As I step into Rajeev Juneja’s office at Mankind Pharma’s Delhi headquarters, the wall in front of me immediately commands attention. It features a collection of iconic quotes and striking black-and-white portraits of renowned leaders. The portraits are without names, and each is accompanied by a keyword that encapsulates their essence.

“We’ve always been inspired by the Tatas; they are my heroes,” says Juneja, gesturing toward a portrait of JRD Tata, with the word ‘admiration’ beneath it. “Our dream was to always turn Mankind into an institution,” says the 59-year-old who is vice chairman and managing director of the company. “And dreams should always seem impossible.”

Back in 1984, Ramesh Juneja, Rajeev’s older brother, had started a formulations business, as a partnership, called Bestochem in Meerut, Uttar Pradesh. This was after he resigned from his earlier job at pharma company Lupin in 1983. A decade later, he withdrew from the enterprise, and started Mankind Pharma along with Rajeev.

When Ramesh worked as a medical representative at Lupin, he would visit small towns and villages in Bihar. “Most patients who came in for doctor consultations had limited money. After paying the consultation fee, they were unable to afford medicines and had to opt for partial medications,” he writes in the company’s FY24 annual report. The brothers started the company with one goal: Making affordable medicines of high quality.

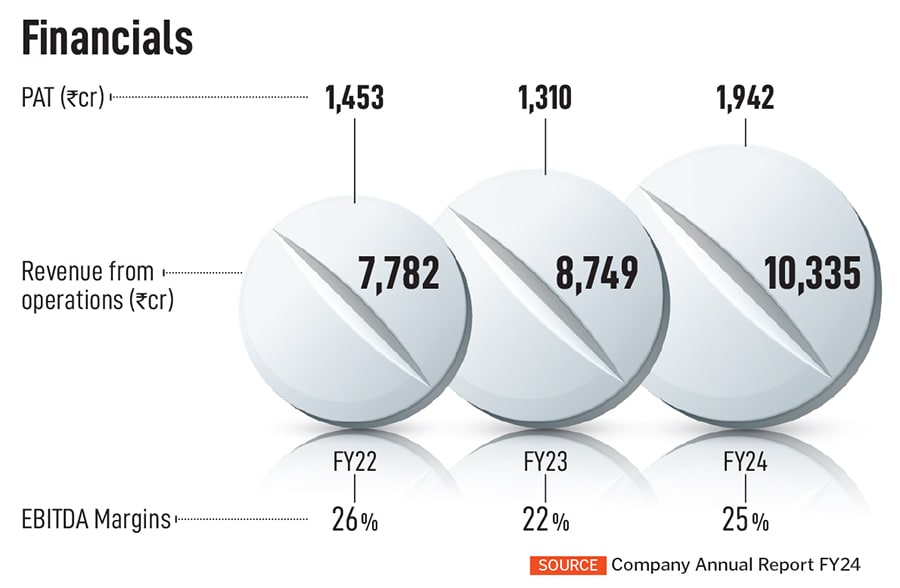

A lot has changed since then: Mankind is today a formidable listed Indian pharma player, with a turnover of ₹10,335 crore in FY24 and market capitalisation of ₹121,193 crore (at the time of writing of this article). Yet, for the Juneja brothers, the goal to make quality medicines accessible and affordable remains.

It has been over a year and a half since the company’s blockbuster ₹4,326 crore IPO, with shares listing at a premium of 20.37 percent in May 2023. Soon after the IPO, says Juneja, “First thing I did was delete Moneycontrol,” and stopped tracking the company’s share price. “It really puts a lot of pressure; it’s key to remember that the share price is because of your work, and not the other way around.”

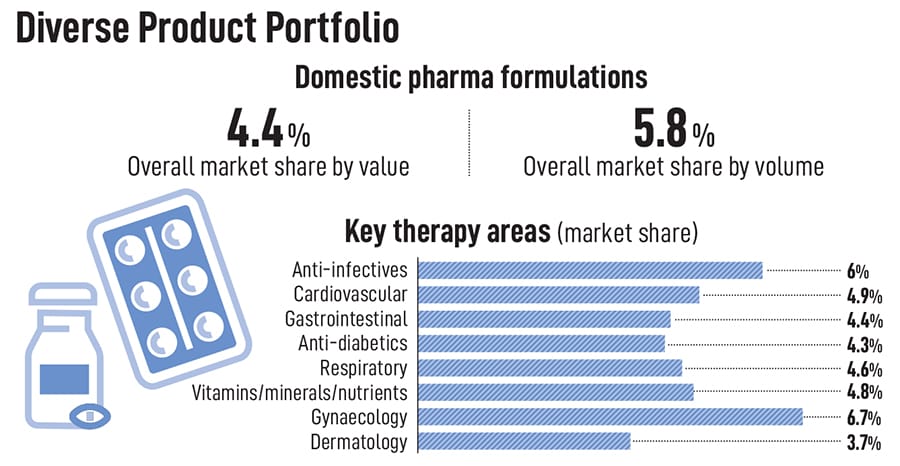

In the last year, the Junejas have acquired Bharat Serums and Vaccines (BSV) in a ₹13,768 crore deal, and made the strategic decision to hive off the consumer business to further scale it up, while continuing to focus on niche molecules in the chronic ailments segment of the pharma business. The company recently concluded a ₹3000 crore qualified institutional placement (QIP) with funds earmarked to partly finance the BSV acquisition announced in July 2024. “However, in the last couple of years the focus is on building the brand, by focusing on niche molecules, increasing chronic therapies from 28 percent in FY18 to 36 percent in FY24 launching new products, in-licensing and acquisitions,” says Sheetal Arora, who took charge as CEO of Mankind Pharma in May 2021. Arora is the nephew of Rajeev and Ramesh.

Scaling up consumer health care

Even after Mankind turned into a ₹500 crore giant in 2007, it continued to face a lot of resistance in bigger cities, given that it came from a small town and also because it was barely present in any part of the country, except for Utter Pradesh, Haryana and Delhi. “The prevailing view in the industry was that Mankind Pharma was a company known for selling ‘cheap products’; not affordable, but cheap. This perception naturally implied a lack of quality,” recalls Juneja. Determined to challenge this stereotype, the brothers launched the over-the-counter (OTC) business in 2007 to shift the narrative. Beyond the financials, what truly defines a company’s value? “Brand equity,” says Juneja. “What you communicate must be supported by the quality of what you offer; delivering excellent products with the right packaging.”

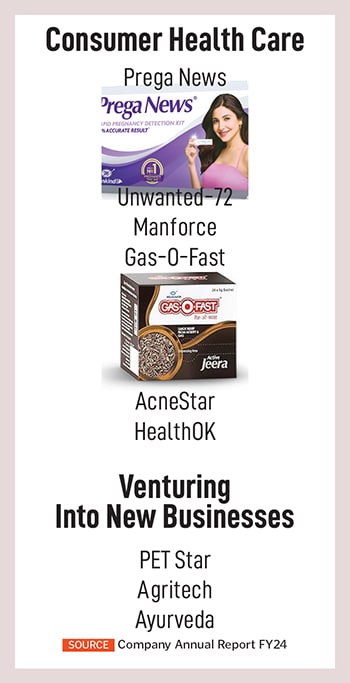

Juneja and his team have a lot of confidence about the company’s consumer business. The portfolio includes top brands like Prega News (pregnancy test kit), Manforce (condoms), Unwanted-72 (emergency contraceptive) and more. “It has given a lot of name to Mankind; at one point, people knew our brand Manforce more than Mankind,” he says. This, for him has been humbling. The consumer business is also one that requires a lot of creativity and constantly keeps the team on its toes.

Since October 1, 2024, the consumer business has been carved out into a wholly owned subsidiary. This move follows a similar path taken by other industry leaders, such as Sanofi India, Cipla, and Zydus Lifesciences. With the scale that the OTC vertical has achieved, the promoters decided to run the two businesses separately. “A completely different mindset is required to run the consumer and pharma business, especially since we are looking to scale some very big brands,” says Arora.

“We are seeing some muted growth in the OTC business due to the restructuring. The investor community is very excited about their consumer business. Now that it is a separate business, we can expect a lot more growth,” says Vishal Manchanda, senior vice president, Institutional Research, Systematix Group. Currently, the OTC vertical contributes about 7 percent to the company’s total sales. “We feel that OTC has a lot of potential for growth. In fact, it can grow a lot faster than the pharma business in the coming years,” adds Juneja, who feels that this segment should have been carved out much earlier.

Also read: Global pharma: Focus on core business, pure-play innovation

Prescription for growth

Affordability and accessibility remain Mankind’s competitive edge but over the last couple of years the brand has built on the strategy “by focusing on niche molecules, increasing chronic therapies from 58 percent to 70 percent by launching new products, in-licensing and acquisitions,” says Arora. Chronic therapies are seeing better margins as compared to acute, which is also why Mankind’s shift in focus has led to higher Ebidta margins—from 21.9 percent in FY23 to 24.7 percent in FY24.

Mankind started working on research and development close to 14 years ago. Launching infertility treatment drug Dydrogesterone took nine years of R&D. Once that product took off in the market, the Junejas had the confidence to look at newer products. Currently, there are a lot more products in the pipeline, for weight loss, autoimmune diseases, oncology and more. The company spends about 2.2 percent of its revenue on R&D, which the promoters believe is good enough for a domestic-focussed company.

Mankind started working on research and development close to 14 years ago. Launching infertility treatment drug Dydrogesterone took nine years of R&D. Once that product took off in the market, the Junejas had the confidence to look at newer products. Currently, there are a lot more products in the pipeline, for weight loss, autoimmune diseases, oncology and more. The company spends about 2.2 percent of its revenue on R&D, which the promoters believe is good enough for a domestic-focussed company.

Products like Dydrogesterone do lead to higher barriers to entry for competition to come in, but take years to launch. Another way around, according to Juneja, is in-licensing deals. The first in-licensed deal was with Novartis in 2024 for Inclisiran, a drug for the treatment of high low-density lipoprotein (LDL) cholesterol. “With a lot of difficulty we convinced them, and that product has seen a lot of success.” Later, Mankind went on to sign an exclusive in-licensing deal with AstraZeneca for asthma management product Symbicort. In July 2024, the company launched the world’s first siRNA therapy, Crenzlo (Inclisiran) for managing high LDL-cholesterol, requiring just two injections per year, under an in-licensing agreement with Novartis, which revolutionises cholesterol management.

In December 2024, the company announced a partnership with Chinese company Innovent Biologics to exclusively license and commercialise innovative immunotherapy drug Sintilimab, used in the treatment of cancer, in the Indian market. The Sintilimab injection, marketed as TYVYT in China, is co-developed by Innovent and Eli Lilly. Sintilimab is expected to be launched in the Indian market in 3 years, upon the successful completion of its phase 3 clinical trial in India and subsequent approval by the Drug Controller General of India (DCGI).

For close to 25 years, says Arora, “we were a fairly conservative company. We chose to grow organically, hence we didn’t do any big acquisitions.” In the last five years, that changed. Acquisitions have been key to diversifying the domestic formulations business. In 2022, the company acquired brands of Panacea Biotec Pharma enabling entry into transplants and oncology. This October, Mankind completed the ₹13,768 crore acquisition of Bharat Serums and Vaccines (BSV). “It was love at first sight,” recounts Juneja. “We first heard of this company in 2019, and lost this deal to [private equity firm] Advent International.” BSV has a range of specialised products, especially in the women’s health and fertility category. “These are all high price, low volume, very niche, super specialty, high-entry barrier products. The gestation period for these products is five to 10 years; that’s the beauty of the BSV business,” says Juneja.

This acquisition helped Mankind get capabilities for developing complex drugs, “which is an area that Mankind was struggling with. And the Indian pharma market currently has some major gaps when it comes to complex drugs,” says Manchanda.

Pharma major Novo Nordisk saw a lot of success with their launch of glucagon-like peptide-1 (GLP-1) drugs Wegovy (for weight loss) and Ozempic (for diabetes). “This reflects the power of one niche molecule. Hence, we also decided to focus more on niche and high-entry barrier products, with higher margins,” says Arora. While there are no big acquisitions in the pipeline, the company is open to looking at smaller acquisitions. But in that, the management will be looking at three key things—a product portfolio with complex products that have high entry barriers, a part of the chronic or semi-chronic therapies and lastly, Ebitda margins better than Mankind’s.

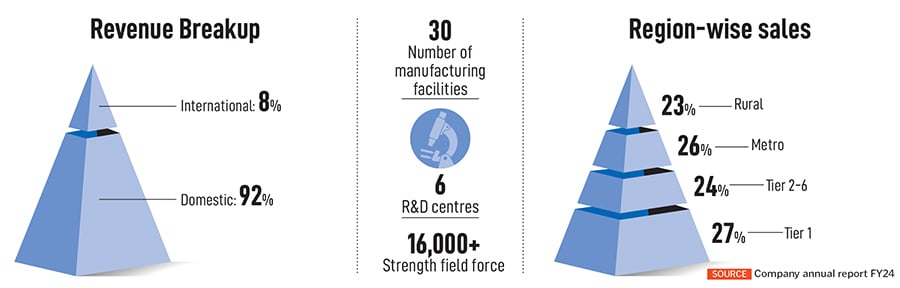

The same thought process also applies to exports, which Manchanda says, “has done extraordinarily well for Mankind”. As per FY24, only 8 percent of their revenue was from international markets. The promoters seem to be happy with this growth, given that their focus remains on the domestic market. “When we get an opportunity to launch a product that will yield better profits, and will have a much longer life, we take it up,” says Juneja.

Interestingly, about 75 percent of Mankind’s products are manufactured in-house, which is unlike many of its counterparts who work with contract manufacturers. “When they export, they produce in-house, but when they sell in India, a majority work with contract manufacturers,” says Juneja. From the early days, Ramesh’s vision was clear: “Making high-quality affordable medicines available even in the remotest part of the country.”

Hence, to deal with this quality perception of the industry, they invested in building factories. The benefit of the same lies not only in maintaining stringent quality standards but also in reducing costs, ultimately enhancing profitability. “Result is a by-product of good work. So instead of looking for result, look for things that are responsible for bringing those fantastic results. The goal is to create that kind of a work culture,” says Juneja.

Indian pharma, for many years has been dealing with quality issues. The general perspective, according to Juneja, is that the quality of drugs in the US or Europe is better than that in India. “The problem with quality eventually goes back to how the factory is being run, investment in maintaining the factory and getting the right manpower. It’s about having the right kind of culture, in the organisation,” he feels.

Development of ophthalmic and injectable formulations is one of the areas of focus at the

Development of ophthalmic and injectable formulations is one of the areas of focus at the

analytical method validation lab at Mankind’s R&D centre in Manesar in Gurugram

Future dose of innovation

Reflecting on the past 29 years, Juneja remarks, “We’ve always been disruptors,” adding that there is much more to come. Mankind is poised to evaluate many more in-licensed agreements while building on key therapeutic areas, including oncology and autoimmune diseases.

“With specialty drugs, the biggest issue in India is affordability,” says Manchanda. “If this issue is addressed, then there is a lot of access that can be built around the same.” Mankind Pharma is hoping to use its key strengths to do just that.

In the consumer sector, they plan to expand the company’s footprint in the fertility segment, building on existing products such as the OvaNews ovulation detection kit, among others. “With the consumer business, it’s not about number of products, but the size of the product that matters,” says Juneja. For instance, antacid Gas-O-Fast, a competitor to Eno, has touched a 9 percent market share in 2024; earlier, almost 98 percent was Eno.

While Juneja says some strategic decisions could have been made sooner, his vision for the future is clear: “I want Mankind Pharma to be a highly respected institution.” Arora concurs: “My uncles have been at this for nearly 40 years, yet their drive for success remains unwavering. They often ask me, ‘When will we be number one?’”