Now, much like the rest of the country, data centres are largely powered by coal-led thermal power.

Now, much like the rest of the country, data centres are largely powered by coal-led thermal power.

n February 13, Prime Minister Narendra Modi and US President Donald Trump discussed enhancing collaborations in technology, which included investments in next-generation data centres as part of broader initiatives in artificial intelligence (AI) infrastructure. Two days earlier, on February 11, during the inaugural India Energy Week held in Delhi, Modi spoke about India’s commitment to be a global energy leader, reiterating the country’s targets of building 500 GW of non-fossil fuel capacity by 2030. The question is: Can these contradictory ambitions fuel each other?

“The rise of AI, an increasing move towards cloud computing, and data localisation regulations mean the demand for data centres will continue to grow significantly,” says Sunil Gupta, co-founder, CEO and MD, Yotta Data Services. His company, which specialises in hyperscale data centres, cloud services and managed IT solutions, is backed by the Hiranandani Group, and is partnering with Nvidia to enhance AI capabilities in India.

Gupta explains that India is home to around 3 percent of the world’s data centres but produces about 20 percent of the world’s data. “It is estimated that India’s data centre market will grow by 21 percent to reach 3.4 GW by 2030,” he says. As per the Economic Survey 2024-25, the data centre market in India is expected to grow from $4.5 billion in 2023 to $11.6 billion in 2032, at a compound annual growth rate (CAGR) of 10.98 percent.

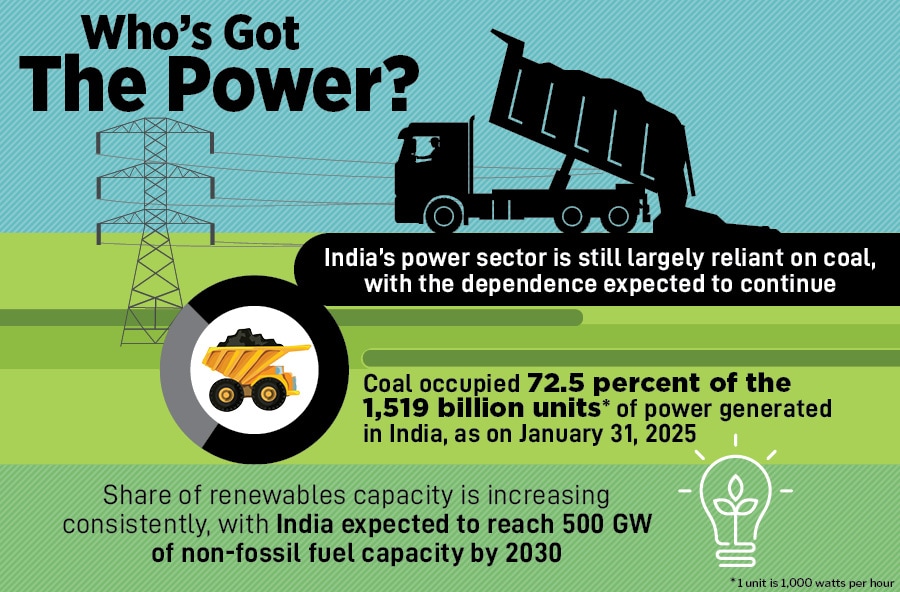

So, why is the growth of AI-led data centres paradoxical with India’s larger energy transition targets? Because right now, much like the rest of the country, data centres are largely powered by coal-led thermal power. Coal occupied 72.5 percent of the 1,519 billion units of power (1 unit is 1,000 watts per hour) generated in India, according to government data as on January 31.

India is experiencing an unprecedented demand for power, spurred by economic growth and climate change. While the share of renewables has been increasing, to meet growing demand, the government has proposed to increase its thermal power capacities, led by coal. According to the International Energy Agency (IEA), this reliance on coal to meet India’s power needs will remain at more than 50 percent till 2035.

An August 2024 report in Mercom India quotes industry leaders saying that data centres account for 2 percent of the total power consumption in India, with the figure expected to increase in the next few years. For context, this share is modest compared to other demands like electric vehicles, industrial electrifications, and household appliances like air conditioners. However, as per an October 2024 commentary by the IEA, as the data centre industry expands, in part because of the expectations of AI, it is important to examine its consequences for the energy sector.

Computing & Cooling

Data centres use power for two main reasons: Computing and cooling. Computing involves powerful servers that process and store vast amounts of data supporting applications like AI, ecommerce and cloud services. It also includes networking equipment and storage systems that manage data flow, ensuring smooth and uninterrupted business operations.

The computing process generates a lot of heat, which can damage the systems if not managed properly. “The density of power used in data centres will have to increase as AI demands higher processing workloads,” says Kiran Dutt, president, electrification, ABB India. The company provides automation and solutions to decarbonise data centres and make them more energy efficient. These include microgrids for renewable energy integration, meters to help companies understand their power usage and build efficiency, and circuit breakers to protect systems.

Dutt explains that higher AI workloads have also increased average rack power consumption in data centres, and as this load rises, every degree of temperature increase will matter. Using energy efficient innovations to “maintain the correct temperature and optimise it is the first step to energy saving”, he says.

When it comes to cooling, traditionally, data centres used systems such as air conditioning or water cooling to keep temperature and humidity at safe levels. According to a study in Nature by David Mytton, a 1-MW data centre with one of these traditional cooling systems can use around 25.5 million litres of water per year.

“It is believed that cooling data centres around the world will need about a billion litres of water every day,” says Gauri Jauhar, executive director, energy transitions and clean tech consulting, S&P Global. “When you stack it up against other existing needs, like water usage by industry or coal-powered plants, it is critical to find innovative ways of utilising less water,” she says. “But there is yet no concerted policy push on that.”

Another reason why high water requirements is of concern is because many data centres in India are located in major cities (see box) that are already facing water scarcity. According to a December 2024 article in Lawfare, Bengaluru’s data centres currently consume about 8 million litres of water per day. “Such unsustainable consumption trends threaten fragile water systems in a city that recently experienced its worst water crisis in 500 years,” the article says.

Another reason why high water requirements is of concern is because many data centres in India are located in major cities (see box) that are already facing water scarcity. According to a December 2024 article in Lawfare, Bengaluru’s data centres currently consume about 8 million litres of water per day. “Such unsustainable consumption trends threaten fragile water systems in a city that recently experienced its worst water crisis in 500 years,” the article says.

Gupta of Yotta says that India poses some unique challenges to the data centre industry. “High population density and rapid urbanisation mean that suitable land is both scarce and expensive. Additionally, many regions in India struggle with water availability and supply. This means we need to adopt more efficient, alternative cooling methods,” he says, on email. “Then there is the overall pressure on power grids in areas with high population, which means data centre operators have to innovate with sustainable practices that are for India.”

Also read: Government intervention is crucial for growth of data centres: Nxtra by Airtel CEO

Green shoots

One big way in which data centres can be more energy efficient is by optimising their fuel mix. “In the near-to-medium term, the location of data centres will matter the most. Is a company able to co-locate to a renewable power source, and can the power backups be renewable or gas-based instead of diesel-based? This can significantly lower the overall emission profile of data centres,” Jauhar says.

Many data centres in India have taken steps towards reducing energy consumption. For example, Nxtra by Airtel has a target to achieve 70 percent renewable energy consumption for its core data centres by 2027. Hyderabad-based CtrlS Datacentres, which inaugurated a data centre park in Chennai in late February, with Rs 4,000 crore direct investments and Rs 50,000 crore indirect investments, aims to use 100 percent renewable energy and become carbon neutral by 2030.

AdaniConnex, a joint venture between Adani Enterprises and EdgeConneX for data centre solutions, plans to build a 1 GW data centre infrastructure platform focussed on sustainability and environmental stewardship. According to an April 2024 report by Mercom India, AdaniConnex has secured $1.44 billion in green financing to fund its renewable-powered data centres.

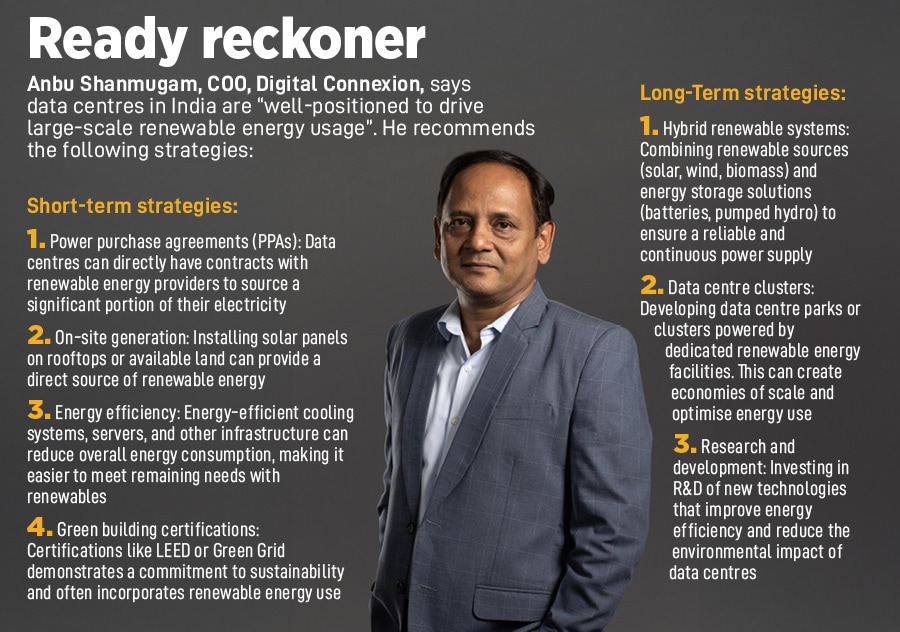

Digital Connexion, a three-way joint venture of Brookfield Asset Management, Reliance Industries and Digital Realty, has launched a 100 MW greenfield data centre project in Chennai, which uses high thermal efficiency materials to enhance insulation and minimise energy loss, and advanced cooling systems that optimise power consumption, says COO Anbu Shanmugam. “Our Chennai facility will be adopting group captive green power solutions, sourcing energy from renewables like solar and wind to reduce our carbon footprint,” he says, adding that data centres in India are “well-positioned to drive large-scale renewable energy usage” in the short-term and long-term (see box).

Jauhar says that as India gets closer to the 500 GW target by 2030, the options to integrate renewable energy into the grid and by extension data centre operations, will increase. “Right now, there is solar and onshore wind, offshore wind is likely a longer-term option. Options like nuclear are getting a renewed push into the energy mix” she says. In the Union Budget this year, Minister of Finance Nirmala Sitharaman announced development of at least 100 GW of nuclear energy by 2047 to bolster India’s energy transition efforts. As of January 2025, India has a total non-fossil fuel capacity of 218 GW, according to government data.

Yotta, says Gupta, is exploring a renewable energy mix that includes a combination of wind and solar energy integrated with pumped storage plants to ensure round-the-clock availability of renewable power. “We are also evaluating a blend of large and small hydro projects, along with other renewable energy sources, to further optimise our energy portfolio,” he says.

According to him, nuclear energy, which offers a reliable, low-carbon baseload to complement the intermittency of renewable sources like wind and solar, is “crucial for data centres that demand uninterrupted power while striving to reduce their carbon footprint”. He adds that in India, where energy demands and sustainability goals are both escalating, integrating nuclear power alongside renewables could not only enhance grid stability, but also accelerate the transition of data centres to a greener, more resilient operational model.

The second way in which data centres can be more efficient is by optimising design, says Jauhar. “This could be reusing and optimising IT equipment, use of waste heat and waste heat recovery, and use of innovative and alternative cooling technologies.”

These include air-cooled chillers equipped with adiabatic kits for effective heat exchange, closed-loop liquid cooling systems, or rainwater harvesting systems to reduce reliance on external sources, and recycling and reusing of water.

Gupta says that government policies such as the Green Energy Open Access Rules and incentives for data centre development encourages sustainability, and India’s push for data localisation is attracting investments in green data centre infrastructure. “As the sector evolves, collaboration between industry leaders and policymakers will be crucial in ensuring a sustainable and resilient digital economy,” he says.

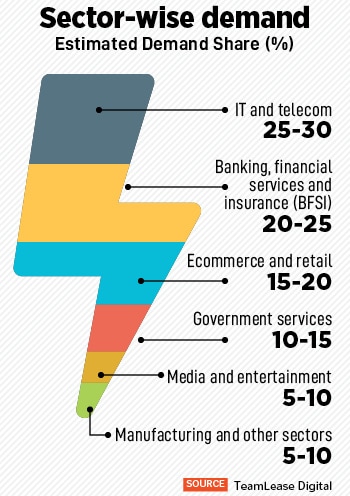

A sustainable shift in the data centre industry also means a smooth and fair transition for its workforce. This includes reskilling and upskilling workers to keep up with new technologies and green practices. “As data centres shift to energy-efficient systems and renewable energies, employees will need training in areas like energy management, green IT, and environmental compliance,” says Neeti Sharma, CEO, TeamLease Digital. According to her, the current growth trajectory of the data centre industry will spur job creation in roles including energy efficiency managers, renewable energy specialists, sustainability consultants, and data centre operations manager with a sustainability focus. Being skilled in these areas can boost salaries by 10 to 20 percent compared to average pay, she says.

While Europe and the US are at a more advanced stage of implementing greener data centres, it is only a matter of time those practices come to India, given that the data centres here will be part of global companies, and transfer of best practices, training and technological know-how will happen, says Jauhar. “There are a lot of options that need to be considered for data centres to be energy efficient and sustainable, but that requires micro-level of energy procurement and planning of the design, data centre by data centre.”