Puneet Chhatwal, Managing director & CEO, Indian Hotels Company Limited (IHCL). Image: Bajirao Pawar for Forbes India

Puneet Chhatwal, Managing director & CEO, Indian Hotels Company Limited (IHCL). Image: Bajirao Pawar for Forbes India

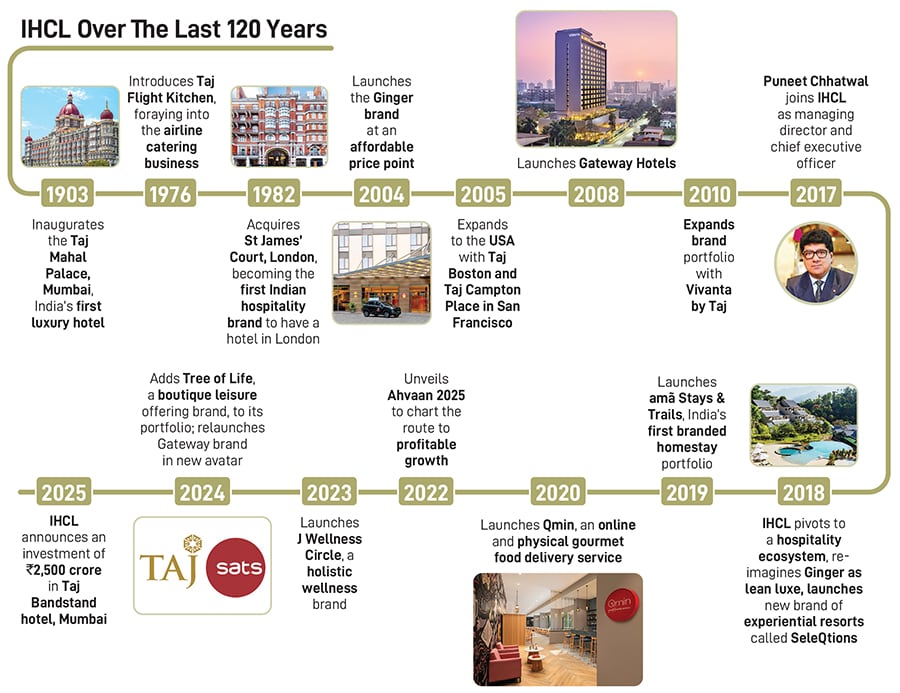

Puneet Chhatwal is well aware of the value the Taj brand carries. “It’s an emotion. Even today, families want their children to get married at the Taj,” he says, seated in the presidential suite of the first and most prized Taj hotel, the Taj Mahal Palace in Mumbai’s Apollo Bunder, built in 1903. Offering expansive views of the Arabian Sea, the hotel is one of the landmarks of the city.

But emotions alone were not proving to be enough to rake in profits for the Taj brand of hotels—with 50 properties, the brand known for its iconic properties around the country brought in 63 percent (about Rs4,500 crore) of enterprise revenues for Indian Hotels Company Limited (IHCL) in 2017.

Weighed down by an asset-heavy model—74 percent of IHCL’s room inventory was asset-heavy, while 26 percent was asset-light (managed) as of 2017—the company was failing to be nimble and agile, in order to adapt and respond quickly to changing consumer demands, and challenges posed by the entry of international hospitality brands in the Indian market. “The company was loss-making for seven years. We had the glory of the Taj brand, and the rest had not seemed to matter,” says Chhatwal, who took over as managing director and CEO in 2017. “Unfortunately, we weren’t making changes as fast as we should have.”

Chhatwal, who earlier had been the CEO and executive board member at Steigenberger Hotels AG–Deutsche Hospitality and chief development officer of The Rezidor Hotel Group–Carlson Hotels Worldwide, realised the formula needed to be tweaked. He mooted that the balance of revenues be shifted from the Taj brand to some of the other five brands in IHCL’s portfolio, and focus moved to its businesses within India, rather than those outside the country. Consequently, began the revamp and repositioning of the Ginger brand, from being affordable stays to becoming lean luxe hotels, followed by the launch of a new brand of experiential resorts called SeleQtions in 2018.

Just as these plans were finding their feet, the global hospitality industry was dealt a hammer blow by the Covid-19 pandemic in early 2020, which brought the tourism industry worldwide to a grinding halt. “There was almost no way to make any revenue. The sector saw its worst in the last 100 years,” recalls Chhatwal.

Also read: How IHCL is consistently achieving strong financial results

Drastic times called for drastic measures. Taking a page out of its international rivals’ playbook, IHCL decided to shift the balance in favour of an asset-light model, whereby the company would take on management contracts of hotels, rather than owning the properties themselves. The year 2020 also saw IHCL launch Qmin, an online gourmet food delivery service, which was in line with a host of other gourmet restaurants across the country launching similar services for high-end clients who were confined to their homes during the pandemic-induced lockdowns. (In the years that followed, as lockdown restrictions eased, Qmin also established physical outlets.)

Subsequently, as the long-term effects of the pandemic began to ease, the measures taken under duress continued to bear fruit. The third quarter of FY25 marked 11 consecutive quarters of record performance by the company: Revenue and PAT have grown by 29 percent year-on-year to Rs2,592 crore and Rs582 crore respectively. This was in sharp contrast to the years between FY11 and FY17, when IHCL reported a negative PAT, except a marginal profit of Rs3 crore in FY12.

In FY24, the Taj brand of hotels brought in 71 percent of revenues, contributing over Rs9,250 crore to IHCL’s total enterprise revenue. Today, the Taj portfolio comprises 125 hotels in 14 countries; 60 percent of these are managed properties, up from 40 percent in 2017.

Also read: At the revamped Taj Mahal New Delhi, a younger interpretation of luxe

With a market capitalisation of Rs101,092 crore, as of February 16, IHCL is growing fast. In Q3FY25, the company opened 8 new hotels under its Taj, SeleQtions, Tree of Life and Ginger brands in locations including Puri, Cochin, Thimpu, Bandhavgarh and Diu; the number of operating hotels now stands at 237 across brands. It has also signed the management contracts of 20 more hotels across these same brands, as well as Vivanta and Gateway. The most prominent announcement has been the investment of Rs2,500 crore in a new Taj Bandstand in Mumbai, where IHCL will own the property.

In this fiscal year, of the 55 hotels signed and 20 hotels opened across Taj, SeleQtions, Vivanta, Tree of Life, Gateway and Ginger brands, 85 percent of the signings are capital light. Chhatwal adds that although the managed room inventory has increased from 32 percent in 2017 to 58 percent in 2024, the Taj brand continues to be the backbone of IHCL with over 120 hotels across 13 countries.

“We worked through finding the sweet spot between properties we own and lease, versus third-party assets that we manage, meaning asset-heavy and asset-light respectively,” he says. From a 74:26 ratio between asset-heavy and asset-light (managed) properties in 2017, the current ratio stands at 57:43. “With strict control on costs—a learning from the pandemic phase—we have been able to grow our margins from 13 to 15 percent traditionally to over 33 percent. This is almost a 2.5X increase.”

“We worked through finding the sweet spot between properties we own and lease, versus third-party assets that we manage, meaning asset-heavy and asset-light respectively,” he says. From a 74:26 ratio between asset-heavy and asset-light (managed) properties in 2017, the current ratio stands at 57:43. “With strict control on costs—a learning from the pandemic phase—we have been able to grow our margins from 13 to 15 percent traditionally to over 33 percent. This is almost a 2.5X increase.”

Experts agree that IHCL’s asset-light model has been highly effective. “The aggression in adding hotels under management contracts will ensure a healthy year-on-year [y-o-y] increase in management fees for the next three to five years,” says Prashant Biyani, vice president (Institutional Equity Research), Elara Capital. “Hotels being added through management contracts also ensure no balance-sheet risks in case of downturns in the business cycle and they improve return ratios.”

While IHCL might consider tweaking the ratio between asset-heavy and asset-light properties in future, it has no intentions of selling any of its owned assets.

Road to recovery

While Chhatwal believes every challenge is an opportunity, one of the biggest challenges he faced was, “bringing about change with the same set of people. These are people who have been very successful. How do you tell them they can do it differently and drive that change?”

Despite the focus on newer brands and ventures, Chhatwal says traditional brands such as Taj and Vivanta take up the bulk, about 80 percent, of business and operational activities. However, “for the remaining 20 percent, we like to innovate and treat this 120-year-old company like a startup. Most of our new and reimagined businesses are a result of the same.” The new businesses, which are aimed towards a more diverse clientele, include amã Stays, Qmin, a private membership club called The Chambers, and Tree of Life resorts. “While Taj is still very relevant,” says Chhatwal, “for the diverse other 50 million Indians, our majority play will be around Gateway, Vivanta, Ginger and the others.” He calls this fine balance of brand, product portfolio, and business model “diversification of the topline”.

“The way we have expanded our brandscape, we are present across multiple segments and price points,” says Chhatwal. “Also, the current generation prefers to ‘live in the now’, which means they are keener to have a work-life balance, take more holidays and spend on themselves.” This trend has created a drive-in demand for both international and domestic destinations.

In Q3FY25, the new businesses vertical comprising Ginger, Qmin and amã Stays & Trails—they are predominantly asset-light—reported enterprise revenue of Rs218 crore, a growth of 38 percent y-o-y, with margins of more than 35 percent. “Going forward, IHCL is looking to focus on organic growth, and further increase its managed hotels count. That’s what we need to watch out for,” says Nikhil Agrawal, equity analyst, Kotak AMC.

Also read: How Taj Hotels is revamping its age-old business model

IHCL’s strategy will centre on driving top-line growth, with 75 percent coming from traditional businesses and management fees, while over 25 percent will be generated from new and reimagined ventures. Chhatwal believes brands such as Ginger and amã Stays can be scaled up a lot more and a lot faster. “There should be at least 500 Ginger-branded properties in India,” he states; currently, there are 102.

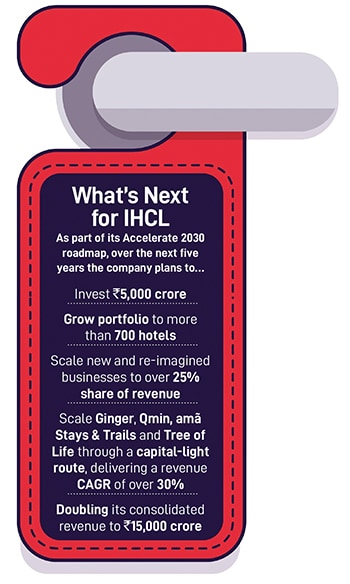

Given the company’s expectation of strong cash flow generation over the next few years, IHCL is likely to remain net cash positive. It plans to invest close to Rs5,000 crore over the next five years, “across existing properties and identified expansion projects. We are also committed to our announced dividend policy of distributing 20 to 40 percent of PAT to shareholders, leaving sufficient cash balance for future greenfield projects, accretive inorganic opportunities and strategic cash reserves,” says Ankur Dalwani, executive vice president and CFO, IHCL.

With the success the Taj brand has experienced in India, one would assume there would be an equal push towards international expansion. Chhatwal, however, says otherwise: “The international expansion will remain paced out, we don’t plan to have 100 hotels outside India.” IHCL currently has 27 hotels in foreign destinations.

As part of the company’s ‘Accelerate 2030’ vision, Chhatwal says, “IHCL will launch new brands to tap the heterogenous market and take its portfolio to 700 hotels by 2030. We will double our consolidated revenue to Rs15,000 crore, scale new and reimagined businesses to over 25 percent share of revenue, and continue to generate industry-leading margins and return on investments, while maintaining our renowned service excellence.”

Managing an organisation with such a rich legacy carries its own weight. “For risk takers, this is not an easy field,” he says. So, is he a risk taker? His team laughs, quickly claiming that he is, indeed, a big risk taker. He, however, prefers to add some footnotes: “If you’re just speaking your mind, people often perceive it as risk; just because others don’t do it, how do you judge whether it’s right or wrong? So just do it. If there are bad consequences, then you learn from it.”