India is broadly seeing policy continuity, the world is watching out for policies adopted by the new administration in the US particularly on matters such as trade, immigration, deregulation, taxes and government expenditure.

India is broadly seeing policy continuity, the world is watching out for policies adopted by the new administration in the US particularly on matters such as trade, immigration, deregulation, taxes and government expenditure.

Illustrations: Chaitanya Dinesh Surpur

Investors are likely to keep a tight grip on their money till the world shakes off the several trends that shattered equities and other assets in 2024. One aspect of stock markets investing that looks most certain in 2025 is ‘volatility’. Weak corporate earnings, slow economic growth amid a soft local currency and a new US government policy are expected to set the tone for markets in India.

Trideep Bhattacharya, president and CIO, equities, Edelweiss Asset Management, remains optimistic about Indian equities in 2025. “While 2024 was marke`d by global elections and leadership transitions in quite a few of the top 20 nations, 2025 is poised to translate policy narratives into economic growth, punctuated by higher tariffs in our view,” he says. He, however, expects India to benefit from tariff related cross-currents between the US and China.

More than half of the world’s economy by GDP and population, including India and the US, went through elections in 2024. While India is broadly seeing policy continuity, the world is watching out for policies adopted by the new administration in the US particularly on matters such as trade, immigration, deregulation, taxes and government expenditure. This will have a bearing on trade and financial markets globally.

“Clearly, both Indian and global equity markets have had a strong run in the recent past, despite headwinds around inflation, high interest rates, geopolitical risks and slowing economic growth,” Pramod Gubbi, co-founder, Marcellus Investment Managers, says.

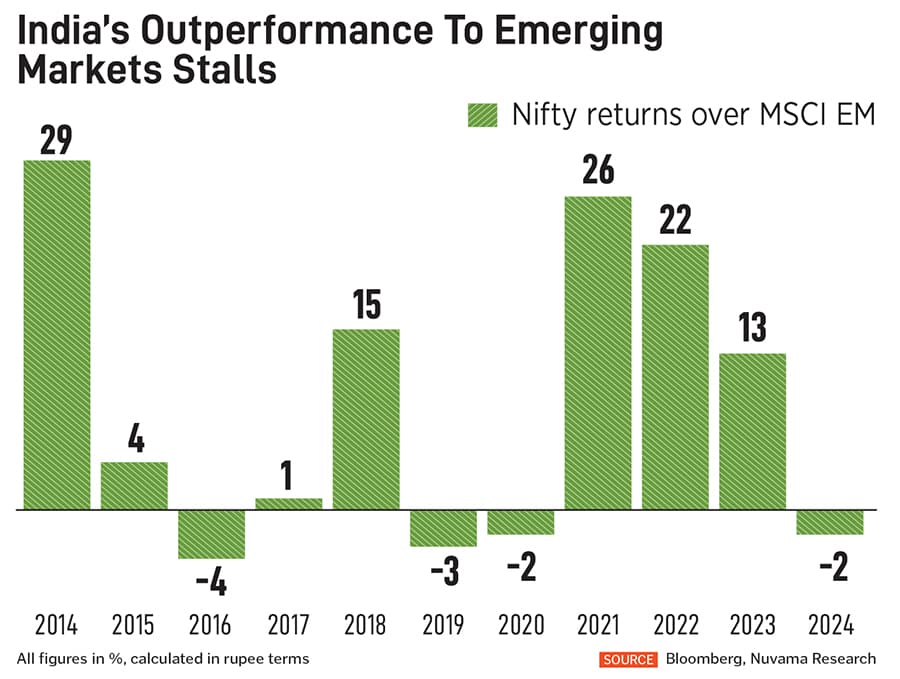

The year 2024 was a year of contrasts for stock markets in India. Overall Indian markets saw a massive rally in the first half with corporate earnings holding up despite a slowing top line and domestic institutional investors providing the cushion. The second half was the exact opposite. In October, the Nifty posted a 5 percent correction in a month, the first time since Covid, while earnings disappointed as margin tailwinds faded and growth concerns rose. India gave up its emerging markets (EM) outperformance and foreign institutional investors (FIIs) got into aggressive selling of Indian stocks.

Overall, benchmark indices Sensex and Nifty made around 8-9 percent gains in 2024. This is the ninth consecutive year of positive annual returns for Indian markets, which is the longest run since 1985. However, Nitin Bhasin, head, institutional equities, Ambit, feels it is time to be selective as 2025 is expected to be a stock-picker’s market.

With earnings growth slowing down, negative earnings surprises accelerating, expensive valuations and worsening sentiment, Bhasin believes caution should be exercised.

Others agree. Madanagopal Ramu, fund manager and head-equity, Sundaram Alternate Assets, feels 2025 will be a reality check for the India growth story.

“India equity returns will be muted due to lower-than-expected earnings growth. But we also rule out any significant drawdown from current levels given the low FII holdings, and India at 6 percent GDP growth will be much better than other emerging markets,” Ramu says. According to him, global equity emerging markets can see a decline; the Trump tariff war and the potential slowdown in China can reduce growth expectations, triggering a sell-off by FIIs.

Also read: Indian stocks caught in a crossfire of Chinese boosters, West Asia flare-up

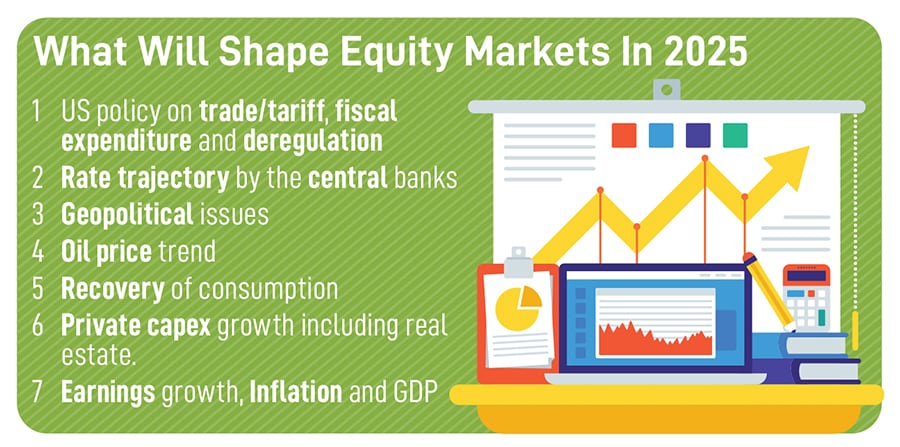

What will shape equity markets in 2025

A mix of US policy on trade/tariff, fiscal expenditure and deregulation, rate trajectory by the central banks, oil price trend, geopolitical issues, recovery of consumption and private capex growth are some of the key themes that are expected to shape the markets in 2025.

Nitin Aggarwal, director, investment research and advisory, Client Associates, believes the IT and health care sectors will provide the best opportunities in 2025. He sees markets consolidation at the current levels or even a possible further decline. However, most of it would depend on the Q3 earnings, inflation and GDP growth. He is positive on the large cap space, while underweight on the small and mid-cap, given stretched valuations.

“On the global front, the prospect of tax cuts, expansionary fiscal policy, and potentially more nationalist trade policy in the US would continue to support US equity markets,” he says.

In 2024 there was a reversal of the policy rate trajectory by the US Federal Reserve, which reduced Fed funds rate by 100 basis points in contrast to a 100 bps hike in 2023. On the domestic front, the Reserve Bank of India chose to take a pause while changing its policy stance to neutral.

Neeraj Chadawar, head-fundamental and quantitative research, Axis Securities, expects the first half of 2025 to be more volatile. For 2025, he is betting on themes such as premium consumption, health care, companies with higher growth potential in the infrastructure value chain, pharma, telecom, real estate and banking, financial services, and insurance (BFSI).

In 2024, defensives such as IT, which underperformed in the first half of the year, significantly outperformed in the later part.

Gubbi bets on private sector financials to offer some absolute value while IT and pharma seem to provide earnings visibility despite high absolute valuations.

Earnings and valuations

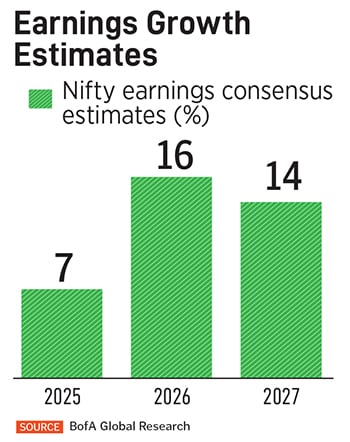

In the absence of healthy earnings growth and stretched valuations, investors are preparing for more turbulence. A subdued corporate earnings performance in the September quarter of 2024 was largely led by a slowdown in capex activities, moderation in urban consumption led by higher inflation and extended monsoons, and a reduction in spread due to the rationalisation of commodity prices. All these indicators impacted the margins of Indian corporates, which translated into earnings cuts.

“That led to an earnings cut of 1.5 percent of Nifty companies for FY25, while the earnings cut for consensus was more than 3 percent,” says Chadawar.

He sees Nifty earnings per share (EPS) to grow by 7.6 percent and 13.7 percent in FY25 and FY26 respectively. In FY27, Chadawar expects earnings to grow by 11 percent. He is hopeful of double-digit earnings growth to be achievable in the next 2-3 years, based on expectations of an increase in government capex, post-monsoon activities, a good number of wedding days, and expectations of rural pick-up in the second half of the fiscal.

He sees Nifty earnings per share (EPS) to grow by 7.6 percent and 13.7 percent in FY25 and FY26 respectively. In FY27, Chadawar expects earnings to grow by 11 percent. He is hopeful of double-digit earnings growth to be achievable in the next 2-3 years, based on expectations of an increase in government capex, post-monsoon activities, a good number of wedding days, and expectations of rural pick-up in the second half of the fiscal.

In FY24, while nominal top-line growth did slow down, it was concentrated more in commodities (owing to deflation) and exports. Domestic growth—particularly among cyclicals—was still strong.

Ramu is optimistic that earnings growth would improve in 2025. “In a few pockets of mid- and small-cap sectors that benefited from momentum during elections, valuations are extremely rich and it will take a substantial correction for any new investor to see value in them,” he says.

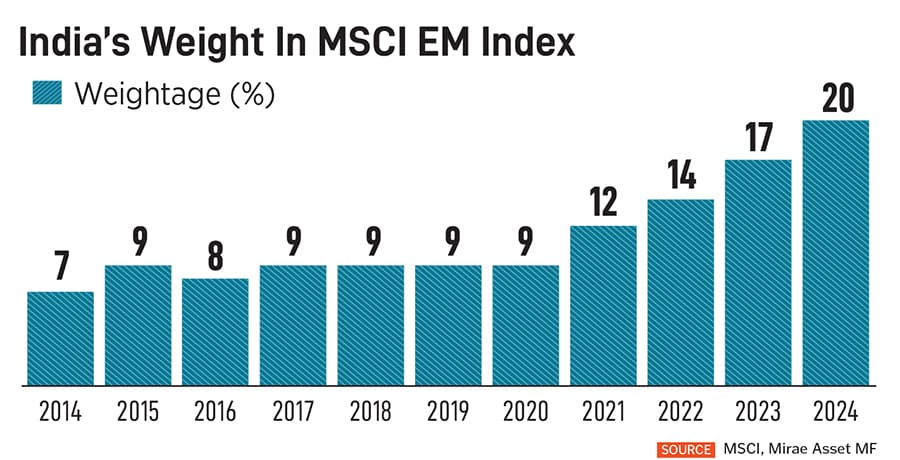

On the valuations front, India’s premium relative to world has slipped while it remains higher relative to the EM basket primarily on account of China de-rating. On a one-year forward basis, Nifty is currently trading at around 20.3 times price-to-earnings ratio.

According to Bhattacharya, Indian market valuations are broadly fair, with large caps at a marginal discount to their 10-year average, while mid- and small-caps trade meaningfully above their 10-year average. He remains positive on manufacturing, IT, real estate and quality NBFCs over the next 2-3 years. Additionally, he views consumption as a potential dark horse for 2025.

Equity still the best asset class in 2025?

On an absolute basis, the Nifty has considerably outperformed bonds and marginally outperformed gold over the last decade. While market returns can be volatile in the short term, equities remain the best performing asset class over a longer horizon.

While earnings growth slowdown, expensive valuations and macro-economic headwinds pose uncertainties around a market return, Bhasin believes equities remain the optimal asset class because of its alignment with India’s growth trajectory. Amidst elevated global uncertainty, the Indian economy has remained resilient and earnings growth has been the highest among EM peers.

Bhattacharya thinks equities could stand out as one of the best-performing asset classes over the medium term as equities are known to be one of the best inflation hedges over time.

Overall, flow of foreign liquidity has been challenging for India. In 2024, FII flows into Indian equities moderated, especially in the last quarter of the year. The net FII outflow from Indian equities was $870 million—a sharp moderation from over $20 billion in the previous year.

“In 2025, there is a risk of India losing share on FII flows to EMs,” Prateek Parekh, equity strategist, Nuvama Group says.

This is because India’s earnings differential with EMs is now narrowing. Post-Covid, the GDP growth differential between India and EM has reduced. The earnings/return on equity (RoE) differential has increased. “This is owing to the restructuring exercise undertaken by India Inc while EM corporates have faced balance sheet issues. However, these are now being ironed out and hence, India and EM earnings differential is likely to narrow hereon, Parekh elaborates.