The positives of the FY26 Union Budget and negatives of the Q3FY25 earnings season may be drowned out in the fallout of the US imposing high tariffs on three major exporters to the US

The positives of the FY26 Union Budget and negatives of the Q3FY25 earnings season may be drowned out in the fallout of the US imposing high tariffs on three major exporters to the US

Illustration: Chaitanya Dinesh Surpur

Markets, already spooked by fears of a tariff war and geo-political tensions, have been jolted further by the new tariffs imposed by US President Donald Trump, effective from February 4. Consequently, investors are dumping Indian stocks and flocking to assets like bonds, with the Union Budget for FY26 doing little to get them out of this bearish mode and buy Indian stocks.

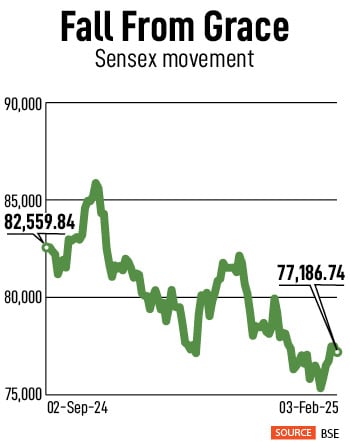

Once touted as the best markets for maximum returns, Indian equities seem to be losing their sheen over the past few months. The Sensex has lost over 10 percent from its life-high of 85,978.25, which it touched on September 27, 2024. The same is true for Nifty. Another 10 percent decline in these benchmark indices will indicate a bear market.

What are the factors that have turned market sentiments so drastically? Well, plenty.

Rich valuations with no real meaningful earnings make equities less attractive. In addition to that are global issues, even as India itself is struggling with economic and consumption slowdown, which the Budget allocations are likely to address but which may not be just enough.

“The positives of the FY26 Union Budget and negatives of the Q3FY25 earnings season may be drowned out in the fallout of the US imposing high tariffs on three major exporters to the US,” says Sanjeev Prasad, managing director and co-head, Kotak Institutional Equities. He is also not ruling out global risk-off sentiment due to a sharp increase in uncertainty in the global economic outlook.

The US government imposed a 25-percent import tariff on goods from Canada (10 percent on oil and related items) and Mexico, and an additional 10 percent import tariff on goods from China. However, tariff hikes on Canada and Mexico have been postponed by one month, as of now.

“The size of these proposed tariffs dwarfs the tariffs Trump imposed in his first term as President. Higher tariffs are likely to push up core inflation meaningfully, which reinforces our Fed call of no rate cuts this year,” say analysts at Nomura.

The increase in tariffs on China alone makes this the biggest single-tariff increase Trump has enacted in either of his presidential terms. During his first term, the effective average tariff rate moved up to 2.8 percent in 2020 from 1.5 percent in 2016; it has since fallen to 2.3 percent.

There is also a growing fear that Trump may impose similar tariff hikes on European countries soon. Tariffs are likely to lead to global macroeconomic uncertainty, higher interest rates and slower growth, leading to worse long-term fiscal dynamics world-wide.

Prasad warns that US import tariffs may hurt global GDP growth and increase investment risks. “Markets will worry about extension of such import duties to other countries, retaliation by other countries and potential earnings downgrades due to lower global growth and investment,” he says.

Budget implications: Too little?

Minister of Finance Nirmala Sitharaman announced a lower-than-expected fiscal deficit target of 4.4 percent of GDP for FY25-FY26. Contrary to the past four years, there has been a tilt towards supporting consumption through tax cuts for households and slower growth in capex. The Budget proposes to boost consumption by cutting the effective income tax rate.

While the government has committed to spend Rs 11.2 lakh crore as capital expenditure (capex) in FY26, it implies a 10 percent jump from revised estimates of FY25. The government plans to spend 3.1 percent of GDP on capex in FY26, similar to the outlay in FY25. The lower-than-anticipated capex target for FY26 is being viewed negatively by a few market experts.

While the government has committed to spend Rs 11.2 lakh crore as capital expenditure (capex) in FY26, it implies a 10 percent jump from revised estimates of FY25. The government plans to spend 3.1 percent of GDP on capex in FY26, similar to the outlay in FY25. The lower-than-anticipated capex target for FY26 is being viewed negatively by a few market experts.

However, Gautam Duggad, head of research, Institutional Equities, Motilal Oswal Financial Services feels that although there has been a large downward revision in capex in FY25, the adverse economic impact will be limited because a majority of the revision is due to lower spending under the ‘New Scheme’, which was never defined. This year also the government has allocated Rs 417 billion for ‘New Schemes’ under the Department of Economic Affairs.

The government has also announced a shift to target the debt-to-GDP ratio from next year, rather than the fiscal deficit. “Assuming 10.5 percent growth over the next five years [FY27- FY31], the fiscal deficit will have to consolidate by 0.2 percentage points of GDP every year to achieve a debt-to-GDP ratio of 49.7 percent. It means that if nominal GDP growth is weaker, more consolidation will be required to meet debt targets,” Duggad explains.

While a capex orientation is a good long-term approach, Duggad appreciates that the government has demonstrated flexibility and pragmatism to adjust the stance tactically in favour of lifting sagging consumption sentiment without resorting to populism. He also feels that government fiscal consolidation target should benefit the bond market, strengthen India’s case with sovereign rating agencies, and open up room for monetary accommodation, allowing the Reserve Bank of India (RBI) to embark on a rate cut trajectory from February onwards.

Others concur. “The simultaneous boost to consumption and capex has to be sweet for equities, especially in the context of continuing and better-than-anticipated fiscal consolidation,” say analysts at Morgan Stanley. They believe that the plethora of announcements around easing of India’s tax regime, including permanent establishment rules, GIFT city clarifications, extension of exemptions to sovereign funds, and changes to tax deduction and collection at source could improve foreign direct investment (FDI) and private investment sentiment.

However, Prasad explains that the market may have overestimated the positives from the FY26 Budget. It will certainly put more disposable income (Rs 1 trillion) in the hands of taxpayers. However, according to him, this amount needs to be viewed in the context of a few factors. He points out that there is negative impulse to the economy from lower year-on-year gross fiscal deficit (GFD)/ gross domestic product (GDP) of 40 basis points, while there is limited impact on the consumption pattern of high-income households beyond certain discretionary spendings. At the same time, there is no impact on low-income households, as the bulk of households in India are below the income-tax exemption limit. Most importantly, there is a muted growth in central government capex allocation.

Frothy valuations & earnings miss

Saion Mukherjee, head of equity research, Nomura thinks the Budget is marginally positive and not negative for the markets, and adds that markets’ movement is determined more by corporate earnings and global factors.

Mukherjee explains that there are pockets of richly valued stocks in markets as some of them have missed their earnings estimates in December quarter of FY25. A Nomura assessment found that out of 76 companies in BSE200 for which consensus estimates were available, 60 percent had missed their estimates. However, consolidated earnings were 2 percent higher than estimates driven by specific cases of contribution from large companies. Since the start of 2025, consensus earnings for BSE200 is lower by 1-1.5 percent for FY26-27.

“We expect the market to trade at 17-20 times one-year forward earnings. Factoring in 5 percent risk to consensus earnings estimates, we had set Nifty 50 year-end target range of 21,800-25,700,” Mukherjee says. Currently, it is trading at 19.1 times one-year forward consensus earnings.

FY25 earnings estimates are broadly unchanged, but FY26 and FY27 earnings have seen a 1 percent cut each in the past month. Kotak Institutional Equities expect net profits of the Nifty companies to grow 4 percent in FY25 and 16 percent in FY26.

FY25 earnings estimates are broadly unchanged, but FY26 and FY27 earnings have seen a 1 percent cut each in the past month. Kotak Institutional Equities expect net profits of the Nifty companies to grow 4 percent in FY25 and 16 percent in FY26.

Prasad finds current valuations across most consumption and investment stocks to be quite “rich” compared to their history. The elevated global uncertainty in the aftermath of US import tariffs on Canada, China and Mexico may also delay the expected recovery in global IT spending and thereby weigh on present high valuations of the sector, he adds. “Only the banking sector appears to be reasonably valued in the current context. Meanwhile, narrative stocks remain frothy, despite the recent sharp correction, especially in the context of a large reset in the capex narrative.”

Also read: FM’s balancing act: Consumption boost and fiscal prudence

Rupee & exodus of FII money

The tariff war triggered by Trump weakened the Indian currency further as the dollar gained strength. The Indian rupee hit its life’s lowest at 87 against a dollar on February 3 on uncertain global environment.

China announced a package of tariffs on a range of US products in an immediate response to a 10 percent tariff on Chinese imports announced by the US, Reuters reported. China exports goods worth around $400 billion to the US, while Canada and Mexico export around $840 billion of goods. At the same time, the US exports close to $630 billion from these countries.

China announced a package of tariffs on a range of US products in an immediate response to a 10 percent tariff on Chinese imports announced by the US, Reuters reported. China exports goods worth around $400 billion to the US, while Canada and Mexico export around $840 billion of goods. At the same time, the US exports close to $630 billion from these countries.

“The trade war can get nasty. The yuan has weakened as the dollar has strengthened and the rupee is witnessing collateral effects,” says Madan Sabnavis, chief economist, Bank of Baroda. He explains that his earlier analysis had shown that a rate of 87 per dollar appeared fair when only the global factor is considered and adjusted for relative inflation. “There is already some panic as importers are rushing to book dollars, thus increasing demand. Will the RBI be selling dollars now or will it let the market decide? The buy-sell swap had a good response, which drew out dollars from the system last week and induced liquidity. Therefore, the puzzle is to manage rupee movements with liquidity because if dollars are sold, it will draw out liquidity,” he adds.

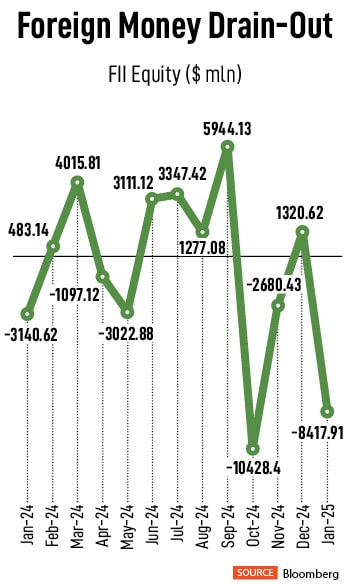

The weak rupee and weak global economic conditions already had an impact on the drain out of foreign institutional investors’ (FIIs) money from Indian stocks. In January itself, FIIs sold Indian equities worth $8.42 billion; in October, they were net sellers of Indian stocks worth $10.43 billion.

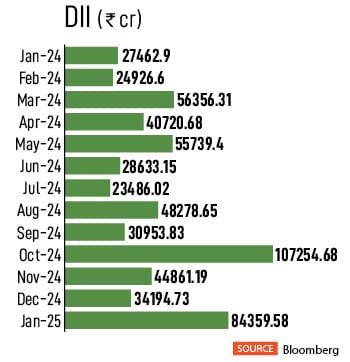

However, domestic institutional investors (DIIs), including mutual funds, insurance companies and banks have been buying equities; in January, DIIs pumped in Rs 84,359.58 crore in Indian stocks.

Taxation on capital markets

The capital markets performance is critical for the government’s tax collection for FY26. The government has assumed gross tax revenue growth of 10.8 percent year-on-year (y-o-y) and nominal GDP growth of 10.1 percent y-o-y. For FY26, the government has pegged corporate tax growth at 10.4 percent y-o-y and GST growth at 10.9 percent y-o-y and personal income tax collections growth estimates at 14.4 percent y-o-y.

The government, however, estimates revenue from securities transaction tax (STT) at Rs 78,000 crore in FY26, around 30 percent higher from the revised estimates in current financial year FY25 at Rs 55,000 crore. This compares to Rs 37,000 crore in budgeted estimates of FY25. In FY24, the government earned Rs 33,777.78 crore as STT.

In the interim budget last July, the government had increased STT on futures and options (F&O) to 0.02 percent and 0.1 percent respectively, effective from October. STT is a direct tax levied on all transactions on securities like stocks, mutual funds and derivatives on stock exchanges in India.

“Growth in income taxes is factored in at 14.4 percent, with large gains expected in collections of STT. While this would be the slowest annual growth rate since the pandemic period, it underscores a buoyant expectation given considerable revenue foregone of Rs 1 trillion due to change in direct tax code and susceptibility of STT collections to market conditions and changing F&O norms,” says analysts at SBI Capital Markets.

Meanwhile, the government’s divestment target is estimated at Rs 47,000 crore in FY26, while for the current year it is revised to Rs 33,000 crore from Rs 50,000 crore.