It was this level of transparency that Jaipur-based Mohit and Rahul Yadav aimed for when they launched the brand in October 2020. Mohit, 41, minces no words when he says, “We had a sense that brands were promising something, but what was put in the product was different.” Their aim was to change that. It was also their best hope in standing out in a crowded marketplace.

The last decade has also seen consumers, particularly in urban India, becoming more discerning. An anti-ageing product with retinol, which is a form of Vitamin A, is likely to do better than a plain vanilla cream with no disclosure. And last, what completed the loop was direct distribution and a D2C (direct-to-consumer) brand was born.

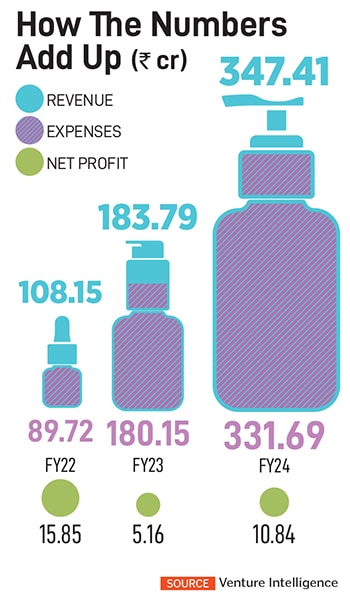

In the four years and counting since Minimalist was founded, sales reached a run rate of Rs500 crore a year, making them the winner in the promising startup category at the Forbes India Leadership Awards. In January, Hindustan Unilever announced its purchase of 90.5 percent of the business for Rs2,995 crore or six times sales.

For now, HUL plans to keep Minimalist as a separate unit based out of Jaipur. Mohit and Rahul, who have a 9.5 percent residual stake, will operate the business while making use of their new owners’ relationship with suppliers, international markets as well as research and development strength. “We will continue to operate independently,” says Mohit. He’s aware that Minimalist’s continued success depends on his team not losing the entrepreneurial verve that got them here.

Starting Up

Having spent a decade working in both salaried jobs and startups, Mohit and Rahul gained experience on how the startup ecosystem operates. They had all the critical skills needed—coming up with a product, working on the market fit and, most important, dealing with investors. In the early part of the last decade, they had successfully exited Mangostreet, an ecommerce store for branded childrenswear.

Also read: Forbes India Leadership Awards 2025: An evening celebrating excellence in India Inc

In 2018, they set up a startup, Freewill, to create custom hair products. Surge, the seed funding platform from Peak XV, gave them Rs15 crore. But, like all entrepreneurs, they kept their minds open for new business ventures and started researching the skincare market, looking for product gaps and meeting with suppliers to discuss formulations. When Minimalist launched in 2020, it was the money from Surge that came handy.

After researching the active ingredients market, Rahul points to the success that global brands like Ordinary and Drunk Elephant have had. They weren’t sure, though, whether consumers would be willing to pay up for such products.

After researching the active ingredients market, Rahul points to the success that global brands like Ordinary and Drunk Elephant have had. They weren’t sure, though, whether consumers would be willing to pay up for such products.

The duo came up with their first batch of 750 bottles across five products in October 2020, giving it a few months to sell. The speed at which the batch sold of surprised them, especially since they had done no marketing. Bottles were filled by hand and manually weighed on a scale. In a month, all bottles were shipped to the top eight cities and, Rahul says, “We’d found our product market fit.” Minimalist was to go on and clock Rs100 crore in revenue in the first eight months.

Mohit stresses on how the duo was clear to never compromise on quality. They kept their cost of goods sold or the cost of the ingredients at 30 percent of the purchase price. In the consumer business, this number is usually 20 percent. Second, their marketing spends were kept low. Initially they relied on word of mouth and explanatory posts to market their product. While the brand does spend on marketing, it’s on Instagram and through sponsored links on Google.

Third was new product development. Rahul, a chemical engineer from IIT-Roorkee, explains that customers are divided into two categories. One type knows what they are looking for. So, if someone is coming for a solution to acne and wants a solution with salicylic acid, they would read the formulation and buy if they are convinced.

But a large set of customers come through searches in more general terms like say ‘delaying ageing’. For them, products are categorised by usage—acne, pigmentation, oiliness—on their website. Irrespective of how consumers search for products, “Minimalist is on the lookout for new products to make either through data from web searches or community feedback,” says Rahul, who leads a team of 25 researchers working on new formulations.

Getting Scale

Distribution is often a knotty problem for D2C brands. The challenge is that, beyond a point, it’s impossible to find scale unless one goes through the traditional retail route. So, while Minimalist may have reached a Rs500 crore annual revenue run rate, maintaining this pace in growth only through direct sales is unlikely.

To get around this, the brand is now available online through Amazon, Flipkart, Nykaa and Myntra—where the fulfilment is done by the respective partners—but Minimalist retains control over pricing and discounting. The brand also plans to work with 2,000 stores and is starting to experiment with that channel.

Also read: Inside the 2025 Forbes India Leadership Awards

About 20 percent of sales come from overseas, with Saudi Arabia, the UAE, Malaysia and Indonesia being the key markets. They plan to launch in Vietnam, the Philippines, the UK and the US soon.

In January, Mohit and Rahul sold their business to Hindustan Unilever. When asked if the decision taken too soon, he says they had to take into account the interests of all stakeholders—from investors (Surge, Peak XV and Unilever Ventures) to employees as well as the brand’s long-term growth. It is probably a smart decision as some startups like Honasa Consumer (now listed) have found it challenging to grow past a certain scale. In Honasa’s case, growth plateaued at the Rs1,700-crore mark.

On their part, HUL realises that India is under-indexed on per capita beauty spends. According to an investor presentation, the company says per capita spends on beauty in the US are 36 times those of India, China spends are 15 times more and Indonesia four times more. Minimalist allows HUL to plug a substantial gap in its portfolio for face cleansing, moisturisers, serums and shampoos. “What we could have done in five years ourselves, we will probably be able to do in two years in Unilever,” says Mohit.

https://www.youtube.com/watch?v=/Unu8m9c4RpU

(This story appears in the 07 March, 2025 issue

of Forbes India. To visit our Archives, click here.)

Rahul Yadav (left), COO, Minimalist, with Mohit Yadav, who is CEO. Image: Amit Verma

Rahul Yadav (left), COO, Minimalist, with Mohit Yadav, who is CEO. Image: Amit Verma The brand fits into the affluent beauty portfolio that HUL is building out to play in a market that is worth about Rs39,000 crore. “It will help us accomplish a 9 percentage points shift towards the premium end of our beauty portfolio,” says Ritesh Tiwari, chief financial officer at HUL, pointing out that there is scope for organic and inorganic actions in this space. With its existing D2C brands—Simple and Love, Beauty & Planet—having a Rs100 crore annual run rate, HUL has chosen to buy rather than build.

The brand fits into the affluent beauty portfolio that HUL is building out to play in a market that is worth about Rs39,000 crore. “It will help us accomplish a 9 percentage points shift towards the premium end of our beauty portfolio,” says Ritesh Tiwari, chief financial officer at HUL, pointing out that there is scope for organic and inorganic actions in this space. With its existing D2C brands—Simple and Love, Beauty & Planet—having a Rs100 crore annual run rate, HUL has chosen to buy rather than build.

After researching the active ingredients market, Rahul points to the success that global brands like Ordinary and Drunk Elephant have had. They weren’t sure, though, whether consumers would be willing to pay up for such products.

After researching the active ingredients market, Rahul points to the success that global brands like Ordinary and Drunk Elephant have had. They weren’t sure, though, whether consumers would be willing to pay up for such products.