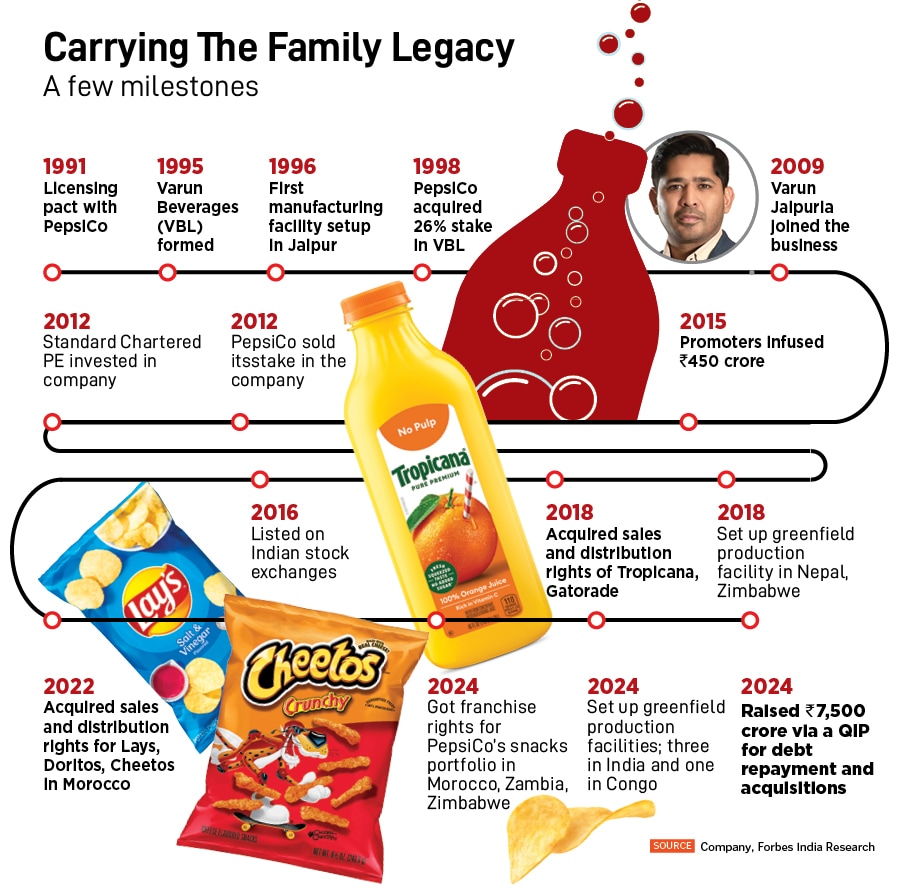

Dressed in a black shirt and black trousers, Varun Jaipuria breaks into a smile as he shares a childhood incident that is etched in his memory even after three decades. He remembers how he had innocently reminded his father, Ravi Jaipuria, a well-known businessman, to name a company after him too—the first one under the RJ Corp umbrella, Devyani International, was named after his elder sister. “I will also join the family business one day,” he dutifully promised. The young boy had a point. And the second company was incorporated as Varun Beverages in June 1995.

In his formative years, the 37-year-old third-generation entrepreneur got the opportunity to learn the ropes of running a business from his grandfather, father, and uncles. The Jaipuria family is among the pioneers in the cola bottling business in India and Varun’s grandfather Chunni Lal Jaipuria was a franchisee for bottling Coca-Cola in the country in the ’70s. Varun grew up in a joint family, and dinner-table conversations revolved around discussing market opportunities and growth strategies. He was no stranger to the hard work, passion, commitment, and attention to details required to profitably grow a company.

Varun’s grandfather split the bottling business among his three sons and his father, who got and led the plant operations in Agra in the late 80s, spent a lot of time in the city to understand consumer trends, and ensure that production and distribution run glitch-free. Most of Varun’s summer vacations were spent in Agra. “We had nothing to do there other than visit the zoo or the Taj Mahal,” he recalls.

But this is where he got critical business lessons. He recalls the meticulous planning and hands-on approach of his father. “Late at midnight he would personally stand at the depot to make sure that the trucks are loaded on time and everything goes smoothly,” he says. “He’s always been very involved with what’s happening on the ground and understanding the speed of the market.” This focus helped the promoters build a strong foundation for growth in the coming years.

But this is where he got critical business lessons. He recalls the meticulous planning and hands-on approach of his father. “Late at midnight he would personally stand at the depot to make sure that the trucks are loaded on time and everything goes smoothly,” he says. “He’s always been very involved with what’s happening on the ground and understanding the speed of the market.” This focus helped the promoters build a strong foundation for growth in the coming years.

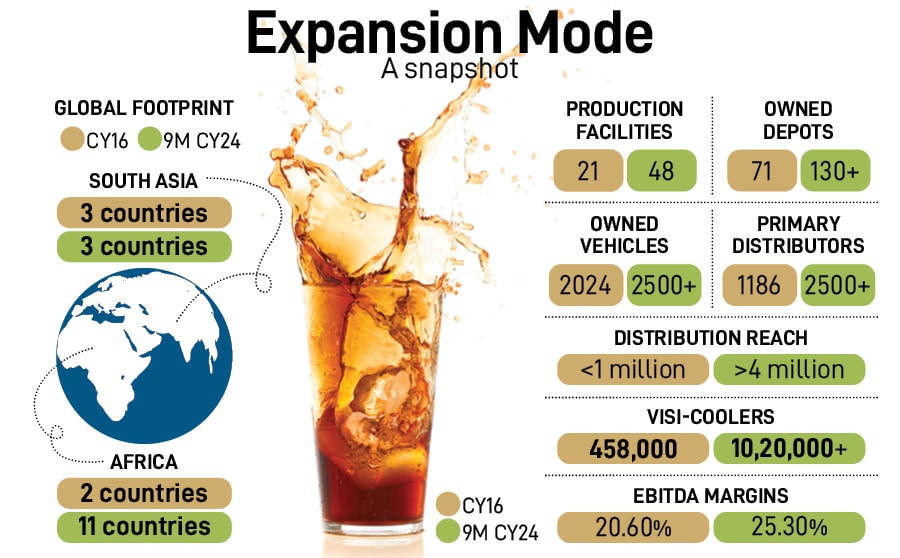

Today, Varun Beverages, a part of the RJ Corp group, is a top player in the global beverages industry and is the second largest franchisee of New York-headquartered food, snack, and beverage behemoth PepsiCo outside the United States. The company’s operations and franchise rights are spread across 10 countries, including Nepal, Sri Lanka, Morocco and South Africa, with distribution rights in another four countries: Namibia, Botswana, Mozambique, and Madagascar.

But India remains its largest market and contributed ~72 percent to revenues in the previous year. As of February, Varun Beverages has franchises for a range of PepsiCo products across 27 states and 7 union territories in the country, and it accounts for around 90 percent of PepsiCo India’s sales volume versus under 30 percent in 2011.

“We have shared an extraordinary journey as partners,” says Jagrut Kotecha, CEO, PepsiCo India and South Asia. “Our long-standing partnership with Varun Beverages has allowed us to navigate our business with confidence in India.”

Also read: Forbes India Entrepreneur of the Year: Supam Maheshwari and the FirstCry empire

Scaling up

Varun formally joined Varun Beverages in 2009. Unlike some of his friends, who were given a ‘structured induction’ when they entered their respective family-run companies, the business scion says he was like a lost lamb running around. “My learning curve was pretty flat for the first couple of years because I was thrown into the deep end to figure things out myself,” he says.

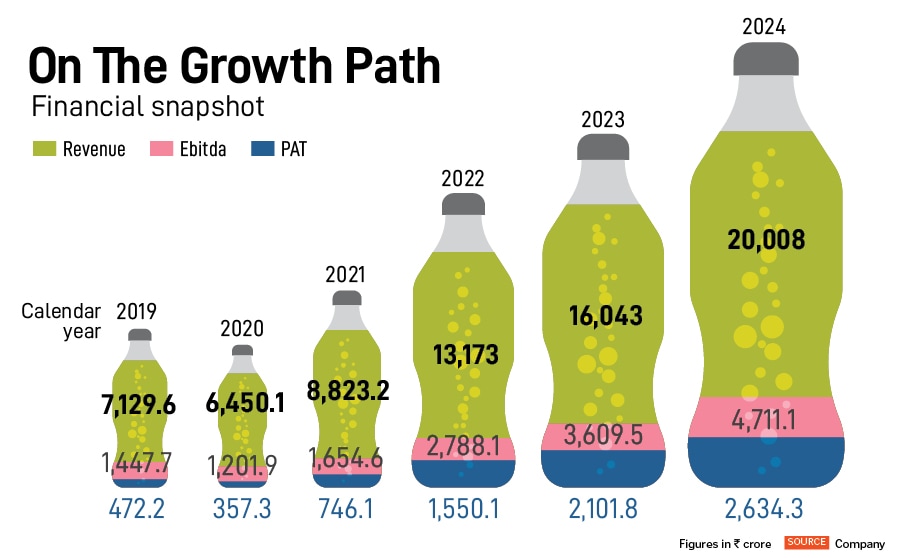

“But that’s the way you will learn”, his father had told him at that time. True enough, this experience sharpened Varun’s execution capabilities and allowed him to tap into the value chain in the beverages industry. From 2013 onwards, over the next decade, Varun led a massive expansion plan through acquisition of newer territories to accelerate growth profitably. Sales and Ebitda expanded by 23 percent and 29 percent each over CY13-23. Though his father, now chairman of Varun Beverages, continues to look after the overseas business, Varun, who joined as a company director and head of the Delhi territory, took over the reins as executive vice-chairman in 2022 and looks after the India business.

“Varun has shown a keen ability to navigate the complexities of the market,” Kotecha says. “His growth as a leader is a testament to his dedication, strategic thinking, and the ability to turn challenges into opportunities.”

Ravi Dhariwal, former CEO, Bennett Coleman & Co, has deep ties with the Jaipuria family. He was PepsiCo’s first employee in India and helped the MNC set up its beverage business in the country in the 1990s. He claims he had persuaded Ravi Jaipuria and his brothers to switch to manufacturing Pepsi instead of Coca-Cola and Thums Up. He has been mentoring Varun for the last nine years.

“I’ve seen him grow through different stages. He is passionate about his business and is prepared to roll up his sleeves and get the troops excited about what needs to be done,” he says. “He has been focussed on winning market share and improving profitability,” he adds. “He is competitive but in a nice way.”

Contrary to perception, Dhariwal argues, joining the family business was not a walk in the park for Varun because he had huge expectations to fulfil as a next-generation entrepreneur: “Don’t forget who he took over from… he had big shoes to fill but he handled the whole transition amazingly well.” He points out that when a senior leader such as Ravi hands over the company reins, many senior aides tend to leave the company. “I don’t think more than 1 percent of the senior people left at that stage,” he claims. “Varun held the leadership team together. He gave them a shared vision and created a win-win situation by giving them ESOPs and other incentives.”

ENAM AMC has invested in Varun Beverages and had participated in the QIP launched by the company in November to raise ₹7,500 crore. Its founder and CIO, Jiten Doshi, says his team has been tracking the company for the last few years and has regular meetings with the management team to understand their strategy.

Doshi credits Varun for building the leadership team. He also says that, unlike some of his peers, Varun, like his father, is intensely involved in the execution at the ground level, and has a strong understanding of consumer taste and preferences. “He has brought new ways of working in terms of embracing technology and digitisation,” he says.

Also see: Forbes India Leadership Awards 2025: An evening celebrating excellence in India Inc

The ‘Sting’ factor

When Varun joined the business, the company did not have an energy drink in the portfolio. Austrian beverage giant Red Bull was synonymous with energy drinks in India and remained unchallenged for nearly eight years after its launch in 2009. But priced at ₹125 per 250ml can, it was unaffordable for most Indian consumers.

Varun Beverages disrupted the market for energy drinks in the country. In 2017, they launched the iconic red bottle of Sting in PET bottles at an attractive price point of ₹20. The rollout was a hit and the company cornered roughly 90 percent of volume sales in this category within four years. They launched new variants. In 2024, the sale of Sting contributed over 15 percent to revenue, and it has been one of PepsiCo’s fastest growing brands in India.

“Varun did a lot of work at the back-end to understand consumer preferences and is responsible for the successful launch of Sting,” Doshi asserts. “He nailed the marketing and distribution.” Sting’s popularity has pushed rivals to enter the segment, which is pegged to grow at 14.7 percent CAGR from 2023 to 2030, according to Grandview Research. “Coke and others are obviously betting big on the energy drinks market now,” Varun says. “We need to introduce new variants because category expansion is happening very fast.” Doshi believes it will be difficult for other players to “do what Varun Beverages has done”.

But Varun is alert. He says the competitive intensity is “super-high”. His team has to swiftly respond to changing market dynamics. There is no room for slack in the crucial six months of the summer season. “Everything in our business happens in that time,” he says. It calls for aggressive and razor-sharp execution on all fronts. Losing even half a percent of market share can exert a huge toll on investments.

Varun Beverages has outlined a capex of ₹3,100 crore for the current calendar year, of which about ₹2,000 crore is earmarked towards setting up greenfield facilities in Prayagraj, Damtal, Buxar, and Meghalaya, as per the company’s earnings presentation for Q4CY24. The company used its QIP proceeds to repay debt and is now debt-free. This has given it headroom to expand and invest in new opportunities for growth.

“Varun Beverages has been growing its capacity for the last 25 years. They have been entering new territories in India and Africa,” Doshi says. “It enjoys economies of scale, its distribution network, technologically advanced plants, infrastructure… these are strengths that the competition does not have.”

New entrants

Industry watchers and investors are closely watching the newest entrant on the block: Reliance Industries bought Campa Cola for ₹22 crore in 2022 and relaunched the brand in 2023 to expand its FMCG portfolio. Can the challenger be challenged in its own game? Campa Cola has started on a strong footing with an attractive price point of ₹10 versus ₹20 offered by the incumbents.

“Brands are built over decades,” Doshi says. Despite being present in India for decades, Coke and Pepsi have not been able to dislodge Thums Up from its number one position, he explains, given its distribution, taste, and recall with consumers. He believes a new entrant will take a long time to match the large-scale capacities built by Coke and Pepsi in the country. “If Coke and Pepsi could not dislodge Thums Up, how will Campa Cola dislodge all three,” he asks rhetorically. “Campa Cola will only enhance and increase the market size,” he reckons. “The markets are a little overly worried.”

Varun is confident that his company is advantageously placed to leapfrog and tap into the potential of the market. Consider this: India has 12 million retail outlets but Varun Beverages sells through only 4 million outlets. Plus, India per capita consumption of soft drinks is low at 7 litres versus 120 litres in the US, for instance. Importantly, the Africa business, led by Ravi Jaipuria, is making rapid strides too. Doshi predicts a combination of these tailwinds will help the company grow by 20-25 percent y-o-y for the next three to four years.

Varun is more conservative and he declines to give a forward guidance since Varun Beverages is a listed company. But he believes the leadership will be able to sustain the current growth rate of around 15 percent given the scope to deepen the market. In fact, he travels by road to far-flung areas to get a pulse of the interiors. He sees a marked improvement in road connectivity and availability of power. “Four months ago, I had probably covered 3,000 km in five days,” he says. He discovered a cluster of nearly 50 villages that had electricity for 22 hours daily. “That’s a population of 5,000 people,” he highlights, underlining the transformation underway in rural areas, and how this will boost consumption.

Moreover, the weather and temperature play a role in shaping business outcomes for beverage sellers. “Extreme weather conditions hit the business,” Varun says. “If it’s too cold, it will hurt sales. But even if it’s too hot, sales will dip, because at high temperatures, like 54 degrees, even if the coolers are on, the product inside will not get chilled,” he adds.

Future roadmap

In a note to investors in January, brokerage firm JM Financial says, “Varun Beverages is an example of a large opportunity getting tapped through exemplary execution.” It believes the company’s end-to-end execution capabilities combined with backward integration allow it a strong hold over the entire value chain which makes the relationship with PepsiCo ‘symbiotic’.

“Varun Beverages is central to our future growth aspirations in India,” Kotecha agrees.

JM Financial analysts expect company sales to grow at a CAGR of 18.7 percent over the next two years. Gross margins improved by 165 basis points to 55.5 percent in CY24 versus 53.8 percent in the previous year. This was largely on account of strategic procurement and storage of PET chips for price benefits and the accruing benefits of more backward integration. Overall, Ebitda margin rose by 105 basis points to 23.5 percent last year. “While margin expansion from current healthy levels is unlikely given the focus on driving volume growth,” JM Financial says in the earlier mentioned report. “Interest cost savings will drive higher earnings CAGR of 29 percent which is much better than global peers.”

Varun also wants to focus on building structures, systems, and processes within the organisation to institutionalise best practices for sustainable growth in the coming decade. And safeguarding the environment has been a key area of interest along with frameworks to define good governance. “He wants to make sure that the company’s ESG journey is not just good but great,” Dhariwal shares. Climate change is an area Varun is concerned about, and points out a slew of measures he has introduced to reduce the company’s carbon footprint.

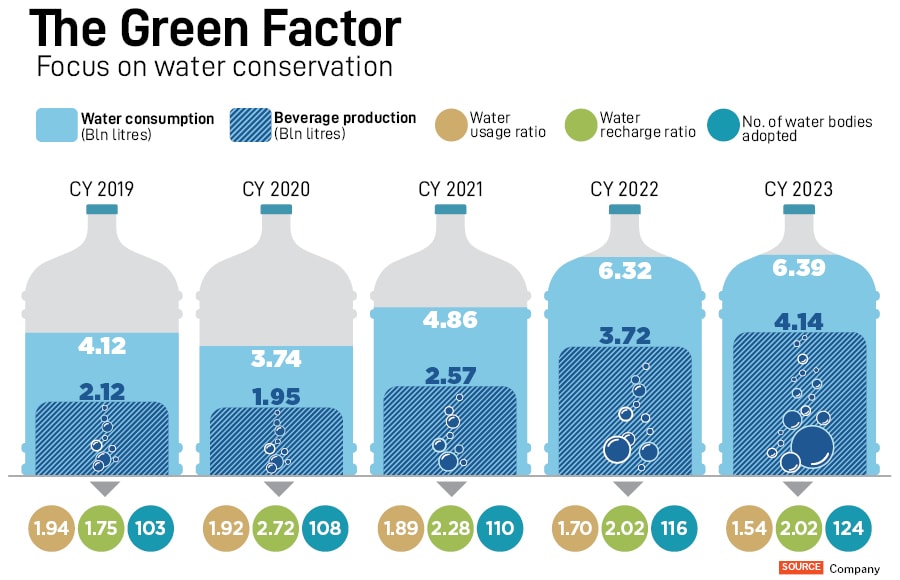

For example, as per the company’s investor presentation dated February 10, Varun Beverages has reduced its water usage. In 2021, it used 1.89 litres to produce 1 litre of beverage. This declined to 1.56 litres in 2024, and the management expects this to further improve to 1.40 litres this year. Likewise, it has increased its dependence on renewable energy sources to 79 kWh million units from 18 kWh in 2021. It hopes this will rise to 125 kWh this year. The company has also reduced plastic usage.

The reticent executive vice-chairman, who doesn’t like spending too much time on social media, is also a health freak. Varun drinks in moderation: “Not as much as I did when I was 25,” he quips. He even goes for regular Ayurvedic detox sessions. So he is astutely aware of how many urban consumers are opting for healthier options, be it food or beverages.

To keep pace with this shift, Varun is focussing on low and no sugar offerings. Last year, the company reported that the mix of low sugar/no sugar products increased to 53 percent of sales volumes from 42 percent in CY23. But Varun agrees the pick-up has been slow outside metro cities. “We are offering no-sugar beverages at attractive price points, cheaper than the sugar ones, still they don’t buy it,” he rues. The company has expanded its range of beverages to include fruit-based drinks and value-added dairy-based beverages, which currently account for about 4 percent of the volume mix.

“They know how to think global and act local when it comes to consumer taste buds and preferences,” Doshi says. He is confident that under Varun’s leadership the company is poised for industry-beating growth. “Varun Beverages is sitting on a decadent opportunity, one that we believe companies rarely get,” he adds. “The best is yet to come.”