A literature review has highlighted critical gaps in governance structures, transparency, and sustainability initiatives, revealing a pressing need for Indian companies to elevate their ESG performance. Challenges such as regulatory hurdles, limited awareness, and resource constraints further complicate this landscape, hindering progress toward sustainable practices.

However, the path forward is illuminated by the best practices of global leaders who have successfully integrated ESG into their core strategies. By establishing dedicated ESG committees, setting measurable milestones, and aligning with international reporting standards, Indian pharmaceutical companies can enhance their attractiveness to global partnerships and contribute positively to society and the environment. As we explore the current state of ESG in Indian pharmaceuticals, it becomes clear that the time for action is now.

The combined performance of Indian pharmaceutical companies in ESG metrics and rankings significantly lags global peers despite their substantial presence in the global market. The performance of the Indian companies is largely driven by their unwillingness to commit to ESG, which, in turn, results from their lack of vision to project the future value of ESG investments. Indian companies remain conservative in their approach to ESG initiatives and largely do so only when required to comply with the law.

For instance, most Indian pharma companies have seen limited progress or failed to meet their targets in reducing emissions and energy consumption. In contrast, a Japanese subsidiary of a global pharma company that ranks as the best in ESG performance globally achieved a 55 percent reduction in Scope 1 and 2 CO2 emissions from its 2019 baseline, far surpassing its targets, while increasing reliance on renewable energy to over 97 percent. The company has also set an ambitious goal to achieve zero carbon emissions by 2050 in an era when companies are targeting net carbon neutrality.

In terms of social goals, leading global companies show consistent improvement in gender diversity, have steadily increased female representation in leadership, and are on track to achieve gender parity by 2025. In contrast, most of the Indian firms are yet to integrate diversity and inclusivity into broader policies.

The ESG policies and strategies of Indian pharmaceutical companies lack ambitious long-term goals and commitment to act and largely fail to align with global sustainability reporting frameworks like GRI, TCFD, SASB, etc. As an initiative that is essentially and almost always driven from the top, creating the right governance structure is the utmost priority, driving regulatory and reporting compliance.

It is not all gloomy, though, as we see some Indian pharma companies ranking highly globally for their ESG efforts; a large majority of Indian companies unimaginably lag behind their global peers. Achieving these goals and bringing Indian pharma companies to par with global companies is not without hurdles. Significant and multifaceted challenges exist, ranging from regulatory complexities to infrastructure limitations. Understanding these challenges will help the industry close the ESG gap and remain competitive globally.

Challenges Faced by Indian Pharma Companies

The challenges the Indian pharmaceutical industry faces in implementing and executing effective ESG strategies are unique to India. Despite growing ESG awareness, several factors hinder progress, setting India apart from its global peers.

- Regulatory challenges: Implementing Indian environmental laws and corporate governance regulations remain inconsistent. Unlike global frameworks such as the TCFD, Indian regulations are less comprehensive, and enforcement is weaker. This makes it difficult for companies to align with international ESG standards fully. Also, the lack of sector-specific ESG guidelines often leaves Indian pharma companies struggling for solutions.

- Lack of Awareness: The lack of awareness and knowledge of ESG issues is another major concern. For many Indian companies, ESG is still seen as a compliance requirement rather than a growth driver, leading to underinvestment in sustainability initiatives.

- Economic constraints: Many Indian pharmaceutical companies, especially SMEs, operate on low margins and lack financial and technical resources to invest in ESG initiatives. The high cost of renewable energy, procurement of sustainably produced raw materials, improving waste management systems, and implementing advanced water conservation measures present a significant hurdle. For example, dependency on traditional API synthesis generates large amounts of waste and consumes high energy. Transitioning to green chemistry involves replacing harmful solvents and chemicals with greener alternatives that are costly to procure and produce.

- Availability of skilled ESG professionals: The country’s lack of skilled ESG professionals poses a significant challenge in initiating, implementing and concluding ESG Initiatives.

- Infrastructural challenges: Infra challenges, like limited access to sustainable energy sources and waste management facilities, make it difficult for Indian pharma companies to achieve their ESG goals.

Learning from Global leaders

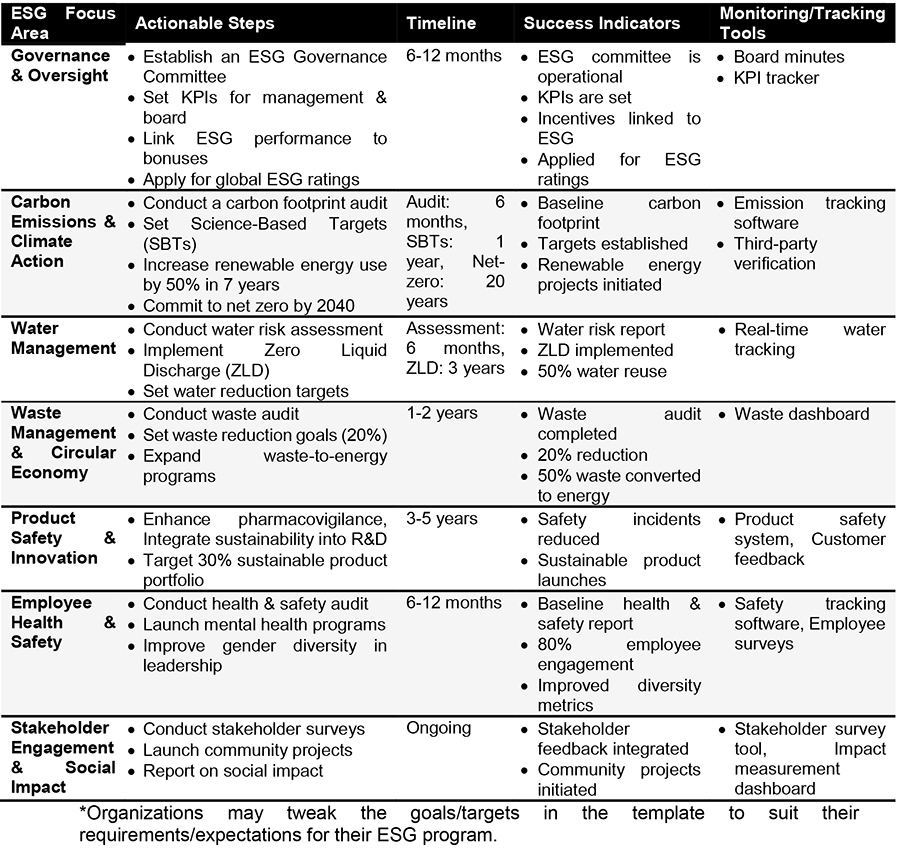

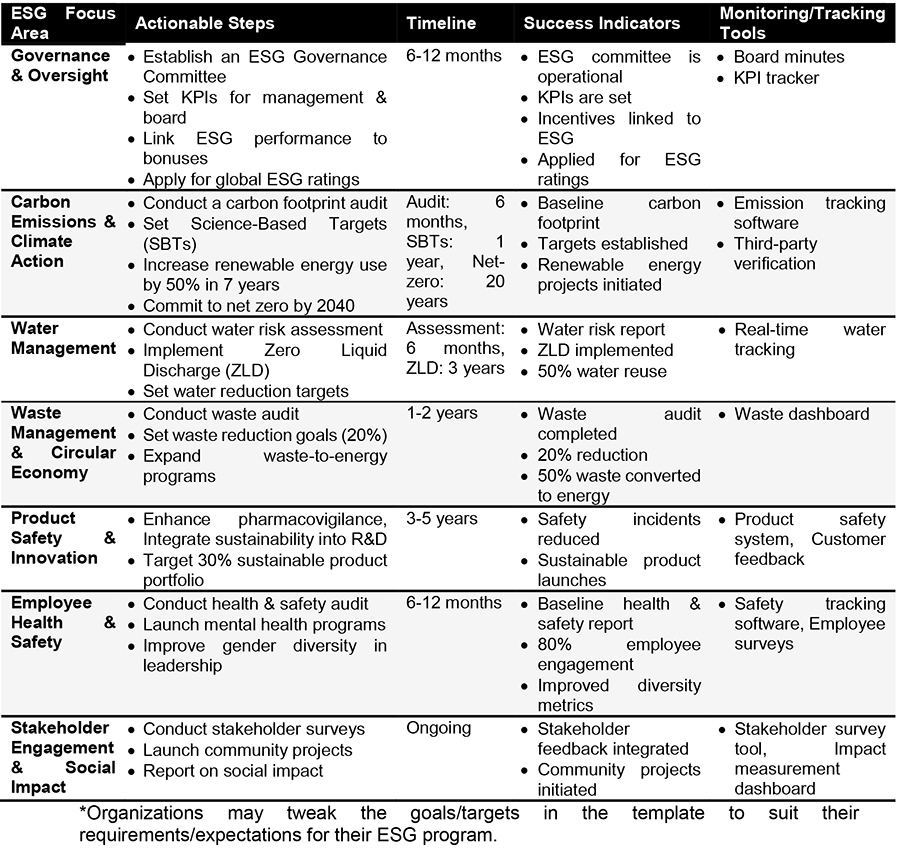

The global best practices illuminate the path Indian companies should follow to start with or achieve greater heights with their ESG initiatives. Using these learnings and extensive research about unique challenges Indian companies face, the authors have developed actionable recommendations for companies who wish to take their ESG initiatives to new heights. These actionable recommendations will empower Indian companies to increase their participation in ESG ratings by implementing a robust ESG framework.

Also read: Novartis: Innovating for the world, from India

Actionable Recommendations Checklist

The Path Forward

Beyond the actionable recommendations provided above for organisations, there is a need for the Indian pharmaceutical industry to get together, align its goals, and aim to improve India’s standing on the global ESG stage. Indian pharmaceutical industry needs to collaborate with stakeholders like government, academia, and investors to foster a culture of sustainability. Creating platforms for dialogue and sector-specific ESG councils can align goals and drive focused efforts towards sustainability. The industry should also leverage partnerships with research institutions and technology firms to pioneer innovative, sustainable practices.

ESG as an initiative is driven from the top. Hence, leaders need to understand the importance of ESG not just as a legal obligation but also as a strategic opportunity for growth and innovation. Globally, ESG-focused businesses tend to do better than their counterparts who do not invest in ESG. According to data from MSCI (2021), high ESG-rated companies, compared to low ESG-rated companies, tend to have higher profitability and dividend payment and lower experience of idiosyncratic risk incidents and systematic risk exposure.

Even with all the unique challenges, the Indian pharmaceutical industry is a global leader in generic drugs with its lion’s share of 20% in the global supply volume and contribution of ~60% to the global vaccines volume, aptly named the world’s pharmacy. A handful of the Indian players have been able to carve their niche in the global ESG rankings by achieving a score higher than even the better-performing global companies and setting up practices that match or even exceed the global gold standards. For example, the largest manufacturing facility of a major Indian pharma company joined the Global Lighthouse Network of the World Economic Forum, which recognises manufacturers driving productivity, sustainability, and supply chain resilience through Industry 4.0. However, apart from these few stand-out companies and initiatives, the situation remains worrisome for the Indian pharmaceutical industry, with most companies failing to comply with the regulations or the global best practices.

The significance of elevating ESG standards in Indian pharmaceuticals cannot be overstated. The sector’s environmental, social, and governance practices impact the industry’s future, the broader society, and the planet. The Indian pharmaceutical industry must embrace ESG as a strategic imperative to remain competitive. Clear governance structures, ambitious goals, and transparent reporting aligned with global standards are essential. By doing so, companies can attract global investments, build trust, and contribute to a sustainable future.

Acknowledgement: This article is based on research conducted by Indian School of Business (ISB) students as part of the Action Learning Project of the Emerging Leaders Programme at ISB’s Executive Education.

About authors

Anjal Prakash is a clinical associate professor (research) and research director at Bharti Institute of Public Policy, Indian School of Business (ISB). He teaches sustainability at ISB.

Arun Prakash leads the marketing team at Silverskills and holds an MBA from the Faculty of Management Studies, BHU.

Anup Marathe is a Sr. Engineer at EXYTE and holds a Master’s Degree in Civil Engineering from the University of Texas, El Paso, USA.

Deeksha Agarwal is an Asst. Manager – Analytics at Cognitio Analytics and holds a Master’s Degree in Mathematics from Delhi University, India

G.A.N. Prasad Rao is a VP-Operations (Underwriting) at SBI Life Insurance CO. Ltd. and holds Masters Degree in Public Personnel Management and Fellowship, Life Office Management Association, USA

Saad Ahmed is a Sr. Manager – at a Leading Pharma Company and holds a Master’s in Management Studies from Mumbai University, India.

Shravani Patro works for a multinational banking and financial organisation in Technology and holds a Bachelor’s Degree in Electronics & Communications Engineering from JNTUK University, India.

[This article has been reproduced with permission from the Indian School of Business, India]

Despite the Indian pharmaceutical industry’s notable achievements on the global stage, it lags behind its international counterparts in adopting robust ESG practices.

Despite the Indian pharmaceutical industry’s notable achievements on the global stage, it lags behind its international counterparts in adopting robust ESG practices.