(L-R) Lakshmi Shankar, Manav Garg, Girish Mathrubootham, Shubham Gupta. Image Courtesy: Together

(L-R) Lakshmi Shankar, Manav Garg, Girish Mathrubootham, Shubham Gupta. Image Courtesy: Together

Four years ago, Manav Garg and Girish Mathrubootham teamed up to start a venture capital firm that they thought could combine their experience as entrepreneur-operators and the opportunity to seed and foster the next generation of Indian software ventures.

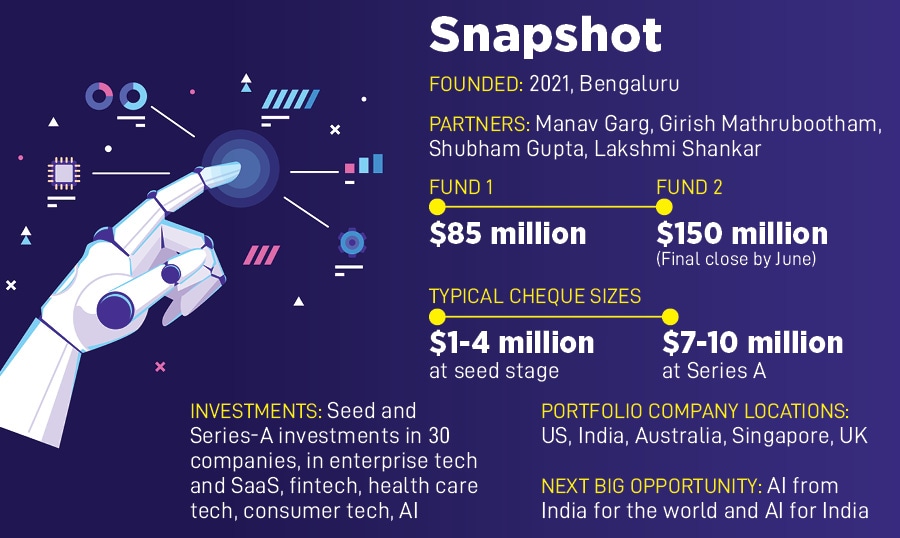

Perhaps it was logical, and even appropriate, to name that firm Together, which to date has invested in some 30 startups. Its first fund was $85 million, with investors (limited partners) including other well-known entrepreneurs such as Aneesh Reddy, Gaurav Munjal and Kunal Shah.

The fund was Garg’s idea, and Mathrubootham took to it right away. And now Together expects to announce the ‘final close’, as they say in VC parlance, of its second fund, at its targeted $150 million. No prizes for guessing that the next big opportunity is in artificial intelligence.

“With AI coming in, there are fundamental shifts happening,” Garg tells Forbes India in an interview.

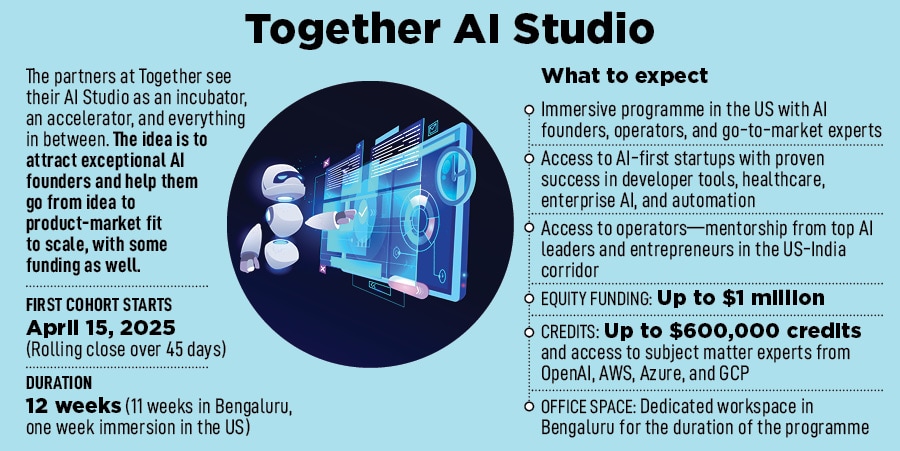

Together has already built up a portfolio of several AI and AI-led startups. Now the firm is ready to step up its efforts, including a new AI Studio that’s currently taking applications.

For Garg, Mathrubootham and many other entrepreneurs in their network, the long-cherished objective is straightforward. Lakshmi Shankar, who joined them as partner last year, articulates it with one critically important proviso: “As know-how gets institutionalised, we will build; we will not be a services nation, we will be a product nation,” he says.

Also read: Five questions to Manav Garg on Together’s AI bets in India

It’s that knowhow that will make a difference, he says, which isn’t quite there yet (and more on that later). It’s not to be confused with the abundant raw talent and the growing ranks of experienced techies in India. But first, consider the shifts that Garg sees on the horizon.

Technology-wise, the combination of generative AI and agentic AI promises to completely overhaul the ‘workflow’ in enterprises. The former is about generating sophisticated content, and the latter about autonomously initiating and completing tasks with minimal or no human intervention.

AI-led automation is rewriting the rules of how companies—be they large software enterprises or scrappy startups—are seeing their market. The next generation of AI-native software will be designed by default to replace not just legacy software but humans as well.

This means the total addressable market (TAM) that startups often need to arrive at as an informed guesstimate will also include human effort that can be confidently replaced. Suddenly, that makes the addressable market potentially much bigger. Therefore, the first big shift is from TAM for software to one for software plus salaries.

And then, “SaaS (software-as-a-service) is becoming SaaS.AI,” Garg says, making way for services-as-software, meaning services that required humans previously can now be delivered as AI software.

Verticals opportunity

Startup founders are emerging who are capable of delving deep into very specialised areas, offering sophisticated products in those specific verticals.

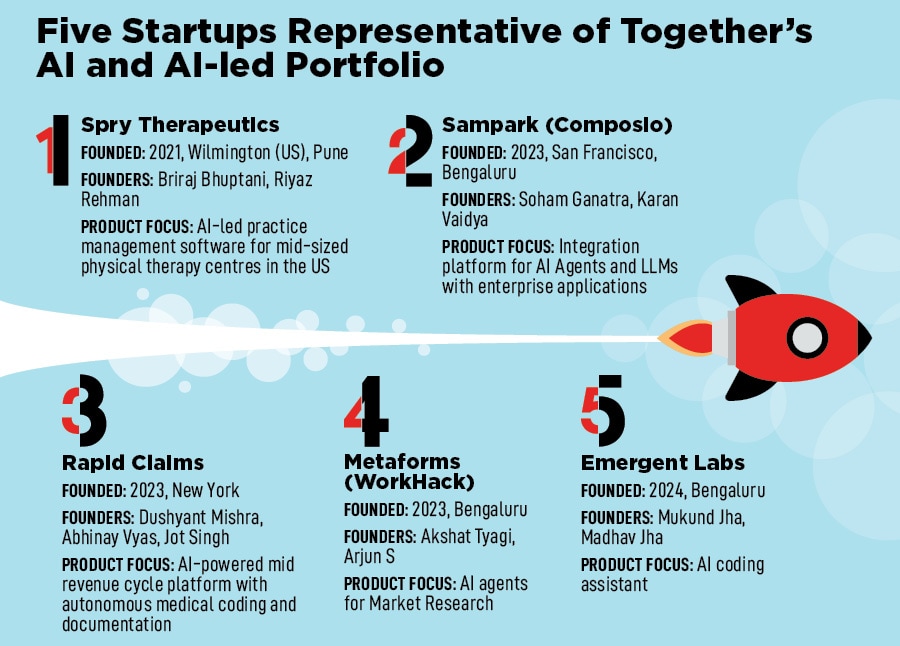

For example, at Spry Therapeutics, Brijraj Bhuptani and Riyaz Rehman are developing an AI-led software very specifically aimed at mid-sized physical therapy clinics in the US. At Metaforms (WorkHack), Akshat Tyagi and Arjun S are razor-focussed on eliminating the pain points in the workflows of market researchers.

And Indian founders have also made a beachhead into the emerging area of AI infrastructure. “We’ve invested in companies like that,” Garg says. For example, at Composio, Soham Ganatra and Karan Vaidya are working on software-to-software communications, building an integration platform for AI agents and large language models (LLMs) with enterprise applications. At Emergent Labs, Mukund Jha, co-founder and former CTO at Dunzo, and Madhav Jha are developing an AI coding assistant and innovating in the area of software development lifecycle (SDLC).

The second shift then is: Unlike in the SaaS era when large horizontal plays such as Salesforce’s CRM cloud software created multi-billion-dollar companies, vertical and specialist software are also big opportunities now.

For example, Tyagi estimates that the historical software-only market for Metaforms is in the ballpark of $3 billion, but in the AI era, it can be much bigger. Here’s how it works out: ESOMAR (European Society for Opinion and Market Research) estimated 2022 global expenditure on research and insights at $130 billion.

Tyagi points out that less than 10 percent of that is actually software today. Within that, if one looks specifically at software vendors for market research such as Qualtrics and SurveyMonkey, the combined market would probably be less than $3 billion, he says.

But given that the activity is very people-intensive, a heavily services-driven business, a lot of the expenditure is not on software but on people. “That expenditure on people is what we’re trying to convert into software, which actually makes our market pretty huge,” Tyagi says. Meaning much larger than the $3 billion conventional software-based estimate.

Or, consider software for the US health care market. Garg describes this as the India-to-US healthcare software opportunity. He reckons it is a $10 billion market for Indian startups to help improve efficiency in those segments. And, in addition to Spry, Together has invested in companies such as Rapid Claims, which makes an AI-powered mid-revenue-cycle platform with autonomous medical coding and documentation. And at Confido Health, Chetan Reddy and Vichar Shroff have built both patient-facing and hospital-facing applications.

The applications use AI to handle personalised interactions over calls and texts, complete data entry tasks, and determine actions that need to be taken in sync with a patient’s electronic health record intelligently, according to Confido’s website.

There are also opportunities in AI for diagnostics, clinical trial software stacks and so on, Garg points out. And the companies are scaling fast, which obviously is a core metric that VCs track.

Bhuptani and Rehman have notched up close to 200 clinics with ARR (annual recurring revenue) ranging from $15,000 to $25,000, depending on the size of the clinic. “We took maybe two-and-a-half or three years to get to the first million. Now we are adding that in close to a quarter,” Bhuptani says.

At Metaforms, “we started going to the market around December, so in about three months or so we are close to about a million dollars” in ARR, Tyagi says. By the end of the year, they aim to be in the range of $5 million, he says.

“We build agents for one part of the workflow and our customers typically end up buying other agents as well,” he adds.

It’s beginning to happen that software vendors can go to customers and say “‘I will give you so many AI agents and you pay me on the basis of efficiency”, Garg says. The expectation is that AI-led automation will perform a task at a fraction of the cost of humans.

Listen: Manav Garg on Together’s new $150 mln fund and his optimism over SaaS IPOs in India

One UK-based market research agency, with about 500 people, has been able to deliver 50 percent more surveys after it started using Metaforms, Tyagi says. “And that is while keeping all the other variables the same. Simply as a result of being able to use an AI agent that helps them get done with their jobs faster”, at various stages of the research process from bidding for a project to processing data.

“The market is now beginning to understand that verticals will also become big, and we are seeing this in the kind of deals that we are getting (as VCs),” Garg says.

Out of the 2,800 or so startups that Together met over the last two years, in terms of where founders were starting in AI, products for horizontal functions were 58 percent and vertical software was 6 percent in 2023. A year down the line, the verticals more than quadrupled to 27 percent, and horizontals had come down to 38 percent.

In terms of subsectors, tech for sales, marketing and productivity remain foundational in horizontal AI. Investment research and BFSI are promising emerging areas for AI tech and vertical healthcare is seeing a lot of innovation too, he says.

It’s all about knowhow

AI could make building a software application easier, less labour dependent. A lot of coding would be done by the AI, and humans would review it. The extent of human involvement will depend on the complexity of the tasks involved. Reliable data and deep domain expertise therefore will become critical.

On the business front, pricing models will change, and the per-user subscription model will become dated. Founders will need to focus on proprietary data and domain expertise and a move to consumption-based pricing, Garg says.

In areas such as business process management, it’s possible that half the roles or more will disappear in five years, Garg says. In the world of AI, “Everything changes. Profit margins will change. Your competition will be much faster as well, we’ll all be talking to machines, my AI agent will be talking to your agent,” he says.

Also read: There’s a $1 trillion value-creation opportunity in Saas for India: Eka Software’s Manav Garg

For software entrepreneurs from India, looking to build products for the US, primarily, but also other markets, “what’s missing still is the knowhow … it’s not the only thing but it’s the main thing,” Shankar says. “That’s just a generation or two away from becoming embedded, institutionalised in the way we work and the way we think. Then there is really nothing stopping us.”

He explains knowhow in the following way: Entrepreneurs must have the discipline and instinct to know which problems are worth solving. This often requires a contrarian mindset, believing in something others do not. Once an idea is pursued, founders must be willing to quickly iterate and change if necessary, learning from failures and new insights.

Building products requires understanding that technology is merely an enabling element. The focus should be on creating a user-friendly product that delivers outcomes, not just showcasing technology. Some of these are intangible elements that make up the magic one sees in Silicon Valley, he says, adding that Together can be a catalyst in bringing the same know-how to founders in India.

Operators at heart

When they announced the formation of Together in July 2021, the operators-at-heart, Garg and Mathrubootham, had teamed up with Shubham Gupta, previously an executive director at the firm Z47 (formerly Matrix Partners), who brought serious finance chops to the table. In industry parlance, an operator is typically an experienced entrepreneur or a senior business executive with experience in running complex business operations.

At Z47, Gupta led the SaaS investments practice, leading seed investments in startups including Rocketlane and Superops.ai, both of which went on to their Series-B rounds, and helped source a deal with Dukaan that Z47 went on to invest in. Previously, he’d spent over a decade in Singapore as an investment banker at Nomura and then Goldman Sachs. He was also a prolific angel investor, having backed about 20 startups, including Ixigo, ZoomCar (now listed companies), Locus, SuperHuman and Ripple.

In August 2024, they added a partner in Shankar who not only brought the same operator’s passion to their mission, but also the combination of global technology products experience and proximity to Silicon Valley, to help Together and its portfolio founders to take advantage of the US-India corridor.

Also read: Is India’s talent pool ready for India Inc’s AI requirements?

Before Together, Shankar was the first ever VP of product strategy for Google Search, trying to grow a product that already made hundreds of millions of dollars a day even on a bad day, as he likes to point out, and which already had gone well beyond billion-user scale. In 2023, he was named the product lead for Gemini AI and developed the roadmap that included the AI overviews that we see today on Google searches, and the recently announced AI Mode.

The second fund, expected to close in June, has been about two years in the making. Among its limited-partner investors are a leading sovereign fund from Singapore, a large health care foundation in the US, and several family offices of global founders, Garg says. Together had announced a ‘first close’ in July 2023, seeing the AI opportunity, and beginning to make investments.

Mathrubootham and Garg, among the most recognised Indian software entrepreneurs, “have phenomenal deal flow”, says Aneesh Reddy, founder and CEO of Capillary Technologies, who’d invested in the first fund. “I know of instances where founders have made space in order to get Together in.”

Reddy adds that founders recognise the experience that the duo has accumulated in building and scaling their respective companies—Mathrubootham’s Nasdaq-listed Freshworks and Eka Software, which Garg sold last year, 20 years since founding it.

“That’s the kind of people you want to take money from, right? And all else being equal, you would want to go with someone who can add value beyond the money,” Reddy says. Today, many of the entrepreneurs are second or third-time founders and they have experience in figuring out the best VCs for their venture.

“I get more requests from people wanting to start up for introductions to Manav or Girish probably more than for any others. The only other person I get similar number of requests is Rajan Anandan at Peak XV,” he says.

For now, many of India’s software entrepreneurs see the US as their primary market. It’s where one can seek billion-dollar scale. That said, Garg also dreams of seeing the masses in India benefit from AI. This probably has its roots in the values of ‘seva’ (service) that were instilled in him by his parents and grandparents when he was a child in a small town in Moga district in Punjab. He writes about this briefly in the opening pages of his 2021 book, The India SaaS Story.

Also read: How to reform higher academia for India’s economic and technological development

Two obvious areas stand out—health care and education. Literacy levels and healthcare can see massive change for the better, in five years, he feels. “I’m from a small town in Moga. I was able to break out. What if those who couldn’t had access to an AI agent of the best professor in IIT in physics or math?”

If AI, on top of India’s digital public infrastructure, can solve the problems of access and affordability of health care and education for the masses, it will unleash a whole new wave of innovation, he says. All this taken together, the next 10 years could be India’s decade of entrepreneurs building AI for the world and for India.

Shankar echoes this: “This is the dawn of Indian ambition. Just like how we leapfrogged mobile, I think, in a generation, which I define as seven to 10 years, we will leapfrog the AI revolution.”