The economic scenario does not seem encouraging. A slower economy would weigh on taxes, leaving little space for a spending boost—thereby reinforcing the slowdown

The economic scenario does not seem encouraging. A slower economy would weigh on taxes, leaving little space for a spending boost—thereby reinforcing the slowdown

Illustration: Chaitanya Dinesh Surpur

It is likely to be all about setting the right priorities in the first full-year Budget of the coalition government since it assumed power for a third consecutive term in 2024. Striking a balance between growth and fiscal prudence is anticipated to be a steep task this time, considering India is already battling a series of risks threatening to derail economic momentum.

Weak domestic demand, domestic currency depreciation, lower government spendings, tepid private investments and threats of higher tariffs under new US President Donald Trump are some of the major risks that the government needs to address in the upcoming Budget on February 1, through policy intervention, tax reforms and social welfare schemes.

However, the question remains. Do we have enough room to accommodate expansionary Budget?

Perhaps not. The key questions facing fiscal policymakers in the upcoming union budget are likely to be around the speed of fiscal consolidation and the spending priorities of the government,” says Santanu Sengupta, chief India economist, Goldman Sachs.

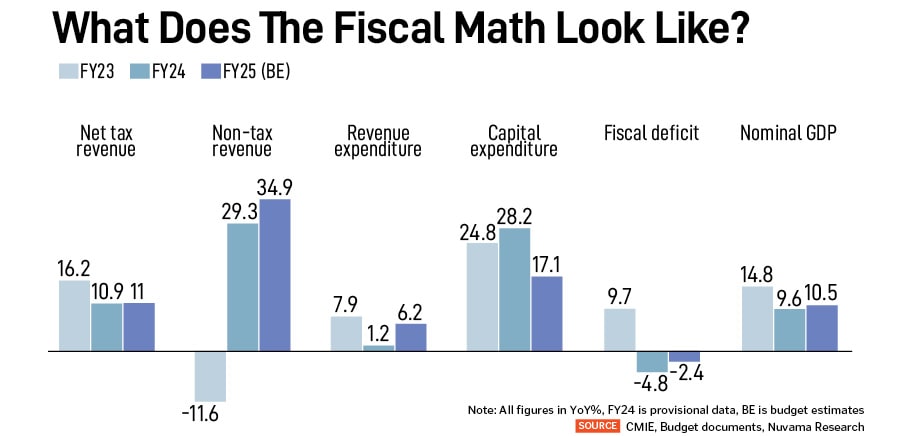

The economic scenario does not seem encouraging. A slower economy would weigh on taxes, leaving little space for a spending boost—thereby reinforcing the slowdown, says Kapil Gupta, economist, Nuvama Institutional Equities. He feels the best may now be behind, without a big disinvestment push, any sops to household (transfers or tax cuts) may impinge on public capex.

“With fiscal hands tied, the Reserve Bank of India (RBI) must do the heavy lifting to support growth. Yet, a decisive monetary push may have to wait for US dollar/US Treasury drain to subside. For markets, fiscal prudence is welcome, but slower capex could be a dampener. Hence, for 2025, value lies in quality,” Gupta explains.

The Indian economy has seen a sharp slowdown over the last two quarters with real gross domestic product (GDP) growth dropping to 6 percent year-on-year (YoY) in first half of FY25 from 8.2 percent YoY in FY24.

The Indian economy has seen a sharp slowdown over the last two quarters with real gross domestic product (GDP) growth dropping to 6 percent year-on-year (YoY) in first half of FY25 from 8.2 percent YoY in FY24.

Globally, uncertainties are mounting with trade tension, US dollar strengthening (domestic rupee weakening) and higher US Treasury yields. “While the current global liquidity squeeze resembles the ones in 2018 and 2022, India’s domestic context is closer to 2018’s. Liquidity is in deficit amid sluggish growth,” warns Gupta.

Despite a benign current account deficit and core inflation, high real rates and fiscal prudence, India’s balance of payment is strained. At this juncture the upcoming Budget will need to balance stimulating domestic demand with fiscal discipline amid rising global uncertainties. The focus areas of the government in the Budget should prioritise capex revival, consumption boost and job creation.

Radhika Rao, senior economist, DBS Group Research, expects budget measures to prioritise demand support, employment generation, ironing out capex capacity hurdles and support localisation of production.

“We expect the central government to prioritise macro stability by sticking with the fiscal consolidation path, and steer clear of populist measures,” she explains. This will help keep additional spending and incremental inflationary impact in check.

As the budget is also set against the backdrop of slower domestic consumption and activity, emphasis will be on employment and skilling with need to boost incomes, support labour intensive sectors, draw in private sector players, and defend against a tougher geopolitical environment, she adds.

Overall, economists at Nomura expect the Budget to adopt a balanced approach to boosting growth while retaining fiscal prudence. This should keep India’s fiscal risk premia low and provide greater leeway to the RBI to begin lowering its policy rate at the February MPC. “However, if markets expect the budget to choose growth over prudence, then there is a risk of disappointment,” they add.

Also read: Budget 2025: Focus on growth and fiscal consolidation

Capex Spending

As 2024 was marked by general elections in seven phases from April to June, followed by few key state elections, the government’s capex disbursements were delayed. Though the pace of spending picked up, thereafter, it is still 12 percent YoY below the corresponding period last year. “Spending is required,” stresses Rao.

This slower run-rate has increased the likelihood that the budgeted quantum will be underspent, lowering the potential growth multiplier. Rao sees a reduction of Rs1.6 trillion in capex disbursements to Rs9.5 trillion which is about 15 percent lower than the budgeted Rs11.1 trillion.

However, Aastha Gudwani, India chief economist, Barclays, differs in her views. She thinks the government has enough space to accelerate expenditure in select sectors, while maintaining the balance between its consolidation goals and a counter-cyclical policy approach to support growth.

However, Aastha Gudwani, India chief economist, Barclays, differs in her views. She thinks the government has enough space to accelerate expenditure in select sectors, while maintaining the balance between its consolidation goals and a counter-cyclical policy approach to support growth.

Gudwani feels there will be an extension of schemes announced last year, including incentives aimed at manufacturing and the formalisation of employment. There may be ‘big bang’ reforms are likely, as only half a year has passed from the last Budget. She expects capex to grow 15 percent, following budgeted growth of 17.1 percent in FY24-25 (over FY23-24 actual) and 30 percent YoY average in the four years prior.

“However, as actual capex in FY24-25 is likely to materially undershoot, at Rs9.6 trillion, FY25-26 could see the government budget higher capex at Rs11.1 trillion (similar in level terms to the budgeted estimates of FY24-25,” Gudwani elaborates. Within capex, she sees allocation for capex-only loans to states will reduce with the absorptive capacity of state governments lagging.

Meanwhile, economists at Nomura feel that late start (final budget for FY25 was in July due to election) has resulted in a departmental struggle to meet spending targets, especially on capex , where they expect a fiscal savings of 0.5 percent of GDP.

“This will, however, be counterbalanced by weaker-than-expected corporate tax collection and indirect tax collections, particularly for GST and excise duties. Lower disinvestment proceeds and a downward revision to nominal GDP growth will also offset the fiscal savings due to lower capex,” say Sonal Varma and Aurodeep Nandi, economists, Nomura.

With private capex still weak, Varma and Nandi expect the public capex budget to increase by 12.5 percent YoY in FY26. Additionally, the government could relax the conditions attached to loans given to states, to enable them to spend more.

Revenue Expenditure

Dasgupta sees continued emphasis on job creation through labour-intensive manufacturing, credit for MSMEs, promoting rural housing programs, and sustained focus on domestic food supply chain and inventory management to control price volatility. The budget is also likely to lay out a roadmap for public debt sustainability, and financing India’s energy security versus transition needs.

“For FY25, we expect a 0.2 percent of GDP upside in receipts mainly driven by higher income tax collections and non-tax revenues from higher than budgeted dividends from the RBI and state-owned companies, which should offset the shortfall from corporate taxes and excise collections (owing to lower receipts from windfall tax),” he says.

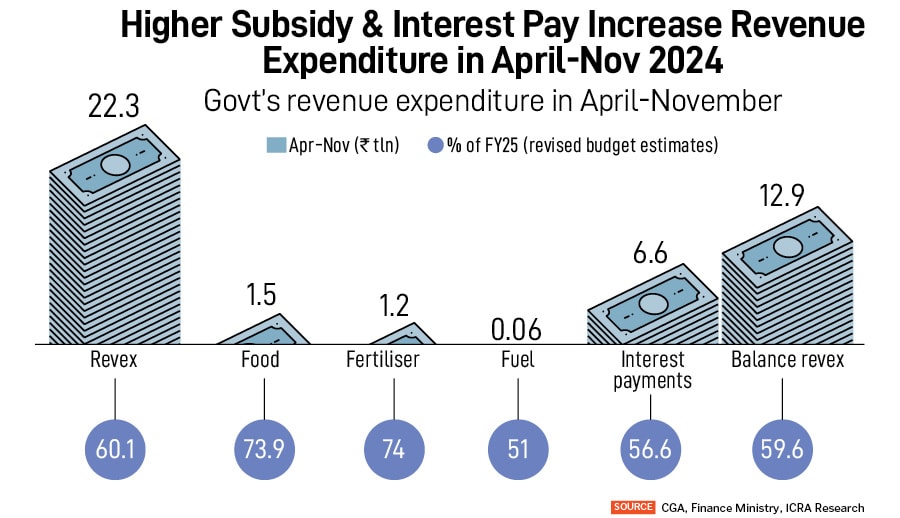

On the expenditure side, ICRA Ratings, however, estimates the total spending to trail the FY2025 budgeted estimates of Rs48.2 trillion, with a lower-than-budgeted capital expenditure partially offsetting the projected overshooting in revenue expenditure.

On the expenditure side, ICRA Ratings, however, estimates the total spending to trail the FY2025 budgeted estimates of Rs48.2 trillion, with a lower-than-budgeted capital expenditure partially offsetting the projected overshooting in revenue expenditure.

The rating agency forecasts revenue expenditure at Rs39.5-39.7 trillion in FY2026, a growth of 5.5-6 percent. “This builds in a 9 percent increase in the interest payments, and a modest 3 percent rise in aggregate subsidy outlay, amid a limited 4.5-5 percent growth in balance revex [revenue expenditure],” says economists at ICRA Ratings.

There may be a fresh allocation of Rs300-350 billion towards the Employment Linked Incentive, launched in the July 2024 Budget. Besides, the allocation for the PLI scheme can be raised in FY2026, with the likely extension of the scheme to other labour-intensive sectors to boost domestic manufacturing, the rating agency adds.

The government’s revenue expenditure rose by 7.8 percent YoY to Rs22.3 trillion in April-November from Rs20.7 trillion in same period last fiscal, led by an increase in the total outgo for major subsidies and interest payments. The YoY expansion in major subsidies to Rs2.8 trillion in April-November from Rs2.4 trillion in same period last fiscal was driven by a higher outgo for fuel and food, while that for fertilisers contracted during this period.

Additionally, the interest outgo rose by 8.3 percent to Rs6.6 trillion in April-November from Rs6.1 trillion in corresponding period last fiscal.

Meanwhile, the total receipts from disinvestment stood at just Rs86.3 billion as on January 15, 2025, shows data provided by the DIPAM. This included sales of the government stake in General Insurance Corporation of India, Cochin Shipyard and Hindustan Zinc through the offer for sale (OFS) route, as well as remittances from the Specified Undertaking of the Unit Trust of India (SUUTI).

According to Rao, revenue expenditure is expected to increase by a modest 5 percent yoy to Rs38.7 trillion, reflecting higher subsidy allocations and an increase in the support for the PLI scheme, likely accompanied by a wider scope to support more labour-intensive industries.

Lastly, to boost consumption it is widely expected that the government may introduce tax relief tops. Four key priority groups, Gareeb (poor), Yuva (youth, Annadata (farmers) and Naari (women) – referred to as GYAN segments, are likely to be in the forefront of social assistance and development programmes.

Towards its vision of Viksit Bharat (developed nation status by 2047), the government is likely to stay focused on achieving multiple objectives outlined in last year’s budget, including productivity and resilience in agriculture, human resource development and social justice, manufacturing and services, and urban development, besides others.