On May 1, 2000, a couple of entrepreneurs—the word ‘startup’ had not yet gained the currency it has today—and their team, in a poky office in Delhi, watched their computer screens with bated breath. A Gujarati gentleman based in the US was booking a flight to India, and the team in Delhi watched the transaction unfold online in real time. It was MakeMyTrip’s (MMT) first customer. “We were all so excited when we saw the first sale,” recalls Co-founder Rajesh Magow. “It has been 25 years, but I don’t think I can ever forget the joy of that moment.”

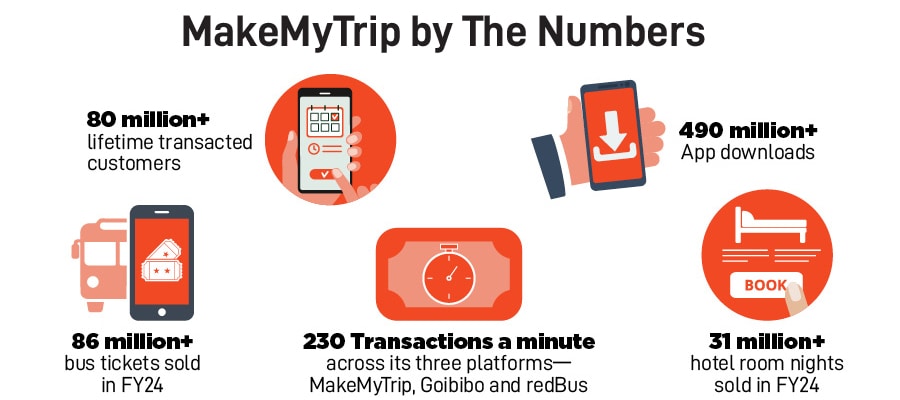

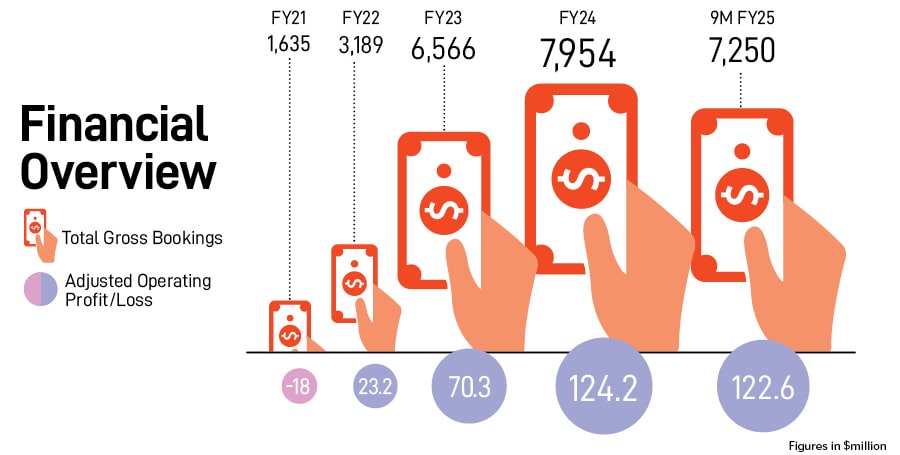

Fast forward to April 2025. MMT has served over 80 million travellers, transforming the daunting maze of travel agents, unending phone calls and uncertainties that was India’s travel industry into a simpler, seamless and accessible process. In FY24, the company (listed on the Nasdaq) clocked in its highest gross bookings of $7,954 million; in the first nine months of FY25, it touched $7,250 million. From flights to hotels, visas to forex, MMT’s journey has been more than just about growth; it has reshaped how Indians travel, through strategic acquisitions and tech-led reinventions.

It’s no surprise, perhaps, that it is, once again, in reinvention mode, with a travel super app that brings newer offerings like experiences and cruises.

MMT is one of the pioneers in setting up a two-sided online marketplace, with partners and customers, in the travel segment. Co-founders Deep Kalra and Magow recognised early on that engagements with travel partners would be essential for long-term success. As Magow recalls, the company didn’t just list properties on its platform, it actively helped hotels digitise their operations. “Back in the day, a lot of small independent hotel properties, even in the mid-segment, did not have the wherewithal to digitise their inventory. So, we ended up making investments in building a software that we would give them; it was called Extranet, and now it’s called ConnectNow,” he says.

Over the years, ConnectNow evolved to provide hotels with the digital infrastructure to manage bookings efficiently. This hands-on approach extended beyond hotels, and became a partnership model across taxis, airlines, and forex services, and ensured MMT’s ecosystem benefited all stakeholders.

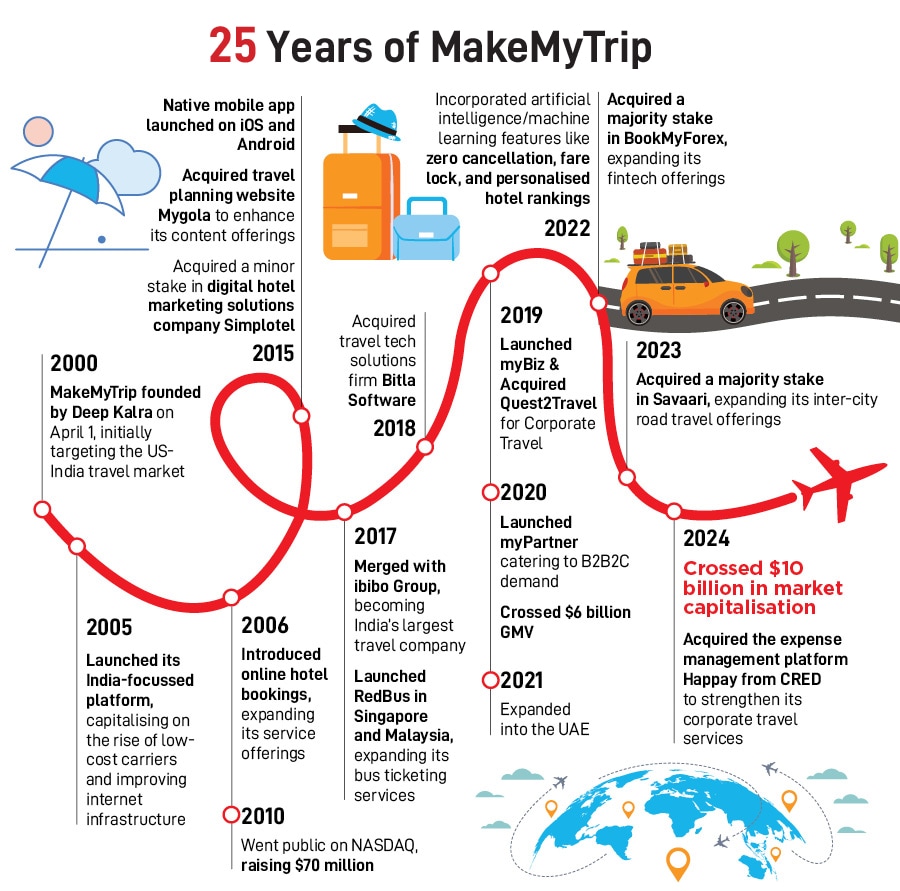

Another key driver of MMT’s expansion has been strategic acquisitions. In 2016, it acquired the Ibibo Group, including Goibibo and redBus, for $960 million in one of the largest deals in India’s travel sector at the time. While Goibibo and MMT have overlapping models, Magow notes that their customer overlap remains only 25 percent. “From a positioning standpoint, Goibibo is seen as a ‘value brand’ for budget-conscious and value-seeking customers,” he explains. Goibibo customers are also younger, which helps both brands coexist. Meanwhile, redBus, which contributes close to 12 percent to MMT’s revenue, has expanded beyond buses and includes railway bookings and intercity cab services.

Since buying Ibibo Group, MMT has expanded across travel verticals through targeted acquisitions. In 2018, it invested in Bitla Software, a Bengaluru-based firm specialising in bus travel management software, and in April 2019, it acquired a majority stake in Quest2Travel and entered corporate travel management.

Initially, MMT had steered clear of B2B travel. “Essentially, traditional travel agencies were putting people in corporates as a travel desk. It was very opaque, and you needed to have warm bodies in the office to get business,” Magow recalls.

However, after acquiring Quest2Travel, MMT reassessed this segment and launched its own B2B vertical, which has since become one of its fastest-growing verticals. “Everything that was opaque became transparent. We were providing companies with deep analytics, and most importantly, the employee had the same user experience as our B2C client, since the online interface was the same.”

In April 2022, MMT acquired BookMyForex, via its fintech arm TripMoney, bringing forex accessibility to travellers, and in January 2024, it acquired Savaari Car Rentals, expanding its footprint in intercity cab services. Magow highlights the common threads across MMT’s acquisitions: “Firstly, they are all small-sized companies. Second, they have niche capabilities and areas that they are working on. For instance, Savaari is an intercity cab service, which was a focus area we didn’t have.”

Most recently, in November 2024, the company acquired Happay, an expense management platform previously owned by Cred, to bolster its corporate travel and financial services portfolio. These acquisitions reflect MMT’s broader strategy of integrating complementary services to create a comprehensive travel ecosystem.

Beyond acquisitions, MMT has adapted to emerging travel trends and shifting consumer priorities. Post-pandemic, Indian travellers are allocating more of their discretionary spends to travel, with 25- to 35-year-olds prioritising experiences over conventional big-ticket purchases like homes and cars. “There’s a lot more focus on travelling for experiences—attending concerts, adventure sports, dining—rather than saving up for a house or a big car,” Magow notes.

“This is also shifting the revenue mix for MMT. Until FY15, air accounted for more than 50 percent of overall revenue. Since then, the air has gone down to less than 40 percent, while the company continued to build on the offerings on hotels [including alternate accommodation], trains, cabs, etc. Today, hotels and packages account for 43 percent of revenue. Bus, train, and other products have grown from about 3 percent of revenue in FY15 to about 20 percent of revenue as of FY25E,” says Manik Taneja, executive director, IT Services and Internet, Axis Capital.

Going forward, MMT plans to continue acquisitions following a similar strategy. “Keeping the vision of the ‘Travel Super App’, wherever we see a particular niche and a gap in our capability, and where we feel a product or domain can be added to our portfolio, we’ll look into it,” Magow explains.

Also read: You either adapt or perish: Deepinder Goyal

Tech-ing it on

Over the last 25 years, MakeMyTrip has navigated every phase of the digital revolution—from desktops and mobile technology to the rise of data science and Generative AI. Through all of these, Magow says, “We have always tried to be industry-first in adopting new technologies and coming up with product innovations. Hence, we proudly say that we are a tech-first business that happens to be in travel.”

Artificial intelligence (AI) is at the core of MMT’s strategy. “It’s not that we’re investing only in one area. AI is becoming an integral part of all businesses and all points in the value chain. But it is more of a mindset shift as well, because we are changing the way you operate; hence engineers also need to start thinking AI-first,” notes Magow.

The platform is using a GenAI chatbot called Myra to respond to customer queries, summarise post sales calls to improve efficiency, and more. “There are language models that we are working on specifically for flights, or hotels, or holidays. Each of these will have independent agents—making Agentic AI very important—that will be present everywhere as assist bots for customers,” explains Sanjay Mohan, group chief technology officer, MMT.

Although AI might seem like the real hero, the real hero is, in fact, data, which has also become a differentiator for MMT. “We have become the de facto search for all travel products for Indians. Whether you book with us or not, most consumers come to search on our platform just to check the options, and in the process we collect a lot of data,” says Mohan. This data helps MMT make AI personalisation at every stage more effective for users.

Mohan adds: “We have built a back-end platform from ground-up, which allows us to launch or experiment with products a lot faster, and at a much lower cost. All our newer offerings, including myBiz, myPartner and myAffiliate were launched within one to two quarters.” Unlike most tech companies, which focus on three Ps—product, process and people—Mohan says, “we always talk about the fourth P—platform.”

Steering growth

Industry projections indicate a 4 to 5X growth in domestic and international air passengers by FY41E, with domestic hotel bookings expected to rise sixfold over the same period. Despite online air ticketing penetration reaching 36 percent for both domestic and international travel, international penetration lags at about 20 percent, and there remains significant room for digitisation and market growth, according to Ambit Capital.

About 61 percent of the market is dominated by offline distribution, including traditional travel agents, travel management companies and tour operators. About 75 percent of international air tickets is still sold offline, while 67 percent of domestic air tickets are sold online, according to a Videc report. Hence, there is significant room for digitisation and market growth in the online space.

However, there are challenges that MMT needs to tackle. “Delay in delivery of aircraft by Boeing and Airbus is constraining the growth of domestic air ticketing,” says Ashwin Mehta, head of Equity Research at Ambit Capital. And although competition with other platforms such as EaseMyTrip, Cleartrip, Yatra etc is intensifying, it is the evolving Indian consumer that presents the bigger challenge. “MMT will need to continue addressing the aspirations of the young demographics which want to travel more frequently, seek more experiences, and step away from just the straightforward air-plus-hotel options. A deeper understanding of the consumer’s evolving wants will be very critical for MMT,” says Taneja of Axis Capital.

Although for the near future, MMT’s focus will remain India, in April 2020, it had expanded into the Gulf Cooperation Council (GCC) region with a UAE launch. “We’re already doing well in terms of flights, and we want to scale up the hotel business,” says Magow. redBus, too, has entered multiple markets, from Singapore and Malaysia to Vietnam and Indonesia. Wherever there is a large market for bus transport, the company will aggressively continue to expand. He adds that MMT plans to continue growing at double digits, while maintaining profitability and a tech-first focus. “We believe we will continue to grow faster than the industry.”

“Corporate is one area for continuous growth because we still have a lot of headroom there. There is the emerging homestays category where we see huge potential both on the supply side and demand side,” says Magow. Currently there are 27,000 homestays listed on MMT.

Looking ahead, it is developing new products, including cruises and destination-based experiences. “If you look at our core business, while online penetration in the domestic flight segment is high, on the hotel and accommodation side, for both domestic and international, the penetration is relatively lower. So, that will remain our core focus area,” explains Magow. While MMT is significantly smaller in scale compared to global platforms such as Booking.com, Expedia, and Trip.com, Mehta notes it is expected to materially outperform these players in growth over the next three years.

So, what’s next for the company? Magow smiles: “The best is yet to come.”