Rooted in ayurveda, with formulations tailored for Indian skin tones and products made using locally-sourced ingredients, homegrown beauty brands have been shifting the narrative and redefining the beauty landscape. They offer what global giants often overlook—cultural relevance and products that cater to the diverse needs of Indian consumers.

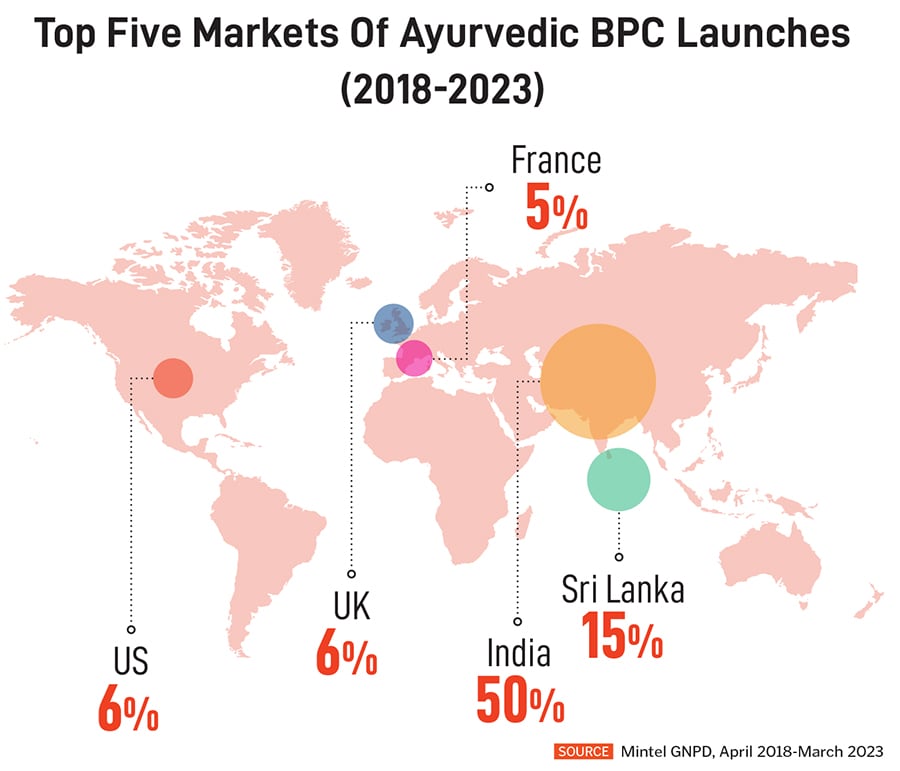

According to research firm Mintel’s report Global New Products Database (GNPD), India leads in ayurvedic beauty (A-beauty) and personal care brand (BPC—beauty and personal care) launches, accounting for 50 percent of them between 2018 and 2023.

In addition to their growing popularity, the brands are also seeing international demand and are beginning to extend their influence beyond borders.

GNPD notes that, in the same period, countries such as Sri Lanka, the United Kingdom, the United States, and France, emerged as the top markets for ayurvedic BPC launches outside India.

“The brands, with their strong ayurvedic foundations and modern aesthetics, are helping to shape a globalised version of A-beauty,” says Tanya Rajani, principal beauty and personal care analyst in India, Mintel. “This suggests there is a growing appreciation and demand for ayurvedic products in international markets, which Indian brands are beginning to meet by expanding their reach and offerings,” she adds.

Dermatologists also agree.

“A-beauty has picked up not only in India, but also internationally, fancily known as botanicals,” says Dr Rinky Kapoor, a cosmetic dermatologist and dermato-surgeon, at the Mumbai-based The Esthetic Clinics. “Plant-derived products are generally well accepted by customers, especially those who are vegan, and most importantly because they are less likely to cause reactions than products with chemical ingredients,” she adds.

To take ayurveda to the world, Kama Ayurveda, founded in 2002, recently launched a store at Harrods and Notting Hill in the UK. In India, along with a strong online presence, it has grown to over 150 stores.

(Clockwise from left) Making of Kalka, a traditional herbal paste, at Kama Ayurveda; making of ubtans at Forest Essentials’ Lodsi workshop; Just Herbs’ range of plant-powered glass lip ink with cica and sweet almond oil

(Clockwise from left) Making of Kalka, a traditional herbal paste, at Kama Ayurveda; making of ubtans at Forest Essentials’ Lodsi workshop; Just Herbs’ range of plant-powered glass lip ink with cica and sweet almond oil

“Having worked closely with consumers in India and internationally, I’ve noticed a clear shift in how people approach beauty and wellness. The UK market, in particular, has been leading this change with a strong emphasis on sustainable beauty,” says Vivek Sahni, founder and chairman.

With India remaining a critical market, Sahni believes the next phase of substantial growth also lies in the country’s Tier-II and Tier-III markets. The brand recently expanded to cities such as Calicut, Siliguri, Gwalior, Jodhpur, Thiruvananthapuram, and Aligarh, among others.

Inspired by a passion for ayurveda, Mira Kulkarni founded Forest Essentials in 2000 to merge centuries-old practices with luxury aesthetics.

The brand, which started with a single store in New Delhi, now has 120 outlets nationwide. It bolstered its retail presence internationally starting 2022, with six stores now across the UK, Dubai and Kuwait.

In 2007, the American multinational cosmetics company, Estee Lauder, picked up a 20 percent stake in the Indian brand, becoming its first investment in India. Kulkarni states the brand has been able to build a loyal customer base and has seen a compounded annual growth rate (CAGR) of 31 percent consistently over the past three years.

“We’re focussed on expanding our presence both in India and internationally, specifically continuing to grow our footprint in the Gulf Cooperation Council (GCC),” she says. “Our vision is to see ayurveda move from an alternative to a mainstream science.”

Also read: From Barabanki to Kalimondir to Raigarh, small towns are new playing ground for beauty brands

The growing demand for authentic, chemical-free beauty solutions led to the birth of another A-beauty brand, Just Herbs, in 2014. With make-up products such as lip inks blended with the medicinal herb gotukola, and highlighters infused with amla, an Indian gooseberry, the brand is ready to explore the global stage to meet contemporary demands.

Eyeing particularly the US and the Middle East markets, Garima Dikshit, business head, states it is the right time to test international waters because they see significant opportunities in tapping into the global interest in ayurveda. But she is also aware of the challenges. “Navigating local market preferences and building brand awareness are some of those, but we are confident that our unique positioning will resonate with consumers globally,” says Dikshit.

While the A-beauty space is brimming with players, with the established ones now ready to go global, the sector is also seeing new startups enter the space to tap into the growing local demand.

Take Nat Habit for instance. To make natural living a habit across every Indian household, Swagatika Das and Gaurav Agarwal launched Nat Habit in 2019. Hailing from medical and agricultural families, the duo has developed 250 SKUs across 40 hair and skin categories over the years. These include ubtans, henna, lip scrubs, malai lotions, foot salts, body oils, and more—catering to men, women, and babies. As of March 2024, with 2.5 million people as their customers across the nation, the company’s revenue touched ₹100 crore, informs Das.

“Overall, today’s Indian consumer is more environmentally-conscious, ingredient-savvy, and selective about blending natural solutions with science-backed innovations, highlighting a sophisticated approach to personal care,” feels Das.

In the short term, the brand is focussed on meeting the local demand for A-beauty products and strengthening the brand within India. “We want to take it abroad after a certain penetration in the Indian market. For now, we plan to deepen our focus on research and innovation, brand building, and offline expansion to meet the ₹500 crore revenue target,” she adds.

While the A-beauty movement has surged in popularity in recent years, Mintel’s Rajani says brands will have to take into account the consumer’s varied priorities. With more Indians prioritising efficacy and functionality, brands, too, will need to emphasise the safety and efficacy of ayurvedic ingredients, she says.

Second, with Indians also embracing skincare routines and seeking products that cater to their skin issues, there is a growing interest in personalised beauty solutions, which brands will have to offer.

Third, the recognition of ayurvedic ingredients such as ashwagandha that have adaptogenic properties—natural substances considered to help the body adapt to stress—will need to be harnessed not just for their beauty benefits but even for well-being.

“Ayurvedic adaptogens like ashwagandha will gain more recognition for their ability to support the mind-skin connection and add stress-alleviating benefits to beauty and personal care products. Brands that leverage these ingredients can tap into the growing demand for holistic wellness solutions,” adds Rajani.

For Indian consumers, utilising natural ingredients readily available in their kitchens has been a tradition. “This familiarity fosters trust, as these ingredients are perceived as safe,” Rajani says.

However, dermatologists also warn that they may not be suitable for every skin type. Plus, there may be a lack of awareness, and the ingredients may or may not be clinically tested.

“Some may experience allergic reactions or side-effects like redness, irritation, inflammation, pimples, acne, and breakouts after using these products,” says Dr Kapoor.

These problems are commonly seen due to misused ingredients, poorly-researched formulations, and lack of regulation, informs Dr Shareefa Chause, a dermatologist at Dr Shareefa Skin Care Clinic in Mumbai.

“It is always better to stick to the products recommended by an expert who examines the skin and then suggests optimum results,” says Dr Chause.