With over 25 logistics service providers offering both on-demand and intercity services, the ONDC network achieved a significant milestone by delivering 2 million orders in November 2024

With over 25 logistics service providers offering both on-demand and intercity services, the ONDC network achieved a significant milestone by delivering 2 million orders in November 2024

Image: Shutterstock

India’s economy is projected to reach $5 trillion by 2027, and a key driver of this growth is the development of a robust, efficient, resilient, and well-structured logistics and transportation infrastructure. India’s Gati Shakti initiative aims to integrate the planning and execution of infrastructure projects to optimise freight delivery and drive GDP growth. One critical metric to measure and improve efficiency in this sector is the logistics cost as a percentage of GDP. According to NCAER, India’s logistics cost to GDP stood at 7.8–8.9 percent in 2021–22. Any incremental improvements in this area could significantly enhance GDP growth, making logistics easier.

According to the IMARC Group, India’s logistics market is projected to reach $557.4 billion by 2032, growing at a compound annual growth rate (CAGR) of 7.85 percent from 2024 to 2032, making it one of the most significant logistics markets globally. However, as per IBEF, only 5–7 percent of the logistics market in India is organised, while the majority remains fragmented. This fragmentation, coupled with a lack of modern infrastructure and technology, limits small fleets, sellers, and warehouses. They face challenges such as poor demand visibility, limited access to cost-effective logistics solutions, and an inability to optimise trip routing for incremental efficiency gains. Addressing these gaps is essential to unlocking the full potential of India’s logistics sector.

Imagine a seller receiving 10 orders daily through a platform and needing to handle shipping independently. The seller must establish individual contracts with logistics providers or rely on aggregators, often at a higher cost. On the supply side, consider a truck transporting goods from Mumbai to Delhi. How does the truck owner find a client to secure cargo for the return journey to Mumbai at a fair price? This highlights the need for a solution where digital infrastructure complements physical infrastructure, enabling seamless discoverability and efficient contracting for sellers and logistics providers.

Open networks facilitated by ONDC are essential in solving this challenge. On the seller side, ONDC has onboarded logistics service providers across the industry. This includes organised players like Shadowfax, Loadshare, Delhivery, and Shiprocket, as well as small fleet owners, who, in turn, are supported by technology service providers (TSPs). With this large gamut of suppliers, ONDC offers a comprehensive catalogue of logistics services, such as hyperlocal immediate delivery, slotted delivery, and intercity delivery, catering to diverse supply needs.

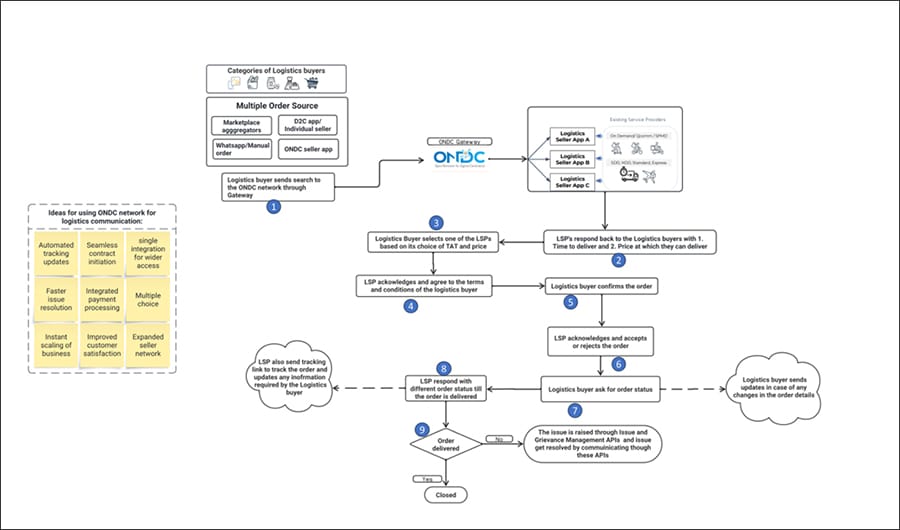

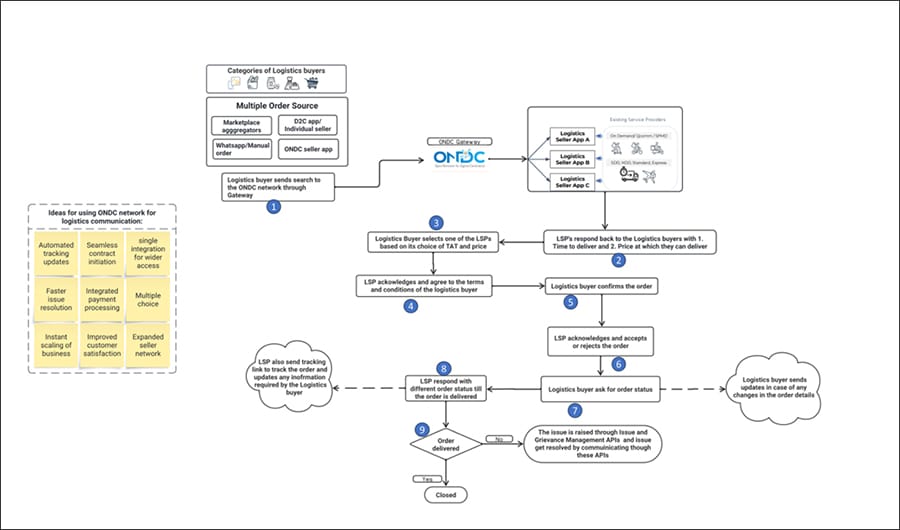

But how exactly does the logistics process work at ONDC?

Source: Authors

Source: Authors

A logistics buyer on the ONDC network can be an aggregator, an individual seller, or any entity requiring logistics services. The process begins when the buyer sends a search request on the network, specifying the pickup and drop-off locations. This search is broadcasted via the ONDC gateway to all logistics service providers (LSPs) on the network.

Also read: Standardised B2B digital infrastructure: The next logical step in India’s digital journey

The LSPs receive the search request and respond if they have the serviceability and capability to fulfil the order. The logistics buyer then reviews the responses and selects an LSP based on specific criteria, such as the lowest rate, fastest turnaround time, or the provider’s historical performance. Once an LSP agrees to the buyer’s terms and conditions, the buyer confirms the order with the chosen provider. The LSP then dispatches a rider to the logistics buyer (or seller) for pickup. The rider collects the shipment and delivers it to the customer while the LSP updates the logistics buyer on the various statuses of the shipment journey. If there are any issues with the order, the logistics buyer can raise a ticket using ONDC’s Issue and Grievance Management APIs, facilitating seamless communication and resolution with the LSP.

The innovation allows small retailers to quickly discover all available logistics capacities with just a click through an aggregator onboarded as a logistics buyer service provider on ONDC. ONDC network enables small businesses to focus on their core competencies. For example, a D2C brand can dedicate its efforts to building and managing its brand without worrying about logistics, accelerating business growth and scalability. Similarly, small logistics providers with limited fleet sizes can list their capacity through a technology or a logistics service provider’s (seller) application on ONDC. This opens up a previously inaccessible market, making their services discoverable and reducing idle time for their fleets.

With over 25 logistics service providers offering both on-demand and intercity services, the ONDC network achieved a significant milestone by delivering 2 million orders in November 2024, a remarkable increase from just 35,000 orders in April 2024. ONDC has captured 3.5 percent of the third-party on-demand logistics market in less than eight months, demonstrating its transformative impact on the industry’s growth.

The integration of physical and digital public infrastructure has been equally remarkable. Physical infrastructure enhances efficiency, enabling faster and more efficient routing, while digital infrastructure optimises pricing, introducing the concept of least-cost routing. These advancements are reshaping the logistics landscape, driving efficiency, and reducing costs for businesses and consumers alike.

About the authors: Ashish Desai is an Associate Professor of Information Management and Analytics at the S.P. Jain Institute of Management and Research (SPJIMR), and Megha Bansal is Vice President of Supply Chain and Logistics at ONDC.

[This article has been reproduced with permission from SP Jain Institute of Management & Research, Mumbai. Views expressed by authors are personal.]

With over 25 logistics service providers offering both on-demand and intercity services, the ONDC network achieved a significant milestone by delivering 2 million orders in November 2024

With over 25 logistics service providers offering both on-demand and intercity services, the ONDC network achieved a significant milestone by delivering 2 million orders in November 2024