deepinder Goyal, founder and CEO of Zomato believes that QC might just be a better business model than ecommerce. This push towards the new retail channel has become one of the highlights of the year as FMCG companies now insist on building a presence on quick commerce platforms. Let’s take a look at the reasons behind this growth and what awaits in 2025.

Discover

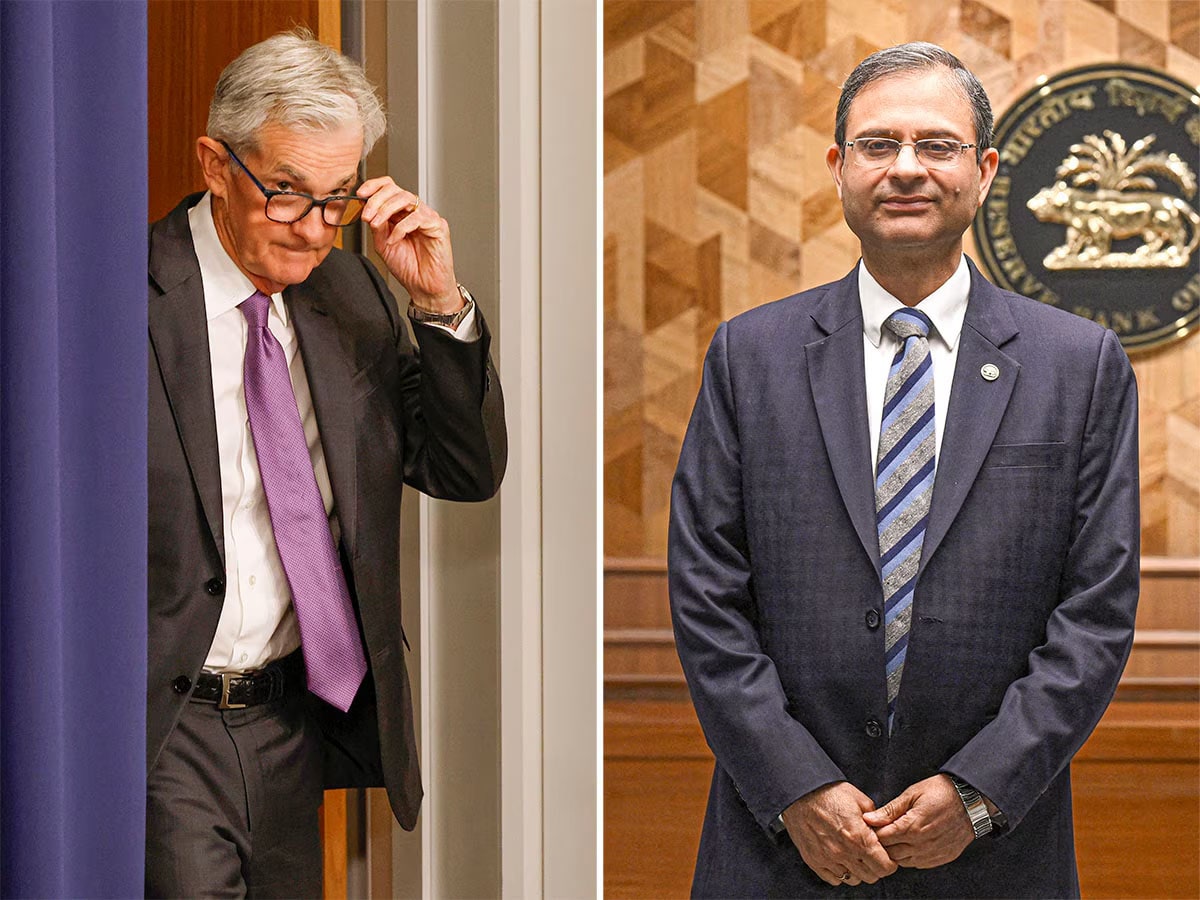

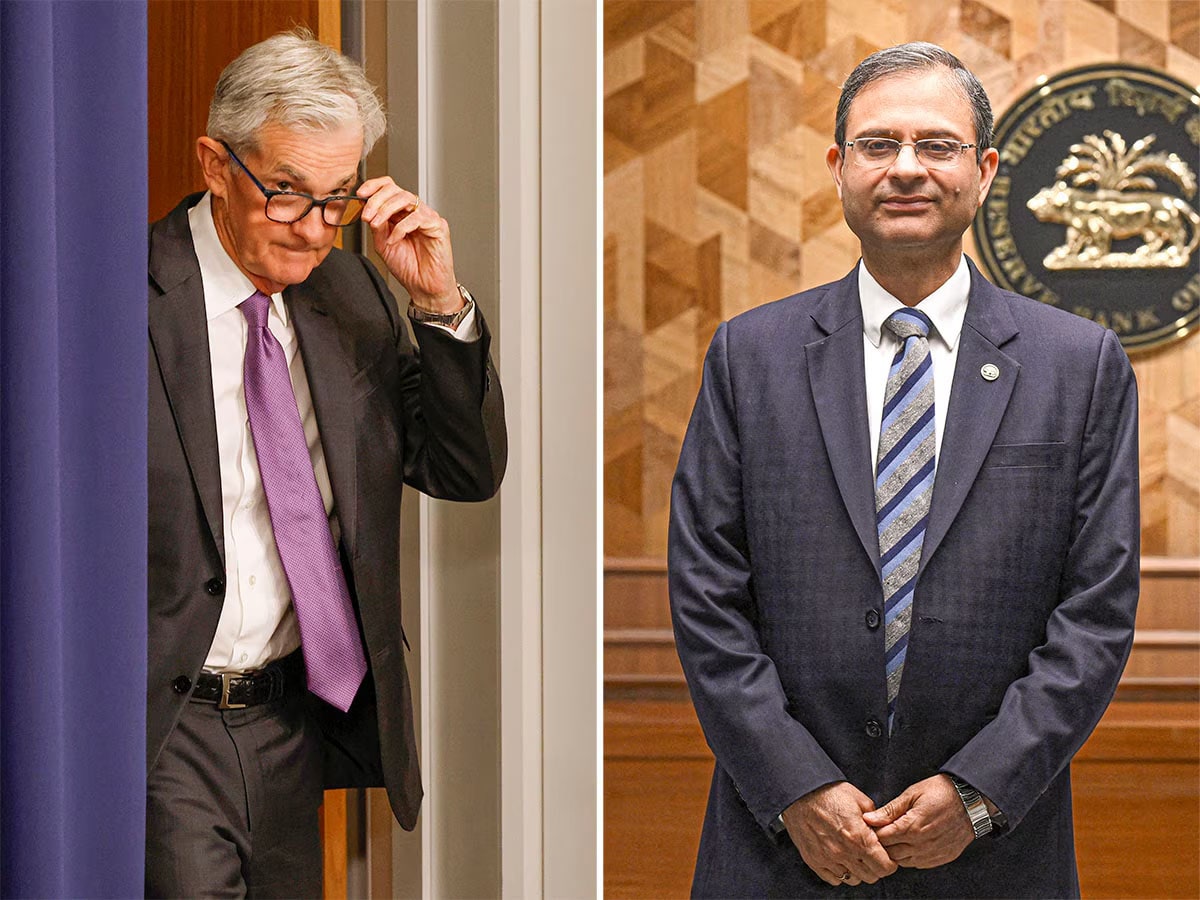

1) On a cautious descent

Federal Reserve Bank Chair Jerome Powell (left) and Reserve Bank of India governor Sanjay Malhotra. Images: Chip Somodevilla/Getty Images; INDRANIL MUKHERJEE / AFP

Federal Reserve Bank Chair Jerome Powell (left) and Reserve Bank of India governor Sanjay Malhotra. Images: Chip Somodevilla/Getty Images; INDRANIL MUKHERJEE / AFP

The Covid-19 pandemic forced policymakers to shift or adjust to the king tides of economic turmoil. Nearly five years ago, since March 2020, global central banks slashed rates to historic lows to support their struggling economies. This move created a new monster called inflation. Faced with the dual problem of anaemic growth and rapidly rising price levels, ‘accommodative’ central bankers dragged their feet to train guns on inflation and began raising rates from early 2022. The year 2024 finally saw some respite as global central banks started easing interest rates. But here’s why they are turning cautious as they tread a slippery zone of potentially inflationary tariffs next year.

2) A new playing ground

Mohammad Imran at his Taaj Palace cosmetic and beauty store at the Rahmani market in Rae Bareli, Uttar Pradesh Image: Madhu Kapparath

Mohammad Imran at his Taaj Palace cosmetic and beauty store at the Rahmani market in Rae Bareli, Uttar Pradesh Image: Madhu Kapparath

Forbes India’s latest issue highlights that the Indian beauty market is evolving beyond traditional products like soaps and lipsticks, driven by a shift towards self-care and investment in small luxuries. The industry is seeing significant demand even in tier 2 and tier 3 cities, influenced by social media and quick commerce. Be it Rae Bareli or Barabanki in Uttar Pradesh, Raigarh in Maharashtra, or Kalimondir in Odisha, consumers are flocking to get their hands on products from home-grown beauty brands–Renee, Swiss Beauty, Sugar Cosmetics, Recode, and Juice–and splurge on what Maybelline, Bobbi Brown, and Mac are selling. Here’s all you need to know about the latest stomping yard of beauty brands.

3) Shaping influence

From (L to R): Sanya Jain and Aakarshika Pandey creating beauty content for their Instagram feeds at Jogger’s Park in Bandra, Mumbai. Image: Neha Mithbawkar for Forbes India

From (L to R): Sanya Jain and Aakarshika Pandey creating beauty content for their Instagram feeds at Jogger’s Park in Bandra, Mumbai. Image: Neha Mithbawkar for Forbes India

Raghav Anand, partner – digital media for Africa, India and the Middle East at EY India, in a conversation with Forbes India last year said that the global influencer community has catalysed economic activities over $15 billion in value. He estimated that within the Indian landscape, select short-video platforms have emerged as catalysts of substantial social impact, and will drive $6 billion in economic value by 2030. Now put these numbers against the Nykaa Beauty Trends Report which says that the Indian beauty and personal care market will grow to $34 billion by 2028, up from its current value of $21 billion. According to the report, this growth is primarily fuelled by increased online penetration and a rising demand for high-quality, premium beauty products. Our next story explores how content creators will be credited for a huge chunk of this by influencing and creating new consumer demand for beauty products.

4) A love-hate story

Workers assemble cosmetics tubes at the Indo Herbal manufacturing unit in Haridwar. Image: Madhu Kapparath

Workers assemble cosmetics tubes at the Indo Herbal manufacturing unit in Haridwar. Image: Madhu Kapparath

As per industry estimates, there are 650 to 700 contract manufacturers in India’s beauty and personal care industry. Grand View Research projects that the personal care contract manufacturing market in India will expand to $1.4 billion by 2030 from $0.7 billion currently. The sheer scale and size of the BPC contract manufacturing industry, coupled with the scope of services offered by them to their clients, is a formidable expression of potential and opportunity for business. Yet, it also has dark pockets, which deepen concerns about gaps in compliance, safety and efficacy. This story from Forbes India’s beauty special blows the lid off questionable practices of some D2C companies and raises the question of whether consumers are being taken for a ride by some new-age brands.

Image: Shutterstock

Image: Shutterstock Image: Shutterstock

Image: Shutterstock Image: Shutterstock

Image: Shutterstock