Beyond the focus on the India-US trade balance, the bilateral meeting reinforced the importance of the two countries’ strategic partnership in areas like defence and technology, analysts feel.

Beyond the focus on the India-US trade balance, the bilateral meeting reinforced the importance of the two countries’ strategic partnership in areas like defence and technology, analysts feel.

Image: Kevin Lamarque / Reuters

“Whatever India charges, we charge them,” US President Donald Trump said while standing next to Prime Minister Narendra Modi during a joint press conference on February 13. “So, frankly, it no longer matters to us that much what they charge. We are being reciprocal with India.”

This briefly sums up the reciprocal tariff proposed by Trump, which has taken the wind out of markets worldwide, with investors rushing for a protective cover.

Fears of reciprocal tariff by the US triggering a global tariff war, disrupting trade and supply chains have already spooked countries across continents, while equities and currencies are rattled. For months, markets in India have been grappling with a steady exodus of foreign money, while uncertainties around unstable global economy and business impact have made matters worse.

“The direct impact of reciprocal tariff hikes will likely be manageable; however, the indirect impact through uncertainty weighing on business confidence is more worrisome,” says Upasana Chachra, chief India economist, Morgan Stanley.

By definition, reciprocal tariffs mean imposing the same tariff rate on imports from other countries as other countries impose on US exports. For instance, if India imposes a 25 percent tariff on US autos, then the US would impose a similar 25 percent tariff on imports of autos from India. “Trump’s objective of implementing reciprocal tariffs is to ensure fair treatment for US exports, which could indirectly also address US trade imbalances with partner countries,” says Sonal Varma, MD and chief economist, Nomura.

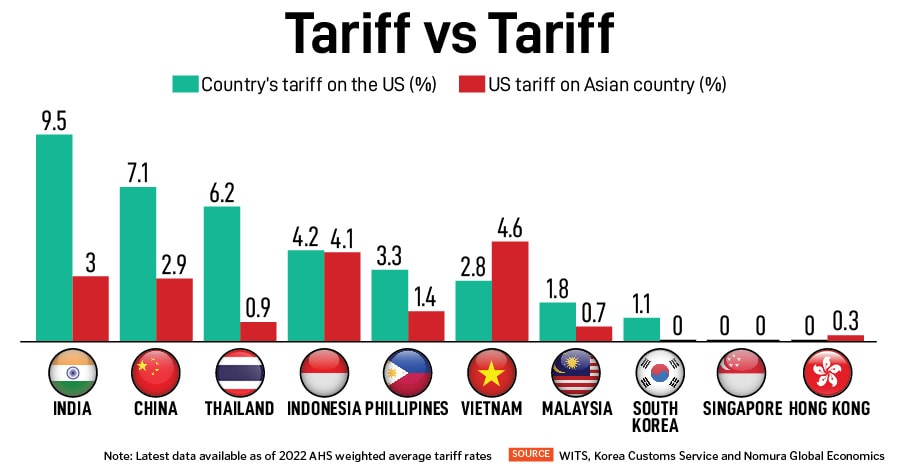

The US accounts for 17.7 percent of India’s goods exports. The reciprocal tariff could severely impact India as it has higher tariff rates vis-à-vis the US. Weighted average tariff rates imposed on US imports (by India) is at 8.5 percent (adjusted for reduction in the recent Budget). This compares to tariff rates imposed by the US at 3 percent, according to the World Integrated Trade Solution (WITS) database. AHS weighted average tariff rate is applied weighted average tariff which is the average of tariffs weighted by their corresponding trade value.

According to Chachra’s estimates, an increase in weighted average tariff rates by approximately 6 percentage points could be manageable. However, there are pain points. First, certain segments may get much higher tariffs, considering that India levies extremely high tariffs on items like motorcycles which could push weighted average tariff rates higher.

Autos are likely to be the second product to be hit by the US’s tariff on imported items as Trump is expected to announce new tariffs on them on April 2. The US has threatened to impose 25 percent tariffs on steel and aluminium, effective March 12. He has also emphasised that there will be tariffs on other items such as semiconductors, automobiles, and pharmaceuticals “over and above” the reciprocal tariffs he announced last week.

Chachra says there could be an indirect impact from uncertainty stemming from tariff and trade policies, creating an overhang on business confidence and potentially lower global growth. “The impact of uncertainty leading to risk aversion and strength in the US dollar weighing on central banks to effectively ease domestic financial conditions,” she feels.

Trump officially directed the US Trade Representative and Commerce Secretary to propose reciprocal tariffs customised to each trade partner. Howard Lutnick, nominee for US commerce secretary, reportedly indicated that he expects these studies to be completed by April 1.

Also read: US tariffs, not Union Budget, behind weak markets

How significant is the US for India’s export & EMs

“India stands out as having much higher relative tariff rates and thus is exposed to reciprocal tariffs,” says Varma.

As of FY24, India’s export to the US accounts 2.2 percent of GDP. The US is India’s largest export destination, with the India-US trade surplus rising to a high of $38 billion in 2024 from $31.2 billion in 2023, according to estimates by Nomura. India’s trade surplus with the US moderated somewhat during the first Trump presidency; it has picked up sharply since and reached a high in 2024.

Key exports to the US include electrical/industrial machinery, gems & jewellery, pharmaceuticals, fuels, iron & steel, textiles, vehicles, apparels, and chemicals, among others, of which iron & steel and aluminium account for nearly 5.5 percent of the total. “Unsurprisingly, these industries form the backbone of India’s manufacturing sector and constitute some of the largest formal sector employers, especially labour-intensive industries like gems, textiles and chemicals,” Varma adds.

Trump has called India “tariff king” in the past, and in his recent conversations with Modi, he has emphasised the need for India to procure more American-made security equipment and move towards “a fair bilateral trading relationship”.

“So far, India has been trying to avoid confrontation,” says Varma.

In Budget estimates for FY26, India has reduced import duties on products across electronics, textiles sectors, and high-end motorcycles.

Varma explains that the “most favoured nation” clause dictates that trading concessions made to one country have to be extended to other trading partners, which is something to which countries like India might be reluctant to commit.

Analysts will watch out how other countries will react to these tariffs and whether Indian exports will remain comparatively competitive once the dust settles. The tariffs could also be simply a negotiating ploy and any potential trade deals with the US might side-step the issue altogether.

“If the Trump administration decides to match not the overall level of tariffs that its trade partners are imposing on US exports, but rather the specific level of tariffs for each product on a like-for-like basis, it would be not just India, but also Vietnam, Indonesia and Thailand that would potentially face the most material tariff hikes in emerging Asia,” says Brian Tan, senior regional economist, Barclays.

India comprises a rather tiny share of US overall imports, with its share at 2.1 percent in 2017 and 2018, rising by 20 basis points (bps) to 2.3 percent in 2019, and further up to 2.7 percent as of 2024. This shows a 11.4 percent CAGR from 2017 until now, as per Morgan Stanley estimates.

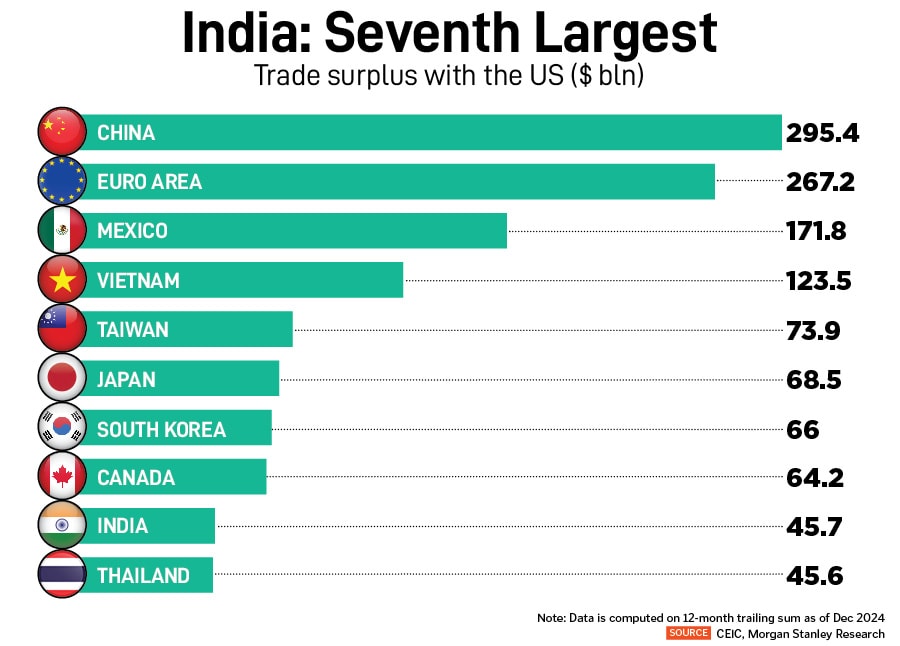

India runs a trade surplus with the US, tracking at $45 billion in CY24, making it the seventh-largest trade surplus among nations that have a trade surplus with the US. The US is also an important market for India’s services exports, with a share of 54 percent in India’s software service exports as of FY24, according to the Reserve Bank of India data.

Besides India and China, Vietnam, Indonesia and Thailand would potentially face the most material tariff hikes in Asia. Countries that have free trade agreements with the US, such as Singapore and South Korea, are safer with respect to Trump’s reciprocal tariff threat.

By product category, two sectors stand out: Agricultural products and transportation. High tariffs on the agriculture sector are common in most developing Asian economies, for both economic and political reasons, which makes it a tougher sector for governments to negotiate on, says Varma.

The transportation sector, on the other hand, which includes Asia’s exports of motor vehicles, has a scope for compromise. Asian policymakers could end up lowering their domestic tariff rate for these products.

Also read: Thawing US-China relations: Competition meets interdependence

Shift in monetary policy stance

The tariff war may see supportive policy measures, feels Chachra. She anticipates the monetary policy easing could be potentially 100 bps of rate cuts alongside incremental support through liquidity and macro prudential norms.

“While fiscal policy remains on a consolidation path, the event of a deeper slowdown in global growth could prompt policymakers to provide support through higher capex spending,” she explains. She will watch out for US tariff-related policies, trend in capital flows and the US dollar.

The Indian rupee hit a record low of 87.95 against the dollar in the first week of February. Indian stock markets, meanwhile, have slumped over 10 percent from their life highs.

According to Tan, the inclusion of factors such as value-added taxes, non-tariff barriers and FX policies implies more economies could be hit and the magnitude of reciprocal tariffs less constrained by simple tariff maths. “While global financial markets may be inclined to take some relief from the delay in the immediate imposition of reciprocal tariffs, it is not clear to us whether the delay necessarily reflects a lower likelihood that they will eventually be imposed,” Tan adds.

Modi-Trump meeting

Beyond the focus on the India-US trade balance, the bilateral meeting reinforced the importance of the two countries’ strategic partnership in areas like defence and technology, analysts feel.

Over the medium term, Nomura economists continue to expect India to benefit from supply-chain relocation. They find that India is one of the key economies to benefit from the China plus one strategy, partly owing to its large domestic consumer market, with a pipeline of projects across electronics (smartphones), automobiles, capital goods and semiconductor assembly and testing.

“Our bottom-up survey of companies showed the India is among the most popular destinations within Asia, with broad-based sectoral interest, particularly in the electronics sector,” Varma adds.

The bilateral Trump-Modi discussions were centred around a trade deal, more energy imports from the US, defence cooperation and a reiteration of the strategic partnership.

Nomura expects India’s purchase of US energy to increase over time, while Russia’s share may fall, which will alter the composition of its energy imports and trade balance. “Over the medium term, we expect India to encourage cheaper imports and invite US investment in key sectors, in line with its Make in India initiative. We continue to expect India to benefit from the ongoing supply-chain relocation,” says Varma.

Advantage India?

Some of the key decisions and initiatives launched as an outcome of the meeting in the US were:

The US-India COMPACT (Catalysing Opportunities for Military Partnership, Accelerated Commerce & Technology) launched to drive transformative change across key pillars of cooperation and for a mutually beneficial partnership.

Defence: A new 10-year framework for the US-India Major Defence Partnership signed. The US would expand defence sales and co-production with India to strengthen interoperability and defence industrial cooperation. Both countries will elevate military cooperation across all domains—air, land, sea, space and cyberspace. To launch an Autonomous Systems Industry Alliance.

Trade and investment: Bilateral trade—‘Mission 500’ aims to more than double the total bilateral trade to $500 billion by 2030. India-US to start negotiations on a trade deal to address the trade gap.

Energy security: India will import more US oil and gas to shrink trade deficit. The US commits to be the leading supplier of crude oil, petroleum products and liquified natural gas to India. India will reform its laws to welcome US nuclear technology, and the two will cooperate on civil nuclear energy and small modular reactors

Technology and innovation: To work together on artificial intelligence, chips and quantum technologies, launch US-India TRUST (Transforming the Relationship Utilising Strategic Technology).