Team Swiggy (from left): Phani Kishan Addepalli, co-founder; Sriharsha Majety, co-founder and group CEO; Girish Menon, head of HR

Team Swiggy (from left): Phani Kishan Addepalli, co-founder; Sriharsha Majety, co-founder and group CEO; Girish Menon, head of HR

Image: Selvaprakash Lakshmanan for Forbes India

The ETA (estimated time of arrival) was March 2020. The karmic delivery was running late—six years after Sriharsha Majety co-founded his second startup in 2014—but when it eventually showed up, it was swift and almost gutted the founder. To make matters worse, the timing was cruel.

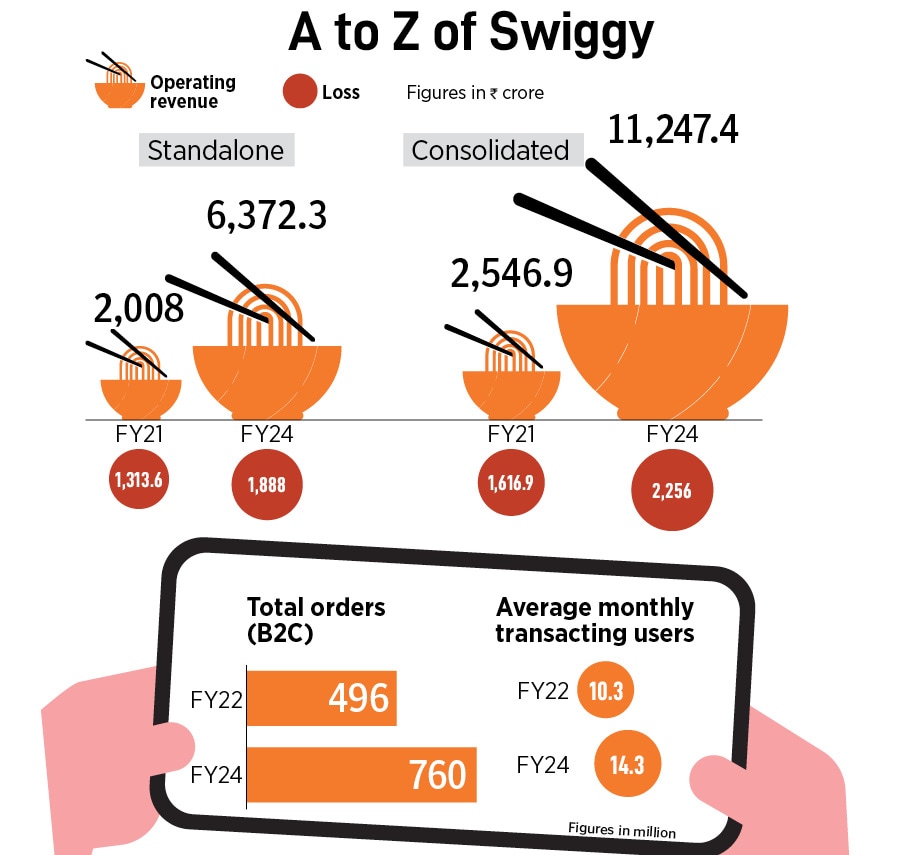

For Swiggy, 2019 was a year of heightened investment. “The company was in a high cash burn phase,” recalls Majety, alluding to heavy investments made in cloud kitchens—billed as the next ‘big’ thing in the foodtech world. The startup was also making promising bets on Swiggy Stores—hyperlocal delivery marketplaces which went beyond food—and a slew of other food-related initiatives. The results, as expected, took a toll on the bottom line. Losses ballooned alarmingly: From ₹385 crore in FY18 to ₹2,345.6 crore in FY19, according to Entrackr, a media venture tracking startups and internet economy in India. Revenue, too, jumped during the same period, but paled when contrasted with the losses: From ₹417 crore to ₹1,121.7 crore.

The timing indeed was brutal. Even as Majety was doing his bit to mow the burn towards the fag end of 2019, a raging pandemic snuffed out all hopes of any funding after the first quarter of 2020. Things soon quickly spiralled out of control. “Just three months after our wild investment calendar ended, the pandemic arrived,” recounts Majety. Though Covid was unforgiving for most of the businesses, for the ones in food delivery, it was the unkindest. Swiggy’s business plunged by 90 percent, its funding runway was pegged to last roughly between six and nine months, and the co-founder was compelled to do something that he had never done in his entrepreneurial journey: Go for layoffs.

Majety was gripped with an imposter syndrome. “I could have done a few things differently. This (layoffs) could have been avoided,” Majety recounts his trauma and regret. Pink slips became a necessary evil and it was an agonising episode. “I slept only once every two weeks. And this continued for three months,” he shares his pain. “I would just lie down on the bed for seven hours and wake up when the sun came out,” he adds. If it was a question of survival for Swiggy, it was the same for the ones who were being laid off.

Also read: Swiggy IPO: Is it worth a bite?

It aggravated the entrepreneur’s mental suffering. “Some form of suffering is a rite of passage,” Majety reckons, alluding to something similar being propagated by Nvidia co-founder Jensen Huang during his interaction with Stanford students last March.

Rohit Kapoor, CEO (food marketplace), Swiggy

Rohit Kapoor, CEO (food marketplace), Swiggy

Image: Amit Verma

Back in early 2020, Majety was fighting for survival. The ‘survival’ question reared its head five years prior to that, in 2015. The query came from a young Turk who joined Swiggy in January 2015, the month Swiggy closed its maiden round of funding. Three months later, the fledgling startup was in talks to close its next round. “Do you think we will last a year?” Phani Kishan Addepalli lobbed an innocuous-but-pertinent query to Majety. It was early days for Addepalli who was finding his feet and, to be fair to the rookie, anybody would have needed a year to get a hang of the business dynamics. The survival question, though, didn’t faze Majety. He smiled and dished out a one-word confident reply: Yes.

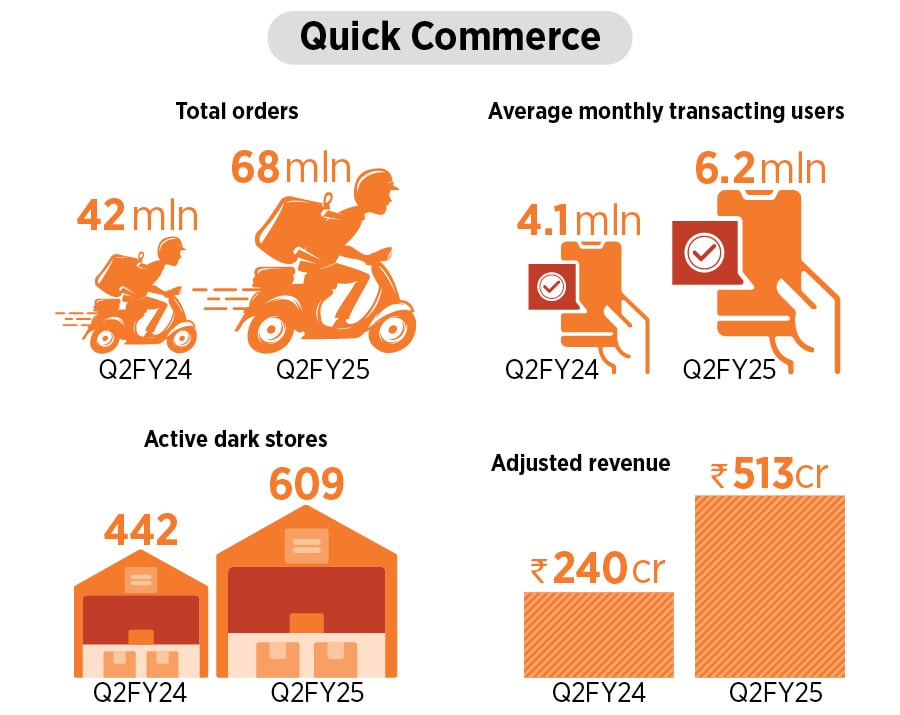

For the young employee, however, the situation was unnerving. “It was wild west out there,” recalls Addepalli, alluding to the presence of a bunch of foodtech players. “Things were moving fast,” he says, recalling a conversation with Majety over a cup of tea in early 2015. Suddenly, another Swiggy co-founder, Nandan Reddy, interjected. “Hey guys, we need to hire 25,000 delivery partners,” he exclaimed, sharing his hiring plans. Addepalli was baffled. “Listen, we’re doing 50 orders a day and, at times, you are delivering yourself. And you are talking about hiring 25,000 delivery partners,” exclaimed Addepali, who was elevated as co-founder in July 2021. “We always had this ‘think big’ element of believing that we can change the world,” says the chief growth officer. One such moment happened in August 2020 when Swiggy pioneered quick commerce in India and rolled out Instamart.

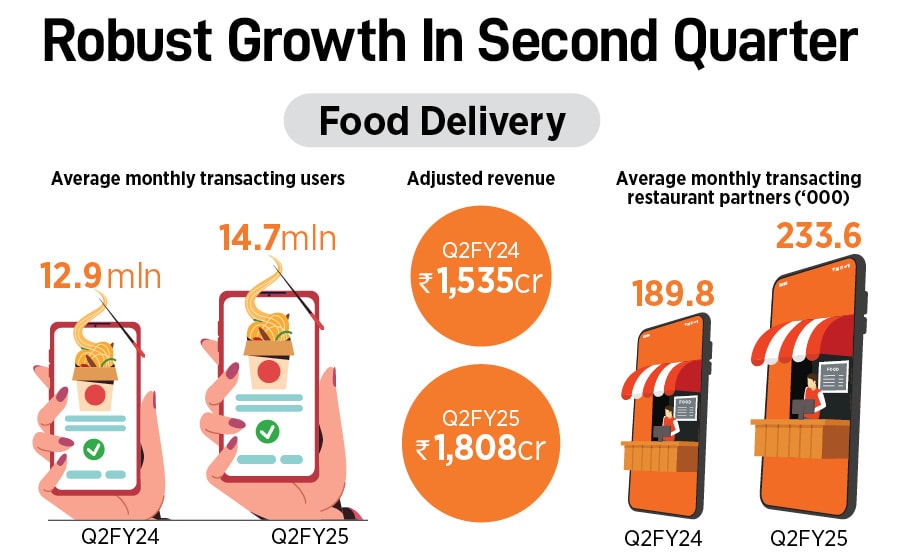

Two years later, in 2022, Swiggy was staring at another survival question. The consolidated losses pole-vaulted from ₹1,616.9 crore in FY21 to ₹3,627.88 crore in FY22. Though revenue too doubled during the same period—from ₹2,546.9 crore to ₹5,704.90 crore—an excessively bleeding bottom line increased the chances of an imminent haemorrhage. Though the first to enter the food delivery segment, Swiggy was quickly yielding ground to rival Zomato. But what was a bigger danger signal was the sluggishness that had crept into the company after the pandemic. It was not firing on all cylinders. Majety roped in Rohit Kapoor as CEO of food marketplace in October 2022. Kapoor, who held leadership positions at Max India, McKinsey and OYO, was supposed to shadow Majety for six months. But, within 15 days, the co-founder gave a thumbs-up.

Swiggy needed a quick reboot, and Kapoor rolled out ‘Operation Pulse’. He picked up the top 400 leaders across verticals in Swiggy and took them on a whirlwind tour across 300 cities during the tail-end of 2022. The idea was to reconnect the organisation to the stakeholders: Restaurant and delivery partners and customers. New roles were created which augmented the staff on the ground, the corporate office was shrunk, and Operation Pulse lasted for three months. The results were impressive.

Kapoor credits the success of his new plan to Swiggy’s culture. “It’s an intellectually-honest organisation,” he contends, adding that, at times, the simplest of programmes turn out to be the most powerful. The organisation was galvanised, the innovation machine got a much-needed reboot, and the results started becoming visible. Swiggy’s food delivery business turned profitable in March 2023.

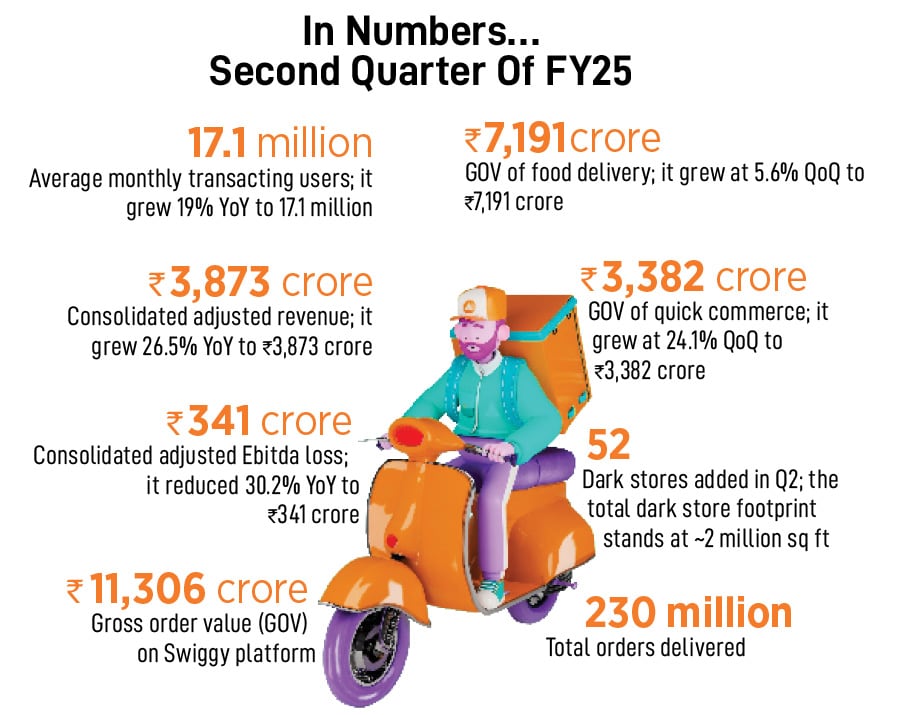

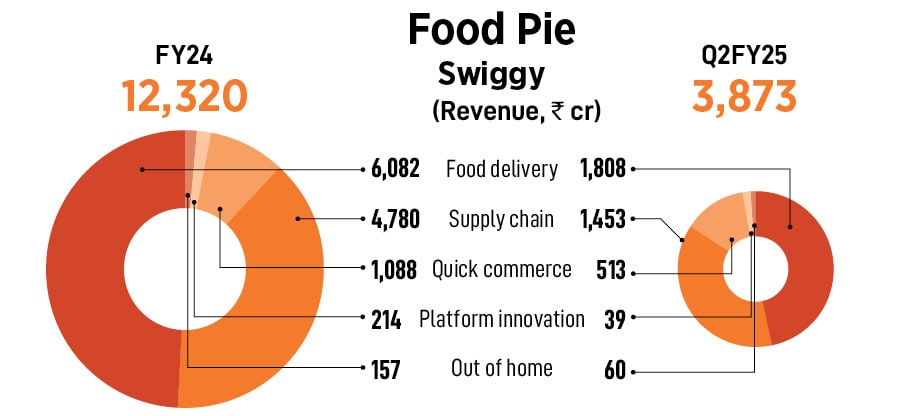

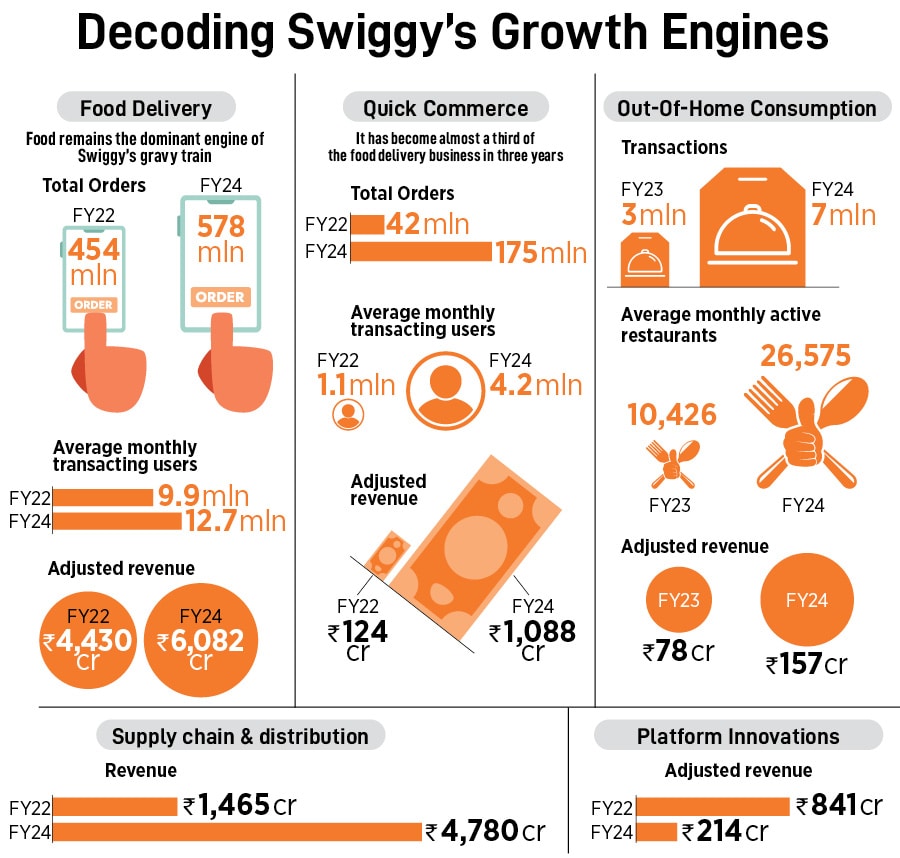

The battle was won, but the war needed to be sealed. As the quick commerce gambit gathered steam—total orders on Instamart swelled from 42 million in FY22 to 175 million in FY24; average monthly transacting users leaped from 1.1 million to 4.2 million during the same period; and gross order value bloated from ₹1,643 crore to ₹8,069 crore—Swiggy needed to find another growth engine.

In October 2024, it rolled out its quick commerce version in food delivery: Bolt. Food delivery in 10 minutes, Bolt was launched across six metro cities—Bengaluru, Chennai, Hyderabad, New Delhi, Mumbai and Pune—and within months, it scaled rapidly to over 400 cities, including Tier II and III towns. “Bolt is a big bet for us,” says Kapoor, claiming that, within two months of launch, it accounted for 7 to 8 percent of all Swiggy food delivery orders. Apart from Bolt, Swiggy rolled out Café (delivering branded and non-branded snacks and beverages in 15 minutes) and Daily (homestyle meal delivery service) last year. Last October, the company also partnered with PharmEasy to deliver medicines in 10 minutes across Bengaluru.

Majety underlines that there is no stopping more experiments and innovations. Even during the pandemic, when the company had six to nine months of runway, we continued to build on stores, he says. “We were scrambling to stay alive but a small percentage of our team was busy unlocking the future,” he contends. “We found the PMF (product-market fit) for Instamart during that period,” he claims.

Backers are elated with Swiggy’s growth trajectory. “When we first met Swiggy’s founders and team, we realised they were forward-thinking business leaders,” recalls Niren Shah, one of the early investors in the startup. Even before Swiggy’s Series A was completed, Norwest approached the foodtech startup in 2015 and led a Series B round with a $7.5 million investment at a pre-money valuation of $35 million. “In the run-up to the deal, we had a fascinating glimpse into lateral thinking, a hallmark of the Swiggy team,” recounts Shah, managing director and head of Norwest India. As part of the diligence on Norwest, Swiggy asked for reference checks with founders of three Norwest portfolio companies that had struggled. “In all my years as an investor, I have never received another reference request like that,” says Shah, who lauds the long-term vision and humility of Majety. “He is different and he is special.”

Ashutosh Sharma, another early backer, tells us why he remained unperturbed despite losses—in ₹2,256 crore in FY24—accumulated by Swiggy. He talks about two pieces of cash burn theory propounded by Majety. The first is gaining mindless share of a business by discounting heavily and hoping that on the other side one would get a higher share of gross merchandise value or orders. “This is market share burn,” reckons the head of growth investments (India and Asia) at Prosus.

The other is mindshare burn. Sharma explains. If one is spending money to expose as many people as possible to one’s service, this kind of burn is okay. When the competition was intense, more cities were being added, more restaurants were enrolled, and new customers were wooed. “It was a responsible burn,” he says, adding that such a burn would peter out in the long run and result in customer acquisition and stickiness. Commenting on the next big opportunity for Swiggy, Sharma is bullish on food delivery and quick commerce. “It’s still Day One for food delivery and Day Zero for quick commerce,” he reckons.

Mukul Arora is bullish on Swiggy despite intensifying competition in quick commerce. The co-managing partner of Elevation Capital explains his exuberance. During the early days of food delivery, Swiggy was stacked against rivals who were loaded with venture capital. “Tiny Owl was 20 times bigger and Foodpanda was 50 times bigger than Swiggy,” he says, adding that Majety was never bogged down by competition or rivals. There was a period when Uber Eats and Ola were hyper aggressive in their food delivery gambit. “Still Harsha had Zen-like calmness,” he says. Swiggy has made it clear that at the consolidated group level, it is likely to achieve positive adjusted Ebitda by the third quarter of FY26. “The company is obsessed with consumers rather than rivals,” underlines Arora.

Also read: Zepto: The unicorn in the grey (funding) winter sky

Majety remains unfazed about the rising intensity in quick commerce. While Zepto has emerged as the most aggressive, Zomato-owned Blinkit has consolidated its pole position. Last year, Zomato’s co-founder and CEO Deepinder Goyal reportedly said that Blinkit has a realistic chance of becoming bigger than Zomato’s food delivery business. The quick commerce space is heating up as more join the queue: Amazon India, Big Basket, Flipkart and JioMart.

Can Majety, who had the first-mover advantage in food delivery and quick commerce, reclaim the crown from Zomato? “We have great competition, and we keep looking at them for inspiration,” he says, adding that Swiggy differs from others when it comes to tackling competition. “We don’t wake up and think of competition as something that needs to be beaten,” he adds. Quick commerce, he underlines, is working in India because the offline version of quick commerce doesn’t exist. Contrary to perception, quick commerce is not fighting kiranas. “Look at their selection. Kirana is built for broad-based India. It’s built around entry-level products,” he reckons. Instamart, in contrast, is building for premium millennials and the upper class. “What we are building is like what Tesco would have built if it were in India,” he says, adding that from food delivery, Instamart, Bolt and out-of-home consumption vertical, Swiggy is firing on all cylinders.

Majety outlined the vision of Swiggy 2.0 in his letter to shareholders in December 2024. “We’re not just delivering food anymore. We’re building an ecosystem,” he outlined, pointing out how Swiggy has diversified over the decade: From food to groceries, to pick-up and drop services, delivering toys, stationery, and pet supplies. “You name it, Swiggy delivers it.” The goal is to weave Swiggy into the fabric of Indian life. “We are becoming as indispensable as chai (tea) and cricket,” he added.

Post IPO, can Swiggy brew a blockbuster innings and hit the ball out of the park? The jury is still out for delivery, and the results won’t be visible in 10 minutes.