Sunrisers Hyderabad’s Ishan Kishan celebrates after scoring a century (100 runs) during the Indian Premier League (IPL) Twenty20 cricket match between Sunrisers Hyderabad and Rajasthan Royals at the Rajiv Gandhi International Stadium in Hyderabad on March 23, 2025.

Image: Noah Seelam/ AFP

In a world of unravelling geopolitics and tumbling stock markets, the IPL’s ability to generate astronomical values year-on-year seems to be as certain as death, taxes, and Jasprit Bumrah’s yorkers.

Consider that the sponsorship revenues for the 10 franchises have seen a jump anywhere north of 20 percent compared to the last season; the organiser, the BCCI, has bagged six central sponsors against last year’s four (as per the IPL website, the board won’t comment); while broadcaster JioStar, which has reportedly commanded a 10-15 percent increase in ad rates compared to 2024—charging Rs8.5 lakh for a 10-second slot on connected TVs (CTVs) and Rs250 for every 1,000 impressions—has managed to sign up 1,100-odd advertisers even before the tournament began.

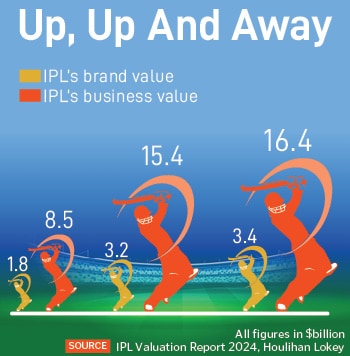

As it steps into its 18th year, IPL is already the second-most valued sports league in the world, next only to the NFL, which recently completed its 105th season. A 2024 report by Houlihan Lokey pegs IPL’s brand value at $3.4 billion, up from $1.8 billion in 2022. IPL 2025 is set to grow only bigger, with over 200 brands expected to play ball this season, say sports marketers.

Adding to the metaphor of superlatives is the fact that this is the first time the IPL would be broadcast on JioStar—a newly-minted entity formed post the merger of Star India and Viacom18—which houses 24 channels, JioHotstar, an OTT platform with over 50 crore users, and both the TV and digital rights of the tournament. A snapshot of its reach was seen during the telecast of the Champions Trophy, the last high-octane cricket tournament preceding the IPL—its digital platform notched 11,000 crore minutes of watch time and a peak concurrency of 6.12 crore for the India vs New Zealand final, while it became the second-highest rated ODI in TV history (outside of World Cup matches).

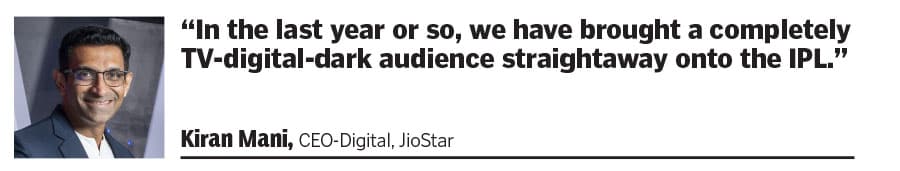

“In the last year or so, we have brought a completely TV-digital-dark audience straightaway onto the IPL. This is the JioBharat [a cheap, internet-enabled phone by Reliance Jio] segment that earlier used feature phones that didn’t even have YouTube installed,” says Kiran Mani, CEO—digital, JioStar. This, coupled with tech innovations like feeds in 12 languages, vertical viewing on mobile, multi-cam viewing, a feed for kids, what have you, the platform expects to bring more fringe viewers within its fold. [Both JioBharat and JioStar are owned by Reliance Industries, which also owns Network18 that publishes Forbes India.]

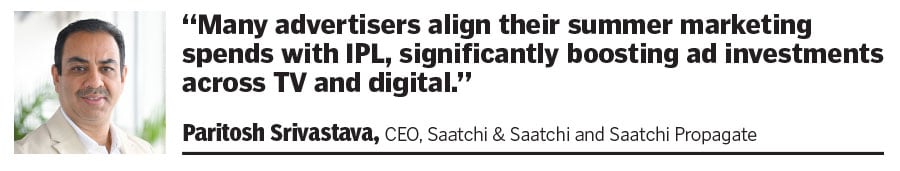

JioStar’s potential breadth of reach has brought outside its door a snaking queue of brands—32 sponsors on Day T-1 and 1,100-odd advertisers across a basket of 40 brand categories. Paritosh Srivastava, CEO, Saatchi & Saatchi and Saatchi Propagate, projects ad expenditure to grow by 8-10 percent this year, with brands allocating dedicated IPL budgets. “Many advertisers align their summer marketing spends with IPL, significantly boosting ad investments across TV and digital,” says Srivastava. “Last season, the IPL had 650 million viewers across TV and digital, with JioStar, this is expected to expand even further.”

Add to it the fact that, unlike last year that saw a number of high-profile events like the general elections, state elections, the T20 World Cup and the Olympics, 2025 doesn’t have too many big-ticket advertising platforms. “Hence, many advertisers will want to leverage IPL 2025,” says Navin Kathuria, EVP, media planning and buying, Mudramax. “Also, since linear TV and digital broadcast rights are with a single merged entity, the bundling of platforms would be preferred by advertisers, especially those who target masses and are present on both the platforms.”

Effectively, the unified JioStar platform is starting to fundamentally transform IPL’s commercial architecture. Says Karan Yadav, the chief commercial officer for JSW Sports: “For the first time, brands have access to a seamless, cross-channel advertising and engagement ecosystem.”

Effectively, the unified JioStar platform is starting to fundamentally transform IPL’s commercial architecture. Says Karan Yadav, the chief commercial officer for JSW Sports: “For the first time, brands have access to a seamless, cross-channel advertising and engagement ecosystem.”

The salience and top-of-the-mind awareness is a top draw for brands, bringing in not just return advertisers but also first-timers like Birla Opus, the paints business owned by Grasim Industries, the flagship company of the Aditya Birla Group. “In IPL, we see an opportunity to not only strengthen brand equity, but also sustained recall. JioStar will help us with one integration plan across three viewing platforms—linear TV, mobiles and connected TVs—leading to better spend efficiency and creative effectiveness,” says Inderpreet Singh, the head of marketing.

JioStar’s Mani further says the platform, through its tie-up with market research agency Nielsen, has launched first-of-its-kind granular metrics for the advertisers to assess their ROI on mobiles and CTVs. “Even till last year, most advertisers had to rely on industry metrics, like TRP data for TV or CPM-CPC purchase for digital,” he says. “This year, we’ll make it possible for them to achieve nuanced outcomes.”

Teams Hit A Century

IPL’s ever-expanding scale has manifested into team sponsorships as well, with multi-year, Rs100-crore-plus deals being the flavour of the season. Mumbai Indians leads the way with its tie-up with Lauritz Knudsen, which, at a reported 30 percent increase from previous deals, is said to be the highest-ever for front-of-jersey, the most premium real estate on the official team shirt. This eclipses the franchise’s previous one with Slice at a reported Rs100 crore for three years.

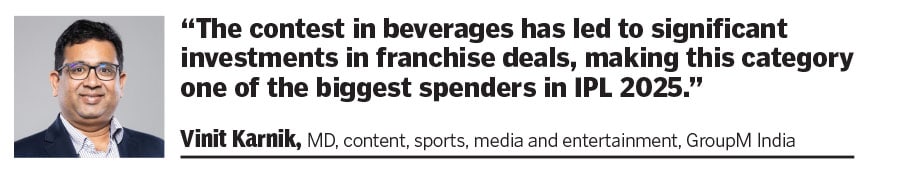

“A new wave of sponsors has pushed the upper limit for marquee assets. These deals are visible across franchises, with brands like RR Kabel for Kolkata Knight Riders (KKR), Birla Estates for Royal Challengers Bangalore (RCB), and global giants like Etihad and FedEx for Chennai Super Kings (CSK) raising values considerably,” says Vinit Karnik, managing director, content, sports, media and entertainment, GroupM India.

A structural shift in 2025 has been the early closures of key sponsorship assets, leading to a significant reduction in distress inventory that has allowed franchises to command higher average pricing. “About 90 percent of team sponsorship inventory was sold out even before the auctions [in December], and demand soared after the mega auctions,” says Chintan Jhaveri, CCO, ITW Catalyst 2.0.

As a result, sponsorship revenue has soared upwards of 20 percent. Crowd favourites and five-time winner MI has onboarded 32 brands, up from 26 last year, with a close-to-30 percent increase in sponsorship revenue, but past performance isn’t the only definitive factor. In a testament to the equity the teams derive from the IPL ecosystem, Punjab Kings (PBKS), which is yet to open their account of trophies, has bagged 21 sponsors with a revenue spurt of 25-30 percent, while Rajasthan Royals (RR), the first-ever IPL winners, is anticipating a 20 percent rise with over 20 brands. “This is a significant achievement, particularly in a year where brands have already allocated substantial budgets towards major global cricket tournaments like the World Cup and the Champions Trophy,” says RR CEO Jake Lush McCrum.

For most of these brands, the IPL gives a better ROI than bilaterals, given the over-60 days the tournament is played over. “We sponsor three teams—MI, CSK and GT—so literally every other day, my logo is visible on TV compared to BCCI bilaterals, where we do boundary ropes, boards etc” says Kairav Engineer, the executive director of Astral Pipes, which allocates Rs 18-20 crore of the marketing budget each year for IPL sponsorship. Engineer can’t put a number to indicate how his marketing needle has moved but insists he is in the IPL not for immediate sales but to reach out to his target audience—the dealers, distributors, plumbers etc. “No one buys pipes the next day by watching our logo. We are in it for the brand presence.”

Also read: There will always be market for premium cricket content: Venu Nair

A Long Innings

With IPL offering bountiful value, brands have come to realise the value of long-term associations, signing up for at least two cycles. “Almost 70 percent had a multi-year association with teams going into IPL 2025,” says Yadav of JSW Sports. For example, most of the sponsors on the jersey of PBKS, which will field a new-look side led by Shreyas Iyer, have continued from previous seasons. And with the franchise picking up a string of formidable players at the auction, even the remaining few slots have fetched them lucrative value thereafter, says Satish Menon, CEO, PBKS. “We had held back some, which were up for renewal, for after the auction. Those slots have delivered for us. If you have more iconic players—like Iyer, Arshdeep Singh, and Yuzvendra Chahal whom we bought in the auction—they will give you a percentage increase over your proposed prices in the marketplace,” says Menon.

While jerseys are the most visible slots in team sponsorships, teams are also rolling out a slew of association opportunities on social media and through off-the-pitch tie-ups. “Brands are looking at topical and contextual campaigns and negotiating for rights that could add value to their business—for example, ice-cream brands selling in the stadium can be integrated in a more seamless manner,” says Jhaveri of ITW Catalyst 2.0. It turns out to be cost-effective for brands, while also leveraging the Himalayan following of most teams, especially on social media. “Your minimum price for a spot on the jersey would be anywhere between Rs3-3.5 crore,” says Menon of PBKS. “An associate deal—digital deals and other IPs—could be literally half of that.”

Karnik of GroupM adds that the IPL’s global appeal has escalated as behemoths—like DP World, FedEx, NEOM, BP—flock to Indian shores for the cricket extravaganza. “This underscores IPL’s growing stature as a premium sponsorship property with worldwide resonance,” he says. UAE’s flagship carrier Etihad Airways, whose first foray into IPL was as an associate sponsor for CSK in 2024 with a logo on the back of the jersey, is known to have significantly upgraded its valuations with the Chennai-based team this year, moving to the front of the shirt. In an interview with Forbes India in September, Antonoaldo Neves, the group CEO, had mentioned these activations (with CSK as well as ISL club Mumbai FC) as a key strategy for the airline to be more local. “Etihad, in the past, was focussed a lot on Europe, and while it remains extremely important, we fly a lot of people from India…We need to be local, I need to be there in the market,” Neves had said.

Brands at an inflection point also turn to IPL as a catapult to the big league. One such is Furlenco, an furniture rental portal, which after expanding into 26 cities is looking to reach out to a larger audience. “Cricket and Bollywood used to be the two unifying factors in India. But, I feel, films have grown more diversified and regional, while the passion for cricket remains pan-India,” says Ajith Mohan Karimpana, the founder and CEO, of Furlenco’s first-ever foray into cricket sponsorship with RCB.

The Match-Ups

However, despite startups recovering from the lows since the Covid years—with venture capital investments clocking at $13.7 billion in 2024, a 1.4x rise from the previous year (according to the India VC report by Bain & Company and the Indian Venture and Alternate Capital Association)—it’s the legacy brands which have been leading the pack for advertising. “Brands across banking, paints, pipes, TMT and insurance categories have secured key jersey assets across all teams,” says Jhaveri of ITW Catalyst 2.0. Five of the 10 brands that have secured deals for the coveted front-of-the-jersey spot are legacy companies.

The legacy brands’ abiding allure for cricket is evident from the top TV advertisers list for the recently-concluded Champions Trophy—eight out of 10 of the top advertisers accounting for 43.2 percent of the ad volume share came from the legacy stable, says data from AdEx India, a division of TAM Media Research. It’s an uptick from IPL’s last season, where seven out of the top 10 with 32 percent of ad volumes were legacy brands. [The numbers exclude the Association of Mutual Funds in India, which doesn’t fit into either bucket.]

IPL also signals the arrival of summer, cricketing and otherwise, and with heatwave predictions to boot, a battle for dominance is under way among water and fizzy drinks brands in the non-alcoholic beverages category. The latter was the top advertising category in the Champions Trophy, cornering 12 percent of the ad volume share on TV. Campa, which has been relaunched in the Indian market by Reliance Consumer Products, the FMCG vertical of Reliance Retail Ventures, has secured the co-presenting rights for IPL for a reported Rs 200-odd crore, replacing 2024’s rights holder, Thums Up, a brand from the Coca-Cola portfolio. “The contest in beverages has led to significant investments in franchise deals, making this category one of the biggest spenders in IPL 2025,” says Karnik of GroupM.

A similar mini-battle is being played out between fantasy league biggies Dream11 and My11Circle. While the latter dug deep through the central sponsorship route, investing about Rs125 crore per season for a five-year deal scripted in 2024, Dream11 has chosen to go wide, diversifying an equal (or even greater) amount through teams and the broadcaster. In 2024, it recorded the second-highest share of ad volumes on TV (7 percent) and would be expected to match it; this year, the company has picked up the front-of-jersey logos for five teams for a price that could be anywhere between Rs25 and Rs45 crore each (depending on the team’s pedigree, say industry sources); it has also signed up as the official partner of four other teams. Both the players have also tied up with JioStar.

“The IPL remains a key part of our marketing strategy, commanding a significant share of our spends. We’ve adopted a balanced approach by leveraging both team partnerships and broadcaster tie-ups to ensure maximum impact across channels,” says Vikrant Mudaliar, chief marketing officer, Dream11. “We’ve consistently seen a significant spike in user acquisition and retention during the IPL.”

In 2008, Kiwi batter Brendon McCullum had launched the IPL with his batting pyrotechnics, scoring 158* off 73 balls in the opening match of the inaugural season. Eighteen years on, IPL’s blitzkrieg has only multiplied.