As lock-in periods of newly listed companies, which raised funds through initial public offerings (IPOs) are about to expire, $42 billion worth of stocks are staring at the risk of sell-offs.

As lock-in periods of newly listed companies, which raised funds through initial public offerings (IPOs) are about to expire, $42 billion worth of stocks are staring at the risk of sell-offs.

Image: Shutterstock

At a time when Indian stocks are facing a massive drain-out of foreign liquidity, which is puncturing investor confidence, sell-offs by existing shareholders in listed companies may spell further bad news. As lock-in periods of newly listed companies, which raised funds through initial public offerings (IPOs) are about to expire, $42 billion worth of stocks are staring at the risk of sell-offs.

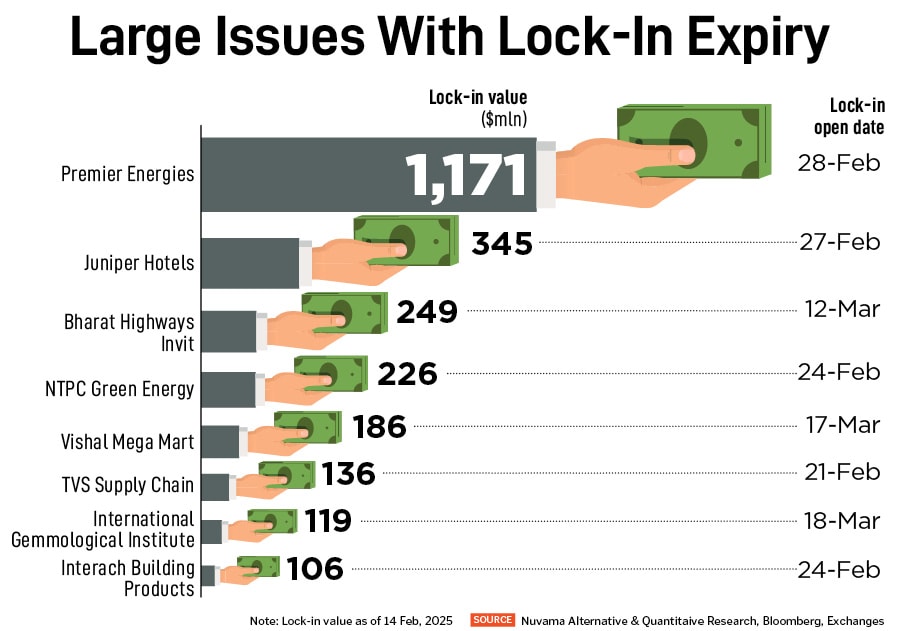

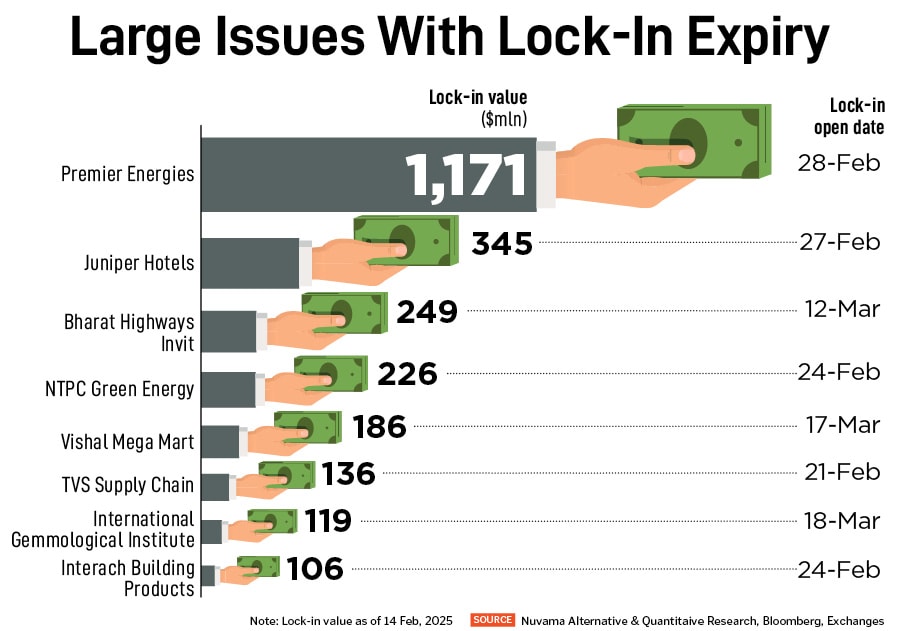

Between February 18 and May 31, 90 companies are to open their pre-listing shareholder lock-ins in various categories, shows an analysis by Nuvama Alternative & Quantitative Research. However, the amount of sell-off will hold true if all existing shareholders start selling shares as soon as lock-ins expire. Not all of these shares will be sold on the same day, as a sizable portion of these are held by promoters and groups, says Abhilash Pagaria, head, Nuvama Wealth.

The analysis considers the closing price of all the stocks as on February 14. It includes all shareholders, both promoters and non-promoters, for the companies and those listed until February 17.

In this period, companies that will see one-month lock-in expiries post listing are Stallion India Fluorochemicals ($3 million), Denta Water and Infra ($4 million), Dr Agarwal’s Health Care ($55 million) and Ajax Engineering ($22 million). These companies had mid-sized IPO issues, while their stock market debuts were also not impressive. Except Dr Agarwal’s Health Care (up 9 percent), the rest are either down by 1 to 8 percent, or flat from their respective issue price at the time of IPO.

Some of the large issues that will open-up shares for sell-offs are Premier Energies ($1,171 million), Juniper Hotels ($345 million) and NTPC Green Energy ($226 million). Shares of Premier Energies were listed last September, with a 120 percent premium over its price; it is currently around 114 percent higher.

Market regulator Securities and Exchange Board of India (Sebi) has mandated different lock-in periods for separate categories of existing shareholders in a company that is listed on the stock exchanges through IPOs. The lock-in filters are meant to arrest immediate decline in stocks after listing. For instance, there is a lock-in of 30 days for 50 percent of the portion allocated to anchor investors, and a lock-in of 90 days for the remaining portion. Earlier, the lock-in period for anchor investors was 30 days, which caused a drastic decline in share prices after the window of selling opened.

Also read: US tariffs, not Union Budget, behind weak markets

Fund flush out of Indian stocks

Even as the analysis considers sell-off of all existing shareholders in these companies as soon as lock-ins expire, the market is at such a fragile state that a small amount of sell-off will be enough to harm sentiments. On various concerns such as a global tariff war triggered by US President Donald Trump, steep valuations, weak corporate earnings against the backdrop of a slow-moving economy, Indian markets have been rattled in last few months. Hectic selling by foreign institutional investors (FIIs) have added to the pressure.

From this January, FIIs have dumped Indian stocks worth $12 billion, compared to a net inflow of $124 million in 2024. In comparison, domestic institutional investors have stayed steady in their allocation of funds to equities.

“The sharp reversal in flows [by FIIs] was driven by multiple factors. Elevated valuations of Indian equities prompted a shift in emerging market capital toward China, where stocks were relatively more attractive,” say analysts at Morningstar.

China’s stimulus measures to revive its slowing economy further diverted investor interest. Rising geopolitical risks, caution ahead of the US Presidential election, concerns over India’s high inflation, surging crude prices, and uncertainty over the commencement of interest rate cuts by the Reserve Bank of India (RBI) added to the selling pressure. Weak corporate earnings for the September quarter further dampened sentiment. Though December saw a brief respite, market conditions remained unfavourable due to rising US bond yields, a strengthening dollar, expectations of a slowdown in the domestic economy, and uncertainty over Trump’s potential foreign policy stance.

According to Morningstar analysts, the sustained sell-off by FIIs is primarily driven by escalating global trade tensions following increased US tariffs on Canada, Mexico, and China, triggering a risk-averse sentiment and capital flight from emerging markets. The sharp depreciation of the Indian rupee against the US dollar has further exacerbated the situation, making Indian investments less attractive.

Additionally, the 25-basis-point cut in the repo rate initiated by the RBI recently, in an attempt to stimulate economic growth, failed to significantly uplift investor sentiment, as concerns over slowing GDP growth and weak corporate earnings persisted.

A silver lining: MSCI rebalancing

The recent rebalancing of the MSCI Standard Index has increased India’s weightage in the emerging markets (EM) index. An increase in weightage typically indicates an inflow of money as foreign passive index funds allocate money to stocks depending on their weightage and constituents.

As per the rebalancing, India’s weight in the EM index is expected to increase to 19 percent by the adjustment date, from the current 18.8 percent. This will result in a net passive inflow of $850 million to $1 billion on the adjustment day, says Pagaria. The effective date of rebalancing is February 28.

Meanwhile, In the Standard index, India will see no net changes. The only adjustments will be one inclusion (Hyundai) and one exclusion (Adani Green). The Standard index will undergo eight adjustments driven by increased float, while the small-cap index will see a significant 51 securities impacted. The adjustments are primarily driven by FII selling deals, QIPs, and float changes due to promoter stake sales, adds Pagaria.

As lock-in periods of newly listed companies, which raised funds through initial public offerings (IPOs) are about to expire, $42 billion worth of stocks are staring at the risk of sell-offs.

As lock-in periods of newly listed companies, which raised funds through initial public offerings (IPOs) are about to expire, $42 billion worth of stocks are staring at the risk of sell-offs.